Do You Have To Pay Interest On Student Loan

Education loans in India have become a must-have financial offering for students who wish to pursue higher studies at home or abroad in today’s highly competitive academic landscape. Whether you want to study at a top engineering institute in India or pursue your Master’s abroad, an education loan can help you bridge the financial gap and not put a dent in your family’s pocket.

What Is a Student/Education Loan?

A student loan is offered by banks or Non-Banking Financial Companies (NBFCs) for educational purposes. It includes tuition, living expenses, travel (for study abroad), and other academic-related expenses. These are generally repaid after a grace period (your course length plus a predetermined buffer, typically 6–12 months).

Who Offers Education Loans in India?

Student loans in India are offered by both public sector and private sector banks at varying rates of interest and terms, based on aggregate family income:

Public Sector Banks:

State Bank of India (SBI) – Most popular due to low interest rates & maximum moratorium period

Punjab National Bank (PNB), Bank of Baroda, etc.

Private Banks:

HDFC Bank, ICICI Bank, and Axis Bank – All process faster, but typically at higher rates.

NBFCs and Fintech Lenders:

Propelled, Avanse, InCred – For students with unconventional profiles, rejected by banks.

Why Does Interest Apply on Student Loans?

Interest is the charge for the privilege of borrowing money, and student loans are no different from other types of credit in this regard. Students are not responsible for repaying the principal at that time, but interest will begin to accumulate on the date the loan is disbursed. This becomes even more critical during the moratorium period, when the interest payment can either be made every month (simple interest) or accumulated on the principal amount (capitalized) by the lender.

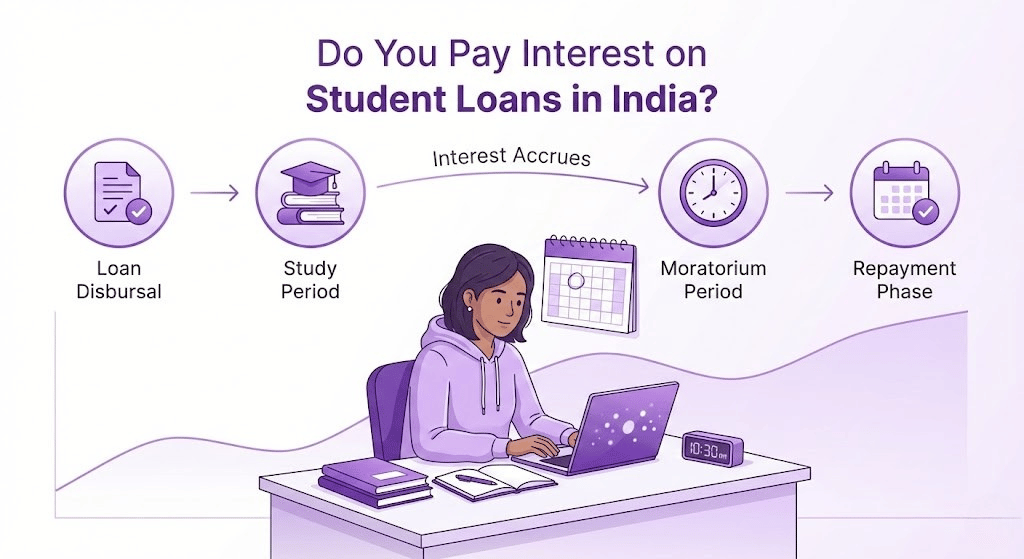

Do You Have to Pay Interest on Student Loans in India?

Yes, interest must be paid on a student loan in India. It doesn’t stop until after graduation, either, it begins building up the day the first loan payment is made. However, the timing and method of paying that interest will vary depending on your bank’s moratorium policy, the type of loan, and whether the loan is from a public sector bank, a private lender, or an NBFC.

When Does Interest on Student Loans Start?

Interest on student loans generally starts accumulating immediately after the loan is disbursed, even while you are still in school. That’s true for the majority of banks, such as:

SBI: Levies interest during the moratorium period, but you may not need to make the payments immediately.

HDFC Bank: You will be charged simple interest during the study period.

ICICI Bank and Axis Bank: Even here, interest payments must commence during the course of study, according to the pact.

There is a lot of misinformation about the period of the moratorium. It gives you a pause on principal, not on interest. And even if you are not yet making payments, interest is quietly accruing in the background.

Do All Banks Charge Interest While Studying?

Yes, all educational loans in India accumulate interest during their tenure, but the treatment of interest differs:

Public sector banks, such as SBI, are likely to offer students the option to either service the simple interest every month during the moratorium or permit it to accumulate and be added to the principal at a later date (capitalisation).

Especially, private banks like HDFC, Axis, and ICICI want mandatory EMI every month for the course duration.

NBFCs and Fintech lenders (E.g., Propelld, Avanse) typically have a private-bank-like structure and may quote you higher interest rates or tougher terms, even.

Not paying interest during this period results in accrued interest being added to the loan amount, which increases the EMI and total repayment amount after graduation.

How to Know Your Bank’s Interest Policy?

These are the things you should do before putting your signature on the loan contract:

Go to the official website of the bank and go to the education loan interest rate page.

Read about:

When interest starts

If you have to pay interest monthly while in school

What if you don’t pay during the moratorium

Could be a capitalization/punctuation penalty there.

Predict future EMIs with the help of the bank’s education loan calculator

The RBI and IBA guidelines stipulate that banks must provide clear documents. Still, the fine print will vary, so be sure to compare at least three to four lenders before settling on one.

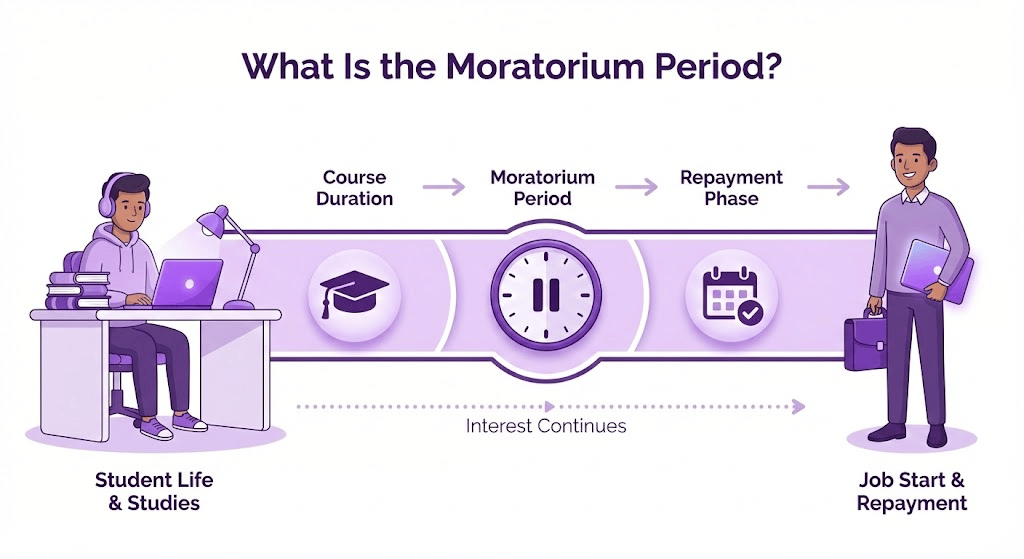

What is the Moratorium Period?

A moratorium on student loans is a necessary process that helps you during the repayment of your student loans in India. It’s really just a period of time, and it usually spans the length of the course plus an additional 6 to 12 months after graduation. The original capital tile will not be repaid by students at this stage. Yet, the majority of lenders continue to apply simple interest, as it’s either due each month or rolled up and added to the principal (a practice known as interest capitalisation).

Why Does the Moratorium Period Exist?

One of the objectives of providing a loan moratorium is to enable students to concentrate on their studies without worrying about loan repayment irregularities. It also allows them time to find a job and start making full loan EMIs.

And it may sound like a total moratorium on loan obligations, but that’s only true for the principal payment. Most banks will seek interest payments during this period, though some are flexible.

One of the most popular education loan schemes is offered by the State Bank of India (SBI) under its SBI Student Loan Scheme. Here is how the moratorium works:

Duration: Period of course + 12 months after completion (or 6 months after getting a job, whichever is earlier)

Interest: Interest continues to accrue during the moratorium; simple interest will be charged during the period.

Repayment: Once the deferment period ends, interest is paid monthly or added to the principal

This flexibility eases the burden, but making interest payments during that time can substantially reduce your total payment.

HDFC Bank’s Policy: Interest Payable Monthly

“Under the terms and conditions of the bank, simple interest is chargeable in moratorium as per the bank’s policy,” the bank says. This means:

Students (or co-borrowers, frequently parents) are required to make interest payments each month of the course period

Lessens the post-graduation EMI load

It wards off interest “compounding” into a far larger principal amount

HDFC provides faster processing and loans for larger institutions, but its repayment discipline policy is stricter.

What Happens if You Don’t Pay Interest During the Moratorium?

If you fail to pay the interest during the moratorium, banks will capitalize the amount. This means:

The unpaid interest is capitalized into the loan.

Once repayment begins, your EMI increases manifold

You’re paying interest on interest, which is always more expensive in the long run.

Private banks and NBFCs, in particular, have been doing this, and the interest rates are also higher, with the moratorium being less flexible.

Interest Rates Comparison by Major Banks & NBFCs

Interest rates, moratorium policies, and processing fees are some of the parameters that you need to consider when choosing the best education loan in India. • Choose your lender: Those from the government stable, such as the SBI, may be more student-friendly, while those from the private and NBFC sectors may approve faster but may charge more.

Here’s a rundown of some major banks and what their 2026 student loan offer look like:

Education Loan Interest Rate Comparison (2026)

Bank/NBFC | Interest Rate | Moratorium | Simple Interest Policy | Processing Fee |

SBI | 8.15% – 11.15% | Course + 1 year | Optional interest pay during moratorium | NIL to low |

HDFC Bank | 9.55% – 13.25% | Course + 1 year | Simple interest must be paid monthly | 1% – 1.5% of loan amount |

ICICI Bank | 9% – 11.5% | Course + 6 months | Interest accrues, repayment starts post moratorium | ₹5,000 + GST |

Axis Bank | 13%+ | Course + 6 months | Interest accrues during studies | ₹15,000 – ₹25,000 |

Avanse (NBFC) | 11% – 14.5% | Course + 6–12 months | Monthly interest required | 1% – 2% approx. |

Propelld (Fintech/NBFC) | 12% – 16% | Course + 6 months | Interest payable during course | 1% – 2.5% approx. |

Note: Interest rates and policies may vary based on student profile, institution ranking, collateral, and co-borrower income.

Why Many Students Prefer SBI for Education Loans

Attractive interest rates starting at 8.15% p.a.

A more extended moratorium: above the course period, providing a relaxation period for job hunting.

Optional simple interest payment: Pay while in school or have it capitalized later

Low to no fees for the majority of government-approved institutions

SBI is also a part of the Credit Guarantee Fund for Education Loans (CGFEL) and various interest subsidy schemes, particularly for underprivileged sections of society.

What to Know About Private Banks

Private banks such as HDFC Bank, ICICI, and Axis Bank usually :

Charge higher interest rates

Charge students or co-borrowers interest during the moratorium

Have expensive processing fees, which can significantly add to the up-front cost

For example, HDFC Bank mandates that students pay simple interest monthly during the course. While this reduces future EMIs, it requires consistent cash flow during studies, which may not be feasible for all families.

What Do NBFCs Like Avanse and Propelld Charge?

NBFCs and fintech lenders, such as Avanse and Propelld, serve students with atypical needs—say, for non-listed colleges, test-prep programs, and international courses that public banks do not fund. However, they typically:

Lend at a higher interest rate (15-16%)

Demand interest to be paid monthly despite the moratorium

Put in higher processing fees

Can provide tailored EMI patterns (step-up or interest-only)

These loans are available to borrowers who cannot obtain loans from banks, but they tend to be pricey.

Tip: Compare offers across 2–3 banks or NBFCs and use the education loan EMI calculator. Always read the fine print before taking a call.

How is Interest Calculated on Education Loans?

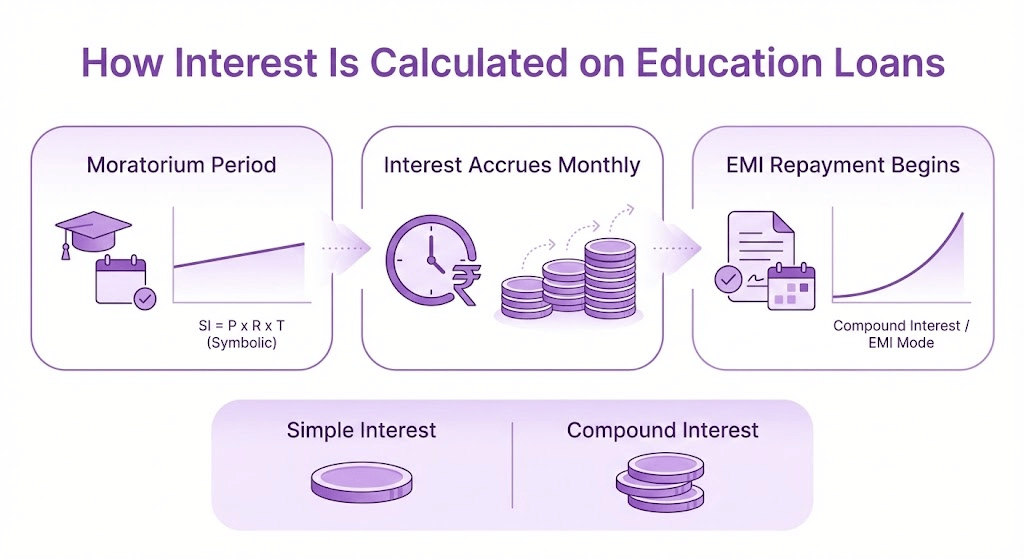

Understanding how interest is charged on an education loan in India is crucial for calculating your total repayment amount. Simple or compound: Education loans can come with simple or compound interest, depending on the lender’s policy and your agreement to pay interest during the moratorium.

In most banks, simple interest is calculated during the moratorium period (course period + grace period), and then we have to pay compound interest (EMIs) when full-fledged repayment starts.

Simple Interest vs Compound Interest

Simple Interest (SI): Applicable in Moratorium Period. It is also computed on the original principal amount. Formula: SI = (P X R X T) / 100 where P = principal, R = rate, and T = time.

Compound Interest (EMI mode): It is applicable during the repayment period post the moratorium. Interest is compounded monthly on the remaining principal plus any unpaid interest.

Monthly or Quarterly Accrual?

Most education loans are compounded monthly, not annually. Even if you’re not being charged interest while you’re on your course, you are still accruing interest each month, which will be added to what you owe if it’s not repaid in full.

Some banks (most of which are in the public sector) provide for the calculation of interest payments every quarter or semi-annually, as quarterly rests occur after or during a moratorium period.

Example Calculation: ₹10 Lakhs Loan at 9.5% for 4 Years

Let’s say you borrow ₹10,00,000 at an interest rate of 9.5% per annum for a 4-year course with a 1-year moratorium.

If you don’t pay any interest during the moratorium:

- Simple interest during 5 years (4 + 1):

SI = (10,00,000 × 9.5 × 5) / 100 = ₹4,75,000 - New principal for EMI calculation:

₹10,00,000 + ₹4,75,000 = ₹14,75,000 - EMI over 7 years: ~ ₹25,000/month (approx.)

If you pay partial interest (50%) monthly during moratorium:

- Interest paid = ₹2,37,500

- Remaining unpaid = ₹2,37,500 → Added to principal

New principal = ₹12,37,500

EMI reduces to ~ ₹21,000/month

Lesson: Paying even part of the interest during the moratorium can save lakhs in the long run.

Can You Get a 0% Interest Education Loan?

In short, not exactly, unless you qualify under the government’s subsidy schemes. Standard 0% interest loans are not available in banks and NBFCs; however, students may have their interest waived under schemes like the Central Sector Interest Subsidy (CSIS) scheme.

Reality Check: No True 0% Loans from Banks

Since 2025, no bank (including NBFCs) in India has offered a 0% interest education loan. Contrary to what some information on the web suggests, not all personal loans for people with bad credit available online are entirely interest-free.

Loan offers eligible for government subsidy on sites like BankBazaar are often referred to as “zero interest”—but only temporarily, under certain conditions.

Government Subsidy Schemes That Help

Central Sector Interest Subsidy Scheme (CSIS) – Active in 2025

The CSIS is a legitimate federal program that offers 100% interest forgiveness during the moratorium to qualified student borrowers. After that, the regular bank interest rate takes effect.

Eligibility:

Family Income: Not exceeding ₹ 4,50,000 per annum

Note: Candidates should be admitted in an institute approved by AICTE (All India Council for Technical Education)/UGC (University Grants Commission) / NAAC (National Assessment and Accreditation Council), and NBA (National Board of Accreditation).

A loan should be availed from scheduled commercial banks (mainly public sector banks, such as SBI, Bank of Baroda, etc.).

Covered Period: The interest rebate is restricted to the moratorium period (course plus grace period). Repayment with interest of the EMI begins only after that.

Where to apply: Automatically linked through the lending bank; students must provide income certificates and proof of institutional approval.

Padho Pardesh Scheme – Discontinued

Previously targeted at minority students studying abroad, this scheme was discontinued in 2022 and is no longer valid in 2025.

Myth vs Reality of “0% Interest” Offers

NBFCs and lenders do not generally offer an interest waiver, even if they offer options of easy EMIs or “study now, pay later”

Some fintechs offering bill financing products will let you defer repayment or allow for “interest-free periods,” but the interest is still accruing in the background.

Loans without interest really are only made possible through subsidy-assisted waivers, not private lender “deals”

Conclusion: Unless you’re eligible for a federally backed subsidy, such as CSIS, you will have to pay interest on your education loan. Be sure to ask your lender if you’re eligible for either subsidy, and don’t fall for the marketing ploy of interest-free education loans with no strings attached.

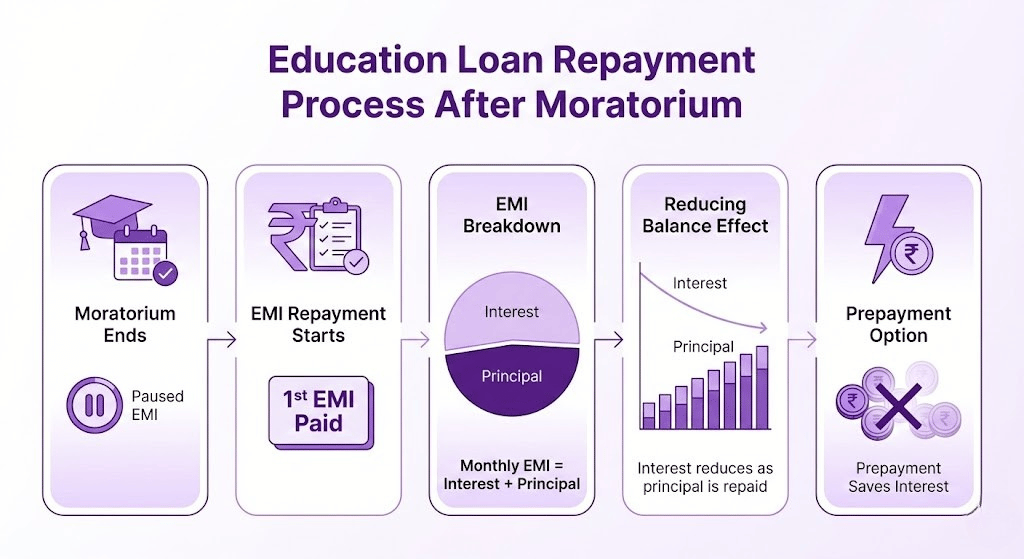

Education Loan Repayment Process After Moratorium

When your moratorium period ends, your education loan repayment period begins, and that’s when the real financial burden kicks in. The majority of Indian banks and Non-Banking Financial Companies (NBFCs) schedule repayments in the form of Equated Monthly Installments (EMIs), which comprise both principal and accrued interest.

When Does Student Loan Repayment Start?

Generally, your education loan repayment starts 6-12 months after you finish your course—this is called a grace period or can be part of your moratorium.

SBI & HDFC: Term of the course + 1 year, in case a moratorium period is specified for repayment under the scheme.

ICICI & Axis Bank: Course + 6 months as grace period

In the meantime, you are supposed to get prepared for the repayment, so get started earning, planning the budget, or repaying any accumulating interest (if you don’t pay it already)

EMI Structure: Interest + Principal

After the repayment starts, your EMIs will include:

Interest on all arrears (including unpaid interest at the moratorium).

Principal repayment

Most banks calculate the EMIs based on the monthly reducing balance method, which reduces the interest component every month as you pay the principal.

Example: ₹15 Lakh Loan, 5-Year Repayment

Let’s say you borrowed ₹15,00,000 for your higher education at 9.5% interest with no interest paid during the moratorium.

- Accrued interest during moratorium (5 years): ~ ₹7.12L

- Total repayment amount: ~ ₹22.12L

- EMI over 60 months (5 years): ~ ₹37,000–₹38,000/month

If you paid interest during study: EMI drops to ~ ₹31,000–₹32,000

Can You Prepay Your Education Loan Early?

Yes, most banks and NBFCs allow you to preclose, and in some cases, it significantly reduces the total interest burden.

SBI:

No charges for prepayment or foreclosure

You can pay a portion of your principal at any time

HDFC:

May have 1%–2% prepayment penalty

Check your loan agreement to see if a minimum lock-in period applies

ICICI & Axis:

May charge a processing fee or an early closure fee

Partial vs Full Prepayment: What’s Better?

Part-payment: Reduces principal, EMI remains the same, or tenure decreases

Pre-closure in full: Closes the entire loan, though it may include documentation/charges

Best time to prepay? To pay as much interest as possible in advance, as soon as possible in the repayment schedule.

Pro Tip: Always request a loan amortization schedule from your lender so that you know the amount going towards interest vs. principal every month.

Can You Reduce or Avoid Interest Payments Legally?

Although you can’t practically escape interest on education loans in India, there are ways to minimize the interest burden to a great extent legally. With good planning, the right choice of lender, and smart repayment, students and parents can save lakhs over the life of the loan.

1. Pay Simple Interest During the Moratorium Period

The simplest and most effective way to lower the cost of the loan is to pay the simple interest each month you are in school.

Interest-only payments during the moratorium are regular (and even expected) in most banks.

Paying any fraction of interest prevents compounding and preserves the principal.

For a ₹10-lakh loan at 9.5%, paying ₹7,900/month over 4 years can result in over ₹2.5 lakh in reduced interest outgo.

2. Choose Banks with Lower Interest Rates

Government banks, such as SBI, Union Bank, and Bank of Baroda, usually provide:

Base interest rates are lower(SBI base interest is 8.15%)

Flexible moratoriums

No or very low processing fees

No foreclosure charges

Try to stay away from NBFCs and private banks unless you need a quick process and a larger loan amount, as they generally charge higher rates (HDFC, Axis: 10.5%–13.5%).

3. Make Early Prepayments with Bonuses or Tax Refunds

Apply scholarships, internships, tax refunds, or part-time wages as lump-sum payments toward the principal.

This also reduces the amount of interest paid on the loan throughout its lifetime.

Paying in the first two years of repayment can benefit you the most.

4. Avoid NBFCs Unless Absolutely Necessary

NBFCs such as Propelld and Avanse typically:

Can charge higher rates of interest (approximately 15%)

Have shorter moratoriums

Apply more rigorous conditions of repayment

Opt for NBFCs only when your loan doesn’t get approved by regular banks or your college/institute is not recognized by government banks.

Smart Strategy: Opt for SBI or Union Bank with repayment as simple interest during studies, and consider part/bonus repayment to minimize the interest burden.

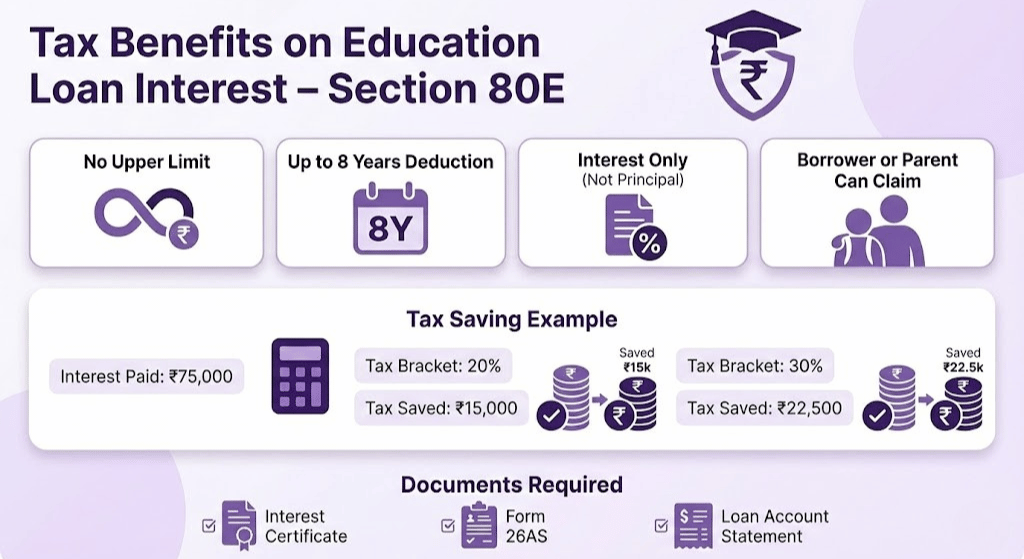

Tax Benefits on Education Loan Interest – Section 80E

Tax Benefit Under Section 80E of the Income Tax Act, 1961. One of the main benefits of availing an education loan in India is the tax benefit under Section 80E of the Income Tax Act. This enables the borrower or co-borrower to claim a deduction on the interest paid on the education loan , thereby reducing their overall tax liability.

What Does Section 80E Offer?

No upper limit for claiming the entire interest paid on an education loan.

The deduction is for a maximum of 8 progressive years, starting from the year you start repaying it.

Only interest paid, not principal repayment.

Who Can Claim This Deduction?

The student borrower is the loan in the student’s name.

Or the responsible co-borrower, such as a parent or spouse, who’s legally accountable for repaying the loan.

Each individual can claim this deduction only once per year.

Documents Required to Claim the Deduction

Interest certificate from the bank or NBFC, specifying the interest paid during the financial year.

Form 26AS, which includes interest payments (significant for filing income tax returns).

Example of Tax Savings

So, if you are paying ₹75,000 (limit for deductions resulting from interest) in interest in one financial year, and you belong to the 20% tax bracket:

Deduction = ₹75,000

Tax Saved = ₹75,000 × 20% = ₹15,000 per year

If you are in the 30% bracket, savings go up to ₹22,500

This can significantly impact the affordability of the loan.

Pro Tip: Hold your interest payment proofs carefully in a safe place and consult a tax planner to optimize your tax benefits under Section 80E.

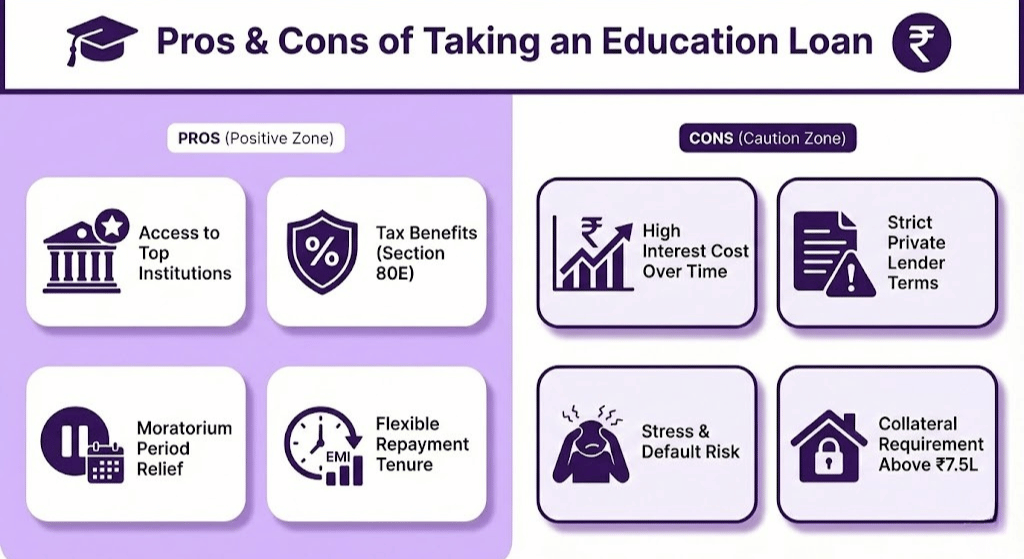

Pros and Cons of Taking an Education Loan

Student loans in India have provided a lifeline to millions of students who wish to further their studies, either in India or abroad. However, like every financial product, they have their pros and cons. Knowing this can help you make an informed decision.

Pros of Taking an Education Loan

1. Access to Top Institutions

Many students dream of attending elite colleges or top-tier universities, but they often lack the financial resources at the outset. An education loan provides these funds to meet capital expenditure and access to good institutions in India or abroad.

2. Tax Benefits on Payment of Loans Under 80E

The interest repayment for education loans is tax-deductible for up to eight years, reducing the effective cost of borrowing.

3. The moratorium period eases the immediate burden.

And you typically don’t have to make principal payments until the grace period ends. This moratorium allows you to concentrate on your studies without any burden to repay the loan.

4. Flexible Repayment Tenures

EMIs of most banks are flexible for 5–15 years, and borrowers can choose the EMI that suits them best, helping them repay according to their financial capacity.

Cons of Taking an Education Loan

1. Interest costs can add up quickly to the total cost

The Interest tends to accumulate over the moratorium period and repayment tenure, increasing the total payout to almost double the principal taken.

2. Tight Lending Conditions, Particularly for Private Lenders

Private banks and NBFCs typically charge higher interest rates and offer shorter moratoriums, with stringent prepayment charges, making them less borrower-friendly compared to PSU banks such as SBI or Union Bank.

3. Psychic Costs and Default Risk

When you owe large sums of money on student loans, the stress is sure to set in when post-graduation work is postponed or doesn’t pay well. EMI defaults can negatively impact a credit score and borrowing capacity in the future.

4. Collateral Requirement

Loans exceeding ₹7.5 lakh will require security or a guarantor, which may not be convenient for all students.

FAQs – Do You Have to Pay Interest on Student Loans in India?

Student loans in India generally accumulate interest monthly, rather than annually. This means that interest is accrued on the outstanding balance of a loan at the end of the month and added to your principal or unpaid interest. For instance, for a ₹10 lakh loan at 9.5% per annum, the monthly interest would be around ₹7,917. If compounding monthly, the total interest paid is higher than if compounded annually. Banks such as SBI, HDFC, and ICICI calculate interest on a monthly reducing balance, which affects the manner in which your EMI is set. You can use an education loan interest calculator to show how the monthly accrual affects your payment.

Yes, many education loans offer a moratorium, allowing you to pay only the simple interest accrued in a month, rather than the principal. This helps prevent your loan from ballooning due to interest capitalization. For instance, SBI offers the option to pay monthly interest during the moratorium, while some private sector lenders, such as HDFC, require payment of monthly interest. Paying interest while in school reduces the total interest accrued post-graduation. If you don’t make payments during the moratorium, interest is typically capitalized, meaning it is added to the principal. For more information, see our in-depth guide to the moratorium period here.

Realistically, no-interest education loans are rare in India. Some government schemes like the Central Sector Interest Subsidy (CSIS) provide interest subsidies for eligible students, effectively making the loan interest-free during the study period and moratorium. However, these are limited to specific income groups and approved institutions.

Among major lenders, SBI generally offers the lowest interest rates ranging from 8.15% to 11.15%, along with longer moratorium periods and flexible repayment options. Other PSU banks like Union Bank and Bank of Baroda offer competitive rates too. Private banks like HDFC, ICICI, and Axis usually have higher rates (9.5%–13.5%).

No, EMIs usually start after the moratorium period, which covers your study duration plus a grace period (typically 6–12 months). For example, if your course ends in May 2025 and the bank offers a 1-year moratorium, your EMIs will start from June 2026. This gives you time to secure a job before repayment begins.

No, EMIs typically cover both interest and principal from the start of the repayment phase. However, the EMI structure ensures that initial payments are interest-heavy, gradually shifting towards principal repayment over the tenure. This is called the amortization schedule.

By prepaying your education loan ahead of time, you can save a substantial amount on total interest outgo as well as reduce your loan tenure. It is generally the case that most banks permit either 50% or 100% prepayment, although some private banks may impose a prepayment penalty. For instance, SBI doesn’t penalize prepayment, whereas HDFC can charge 2-3% of the prepayment amount taken early.

Miss an EMI, and you are charged a penalty, higher interest, and ultimately, it impacts your credit score. There is usually a small grace period, but defaulting too many times may cause the loan to be classified as a non-performing asset (NPA), which will subsequently affect your future loan eligibility.

Yes, many banks allow you to refinance or transfer your education loan to another lender, which may offer better interest rates or terms. This is known as a loan balance transfer. For instance, if you have availed a loan from a private lender at 12% and SBI is offering a deal at 8.15%, transferring could lower your EMI.

To calculate EMI on a ₹10 lakh loan over 5 years at 9.5% interest:

- Use the EMI formula or an EMI calculator.

- Approximate EMI = ₹21,000 per month.

- Total repayment = ₹21,000 × 60 months = ₹12.6 lakh (includes ₹2.6 lakh interest).

Conclusion: Is Paying Interest on Student Loans Worth It?

Paying interest on student loans in India is an unavoidable reality, but understanding how it works can help you manage your debt effectively. From the moment your loan is disbursed, interest starts accruing, whether during your study period or repayment phase. However, the moratorium period offers some relief by allowing you to delay principal repayment and, in some cases, pay only simple interest.

To make the most of your education loan, compare interest rates and moratorium policies across banks before applying. Public sector banks like SBI often provide lower rates and longer moratoriums, while private lenders may require monthly interest payments even during studies. Paying interest promptly during moratorium can significantly reduce your overall repayment burden.

Ultimately, a student loan is an investment in your future. Managing it smartly, by using tools like education loan EMI calculators, understanding your repayment schedule, and consulting your bank for the latest terms, can help you pursue your educational goals without financial stress.