Can You Get Student Loans to Pay for Living Expenses in India?

Empowering Your Financial Freedom

Can You Get Student Loans to Pay for Living Expenses in India?

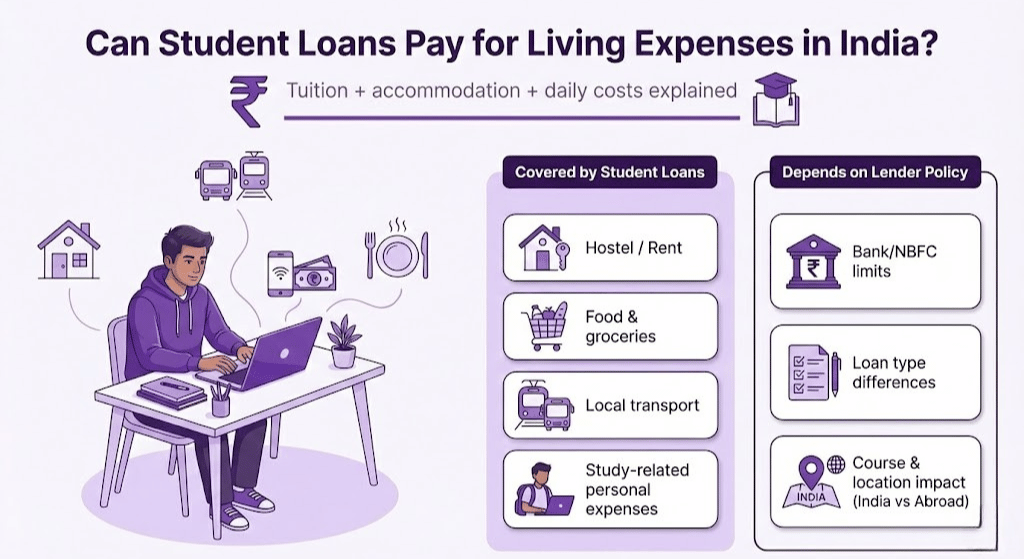

The rising cost of education in India, driven by increasing tuition fees and living expenses, is a concern. Day-to-day expenses, such as living costs (accommodation, food, transportation, personal expenses, etc.), are likely to significantly impact many students, particularly those moving to a new city or country to pursue their education. That is why it is essential to be organized and thoroughly analyze all sources of financial aid.

A frequently asked question is whether student loans in India can cover both living costs and tuition fees. Education loans are traditionally designed to finance only your education. However, many financial institutions and banks offer provisions that allow a portion of the loan to be used for funding your living expenses. However, how much of the cost of living you’ll be able to afford comes down to the lender’s policies, the type of loan, and the conditions of the loan.

In this definitive guide, we will delve into the details of this product, including how it works, the types of living expenses you can pay for using the loan, eligibility criteria, limits, interest rates, and some tips on how to effectively leverage it to make the most of your finances within India. It doesn’t matter if you’re applying for a loan to Axis Bank, Tata Capital, IDFC FIRST Bank, SBI, or even to global lenders like Prodigy Finance; you can take help from this article to know how to approach the process and make informed decisions.

What is an Education Loan in India?

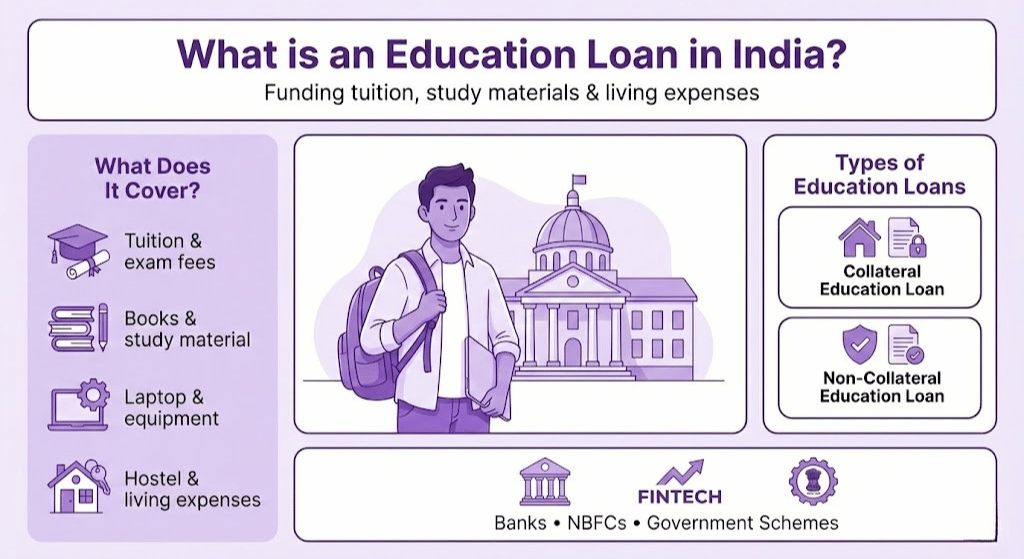

An Education Loan is a type of loan designed to help aspiring students pay their tuition fees at an institute or university. These loans are primarily intended to help with tuition fees; however, they commonly cover other costs associated with your education. Various education loans offer students from all streams the opportunity to pursue their dreams without worrying about immediate financial constraints, with the expectation that they will repay the amount at a later stage, once they are employed and financially stable.

Usually, an education loan takes care of a variety of charges such as fees (annual, examination, library, admission, etc), books and other material needed, equipment if any (laptop or lab equipment), and others. Some lenders also include other expenses, such as hostel fees and living expenses, under the purview of the loan, making these loans quite comprehensive.

The Indian education loans can be classified broadly into two:

- Collateral Education Loans: This type of loan requires collateral as security, which can include your house, fixed deposit, or other assets. Collateral loan amounts are typically higher than those found with bad credit loans and come with significantly lower interest rates. These are ideal for extended/expensive courses or studies abroad, as the loan amount would be substantial.

- Non-Collateral Education Loans: Smaller education loans not secured by a guarantor. However, they typically have lower loan limits and slightly higher interest rates. Unsecured loans for education are also available from many banks, up to a specific limit, and are accessible for students who do not have assets to pledge.

Some of the leading education loan lenders in India include Axis Bank, Tata Capital, IDFC FIRST Bank, State Bank of India (SBI), Prodigy Finance, and EduFund. These institutions offer a range of loans to suit every type of student, from those who require additional support for living expenses, course materials, and overseas study costs.

The Government of India is also encouraging loans for education through schemes on the Vidyalakshmi Portal, which provides a single window for students to access information and apply for educational loans, as well as government-certified education loans. There are numerous central and state government schemes to support weaker sections, which offer subsidized interest rates or loans without collateral to eligible candidates.

Understanding the Cost of Attendance (COA) for Indian Students

The Cost of Attendance (COA) is the total amount it costs a student to enroll in a specific program or institution. It is comparable to the course tuition costs, as well as the cost of living and other miscellaneous requirements required to complete the course successfully. You need to understand COA, as banks and financial institutions consider it when deciding how much of a loan to grant to students.

The constituents of COA usually are:

- Tuition and Fees

- Feast in hostels or for off-campus accommodation

- What I spent money on every day – food, groceries

- Expenses for travel and transportation of individuals

- Health and medical insurance

- Textbooks, stationery, and other essential supplies are necessary for students to succeed.

- Other outgoings, including broadband, utilities, and minor personal expenses

The maximum amount of an education loan is calculated based on this total COA number. They factor in the tuition, as well as a fair estimate for the cost of living (this can vary significantly depending on the city or country where the student will reside).

There is a significant distinction in the COA for IN-students and OUT-students. When it comes to education abroad, currency exchange rates, the higher cost of living in foreign cities, as well as other expenses such as airfare and visa fees, are all potential additional costs that are factored into the loan amount. On the other hand, COA for Indian studies tends to have a lower cost of living, but this varies significantly by city – one would expect a larger city like Mumbai or Delhi to have higher living expenses than a smaller town.

For instance, when they sanction education loans, Axis Bank factors in tuition and an estimate for hostel or rent, food, travel, and sundry other expenses. Simultaneously, across Tata Capital and IDFC FIRST Bank, the Loan amount is computed based on the complete COA, ensuring the student has sufficient funds to cover both academic fees and living expenses. This group of lenders may require substantiation of the estimated living expenses to approve the amount of the loan earmarked for non-tuition costs.

Comprehension of the COA and its impact on education loan coverage for living expenses is crucial, enabling students to budget wisely and avoid becoming overburdened with debt.

Can Student Loans Cover Living Expenses in India?

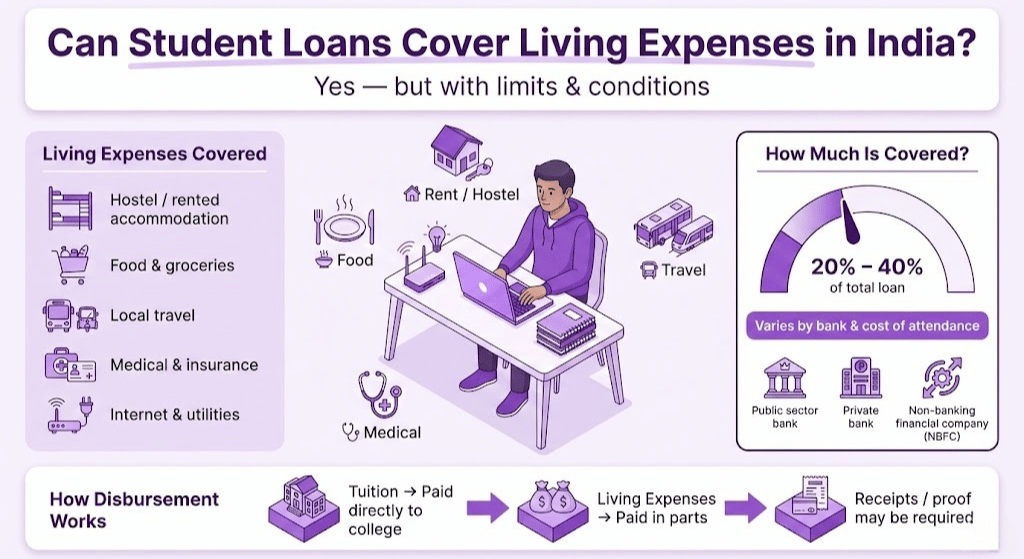

The short answer is yes, student loans in India can be used to finance living expenses, but it’s not that straightforward, and there are some cons and stipulations. In many cases, students are required to contribute their earnings through part-time work, and only tuition and academic costs are eligible to be paid with borrowed funds; however, historically, the cost of living was also borne by the student.

Typical Living Expenses Covered by Education Loans

Use your education loan for living expenses. It is ok to use your education loan to pay for living expenses like:

- Hostel rent and off-campus rent if staying in a rented accommodation.

- Food and groceries

- Local travel expenses, such as commuting and regional travel.

- Health and medical coverage and costs

- Internet and utility (electricity, water, phone, etc.) bills

- Stationery, study materials, and course-related costs are not included in tuition fees

How Much of the Loan is Allocated to Living Expenses?

A portion of your approved loan amount is set aside for day-to-day expenses. This percentage typically ranges from 20% to 40% of the entire loan amount, varying depending on the bank and the student’s estimated cost of attendance. For example:

- Axis Bank – Axis Bank typically offers living expenses as an additional component of the education loan, allowing up to 40% of the sanctioned loan amount to be utilized for other costs, such as hostel accommodation and rent.

- Tata Capital allows a similar allotment; however, they require proof of the tentative expenses for living for 3 months at the time of the loan application.

- IDFC FIRST Bank treats living expenses as a component of the cost of attendance and includes them in the total loan.

- The State Bank of India (SBI), the country’s largest lender, considers living expenses, including hostel fees and day-to-day expenses, as part of the education loan. Still, such an amount must be substantiated with proof.

Upfront Disbursement vs Reimbursement

One of the frequently asked questions by students is whether they will be paid directly by the lender or reimbursed at a later time. As per discussions on Quora, Reddit, etc., most banks release the loan in parts and transfer it directly to the lender for tuition fees. They then transfer the amount for living expenses to the borrower’s account according to their needs, or the disbursement can be made against the proofs/documents submitted. That means students often won’t receive living expense funds until they have submitted receipts or billing statements, which can also be a hassle due to bureaucratic delays. However, some lenders will provide a loan to help defray immediate costs.

Lender Flexibility and Misconceptions

Some lenders are flexible when it comes to customizing the amount of the loan to meet individual needs, and students can indicate what they’d like to use the loan for, whether it’s for tuition, books, or living expenses. You’ll want to clarify this with your lender before applying.

A misconception is that any proportion of the education loan amount can be utilized for personal expenses, and education loans can be freely used for purposes other than education. The bank closely monitors the loan’s intended purpose, and misuse of the funds may result in penalties or cancellation of the loan. Living costs must be sufficiently significant to the student’s academic life and reasonable.

What Expenses Are NOT Covered by Student Loans?

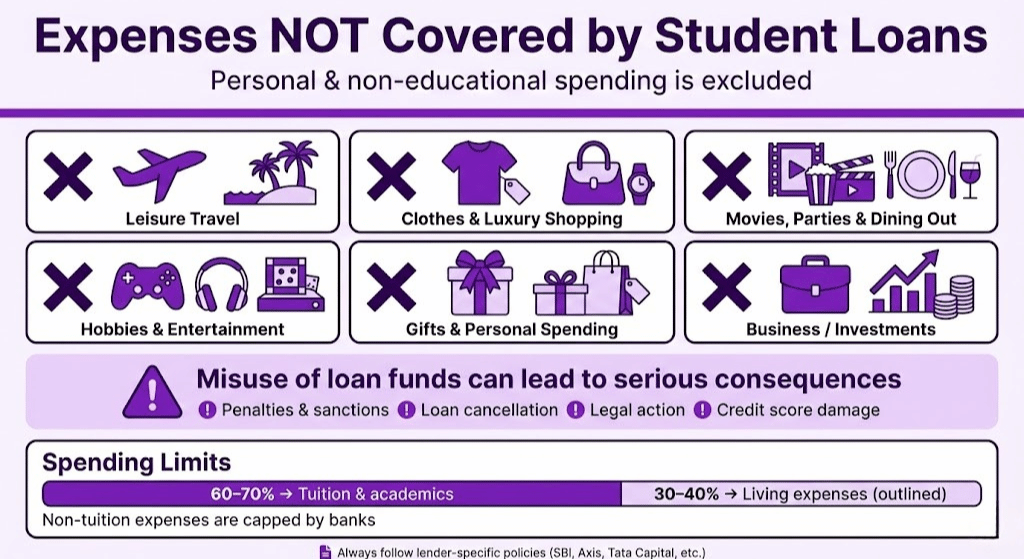

Although student loans are a valuable source of financial assistance, they should be used exclusively for educational purposes and modest living expenses. Student loans in India do not cover personal, non-educational expenses, such as vacations, shopping, and entertainment, or luxury items.

Personal Non-Educational Expenses Excluded

You can’t use student loans for:

- Travel for leisure or not connected to study.

- Buying clothes, devices, or personal luxurious stuff

- Entertainment costs could include movies, parties, and dining out.

- Gifts, Hobbies, or Other Discretionary Spending

These exemptions are in place to ensure that student loan funds are spent wisely and strictly on supporting a student’s studies and reasonable living expenses.

Consequences of Loan Misuse

The careless use of loan money for non-allowed purposes has serious consequences. Banks and financial institutions often need to see copious amounts of paperwork and documentation proving how you are spending the money, particularly if the amount borrowed is a large portion of your living expenses. If you either overstate expenses or use loan funds for personal use, you could trigger:

- Sanctions or fees by the lender

- Withdrawal or return of the borrowed sum

- Litigation up to and including court proceedings

- Hurt the borrower’s credit and financial standing

Limits on Non-Tuition Portions of Loans

Lenders at most banks have strict caps on the percentage of the loan amount that can be used for living and other non-tuition expenses. While these limits differ, there is usually a maximum of 30-40% of the total loan amount. Establishing the hierarchy of respondents allows tuition and academic fees to take priority in financing.

Bank-Specific Policies on Excluded Expenses

Individual lenders will have their detailed policies on which expenses should be excluded. An example of this is covered by Axis Bank, SBI, and Tata Capital, which state categorically that an Educational loan does not cover the following:

- Paying off personal debt currently held by the applicant

- Non-instructional charges of a personal nature

- Non-educational investments or business initiatives

Borrowers would have to carefully read their loan agreements to determine which restrictions they are subject to, and presumably to avoid problems, follow them to the letter.

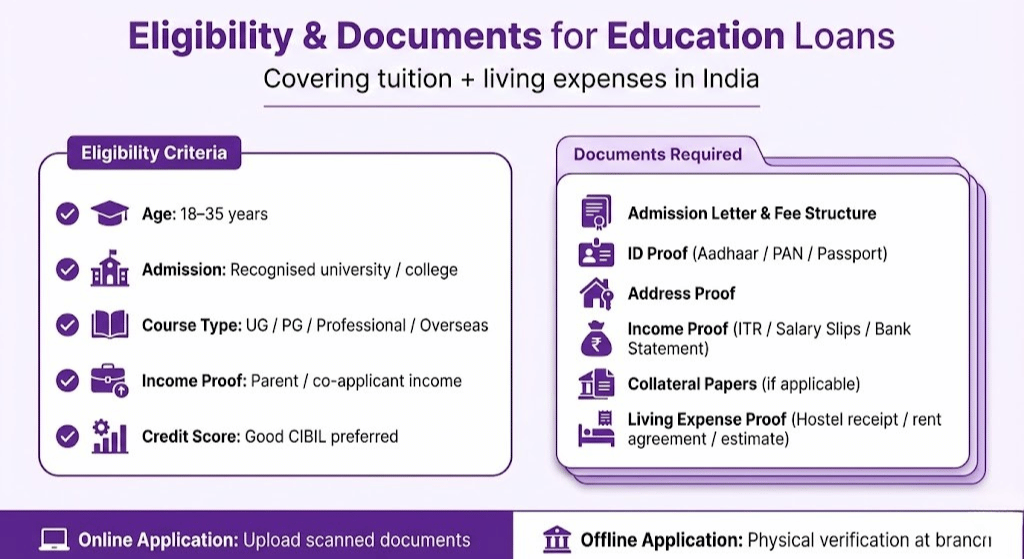

Eligibility Criteria & Documentation for Education Loans Covering Living Expenses

Obtaining an education loan in India for tuition fees and living costs requires prospective students to fulfill specific eligibility criteria and submit a comprehensive list of documents. Being aware of these requirements can facilitate loan approval and provide more efficient access to funds.

Eligibility Criteria

- Age: Applicants typically need to be between 18 and 35 years old at the time of application. A few lenders may offer some leeway with course type and loan length.

- Proof of Admission: Candidates should have a valid Admission (offer or confirmed) or the participation letter from a recognized university at the time of appearing in the final selection process. There is a specific time limit for the duration of the course (1 year or more).

- Courses: The loans are granted for professional, technical, and higher education courses in India or abroad.

- Proof of Income: Lenders may require proof of income from the applicant or co-applicant (typically parents or guardians). These can be in the form of salary slips, income tax returns, or bank statements to demonstrate repayment capabilities.

- Credit Score – A good credit score is required to show that the borrower is creditworthy. A poor credit score can result in rejection or high-interest rates.

Documentation Required

- Educational papers: Acceptance letter, fees, and a copy of the course curriculum.

- Proof of identity: Aadhaar, PAN card, passport, voter ID.

- Address proof: Utility bills, ration card, or passport.

- Proof of income: Salary slips, bank statements, or the tax returns of the applicant/co-applicant.

- Collateral Documents: In the event of a loan greater than 7.5 lakhs or any other requirement of a lender. Collateral may include property papers, fixed deposits, and other assets.

- Proof of Living expenses: In cases where the loan is sought to cover living costs, banks may request receipts for hostel fees, a rent agreement, or an estimate of monthly living expenses to verify the loan requirement.

Online vs Offline Application Documents

The online application is now available in most banks, which requires you to upload scanned copies of documents such as ID proof, admission letter, and fee details. The offline process may require the original documents to be verified at the branch.

When you meet these conditions and have all the required documents, applying for a student loan to cover living expenses becomes convenient and straightforward.

How to Apply for Student Loans to Cover Living Expenses in India (Online & Offline Process)

Loans for living expenses in India for education have become more accessible due to user-friendly online and offline processes offered by leading banks and financial institutions.

Stepwise Online Application Process

The application process for most top-of-the-line lenders, such as Axis Bank, Tata Capital, and IDFC FIRST Bank, is entirely digital.

- Visit their official website or download the mobile app to obtain the application form for a student’s education loan.

- Enter name, address, phone number, and course of interest.

- Upload necessary documents, such as an admission letter, ID proof, income proof, and fee structure, online.

- Complete KYC verification (fill out and upload a video or document through the bank’s procedure) as recommended by the bank.

- Apply for the loan and wait for confirmation. It only takes 7-15 working days, provided the documents and background information are in good order.

- After the loan is sanctioned, the bank will communicate the sanction letter, which describes the terms of the loan.

Disbursement Process

- The tuition fee loan element is paid directly to the college of higher education in monthly instalments, as per the academic calendar.

- The living cost payments, which are typically paid in installments or a single sum into the borrower’s bank account, help students meet expenses such as rent, food, and transportation.

Offline Application Highlights

For students who wish to complete the process offline, they must visit the nearest branch with all original documents. It is wise to schedule an appointment to avoid lengthy wait times and to address any specific questions about living expenses coverage.

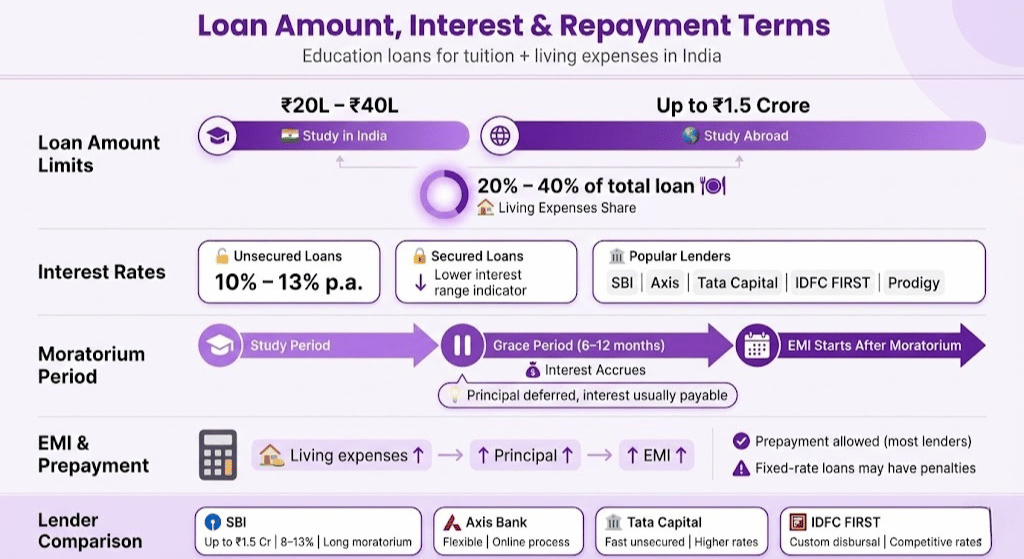

Loan Amount Limits, Interest Rates & Repayment Terms

It is essential to be aware of the loan amount limits, interest rates, and repayment terms when applying for student loans for living expenses in India. These factors all influence how much you can borrow, your monthly repayments, and your overall financial planning.

Loan Amount Limits

In India, the education loan amount ranges depending on the course and institution:

- For studies in India, you may be able to borrow anywhere from Rs. 20-40 lakhs.

- For foreign education, many lenders in India offer loans as high as Rs. 1.5 Crores, the amount, however, depends on the lender’s terms and the collateral offered.

- The living expenses component of the loan typically accounts for 20-40% of the total amount sanctioned, although this percentage may vary depending on the bank and the type of loan.

Interest Rates

Interest rates on education loans in India depend on several factors:

Although the interest charged on collateral-free loans is relatively high (roughly 10-13%) compared to secured loans, such as those against property or other security.

The biggies — SBI, Axis Bank, Tata Capital, IDFC FIRST Bank, and Prodigy Finance — provide competitive rates within this range, including the loan giant that specialises in uncollateralised loans for international students, Prodigy Finance.

Moratorium Period

The moratorium period for most education loans typically ranges from the study period plus 6 to 12 months after completing the course. Such debts usually charge no interest for the student, who remains enrolled in a so-called “in-school deferment” for a set period. During this time, they do not have to make principal payments but are usually required to make interest payments, sometimes even the interest itself.

EMI Calculation and Prepayment.

The fact that living expenses have been added to your loan amount increases your total principal, and in turn, your EMI. It is essential to use online EMI calculators to determine the approximate monthly installment amount.

Most lenders offer the ability to prepay loans without penalty, which reduces the balance and saves interest costs faster than the loan was scheduled. However, some banks may charge a prepayment penalty on fixed-rate loans, so be sure to read the fine print.

Comparison of Popular Lenders

- SBI Education Loans: Up to Rs. 1.5 Cr, interest rates around 8-13%, moratorium up to 7 years.

- Axis Bank: Adjustable loans with a living expense cover, rates ranging from 10-13%, and an easy online process.

- Tata Capital: Provident Funding offers competitive unsecured loans; however, you pay high interest on living expenses.

- IDFC FIRST Bank: Competitive rates, secured and unsecured options, and loan disbursement tailored as per your needs.

Consider other options, including loan terms, interest rates, and repayment flexibility, before making a decision. Consider the cost of living carefully to prevent overborrowing and ensure that EMIs are manageable.

FAQs Related to Living Expenses in Education Loans

Yes, you can obtain an education loan of Rs 25 Lakh without collateral in India, although some lender policies may vary. All banks and NBFCs offer unsecured education loans ranging from Rs. 10 lakh to Rs. 25 lakh. For instance, banks such as Axis Bank, IDFC FIRST Bank, and Tata Capital offer unsecured loans based on the applicant’s academic background, course, and admission to a reputable institution.

But, above Rs. 7.5 lakhs, Banks can ask for collateral or a third-party guarantee for the loan. The qualifications are more stringent, and the creditworthiness of the applicant or co-applicant is of greater importance.

For living expenses support, some creditors may have restrictions regarding the non-tuition portion of the deficiency. It’s essential to review each bank’s terms and negotiate, if possible.

Yes, Other living costs, such as hostel fees, rent, food & travel, are also covered by SBI Education Loans as part of the total Cost of Attendance (COA). SBI generally calculates your loan amount, including study costs, as follows: the total estimated costs for tuition, living expenses, insurance, and all other costs related to your study.

The portion of the loan allocated to living expenses is directly deposited into the borrower’s account after the tuition figure is sent to the school. This is a nice convenience that allows students to manage day-to-day expenses with confidence.

Proof of hostel fee payment/rent agreement receipts, along with other relevant documents, should be submitted by the borrower at the time of loan application, as well as during subsequent disbursements, to demonstrate proper utilization of funds.

Yes, an 18-year-old student can apply for a student loan in India, even if they do not have personal income proof. However, the co-applicant (generally a parent or guardian) needs to have income proof. Banks take into account the repaying capacity of the co-applicant, not that of the student, who, in case they are not an earning member in the family.

Students should have valid identification proof, an admission letter, and educational certificates. The co-applicant’s salary slips, bank statements, and income tax returns are essential factors that determine loan approval.

Documentation needed to claim for living costs under an education loan. To claim living costs under an education loan, borrowers usually must supply:

Receipts of hostel fees or rent agreement for off-campus residence

Evidence of payment for utility or internet services (if applicable) (May not be required)

The fee structure from the academic or sanction letter, indicating the cost of living, is included in the loan.

Statements showing the use of funds on living costs

Some banks will require you to submit receipts regularly throughout the year to continue receiving the living expenses portion.

No, education loan money can be used only for tuition, hostel expenses, rent, books, and transport, and no lending institutions help with it. The loan may not be used for personal needs, holidays, luxury goods, or non-related trips.

If the education loan money is misused, you may be in trouble with the law, and your loan could be recalled, or the lender might block you. Maintain transparency and always use the loan according to the terms and conditions.

The minimum income required for co-applicants is lender-specific but is usually in the range of Rs. 15,000-25,000 for unsecured loans. The income requirement may be higher for loans with collateral/with a higher loan amount.

The application also checks the joint applicant’s debt-to-income ratio to ensure that this person has the financial freedom to repay the loan promptly.

For the poor or low-income students, the educational loans can be obtained by:

Government initiatives, such as the Vidyalakshmi Portal, provide subsidized loans with interest waivers.

Banks sometimes offer interest-subsidised loans, such as CSIS, to low-income students.

There’s flexibility for co-applicants to be family members or trusted guarantors.

NGOs and institutions, such as EduFund, offer easy eligibility criteria and digital processing of loans for students from low-income families.

A good academic track record and enrollment in a reputed institution increase the possibility of getting the loan approved.

Tips to Manage Living Expenses Smartly When Taking an Education Loan

Living smart is as important as getting an education loan to pay for college. Prudent financial management and budgeting can be used to maximize the use of your loan while helping to minimize unwanted debt.

Budget Realistically

Begin by creating a thorough budget that includes core living expenses, such as rent, food, local transportation, and utilities. Research the average costs in your study city or campus area to ensure you don’t underestimate. If you overestimate, you’ll end up borrowing more than you need, which will add to your repayment burden.

Avoid Overborrowing for Lifestyle Expenses

Student loans can be used for some living expenses, but do not take out loans for luxury or lifestyle expenses. Spending the loan only on education expenses also helps keep you financially in check and lowers the chance of taking on more debt than you can handle.

Explore Scholarships, Grants, and Part-Time Work

Look into Scholarships and Grants offered by your school and other organizations before taking out a large loan sum. These can significantly reduce the amount you need to borrow. Also, look for part-time work and freelancing opportunities to help fund your living expenses, thereby decreasing your reliance on loans.

Use Loan Money Strictly for Living Costs

Keep money set aside for living expenses separate from your other funds and only spend it on rent, food, travel, and studying. This makes it transparent and eliminates complications in loan disbursement or redemption.

Maintain Expense Records

Keep a copy of receipts/records for all living expense payments, particularly if the lender requires documentation (e.g., to disburse funds or refund monies). Additionally, organized documentation can help you track your spending, ensuring you don’t exceed your budget.

Plan Repayment Early

Even while you’re pursuing your course, start planning how you will repay the loan. If possible, make the interest payment during the moratorium to reduce manageable interest liability and alleviate post-study financial burden.

Conclusion: Is It Worth Using Student Loans for Living Expenses?

Yes, student loans in India can be used to cover living expenses alongside tuition fees, but this comes with important limitations and considerations. It is essential to understand how much of the loan can be allocated to rent, food, travel, and other day-to-day costs, as lenders often impose caps or require proper documentation.

Careful planning is crucial. Before borrowing, clarify the terms with your lender to avoid surprises, and realistically assess your living expenses based on your study location and lifestyle. Borrow only what you need, and maintain strict budgeting to ensure your loan lasts throughout your course duration.

Comparing offers from multiple lenders such as Axis Bank, Tata Capital, IDFC FIRST Bank, SBI, and innovative platforms like Prodigy Finance and EduFund can help you find the most favorable interest rates and flexible repayment terms.

If you’re planning to pursue higher education and require financial support, don’t wait. Check your eligibility, explore various loan options, and apply for an education loan today to confidently manage both tuition and living expenses.