How to Get a Student Loan for a Laptop in India [2026 Guide]

By 2025, it’s not just a gadget – it’s a must-have academic tool, and that’s okay too. With the increasing popularity of hybrid learning environments, online classes, and AI-enabled learning platforms, a laptop is now almost mandatory for students who want to keep up with the demands of modern education. With online classes, assignment submissions through LMS portals, and research, a laptop is a must-have across schools, colleges , and even professional courses.

However, high-performance laptops are expensive, starting at ₹40,000 and reaching over ₹1,00,000. Purchasing such devices is a financial challenge for many middle-class and economically disadvantaged families. This digital divide persists and is a significant barrier to learning access for students in Tier 2 and Tier 3 cities, in particular.

This is where education loans for laptops in India provide an informed and cost-effective solution. These days, there are plenty of banks and fintech lenders that make it possible for students to use a student loan to purchase a laptop as part of their academic expenses. Carried as an ‘essential component under the course-related materials’, laptops can be availed of under educational loans or laptop EMI schemes. They may even be purchased through student credit cards that offer relaxed repayment options.

With the right one, eligible students can receive a 100% loan to cover the cost of their laptop, either packaged with their student loan or provided separately. If you are a student or a parent wondering how to manage this expenditure, this guide will help you understand everything related to student loans for laptops in India, including eligibility, required documents, the application process, and the best options for 2025.

Whether you are looking for admission to college after 12th or are willing to continue your higher studies, meeting your laptop requirements as a college student is easier nowadays than ever before with a bit of financial help.

Can You Use an Education Loan to Buy a Laptop in India?

If you’re a student or parent preparing for higher education, one of the questions you might have is: Can you use student loans to purchase a laptop? The good news is yes, in most cases, that is, in India, you can finance laptops, a college campus, or an institute under a general education loan based on certain conditions, that is, you should be a student, and it needs to be a part of your “essential academic tools.”

What Do RBI and UGC/AICTE Say About Education Loan Coverage?

In accordance with the Reserve Bank of India (RBI) guidelines, as well as recommendations supported by the University Grants Commission (UGC) and the All India Council for Technical Education (AICTE), an education loan can extend to more than the tuition fee. The scope includes:

- The tuition, laboratory, and library fees for the courses.

- Fees for the exam and travel

- Purchase of books, instruments, and essential digital devices

This includes laptops explicitly as a “course-related expense.” In today’s technologically advanced educational arena, the presence of laptops is a given, not an option.

Laptops Are Classified as Academic Necessities

Banks and financial institutions have now begun to realize that it is no longer a luxury but a learning essential. Especially for students of:

- Engineering and IT courses

- Schools with MBA and business analytics programs

- Online and Hybrid Programs

- Creative professions such as design, architecture, video editing, and animation

So, if you are buying a laptop just for educational purposes, almost all education loan lenders treat this as part of your loan requirement or a reasonable add-on.

Clarification from SBI & Union Bank Education Loan Brochures

As per the loan coverage under the SBI Student Loan Scheme, “purchase of computers if necessary for completion of the course” is included. That language is specifically for the purchase of a laptop through the same loan.

Similarly, Union Bank of India has listed “essential equipment, including computers, books, and instruments” as eligible inclusions under their education loans. The laptop is usually referenced on the expense sheet or fee schedule provided during the loan application process.

Tip: Always ask the vendor for a quote or official quote that includes the model, price, GST, and your name for approval.

Propelld’s Insight: Laptop Quotations Are a Must

As detailed in a recent blog by Propelld, a large number of education finance lenders (including Propelld) require students to share a reverse-stamped laptop quotation from a known vendor. This quote confirms the academic nature of the laptop, its model, and its price.

The blog emphasizes:

The saying should reflect the laptop’s use cases among students

It can be combined with the offer letter of admission to the college.

The laptops can also be availed at no cost, EMI or laptop-only loans through education partners

Key Takeaway

Can I take out a student loan to buy a laptop?

Yes, absolutely. If a computer is mandatory for your course and you can submit a relevant document, the majority of banks and NBFCs will approve the inclusion of laptops in the student loan in India.

Pro Tip: Apply early, add the quote, and include the course curriculum with the laptop requirement so you don’t have any inconvenience.

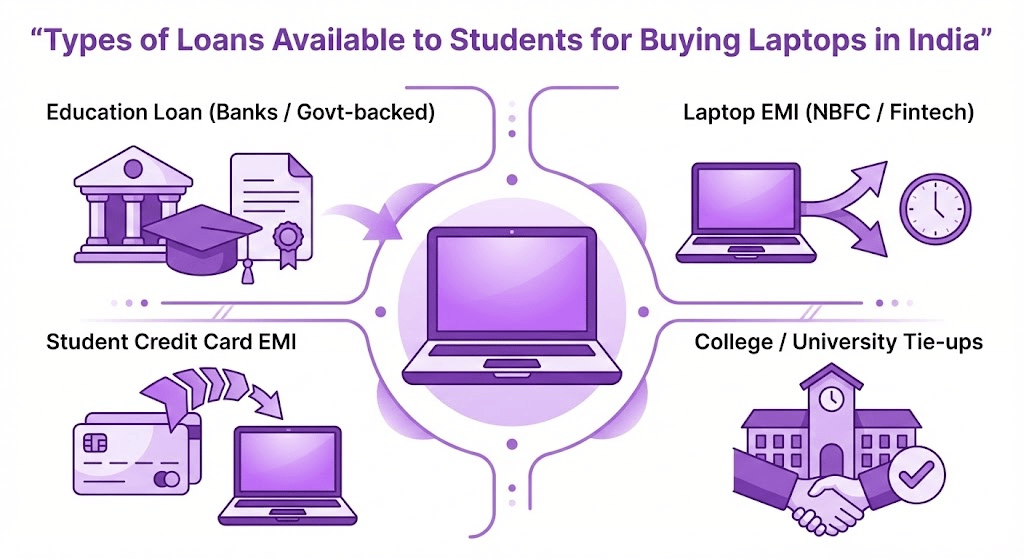

Types of Loans Available to Students for Buying Laptops in India

A good laptop is just as essential for today’s college students as their textbooks or tuition. Fortunately, students in India can choose from a variety of financing plans to facilitate this purchase. Whether it’s a full-fledged education loan, a laptop with EMI plans, or flexible student credit cards, there are options for every budget and need.

Here are the four best ways to get a laptop loan for students in India, explained in detail:

A. Education Loans (Govt or Bank-backed)

The best conventional approach is to take a loan based on education from a nationalized bank/private bank. These loans frequently cover school or course-related costs, laptop charges, especially if they are critical to your course.

SBI Student Loan Scheme

Under the SBI Student Loan Scheme, students are eligible to apply for loan amounts of ₹10–20 lakhs to pursue their higher education in India or abroad. These include a laptop, if you need one for the course.

Interest Rate: Begins from approximately 8.15% (as on 2025)

Collateral: Not needed up to ₹7.5 lakhs

Repayment: Maximum 15 years post moratorium period

Criteria: College admission proof and fee/ laptop Quote to be submitted

Union Bank Vidya Lakshmi Education Loan

Union Bank supports students through the Vidya Lakshmi Portal, clearly mentioning “essential equipment like laptops and books” in the list of eligible expenses.

Up to 100% financing

Exclusive grants for girls, EWS, and reserved categories

Suitable for undergraduate and postgraduate students

B. Laptop EMI Loans by NBFCs/Fintech Companies

If you are unable to obtain a traditional loan from a bank for a laptop, or if you do not have the time to wait for the bank to process your loan application or disburse the loan, you can explore options for laptops on EMIs with zero cost from NBFCs or Fintech lenders.

Popular Fintech Lenders:

- IDFC FIRST Bank

- Bajaj Finserv

- ZestMoney

These lenders allow you to:

- Buy laptops on EMI without a credit card

- Loan up to 1,00,000 or more

- Get instant approval even with fewer documents

- No (or little) credit history is necessary in many cases

- Many of them offer 0% EMIs with pre-approved vendors and include tenures ranging from 3 to 24 months.

C. Student Credit Cards (With EMI Options)

Some banks now offer student credit cards designed for responsible spending or educational purposes.

ICICI Bank Student Credit Card

- It is offered by the ICICI Bank to fulfill the credit card needs of students.

- Available for students in selected colleges or with parent as co-applicant

- Credit limits between ₹20,000 to ₹50,000

- The EMI offer applies to Desktops, Laptops, and select large products.

- Helps build a credit score

Bank of Baroda Campus Card

- Connected to student loan accounts

- Provides competitive interest rates and no annual fee

- Perfect for getting a laptop while in college

Note: If you’re wondering, “Can I buy a laptop with a student credit card?” the answer is yes, and many banks promote EMI purchases as a feature.

D. College/University Tie-up Financing (EdTech + Fintech)

Some edtech platforms and NBFCs also have tie-ups with universities, offering pre-approved laptop financing to their students.

Popular Players:

Propelld: Provides laptop loans along with tuition financing; a quote is required for a laptop.

Eduvanz: No-collateral laptop + course loans, instantly approved as well.

These companies partner directly with colleges to provide embedded financing through admission portals.

Regularly have EMI options on the laptop alone

100% paperless process

Quicker than conventional bank loans

Pro Tip: Check if your university has established a relationship with any loan provider that helps with bundling academic expenses.

Summary

Regardless of the background or the course you are opting for as a student in India, there are several alternatives through which you can get a laptop finance:

- State-funded loans for full education sponsorship

- Fintech EMI

- Small ticket flexibility with credit card EMI options

- Quick, college-affiliated loans that come with tuition as a package

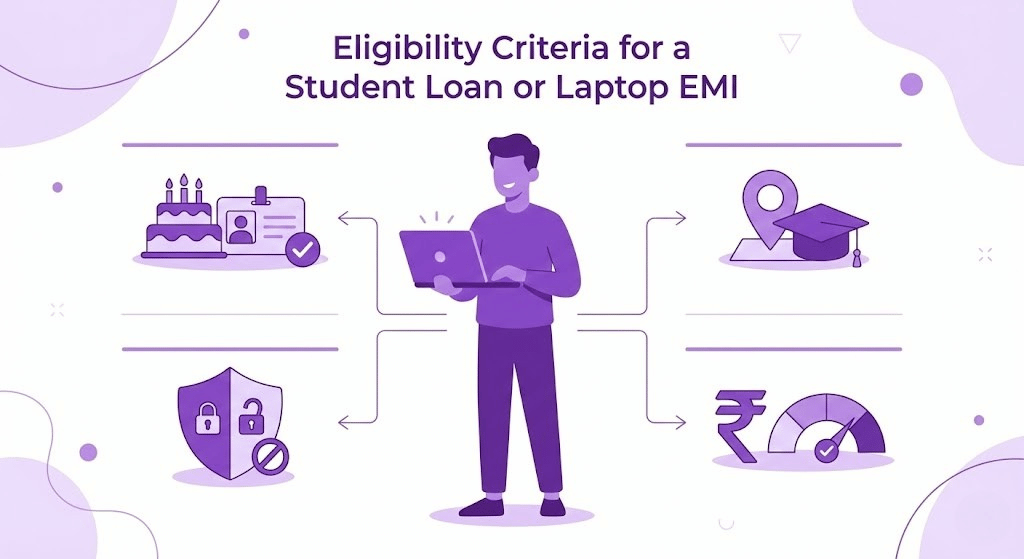

Eligibility Criteria for a Student Loan or Laptop EMI

To apply for a student loan or laptop EMI in India, it is essential to understand the eligibility criteria established by banks, NBFCs, and credit card companies. Whether it’s a regular education loan, a zero-cost EMI, or a student credit card, there are special terms associated with each.

Let’s break down the common eligibility criteria across all platforms:

1. Minimum Age Requirement

To apply independently:

The candidate must have attained the age of 18 years

If the student is under 18:

A parental or legal guardian co-applicant will be required for the loan

2. Indian Nationality & Admission to Recognized Course

The candidate should be an Indian Citizen.

You must be accepted into a college, university, or online program.

The UGC, AICTE, or any other approved board/university should recognize the institution.

This applies to undergraduate, postgraduate, diploma, and even short-term certification programs that demand laptop use.

3. Collateral-Free vs. Collateral-Based Loans

Most banks and NBFCs don’t require a guarantor for amounts below ₹7.5 lakhs.

Collateral or third-party guarantors may be necessary for amounts above ₹7.5–₹10 lakhs.

Fintech EMI options are typically collateral-free and require only basic KYC

In case it’s for a laptop EMI or a student credit card, then there is no need for collateral, but only ID, income/guardian proof, and admission documents would be required.

4. Income Criteria & CIBIL Score (When Applicable)

For education loans, the co-applicant (usually the parent) must provide regular income proof, such as salary slips, ITR, or bank statements.

NBFCs may not demand conventional income proof, but may seek a bank mandate or NACH e-signature

What CIBIL Score is Required?

For an EMI or credit card loan, the minimum CIBIL score required is 650–690.

For borrowers with no credit or first-time borrowers, the bank may sanction a loan with a co-borrower score or may offer limited credit limits

Summary

If you’re:

- Indian student (or have an Indian Co applicant)

- Enrolled in a valid course

- Able to show necessary documents (like admission proof, ID, and income where applicable)

You’re likely eligible for a student loan or EMI for a laptop.

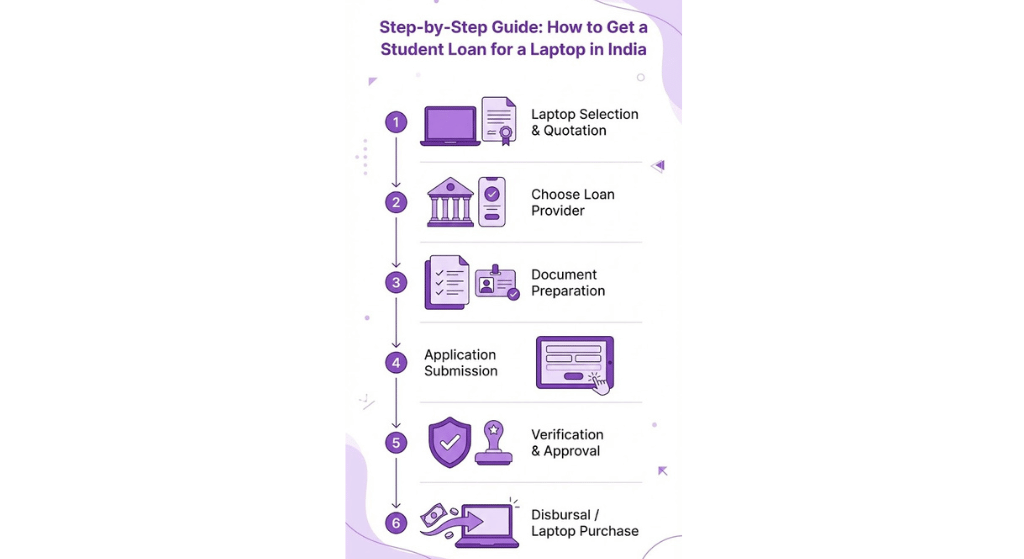

Step-by-Step Guide: How to Get a Student Loan for a Laptop in India

It is easier now, more than ever, to buy a laptop for education, as student loans, EMI plans, and fintech financing options are available. Whether you opt for a government-supported education loan or a no-cost EMI scheme, the application process is generally the same, with some variations depending on your chosen loan provider.

Here is a step-by-step guide to the laptop loan process in India, which will help you complete the process and receive the funds in a hassle-free way without any delays.

Step 1: Select Your Laptop + Get a Quotation

You should never apply for any loan without:

- Conclude with the computer type for your academic needs

- Get a quote or a proforma invoice from a certified supplier ( online or offline )

Ensure that the quote contains:

- Student’s name

- Laptop specs (memory, core, etc.)

- GST breakup and total cost

- Stamp of the vendor with contact details

Applying for the loan, you must provide a stamped quotation to the lender, as Propelld’s blog post announces that it will enable lenders to review the academic requirements of the laptop.

Step 2: Choose the Right Loan Provider

Below are some of the loan types that are available to you, based on your profile and requirements:

Government/Bank Loans

Banks such as SBI and Union Bank provide education loans that cover the cost of tuition and a laptop.

NBFCs and Fintech Lenders

IDFC, FIRST, Bajaj Finserv, Eduvanz, Propelld, and more: laptop EMI plans or quick education loans tailored for fast disbursement and zero-cost loans.

Student Credit Cards

Banks such as ICICI and BOB offer student credit card EMI options, which can be helpful if you are eligible and have a spending discipline.

Shop around: Do not decide on your provider before comparing the interest rates, the time it takes to process the loan, the documents required, and the flexibility when it comes to repayment.

Step 3: Prepare the Required Documents

The provider will typically set the actual requirements, but you’ll likely need:

- Laptop quotation

- Letter of acceptance or evidence of enrollment in a course

- ID proof (Aadhaar, PAN)

- Address proof

- Parent/co-applicant’s income proof (salary slips, ITRs, bank statement)

- Passport-size photographs

- Marksheets (If Applicable) or Academic History (If Applicable)

This makes the loan approval process faster since you already have the necessary documents in place.

Step 4: Submit Your Application (Online or Offline)

Once documents are ready:

- Go to the website of the bank/NBFC

- Complete the loan application form.

- Visit a local branch if offline submission is required

A few fintechs, such as ZestMoney or Propelld, enable instantaneous loan applications through mobile phones or partner portals.

Step 5: Verification & Sanction Process

After submission:

- The lending institution will authenticate your credentials, academic qualifications, and quote

- Telephonic or personal verification may be carried out if necessary

- A sanction letter is given when formally approved.

This typically ranges from 24 hours to 72 hours in the case of fintechs and 7–10 days for traditional banks.

Step 6: Disbursal of Funds / Payment to Vendor

Once the money is sanctioned, it is either:

Deposited into your bank account, or

Go straight to the vendor you received the quote from for your laptop

For an education loan, disbursements may be made in stages, with one disbursement allocated for the laptop.

Pro Tip: If your bank does not offer a laptop on the spot, you can purchase it through a credit card and convert it into EMI or add it to your next tuition fee cycle.

Key Takeaway

If you follow these steps, obtaining a student loan for a laptop is easy in India:

- Choose your laptop

- Get a proper quotation

- Pick the right lender

- Prepare documentation

- Submit your application

- Get the approval on your loan or EMI

There are several digital lenders now providing student loans with flexible EMI options, so students have more options and less paperwork than ever before.

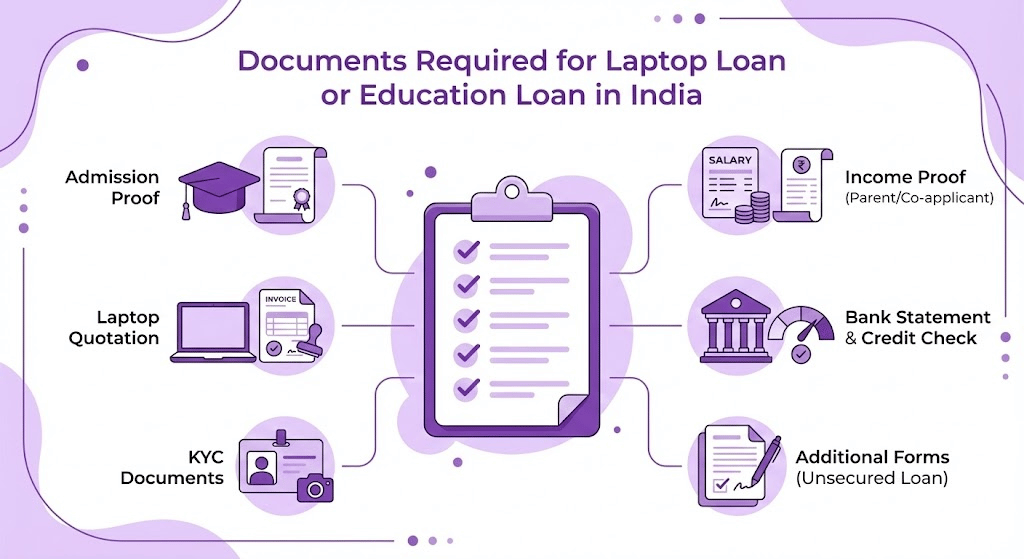

Documents Required to Apply for Laptop Loan or Education Loan in India

Whether it’s a full-education loan or a loan to finance your laptop through EMI or a credit card, documents are the most critical aspect in obtaining quick approval and disbursement. There may be some differences in the list of requirements among various lenders (banks, NBFCs, fintech platforms), but the basic list of documents for a personal loan is almost uniform.

Here is the complete list of documents you must have while applying for the student laptop loan in India that you may need to submit for the successful application:

1. Admission Proof

To establish academic eligibility, you’ll need

- College admission letter (with course details and institution name)

- OR valid student ID card

- Some lenders may also ask for the university’s affiliation certificate (UGC/AICTE approved)

This confirms that the loan or EMI is being taken for educational purposes.

2. Laptop Quotation (with Specifications and Vendor Stamp)

This is mandatory if equipment costs are included in education loans:

A Proforma invoice / Quote by the legal laptop dealer

Must include:

- Student name

- Laptop: Make / Model / Specs (RAM, SSD, Processor, etc.)

- Total cost with GST

- Official stamp and vendor’s signature

3. KYC Documents of Student & Co-Borrower

Typically required:

- Aadhaar Card (student / co-applicant)

- PAN card

- Passport-size photos

- Proof of Address (utility bill, Voter ID, or rent agreement)

4. Income Proof of Parents/Co-Applicant

If you are an applicant for a traditional loan or NBFC EMI:

- Pay slips (last 3–6 months)

- OR Income Tax Returns (ITRs) (for the previous 2 years)

- OR Last six months’ bank statement

- Sometimes, even salaried parents can submit Form 16 as well

5. Financial Background – Bank Statement & CIBIL Score

For unsecured or high-value loans, additional documents may be required:

- Latest CIBIL report (especially for co-applicants)

- Bank account statement (student or parent) showing monthly income/inflow

NBFCs like Bajaj Finserv or ZestMoney often evaluate creditworthiness using digital credit scoring tools.

6. Other Requirements for Unsecured Loans

If you’re borrowing an unsecured loan, lenders may require:

- Third-party guarantee (applicable for loans above a specific amount limit)

- Original and photocopies of academic records/mark sheets

- Duly signed loan agreement forms and NACH mandate form 47.

Final Tip

Have all your documents scanned and organized before you begin the application. Lenders now frequently allow you to fully upload documents digitally through portals or apps, significantly reducing the approval process.

Providing complete and verifiable documents not only builds trust with the lender but can also increase your loan limit and likelihood of approval.

Top Government & Private Banks Offering Laptop Loans for Students (2026)

You can find the best laptop loan by comparing the offerings of popular government and private banks, as well as fintech lenders that offer student-friendly financing in India. Laptop costs are also bundled into a broader education loan by some lenders; some also provide separate EMI facilities.

Here is the comparison list below to guide you in selecting the right provider based on interest rate, eligibility, processing fees, and whether laptop costs are covered or not.

Comparison Table: Student Laptop Loan Options in India (2026)

Bank / NBFC / Fintech | Max Loan Amount | Interest Rate (Approx.) | Laptop Included? | Margin Money | Processing Fee | Eligibility |

SBI Student Loan Scheme | ₹7.5 Lakhs (no collateral), ₹20+ Lakhs (with collateral) | 8.30% – 10.05% | ✅ Yes (course-related expense) | Nil up to ₹4L | ₹10K+GST (above ₹7.5L) | Indian citizen, confirmed admission, co-applicant needed |

Union Bank of India – Vidya Lakshmi | ₹15–20 Lakhs | 8.75% – 9.85% | ✅ Yes | Nil up to ₹4L | ₹5K–10K | Recognized course, admission letter required |

Canara Bank – IBA Model Loan | ₹10–20 Lakhs | 8.90% – 10.20% | ✅ Yes | 5% (above ₹4L) | ₹5K–₹10K approx. | Indian student, secured/unsecured loans allowed |

IDFC FIRST Bank | ₹1–5 Lakhs (Laptop EMI plans) | 0% to 18% (depending on tenure) | ✅ Yes | NA | ₹0–999 (depending on offer) | Basic KYC, CIBIL 650+, income proof or co-applicant |

Axis Bank Education Loan | ₹7.5 Lakhs – ₹20 Lakhs | 13% – 15% | ✅ Yes (must be justified in expense) | 5% (for unsecured) | 1–2% of loan amount | Course + income documentation |

ICICI Bank Education Loan | ₹10–20 Lakhs | 11% – 13% | ✅ Yes | 5% | 1–2% | Income-based approval, co-applicant preferred |

Propelld (Fintech) | ₹20K – ₹5 Lakhs | 0% – 15% (varies) | ✅ Yes (quotation required) | Nil | Usually NIL for students | Partnered colleges, student admission + laptop quote |

Eduvanz (Fintech) | ₹25K – ₹10 Lakhs | 0% – 14% | ✅ Yes | NA | NIL or small % | KYC, student ID, repayment ability or guardian approval |

Key Notes:

Laptop cover: The majority of bricks-and-mortar banks offer to cover laptops as “course-related expenses” provided you have a valid quote.

Margin Money: Banks may ask students/ parents to provide a certain amount, especially in cases where the amount is significant.

Fintech lenders such as Propelld and Eduvanz provide unsecured, low-documentation online financing for laptops to help you finance them more easily.

Although government banks, such as SBI and Union Bank, are perfect for long-term education funding when laptop costs are included in tuition and living costs.

Interest may differ according to:

- Institute ranking

- Type of course (STEM vs Arts)

- What is the CIBIL and credit record of the co-applicant?

Final Tip

Look at more than just your interest rates, but also:

- Loan processing speed

- Flexibility in repayment

- EMI models (more suited for short-term or one-purpose loans such as laptops)

Can Students Get EMI on Laptops Without a Student Loan?

For many students, waiting for the whole education loan process can feel slow when they are in immediate need of a laptop. However, there’s good news for you, EMI options without a real student loan have become highly acceptable and available in India. Here’s how you can buy a laptop on EMI for students easily and quickly:

EMI via Online Marketplaces

Amazon, Flipkart, and other e-commerce sites offer EMI plans when you buy a laptop on:

- Credit Cards (from top banks including SBI, HDFC, ICICI)

- Debit cards (with Select EMI options)

- No-cost EMI deals at special sales or with partner banks

These EMIs usually cut the laptop price into 3, 6, 9, or 12-month installments, which are easier to manage.

Fintech EMI Lenders with Minimal Credit History

If you’re without a credit card, or don’t have a favourable credit score, there are a few fintech platforms like ZestMoney, InstaCred, Simpl, and LazyPay that let you buy laptops on EMI with:

- Minimal documentation

- No credit history necessary

- Some are instant approval

- Flexible repayment tenures

These online lenders use alternative methods to determine eligibility, making it easier for students to obtain EMI.

Student-Friendly Credit Cards Offering EMI

ICICI Bank (Student Credit Card), Bank of Baroda (Campus Card), among others, also provide customised credit cards specifically designed for students. Benefits include:

- Low credit limits - suitable for students

- Option to convert purchases into EMI using the card

- Extra 10% cashback & reward points on laptop purchase

EMI vs Education Loan: Pros and Cons

Pros of EMI

- Quick and easy approval

- No collateral or co-applicant required

- Can be availed without admission or course proof

- No complex paperwork

Cons of EMI

- Typically higher interest rates than education loans

- Shorter repayment tenures mean higher EMIs

- Loan amount limited to laptop price only

- Not ideal for funding tuition or other education expenses

Final Thought

Laptop EMI loan, not a student loan, is best suited for students who want to make an easy and quick application for money and enjoy easy installment payments. However, when it comes to financing on a larger scale or covering the full cost of education, education loans are more cost-effective and comprehensive.

Free Laptop Schemes for Students (Government & NGOs)

Free laptop schemes and donations through the government and NGOs can offer a crucial lifeline to struggling students, enabling them to purchase laptops. In India, several state governments and nonprofits operate programs to narrow the digital divide and support education.

Tamil Nadu Free Laptop Scheme

The Tamil Nadu Free Laptop Scheme is one such well-known initiative in which the Government of Tamil Nadu provides free laptops to students studying in government colleges and institutions. The scheme focuses on:

- Enhancing digital literacy

- Bringing underprivileged students into the mainstream

- Encouraging the study of professional courses

Students usually apply through their colleges after the scheme is announced each academic year.

Karnataka Student Tech Scheme

Karnataka also operates tech distribution schemes, in which eligible students receive laptops and tablets, particularly in government and aided colleges. The scheme prioritizes:

- Rural background students

- It excluded those studying for technical and higher education purposes

Applications are managed by the school, which will inform students of eligibility and the application procedure.

NGO-Based Laptop Donation Drives

Many NGOs and charitable trusts in India conduct laptop donation campaigns for underprivileged students. Examples include:

NGOs directing towards digital education

These NGOs are often places where students can apply by presenting proof of admission to an institution and their financial status, along with other supporting documents, for example. Many drives are even promoted through educational institutions and social media by organizations.

How to Apply or Get Enrolled

- Check your college or university’s official website for details about laptop schemes.

- Visit your student affairs or scholarship office and ask if there are any current government or NGO programs available.

- Watch state education department websites for application forms and eligibility information.

- For NGO programs, look for legitimate laptop donation drives online and contact them through their official channels.

Final Note

Free laptop programs are both limited and competitive, but they also serve as a lifeline for some students who cannot afford the upfront cost or take out loans. Pair up with student loans or EMI options, it can make all the difference financially.

Can I Use an Education Loan for Other Academic Purposes Too?

Yes, an education loan in India can be used for more than just tuition fees. This lever gives students a tool to address the full cost of education, for which it can be used within the limitations:

- Transit costs to and from college or field study trips

- Textbooks and supplies are required for classes

- Accommodation and Hostel charges for the period of study.

- Devices such as laptops and tablets, which are seen as fundamental to education

Many of these costs are allowable; you just need to submit the proper documentation, such as receipts, quotes, and estimates. Most banks and lenders allow these costs.

What’s Not Allowed?

Costs of a non-educational nature, including:

- Parties or social events

- Non-academic personal electronics (e.g., game consoles, leisure use of smartphones)

- Purchases of luxury or discretionary items

tend to be ineligible for student loan protections.

How to Structure Expenses to Include a Laptop

Send a detailed quote from an approved vendor stating that the laptop is required for your course, so that the computer you purchase is authorized under the education loan. Many lenders require this before sanctioning the loan amount for gadgets.

Common FAQs About Getting a Student Loan for a Laptop in India

Yes, many banks and government-backed educational loan schemes offer up to 100% of the loan amount towards course-related fees (which includes laptops as well). For instance, SBI and Union Bank offer loans to cover the cost of the computer, as well as tuition and other fees, provided you submit proper documents and quotations.

You will require a formal quote from a certified vendor or supplier/supplier with their stamp and signature, specifying the model of laptop, configuration, and price. This can help lenders confirm the cost of the computer and approve the loan amount for the device only.

Yes, students who have taken admission in recognised courses after passing their 12th grade can apply for an education loan to purchase a computer/laptop. You can apply for the loan through banks/NBFCs after you receive the admission proof and other required documents.

Most banks and fintech lenders offer online application platforms for education loans and laptop loans. You can submit documents, monitor your application status, and receive a sanctions decision online, in a process that should be faster and more convenient.

Laptop EMI interest rates differed hugely from lender to lender:

Interest on education loans generally ranges from 8% to 13% p.a.

NBFC EMI loans or other fintech zero-cost EMI schemes may offer 0% interest* for a limited period upfront. Still, the regular EMI interest rates can fall anywhere between 12% and 24% APR in this category of buy now, pay later schemes, and you should read the terms and conditions carefully.

If you get turned down for a loan, try the following:

Enhancing Your CIBIL Score or Credit Worthiness

Apply with a co-applicant or co-signer

More precise documentation and laptop quotations would have been helpful.

Consider trying out different lenders, such as NBFCs or fintech platforms, who may be more lenient in meeting minimum requirements.

Yes, specific fintech lenders and NBFCs offer loans and EMI plans that do not consider the CIBIL score and instead use alternative credit assessments. The problem is that most banks won’t approve you for a loan unless you have good credit.

EMI options are relatively quicker and easier, with less paperwork, but generally at a higher rate of interest and shorter duration. Education loans have low rates and longer tenures, making them more cost-effective for higher amounts, but the process requires more documentation and time.

Yes, banks and lenders usually approve expenses for accessories related to the course, such as a mouse, as long as they are listed on the loan application and you have quotes ready for any non-built-in items (e.g., software licenses).

Yes, the Vidya Lakshmi portal is a government-sponsored platform where students can apply for education loans offered by several banks, track their applications, and even receive loan assistance, such as for laptops and other academic expenses.

Tips to Improve Chances of Laptop Loan Approval

Facilitating a smooth approval of your student loan or laptop EMI largely depends on a few key factors. Here’s how you can increase your odds:

1. Maintain a Good CIBIL Score (Above 650)

Your CIBIL score is essential when it comes to NBFCs and fintech lenders. A score of more than 650 demonstrates good creditworthiness and increases the chances of being quickly approved. If you’ve never borrowed before, a co-applicant with a well-established credit history can also be beneficial.

2. Choose a Laptop Within ₹75,000

Banks generally approve loans for laptops below ₹75,000 to avoid complicating the process with further documentation and/or collateral requirements for higher amounts. Laptops in this price range also tend to be within the limits of education loans, as well as most EMI plans.

3. Use a Co-applicant with Stable Income

Including a co-applicant (often a parent or guardian with a steady income) will strengthen your loan application. It helps the lender feel more confident that you can repay the loan, and allows you to secure better interest rates or potentially larger loans.

4. Apply Through Verified Portals

To avoid delays and ensure transparency, apply via trusted platforms such as:

- SBI Education Loan Portal

- Propelld (fintech lending)

- Vidya Lakshmi (government-backed education loan portal)

These portals streamline documentation and sanction processes, improving your loan approval timeline.

Final Verdict: Is It Worth Getting a Loan for a Laptop?

Getting a loan for a laptop can be a smart financial decision for students who need immediate access to a reliable device for their studies but cannot afford the upfront cost. The pros include:

- Immediate access to necessary technology without waiting to save up

- Reduced financial burden on parents by spreading payments over time

- Flexible EMI options tailored to student budgets

However, there are cons to consider:

- Interest costs can add up, making the laptop more expensive overall

- Loan application risks, including potential rejection due to credit or documentation issues

Overall, a laptop loan is best suited for students with financial constraints and those enrolled in long-duration courses like engineering, medicine, or professional degrees where laptops are essential tools throughout.

If you’re considering financing, explore options like SBI Education Loan, IDFC FIRST’s EMI plans, and Propelld’s student loan platform today to find the best fit for your needs.