How Much Student Loan Can I Get in India? Complete Guide 2026

Student loans are widely recognized as a vital financial mechanism for the education of Indian students, both within the country and abroad. As the cost of education continues to rise, particularly in professional disciplines such as medicine, engineering, and business management, an increasing number of families struggle to cover tuition fees, living expenses, and other associated costs without outside assistance. This is where education loans come in as a facilitator of your academic ambitions.

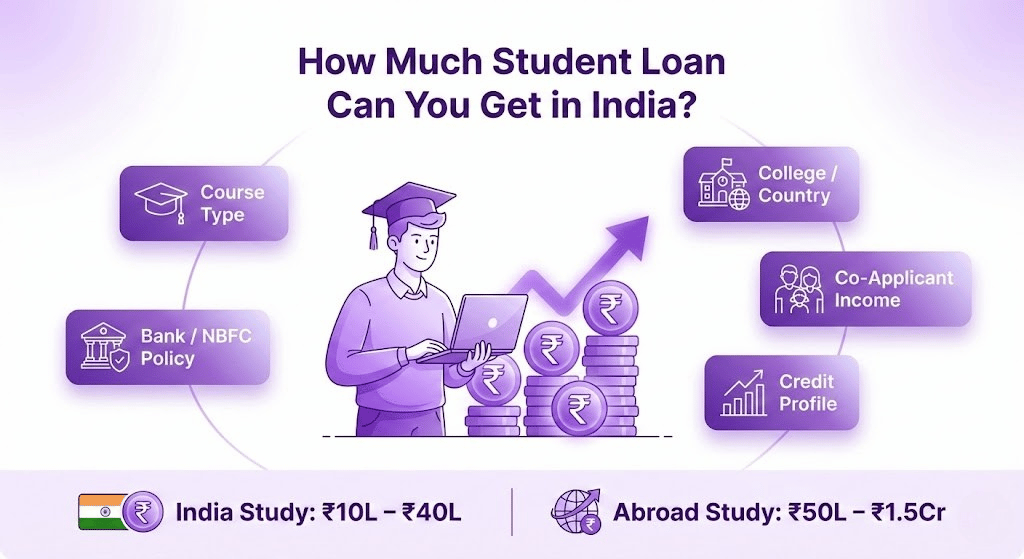

Student loans are offered by the Indian banking and finance ecosystem, ranging from government-owned banks such as SBI and Bank of Baroda to private lenders like HDFC and NBFCs, for various courses, institutions, and geographical locations. Whether you’re applying for a ₹10 lakh loan for a B.Tech course in India or a ₹1.5 crore loan for an MBA degree in the US, the quantum of loan that you can avail is mainly determined by a few factors -type of course, college where you are studying, your co-borrower’s credit profile, and lending policies of the bank.

Knowing how much student loan you can get in India is essential before starting the application. Understanding your education loan limits in advance can help you make the right course decision, plan your finances effectively, and prevent loan rejection, thereby minimizing the burden of repayment.

In this comprehensive guide, we will uncover all that you need to know about the maximum loan that can be availed by a student in India, including eligibility criteria, documents required, interest rates, EMI & repayment schedule, tax deduction under Section 80E and loan limit criterion per lender so that you can take an informed and confident call.

What Is the Maximum Student Loan Amount in India?

General Overview of Loan Limits

In India, education loans are available in the range of ₹50,000 to ₹1.5 crore, depending on the course, location (within India or abroad), institute type, and the lender’s internal criteria.

The majority of bank and NBFC loans are categorized as secured loans (backed by collateral) and unsecured loans (with no collateral).

The unsecured loan is granted up to a maximum of ₹7.5 lakhs to ₹75 lakhs, depending on the profile of the student and the co-borrower, if any.

Secured loans – these are loans that are backed by property, fixed deposits, or any other acceptable asset, and can be a lot more, up to ₹1.5 crore or more, in the case of an international education.

Knowing whether you are eligible for an unsecured or a secured education loan in India will help you estimate how much you can borrow.

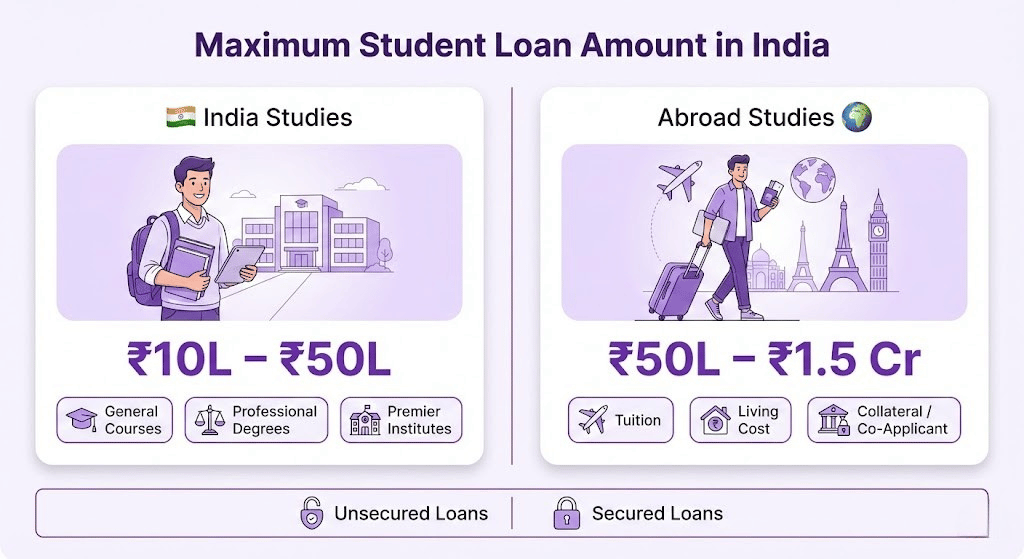

Maximum Loan Amount for Studies in India

Contrary to this, the maximum loan amount for students seeking education in India differs according to the course as well as the institution:

Standard Loan Limit: ₹ 10 lakhs. When you are pursuing undergraduate or postgraduate courses in Arts, Commerce, or General Science.

Higher Loan Limit for Professional Courses: MBBS, B. Tech, BDS, MBA, law, etc., are allowed to have a higher amount of private education loan – up to ₹30 lakhs from various banks, if it is from a good college.

Premier Institutions Exception: Banks such as SBI & Bank of Baroda offer higher education loan limits to those who have secured admission in premier institutions, including IITs, IIMs, NITs, and AIIMS. For instance, under the SBI Scholar Loan, students in AA category institutes can obtain loans of up to Rs 50 lakh without a third-party guarantee.

For studying in India, loan limits are typically considered on a case-by-case basis. Students with high grades or those admitted to government-approved institutions may secure more favorable terms and higher loan caps.

Maximum Loan Amount for Studies Abroad

Through education loans, in the case of studying abroad, as we all know, the tuition amounts can be much higher, costing more towards accommodation / thereby making insurance and travel fees too high.

International student loan schemes, like SBI Global Ed-Vantage, on the other hand, offer up to ₹1.5 crore for recognized schools and colleges in the US, UK, Canada, Australia, and Europe.

Union Bank of India extends up to ₹1.5 crore to students admitted to Category A universities.

Private lenders and NBFCs, such as HDFC Credila, Avanse, and InCred, tend to sanction high unsecured loans, subject to the earning capacity and credit score of the student and the co-applicant.

The two determinants affecting foreign loan sanction are: CoA and reputation of the university, cost of living, real estate value, visa type, co-applicant’s annual income, and debt-income ratio.

Summary Table: Loan Limits Based on Study Location and Course Type

Study Type | Loan Limit (Typical) | Loan Type | Remarks |

General Courses in India | Up to ₹10 lakhs | Secured/Unsecured | Standard courses in Arts/Science/Commerce |

Medical/Engineering/Professional (India) | Up to ₹30 lakhs | Mostly Secured | Higher fee structure justifies larger amount |

Premier Institutions in India (IIT/IIM) | ₹30–50 lakhs | Often Unsecured (SBI) | SBI Scholar Loan – special terms apply |

Studies Abroad | ₹20 lakhs to ₹1.5 crore | Primarily Secured | Includes tuition + living expenses + travel |

Unsecured Loans (India/Abroad) | Up to ₹75 lakhs | Unsecured | Based on co-applicant profile and lender |

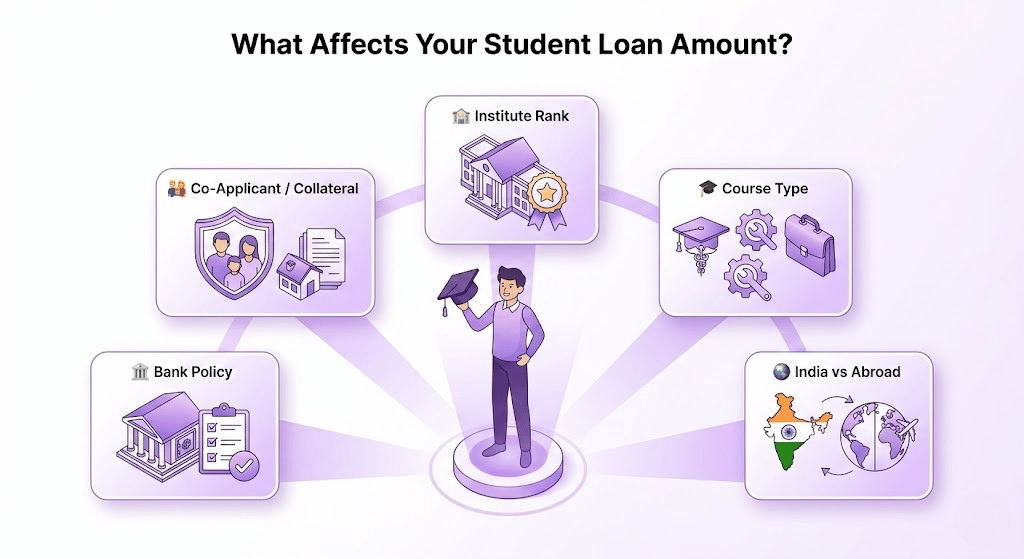

Key Factors Affecting Your Maximum Student Loan Amount

When you’re looking to apply for an education loan in India, the course fee or the reputation of the university is not the only factor that determines the amount you can borrow as a student loan. “Banks and NBFCs just have to add several points for a profile (institutional rank, type of course, borrower profile, collateral availability, and lending policy) to arrive at the final sanction amount. Here are the key factors that determine your eligibility and the maximum loan size for an education loan.

Institution Category and Its Impact

Banks classify universities and colleges into “tiers” — particularly when it comes to unsecured lending. Top institutions, such as IITs, IIMs, NITs, AIIMS, and globally ranked foreign universities, usually fall under the AA or A categories, which entitle students to the highest loan amounts and lowest interest rates.

For instance, the SBI Scholar Loan Scheme offers a loan amount of ₹50 lakhs, collateral-free, to students who have been admitted into Category AA institutes. In contrast, those who got admission into Category B, the loan amount would be restricted ( ₹30–40 lakhs). Likewise, Bank of Baroda and Union Bank offer preferential loan slabs for top-rated institutions, with easier approval procedures.

Why is this important? Higher-ranked colleges keep perceived risk lower, which in turn increases your loan eligibility and your chances of an unsecured loan approval.

Course Type Influences Loan Limits

Not all programs have the same loan limits. Programs are rated by banks based on earnings and employability:

Medical courses (MBBS, MD, BDS) typically have the highest loan limits – up to ₹30 lakhs or more, considering the high tuition and duration of the course.

Engineering, Management (MBA), and Technical Programs, such as Data Science, AI, and Architecture, can also be eligible for a loan between ₹20-30 lakhs, depending on the college.

There are generally lower limits for Arts, Commerce, and General Science courses – up to ₹10 lakhs – for those not attending a premium college.

Advanced professional programs, such as the CFA, Law, or Pilot Training, may be eligible for increased limits if the certification is reputable and high-paying.

The banks consider courses based on the ROI (Return on Investment) — the higher the expected salary after graduation, the larger the loan a student can justify.

Domestic vs. International Study Loan Amounts

The maximum loan limits for foreign studies are higher, as they require more funding. Relate this to the cost of a foreign degree — international tuition, visa fees, health insurance, accommodation, and ticket fares can add up to a loan, which, in most cases, runs into ₹20 lakh- ₹1.5 crore.

However, this also comes with stricter scrutiny. Lenders assess:

- Visa status

- University ranking

- Expected post-study salary

- Co-borrower’s ability to repay

For instance, SBI’s Global Ed-Vantage loan offers up to ₹1.5 crore for high-end international universities, but typically requires collateral and a strong financial profile.

Bank Policies and Individual Assessment

Each bank in India has a different education loan policy.

- SBI extends coverage of up to ₹1.5 crore for overseas studies and up to ₹50 lakhs for premier Indian institutions.

- Bank of Baroda has an upper limit of ₹20–30 lakhs but tends to give some say to top institutes.

- HDFC Credila and NBFCs can provide unsecured loans of up to ₹75 lakhs, but at a slightly steep rate of interest.

- For Category A institutes, the maximum amount is ₹1.5 crore from the Union Bank.

In addition to the rules of the institution, banks also take into account;

- In some cases, the co-borrower’s income and credit score may be considered if one party is disqualified.

- Value of collateral (property, FDs, insurance, etc.)

- Profile of the Guarantor (if any)

The stronger the borrower’s profile, the more likely they are to get approved and receive higher loan sizes without full coverage of the collateral.

Other Influencing Factors

Also, some personal and technical factors can influence the amount of the final loan:

- Age and Course Duration: If the applicant is younger and enrolling in a longer duration course, a higher loan may be sanctioned.

- EMI Tenure: A loan with a higher tenure would reduce your monthly commitments and give the bank leeway when sanctioning a higher loan amount.

- Student’s Historical Defaults: If either the applicant or their co-borrower has defaulted on student loans in the past or has a poor credit history, the loan amount sanctioned may be reduced or the application may be denied.

Knowing these variables in advance can help you prepare, select the best lender, and present a stronger loan package.

Maximum Student Loan Amount by Major Banks & Loan Schemes

The maximum education loan amount in India varies across different banks and financial institutions, based on course type, study destination, and the type of institute. You should compare what each lender offers, as this is key to finding the best loan for your educational needs. Here is an analysis of the maximum student loan limits across leading Indian Banks and NBFCs.

1. State Bank of India (SBI) Education Loans

Maximum Loan Amount:

- Loan amount: Up to ₹1.5 crore (abroad studies) under the SBI Global Ed-Vantage Scheme

- SBI Scholar Loan Scheme for students who are admitted to the organization that has category AA by NAAC and NIRF, up to ₹50 lakh

- ₹20–30 lakhs for other Indian institutions as per the general SBI Student Loan Scheme.

SBI Scholar Loan Scheme:

- Loans up to ₹7.5 lakhs – No collateral required

- No processing fees for the given institute

- Repayment begins after the moratorium period ( course period + 12 months )

Interest Rates:

- 8.15% – 10.50% p.a. (could vary)

- Relaxation of interest for girl students (0.50% interest rate concession)

Loan Tenure:

Up to 15 years, including the moratorium period

2. Bank of Baroda Education Loans

Maximum Loan Amount:

- Up to ₹20 lakhs for domestic education

- Higher amounts possible for studying abroad under the Baroda Scholar and Baroda Gyan loan schemes

Key Features:

- Scholarship covers Tuition Fees, Books, Laptop, Travel (in case of Foreign Studies)

- Lowest interest rates offered for most colleges.

Interest Rates:

Typically ranges between 9.15% to 10.90%, with rebates for girl students

Documentation Requirements:

Proof of Admission, Fee Details, KYC of Student and Co-Borrower, Proof of Academic Records, Proof of Income

Loan Tenure:

Repayment period: 15 years, EMI options are flexible

3. HDFC Bank Education Loans

Maximum Loan Amount:

Up to 50 lakhs, and in some rare cases, more for established institutions or students planning to go abroad

Eligibility Criteria:

- Indian citizenship, acceptance in an authorized university

- Co-Applicant having a Good source of income and a Good credit record

Processing Time:

- 7 to 10-day fast-track approvals

- In some case studies, international, no margin money is required

Interest Rates:

10.25% up to 13.99%, based on loan amount and applicant profile

Loan Tenure:

Up to 15 years with custom payment plans.

4. Union Bank of India Education Loans

Maximum Loan Amount:

- Up to ₹1.5 crore if enrolled in Category A foreign institutions

- INR 30-40 lakh for the premier Indian institutions

Security Requirements:

- Higher loans generally need to be secured above ₹7.5 lakhs

- May consist of immovable property or a third-party guarantee

Interest Rate Structure:

- Begins at 8.90% with rebates for girl students and premier institutes

- Interest to accrue on a simple interest basis during the moratorium period

Tenure:

Up to 15 years

5. Other Notable Banks and NBFCs

- Punjab National Bank (PNB): Up to ₹20 lakhs in respect of studies in India and ₹30 lakhs for studies outside India

- Canara Bank: Up to ₹40 lakhs under special schemes for all top-grade institutions

- IDFC First Bank: Offers loans up to ₹50 lakhs, hassle-free disbursement, and easy repayment options

NBFCs & Fintechs (e.g., HDFC Credila, Avanse, InCred, Propelld)

- Provide unsecured personal education loans up to ₹75 lakhs

- Quicker and less restrictive, but higher interest rates (11–14%)

- A good fit for students who lack collateral or co-borrowers.

- Choice of flexible schedule documentation and EMI scheduling of your choice.

Pros:

Speed, flexibility, international partnerships

Cons:

Higher cost, lack of subsidy benefits, stringent repayment terms.

Comparative Table: Maximum Education Loan Amounts & Features

Bank/NBFC | Max Loan Amount | Interest Rate Range | Collateral Required | Loan Tenure |

SBI | ₹1.5 Cr (Abroad), ₹50L (India) | 8.15% – 10.50% | Yes, if above ₹7.5L | Up to 15 years |

Bank of Baroda | ₹20L (India), higher abroad | 9.15% – 10.90% | Yes | Up to 15 years |

HDFC Bank | ₹50L+ | 10.25% – 13.99% | Mostly Yes | Up to 15 years |

Union Bank of India | ₹1.5 Cr (Abroad), ₹40L (India) | 8.90%+ | Yes (above ₹7.5L) | Up to 15 years |

NBFCs (Credila, Avanse) | ₹75L+ | 11% – 14% | Optional (for unsecured) | 10–15 years |

Eligibility Criteria for Maximum Education Loan Amount

The ideal education loan in India offers the maximum amount; however, this depends mainly on your eligibility. Lenders consider a range of factors — from your academic history to your co-applicant’s income and credit score. Knowing these requirements can help you get approved for higher-value student loans.

1. Basic Eligibility Requirements

To be eligible for any type of education loan in India, students need to meet the following criteria:

- Nationality: The applicant should be an Indian citizen or an NRI, as per the lender’s policy.

- Age Restrictions: The candidate’s age should be between 18 and 35 years.

- Eligibility: You must have a confirmed admission to an Indian or overseas university or school that is recognized without any coaching, i.e., through merit or an entrance test.

- Educational Qualification: It is mandatory to have a consistent education mark sheet (with a minimum of 50% in the qualifying exams), although this requirement may vary depending on the lender and the specific course.

2. Income & Credit Score Requirements

A co-applicant is usually either a parent or guardian, and lenders value their financial credibility in the loan approval process.

- Family Income: Families with higher incomes can borrow more. For instance, in loans above ₹20–30 lakhs, you are often required to show a steady annual income (generally ₹6–12 lakhs or more, based on the EMI).

- Credit Score: You need to have a CIBIL Score of at least 700 for high amount loans. Scores may also be rejected, or they may lead to lower sanction limits.

- Co-applicant Role: Banks verify the co-applicant’s repayment capabilities, IT returns, salary slips, and employment history.

3. Institution & Course Approval by Banks

Your loan limit also depends on the institution type and course you’re in:

- Only loans for colleges approved by the UGC/AICTE/Foreign Government will be granted.

- Structure of Fees: According to the submitted fee structure, college applicants are required to provide full fee accounts, including tuition, hostel, books, and other expenses, from which banks determine the need for a loan.

- Top Institutions: Banks such as State Bank of India, Union Bank of India, and Bank of Baroda provide higher limits and lenient security criteria for premier institutions (like IITs, IIMs, foreign universities like Harvard or Oxford).

4. Collateral & Guarantor Requirements

For loan amounts more than ₹7.5 lakhs, security (collateral/security or guarantee) will be taken:

- Collateral: May be residential/commercial building, FD, LIC, or non-agricultural land.

- A third-party guarantor (typically a relative) who possesses a steady income and good credit may be required.

- A clutch of NBFCs and fintechs offer unsecured loans of up to ₹75 lakh, but at a higher rate of interest.

5. Documentation Checklist for Getting Maximum Loan Amount

To hasten the loan process, have these crucial documents ready:

- Identity Proof: Aadhaar card, PAN card, passport(for foreign admission)

- Proof of Address: Utility bills, Aadhaar, Voter ID.

- Academic credentials – marksheets/entrance exam scores

- Admission Letter: Issued by the university with the course details

- Fee Structure: Breakdown of cost mentioned by the institution

- Income Proofs: ITR of last 2–3 years, salary slips, bank statements

- Collateral papers: Title deed of property / champ, receipt of FD / LIC policy

Students can improve their chances of securing high-value education loans (above ₹50 lakh or even ₹1.5 crore for overseas studies) by fulfilling these eligibility criteria and submitting all the required documents.

Can Students Get Multiple Education Loans?

If you’re wondering, “Can I take 2 education loans in India?”, the answer is yes—but with certain conditions. It is legally permissible and sometimes necessary for students to apply for multiple education loans, especially when the cost of study exceeds the limit provided by a single bank.

Borrowing from Multiple Banks Simultaneously

In countries like India, students can also take a second education loan from another financial institution if the total cost of education — including tuition, travel, and accommodation in the case of an overseas education — exceeds the borrowing limits of a single lender. This is commonly known as a “top-up loan” or a second education loan.

For example:

- A student taking ₹30 lakhs from Bank A for tuition

- May take an additional ₹10–15 lakhs from Bank B for living expenses, especially for overseas education

Conditions and Risks Involved

Although not illegal or limited, banks will subject the second loan application to a higher degree of scrutiny. Key conditions include:

- Co-applicants’ income is sufficient to service both EMIs

- Exemplary credit score and solid repayment history

- Documented need for additional funding, including cost breakdown

Risks include:

- Over leveraging: Borrowing more money than you or your family can repay

- RISK OF DEFAULT is higher. Missing EMIs is a reflection of non-payment of EMIs, which affects your credit score and can result in legal action.

- Collateral saturation: you run out of collateral to support multiple big loans.

When Is It Advisable to Take Multiple Loans?

It’s a good idea to take out multiple student loans when:

- First loan not meeting expenses

- Tuition must be paid in advance at your university, and you have already been granted a loan, but you haven’t received your first disbursement.

- You require top-up funding for living costs, laptops, or travel expenses overseas.

You should try to negotiate with your existing bank first for a top-up or enhancement. Failing that, consider a second loan from another bank or NBFC.

You can take out two education loans, but it needs to be a cautious and responsible decision. It is, therefore, necessary that effective financial planning and transparency are maintained after two lenders are involved, to avoid over-borrowing.

How to Calculate Your Maximum Education Loan Amount?

Students often ask: “How much student loan can I get in India?” The answer depends on a host of financial factors — but there are tools and simple formulas that can help you arrive at a solid estimate. Applying for a Home Loan through SBI, HDFC, or private players is a breeze if you know how to calculate your maximum loan amount.

Using Bank Education Loan Calculators

Most top banks and NBFCs in India offer online education loan calculators to help students calculate their loan eligibility and repayment.

Popular calculators include:

- SBI Education Loan Calculator

- HDFC Credila Education Loan Calculator

- Bank of Baroda Loan Estimator

- IDFC FIRST Bank EMI Planner

These all-in-one calculators usually have features such as:

- Total Course Fee (tuition+hostel+transport)

- Cost of Living (especially for overseas universities)

- Collateral Value (in case of loan against property, FDs)

- Family Income And Current Liabilities

- Loan Tenure and Interest Rate

Once these fields are entered, the tool calculates the maximum loan amount, possible EMI, and the total interest outgo.

Manual Calculation Method

If you’re the sort who wants to get your hands dirty, here’s a simplified formula:

Maximum Loan Amount: Total Cost of Education – Student/Family Payment + Collateral Value (if applicable)

For example:

- Total cost (India): ₹12 lakhs

- Family contribution: ₹2 lakhs

- Collateral offered: ₹10 lakhs

Possible loan amount: ₹10 lakhs to ₹12 lakhs

Also, calculate your EMI using a general EMI calculator or a tool that reduces your EMI:

- Loan amount

- Interest rate (10%–13%)

- Repayment tenure (5–15 years)

This will ensure you’re not taking out more money than you can reasonably repay after graduation.

Importance of Accurate Calculation

Getting the loan calculation right can:

- Prevent borrowing too much or too little

- Boost your approval odds by meeting the eligibility requirements

- Keep EMIs affordable after you graduate

- Maximize Tax Planning with Section 80E for interest payment

With the help of official education loan calculators in India, a good grasp of your repayment capacity will ensure that you are not burdened by loan stress in the future.

Interest Rates on Student Loans in India & Tax Benefits

The student loan amount in India is now. When considering the amount of student loans available in India, it is also crucial to know the interest rates and tax exemptions associated with these types of loans. Interest rates will determine the total amount borrowed, and tax deductions can provide much-needed relief after graduation. Let’s break down both.

Typical Interest Rate Range on Education Loans in India

The interest rate on education loans in India can be 6.5% to 12% per annum and may vary, or can be higher depending on:

- The lender (public banks, private banks, and NBFCs, details of which are shared later in the article).

- The quantity and purpose(teaching in Indian vs. overseas studies)

- Whether the loan is secured or not (with security)

Fixed vs Floating Interest Rates

- Fixed rates remain the same throughout the life of the loan.

- Floating rates move in line with the market (collared to the MCLR or the repo rate).

For example:

- The SBI Scholar Loan is available at approximately 8.15% for premier institutions.

- You may receive rates starting from 10.25% depending on your credit profile and course, through private banks , such as HDFC Credila.

Tip: Borrowers who apply with collateral and a strong co-applicant profile may be eligible for lower interest rates.

Tax Benefits on Education Loan Interest (Section 80E)

According to Section 80E of the Income Tax Act, a 100% tax deduction can be claimed on interest paid on an education loan, either by the student or a parent.

Key Highlights:

- No cap on interest deduction

- 8-year tax benefit is available (tax benefit available till the loan is paid in full or 8 years, whichever is earlier)

- For interest, not for principal

- Can be discharged for the student or co-borrower (e.g., parent or spouse of the student)

Eligibility & Document :

- A Bank or a rotary organization should give the loan to the customer.

- Objective: Higher education in India or outside India.

- Documents needed: loan sanction letter, interest certificate from the bank, payment receipts.

Example Tax Savings:

Suppose you are paying ₹1.5 lakhs a year in interest:

- If you’re in the 20% tax bracket, you save ₹30,000 in taxes each year

- Over 8 years, that’s a saving of ₹2.4 lakhs

Other Financial Benefits and Subsidies

In addition to Section 80E, several government-backed schemes provide financial assistance to qualified students:

Government Interest Subsidy Schemes:

- Padho Pardesh Scheme (now closed): A 100% interest subsidy was provided to minorities during the moratorium period.

- Central Sector Interest Subsidy (CSIS): (For EWS/LIG and pursuing higher education from its infrastructure) CSIS for the period of moratorium.

- Subsidies of States: (For instance , Tamil Nadu & Karnataka – in favour of Resident Subsidies).

- PMSSS (Prime Minister’s Special Scholarship Scheme) for students from Jammu and Kashmir and Ladakh.

Moratorium Period Benefits:

Generally, Banks provide a moratorium period of the course period + 6 months to 1 year. During this time:

- Interest may be simple (not compounded)

- No EMI is required (helps ease financial pressure)

Tips to Maximize Your Student Loan Amount & Approval Chances

Obtaining the education loan you need — especially if you’re seeking larger loan amounts — requires more than simply completing an application form. A large loan is not the kind of money you get on a whim. In other words, if you follow the advice below, you will easily manage your education loan eligibility and increase the likelihood of your loan approval.

Apply Through Premier Institutions

Just because most banks offer special schemes and higher loan amounts to students who get admitted to a Tier college like –

- IITs, IIMs, NITs

- AIIMS, IISc, XLRI

- Reputed foreign universities

For instance, students from top Category AA institutions can obtain an education loan of up to ₹50 lakh without a guarantor through the SBI Scholar Loan. This arrangement suggests a potential for high repayments and lowers the risk to lenders.

Prepare Strong Documentation

Ensure your paperwork is in order and appears professional. This includes:

- Admission letter

- Detailed course fee structure

- Identity and address proofs

- Family income tax returns

- Colateral Wenn aplicable documents.

Providing them with all the editions of a document supports them and makes lenders feel more secure about your information.

Offer Collateral and Guarantor Support

To obtain higher loan amounts (particularly over ₹7.5 lakhs), Collaterals in the form of residential property, fixed deposits, or insurance policies tend to add weight to the application. Additional chances of approval are created when a co-applicant or guarantor with healthy finances is present.

Maintain a Good Credit Score and Income Track

A good credit score for education loan eligibility is anything above 700. Plus, banks look at the stability of your family’s income. Never make late payments or default on your current loans and credit cards – this can have a direct impact on your credit profile.

Compare Offers from Multiple Banks and NBFCs

Lenders have varying limits, interest rates, and durations. For example:

- SBI provides up to ₹1.5 crore for studying abroad.

- You can obtain loans for large amounts with / without collateral from HDFC Credila and Union Bank, based on your profile strength.

Shop around and negotiate better terms using online portals or loan counselors.

Apply Early with Proper Planning

Begin preparing 2-3 months before the course starts. Early applications leave you more time to address any gaps in your application, and are typically associated with more favorable terms.

Frequently Asked Questions (FAQs)

The maximum student loan amount in India depends on the lender, course, and institute. For domestic studies, loans are granted based on tuition fees and can range from ₹ 10 lakhs to ₹ 30 lakhs for most courses and medical or technical studies. For overseas studies, SBI, Union Bank, and others offer loans of up to ₹1.5 crore. The final approval amount also depends on the creditworthiness of the collateral and the co-applicant.

Yes, you can obtain a ₹ 20 lakh education loan in India. Banks such as Bank of Baroda and HDFC offer loans of up to ₹20 Lakhs or more without credit checks, provided the borrower has security. Your credit profile, the co-applicant’s income, and certain documents will determine your eligibility.

One can obtain an education loan of ₹ one crore; however, such loans are primarily intended for premier institutions or studying abroad, where course fees are higher. Banks such as SBI and Union Bank may sanction loans of up to ₹1.5 crore against collateral, evidence of income, and a good repayment capacity.

A loan of ₹10 lakh becomes easier for students admitted to recognised colleges in India. These funds are easily approved without complex collateral, such as long-term insurance and shares, when the combined co-applicant income and credit rating are acceptable.

There are some banks and NBFCs that offer unsecured education loans, which can be availed of up to ₹7.5 lakhs or ₹75 lakhs in some cases (depending on the strength of the profile). The SBI Scholar Loan is for students who have secured admission to premier institutions in India and abroad. NBFCs, such as HDFC Credila, also provide unsecured loans at a higher rate of interest.

The students must be admitted to an Indian or foreign university/institution. There are many factors that HDFC takes into consideration, such as the student’s academic performance, the course fees, the co-applicant’s income, and their credit history. Loans: Up to ₹50 lakh (Secured and unsecured, on a case-by-case basis)

Yes, Indian banks do offer education loans for abroad studies, including tuition, living expenses, travel, and other related expenses. You can obtain a loan of up to ₹1.5 crore. Evidence of admission, tuition, and financial background plays a vital role in the approval process.

In a technical sense, yes, but the decision is ultimately in the lender’s hands and based on your ability to repay the loan. Several loans can increase your risk and negatively affect your credit score. It’s wise only when truly necessary — say, you need an extra top-up loan for living expenses — and with clear repayment plans.

The list of mandatory documents includes the admit card, fee breakup, ID proof, address proof, co-applicant income, return forms, sets of collaterals (if applicable), and guarantor details. The more documents you provide, the quicker you’ll be approved and the more money you’re likely to qualify for.

Interest rates range between 6.5% and 12% per annum, depending on the offering bank, loan amount, and whether the loan is secured or unsecured. Rates are generally floating, but some banks offer fixed rates. There may be interest subsidies available for eligible candidates under government schemes.

Conclusion: Be Loan-Ready and Apply Smartly

Understanding how much student loan you can get in India is crucial before starting your education financing journey. As we’ve seen, loan amounts vary widely—from ₹10 lakhs for most domestic courses to as high as ₹1.5 crore for studies abroad—depending on factors like the course, institution, lender policies, collateral, and your financial profile.

Before applying, it’s essential to check your eligibility carefully and compare loan offers from multiple banks such as SBI, Bank of Baroda, HDFC, and Union Bank. Each lender offers different interest rates, repayment options, and documentation requirements, so choosing the right one can save you money and hassle.

Early preparation of your loan documents—including admission proof, income statements, and collateral papers—can speed up approval and maximize your loan amount. Don’t forget to use reliable education loan calculators available online to estimate your loan eligibility and EMI before committing.

Take the smart route—be informed, compare options, and approach lenders well-prepared to get the best education loan offers in India tailored to your needs.