Complete Guide to Loans for College Students in India

The right education loan can mean the difference between pursuing that dream course or delaying it indefinitely. This guide is designed to support Indian students and their families through topics ranging from types of lenders and eligibility criteria to repayment options, as well as case studies and practical checklists.

You will learn how student loans for college in India work, the evidence required to apply for an education loan, how interest and moratoriums affect the total cost of borrowing, as well as other options (scholarships, part-time work, crowdfunding) available alongside a loan.

Whether it’s a desired engineering stream at an IIT, an MBBS in India, a master’s degree abroad, public sector banks such as SBI, private banks, and NBFCs, government schemes such as the Central Sector Interest Subsidy (CSIS) and the Vidya Lakshmi portal, or fintech options, the guide addresses these options.

Look for clear action steps: how to compare offers using effective interest rate and total cost, what to ask lenders before signing, how to handle EMIs, and how not to get trapped in debt.

By the end, you will have the following ready-to-use templates: Loan comparison checklist, Document Checklist for Students and Co-applicants, Sample bank email to ask for sanction or extension, and EMI Planning Worksheet.

This guide focuses on real-world, India-specific advice — from collateral and unsecured loans to loan top-ups, from balance transfers to education loan income tax relief (Section 80E) —while understanding average processing times & disbursal practices, so you can apply strategically, maximizing the value of every rupee borrowed.

Understanding Student Loans in India — Who Needs Them & Why

What qualifies as a student loan

In India, the student loan usually covers only direct academic expenditures, such as:

- Tuition, semester, and university charges.

- Accommodation, Food, Local Travel, or Utilities.

- Study-abroad-related expenses: foreign university costs, visa fees, airfare, and foreign exchange conversion.

- Course-related equipment/materials: computer technology, including laptops, equipment required in labs, textbooks, and exam fees, project-related expenses, or professional license/exam costs.

Of course, there are differences in which expense categories are allowed and the maximum caps; always obtain written confirmation from a bank/NBFC on whether living expenses or contingency allowances are included.

Who is eligible: students, parents, guardians, co-applicants

Most Indian education loans are signed by two signatories: the primary applicant or student and the co-applicant, typically a parent or guardian. Typical eligibility rules:

Student Applying: Applicant must have confirmed or provisional admission to an accredited institution. Admissions to undergraduate, postgraduate, vocational, or professional courses are acceptable to lenders.

Co-applicant: parent, guardian, or spouse must provide income proof and is financially responsible for repayment. A parent must accompany minors.

Educational loans without security up to a limited amount (e.g., INR 4 -10 Lakh) for top institutions are provided by some banks; usually, higher amounts require security or a guarantor.

Types of borrowers: undergraduate, postgraduate, vocational, professional courses

- Professional courses (engineering, MBBS, business): Loan amounts are often higher than for arts and Social Science courses. Banks are projected to assess lending risk as lower, as these courses are perceived as highly employable and may offer more favourable terms to reputable institutions.

- Study-abroad students: Loan amounts vary, with components for forex conversion, pre-boarding expenses, moratorium, and disbursal clauses.

- Vocational and skills courses: Lower tenure, smaller loan amounts; these borrowers’ requirements are often well served by NBFCs or fintech lenders.

When to consider a loan vs scholarships, savings, or part-time work

Focus on scholarships and grants first — they will lower how much you need to borrow, and do not have to be paid back.

Use savings to pay for smaller costs or to lower the principal and reduce interest.

Part-time work and internships can help cover living costs and develop skills; don’t rely on them to cover full tuition.

It’s okay to borrow when scholarships leave a significant gap, you don’t have family savings to keep pace with fees and expenses on time, or your course builds earning capacity in the future (such as professional degrees).

Evaluate total cost to borrow – including interest and fees – against the anticipated incremental earnings after the degree.

Misunderstandings of Indian students about education loans

- “Loans are for tuition only.” Many loans also cover living expenses, travel, and equipment.

- “Interest is not charged during study” — Interest frequently accumulates during moratorium; unpaid accrued interest may be added to the principal later.

- “No co-applicant options are easily available” — Unsecured solo loans are in short supply, and most lenders demand a co-applicant or collateral.

- “Banks are all the same” – your public banks (SBI) may give lower interest rates and government scheme attachment, but private ones/NBFCs might process faster with free facilities at additional cost.

- “Scholarships and loans cannot be combined.” — You are frequently able to use both; lenders adjust disbursal based on scholarships and fee receipts.

Types of Student Loans Available in India

Education loan from public sector banks (SBI, PNB, etc.) – features & benefits

- Attractive interest rates: Public banks have lower base rates. This is the well-known benchmark for the SBI education loan.

- Government scheme linkage: Access to the Central Sector Interest Subsidy (CSIS) and other state-provided schemes.

- Standardised documentation and transparency: Clear protocols to minimise surprise at sanction/disbursal.

- Longer tenures and moratoriums: Several public banks offer an extended moratorium period that spans the tenure, including the grace period.

- Disadvantages: Processing can be slow, and branch visits may be necessary; eligibility criteria can be conservative.

Private bank education loans: differences, faster processing, higher rates

- Faster processing and digital interfaces: Private banks typically offer faster sanction and disbursal as well as superior online tracking.

- Value-added services: A few offer pre-sanction letters, university partnerships, and foreign exchange assistance.

- Higher interest rates and fees: Convenience and speed often entail a higher cost of borrowing.

- Lenient collateral norms: To attract students, some private banks accept other securities or structured payments.

Non-banking financial companies (NBFCs) and fintech lenders

- Customised products: NBFCs and fintech platforms provide loans for vocational courses, short-term programs, and bootcamps that traditional banks reject.

- Accepting alternative proof of income: helpful when co-applicants are employed in the unorganised sector or have fluctuating incomes.

- Faster underwriting and technology-enabled disbursement: Most offer online applications, instant approval, and flexible repayment options.

- Cost trade-offs: Interest rates and origination fees may be higher; scrutinise the fine print regarding prepayment and top-up terms.

Government schemes and subsidies (Central Sector Interest Subsidy, Vidya Lakshmi, state schemes)

- Central Sector Interest Subsidy (CSIS): Interest subsidy to benefit economically weaker section students during the moratorium period for government-recognised courses; brings down cost significantly.

- The Vidya Lakshmi portal facilitates comparison of loan offers, online application, and viewing of state scheme details.

- State-level schemes: Many states reimburse fees or provide additional subsidies; eligibility and scope vary widely.

Loans for study abroad vs domestic courses — foreign exchange, moratorium specifics

Level of school: Stafford loans are less generous for more expensive schools than study-abroad loans, which generally require larger amounts because of higher tuition and living costs.

Forex and currency conversion: Lenders indicate whether they pay in INR or a foreign currency and whether they provide foreign exchange conversion assistance.

Moratorium: Banks may offer a moratorium on foreign-study loans for up to six months after completing the course or obtaining employment abroad; check specific terms.

Documentation: Additional documents, such as offer letters, the foreign-currency fee structure, and visa evidence, will be required.

Secured vs unsecured education loans: margin money, collateral, guarantor

No collateral loans: Up to a limit (INR leads from 4 to 10 lakh), with limits varying by lender and institution reputation. No collateral is required, but a strong co-applicant credit score may be required.

Secured loans: Collateral is required for large amounts (FD property/NSC) or a third-party guarantee. Collateral lowers interest rates and increases the likelihood of approval.

Margin money: While most lenders finance between 75–100% of the course/institutional cost in India, margin requirements tend to be higher for studies abroad.

Guarantor: A guarantor may be required if the co-applicant’s income or creditworthiness is weak.

Eligibility Criteria & Required Documents

Standard minimum eligibility age, academic standards, and evidence of admission

Age: Many creditors do not specify minimum or maximum ages for student financing, but co-applicants must be adults with minimum earnings.

Academic Qualification: You are required to have an offer for a recognised program from a reputable university/ college. Minimum qualifying academic performance may apply to certain Bank services.

For pre-admission or entrance-based admissions, banks may accept provisional letters; final proof of admission will be provided later.

Income criteria, CIBIL & credit history considerations

Co-applicant income: Banks take into consideration the co-applicant’s regular earnings, job tenure, and debt-to-income ratio. Salaried parents with a stable salary are favourable.

CIBIL score: This is the credit history of students and co-applicants that lenders use to evaluate them. A low score or high liabilities can increase the interest rates offered to you or result in rejection.

Self-employed co-applicants: Income evidence other than salary slips, bank statements, tax returns, and business turnover documents is used for evaluation.

Documents checklist for the student, co-applicant, and collateral

For the student:

- Admission/offer letter, course fee details, and course duration.

- Proof of identity: Aadhar, passport, or PAN.

- Academic documents: Mark sheets, certificates, and entrance test score cards.

For co-applicant (parent/guardian):

- ID proof and address proof, among other details: PAN card.

- Income proof: salary slips (last 3–6 months), Form 16, and IT returns (2–3 years) for self-employed individuals.

- Bank statements (6-12 months), proof of employment.

Collateral documents (if applicable):

Property papers, FDs, NSCs, KYC of the collateral provider, valuation by experts, and no-objection certificates.

Proofs specific to study-abroad applications (offer letters, visa proof, and fee structure)

- The university offers/conditional offer letter (with fee breakup).

- Estimated cost of living, confirmation from hostel or rent (if possible).

- Proof of visa approval or signature pending under the Visa application.

- Fee notice in the foreign currency with a Comprehensive Breakdown (tuition, living, insurance).

- Copy of the Passport and travel plans, if necessary.

Interest Rates, Fees & Repayment Structures: What to Expect

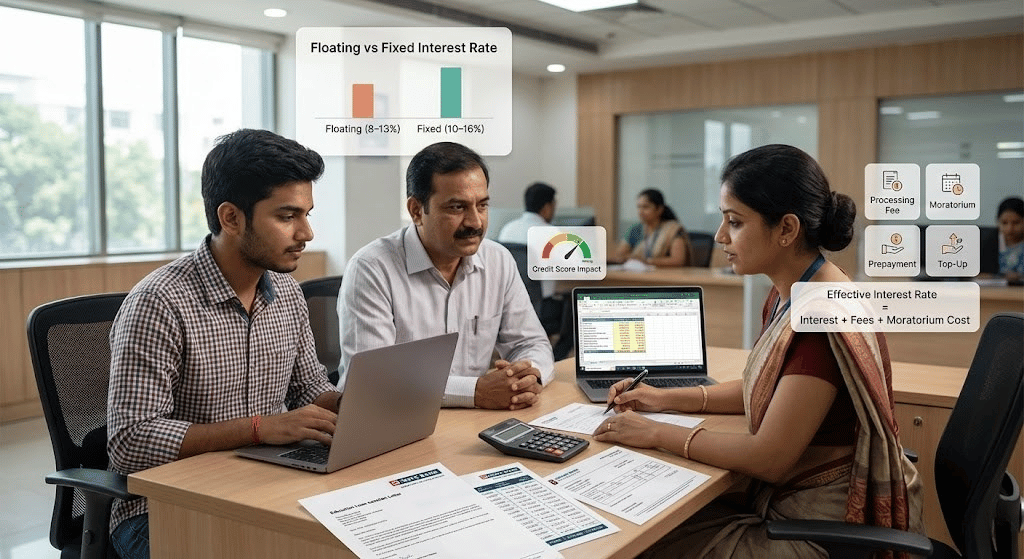

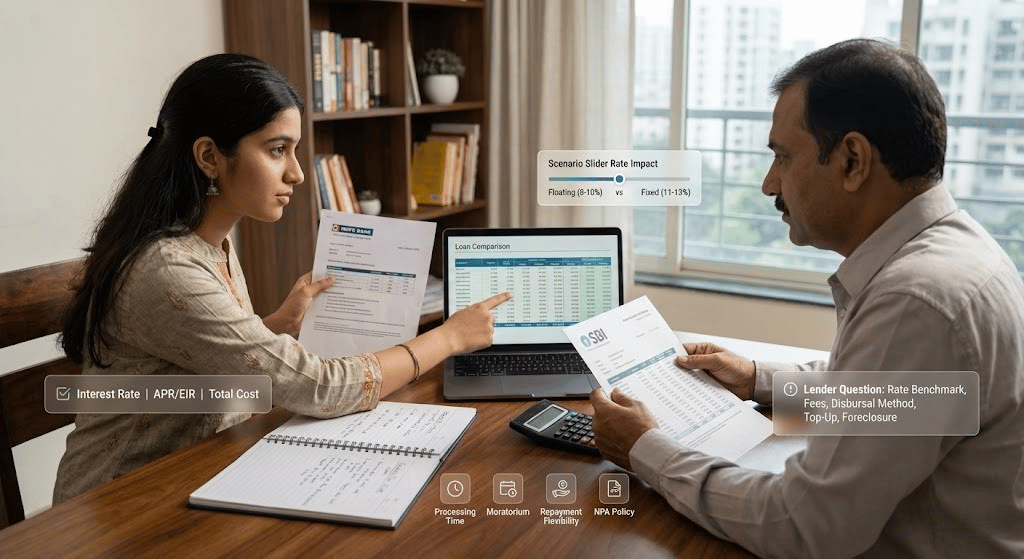

Compare interest rate types, total cost of loan, and effective interest rate

Floating rates: Most education loans use a floating interest rate (linked to external benchmarks such as MCLR, bank base rate, or repo-linked rates). Floating rates are linked to market rates so that EMIs can change over the tenure.

Fixed rates: Less standard; interest remains the same for a period or for the life of the loan, offering predictability but often slightly higher at the outset.

Ranges can vary (guideline values): For unsecured smaller loans, effective rates may be higher (12–16%). Govt banks give these under 8-13% for secured loans; Pvt banks/NBFCs charge between 10–16% based on risk profile. Study-abroad rates may be a bit higher to account for greater exposure.

Effective interest rate: Always consider the total cost, including processing fees, margin, and moratorium compounding, when comparing offers.

Processing fees, prepayment charges, and penal interest

Processing fee: One-time charge (flat or in percentage, for example, 0.5–1.5 % of loan amount) levied at the sanction or disbursal of the loan.

Prepayment charges: A few banks allow you to foreclose without levying a foreclosure charge on floating-rate loans; for some, there is a small fee (please check the lender’s policy). Prepayment penalties for NBFCs may be higher.

Penal (Compounded) Interest: Applies to delayed EMIs; rates are generally 2% to 4% above the standard rate. Ensure you’re aware of the exact penal rates.

Documentation charges and stamp duty: Applicable to secured loans for document preparation, property valuation and legal verification.

Moratorium period explained: variations on study period + grace period

A moratorium is generally for the course period and up to a specific No-Interest period (usually 6-12 months) or 6 months from employment, if done pre-hand; it varies by lender.

Interest during moratorium: Interest accumulates during this period; some government schemes pay interest if you are eligible, so it is not even capitalised (CSIS). If interest isn’t paid during a moratorium, it may be capitalised (added to principal), thereby increasing the total cost.

Please check whether the moratorium includes internships or placement delays; employment documents may be required to begin EMI.

For part-payment, prepayment, and loan top-up rules

Part-payment: Many lenders allow part-payment to reduce the principal and interest (PI) balance; check minimum amounts and notice periods.

Prepayment/foreclosure: Banks do allow partial/full prepayment without penalty for floating-rate loans; private lenders may levy a fee. Determine whether the NOC is mandatory for foreclosure, and list the documentation required to release it.

Loan top-up: For higher education, higher expense studies, or other; Top-up available based on the repayment track record, outstanding principal debt, and co-applicant credit person (if any). Top-up terms may differ from those of the original loan.

How the co-applicant’s credit score affects interest and approval

The co-applicant’s creditworthiness plays a key role in determining the sanctioned amount, interest rate, and security margin. A strong salaried co-applicant with a CIBIL score above 800 improves the chances of loan approval and significantly lowers interest rates.

Weak credit could result in higher interest rates, additional collateral requirements, or rejection.

Your co-applicant’s current loans must be manageable based on their income; the Measure is a combined debt-to-income ratio.

How to Choose the Right Education Loan

Compare the different types of interest rates, the total cost of the loan, and the effective interest rate.

- Request the APR or EIR, including fees and moratorium capitalisation, to compare actual costs.

- Run scenario analysis for potential rate increases – compare against floating vs fixed offers.

- Request full amortisation schedules and total repayment amounts from each lender.

Evaluate processing time, disbursal schedule, and bank branch access

Turnaround time is essential as fee payment days approach; some NBFCs/fintech firms may have faster disbursal.

Disbursal schedule: Is disbursal staged, linked to fee deadlines (e.g., semester-wise), or does the lender pay the college directly?

Branch support: If you prefer to conduct your banking in person, check the branch location and hours of operation.

Verify the duration of the moratorium, flexibility in repaying, and the NPA policy

Moratorium: Duration and whether, during that period, payment of interest is optional or mandatory.

Repayment flexibility: Manage your payments with EMI holidays, part-payments, refinancing, or top-ups.

NPA policy: Understand the default definitions, late-fee charges, and the bank’s restructuring process.

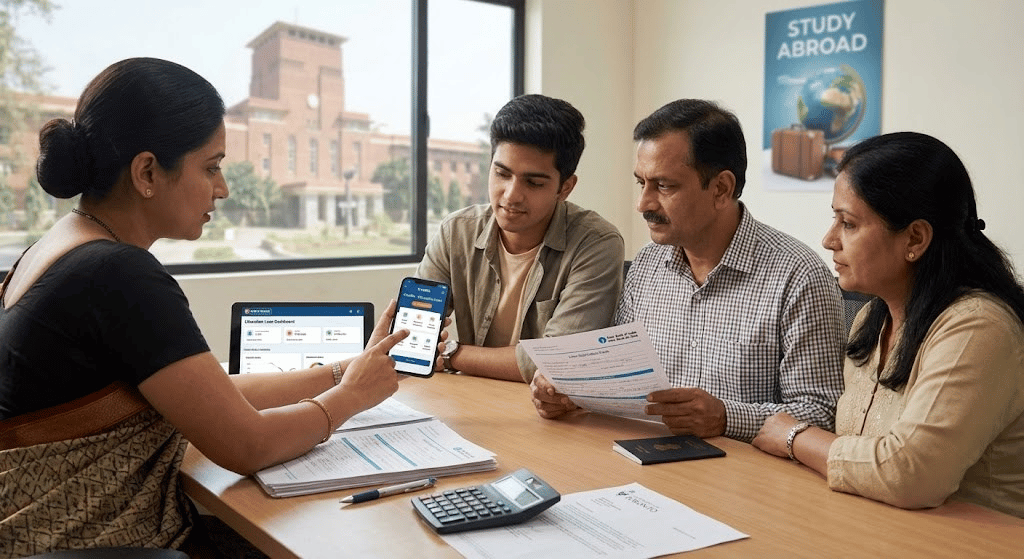

Consider value-added services (pre-sanction offers, tie-ups with universities)

Pre-sanction letters: Ideal for visa purposes and seat reservations.

University partnerships: Some lenders offer expedited verifications for partner colleges.

Forex assistance and career support: Value-added services can be essential for study-abroad borrowers.

Here are some questions to ask the lender before signing off on the loan agreement

- Exact interest rate: fixed/floating, its benchmark, as well as reset frequency.

- All charges: processing, documentation and valuation, prepayment, and penal charges.

- The details of the moratorium and whether it capitalises interest.

- Method and timing of disbursal (direct to institution vs student account).

- Top-up, foreclosure, and balance transfer.

- Documentation held for Collateral Releasable at Time of Closing.

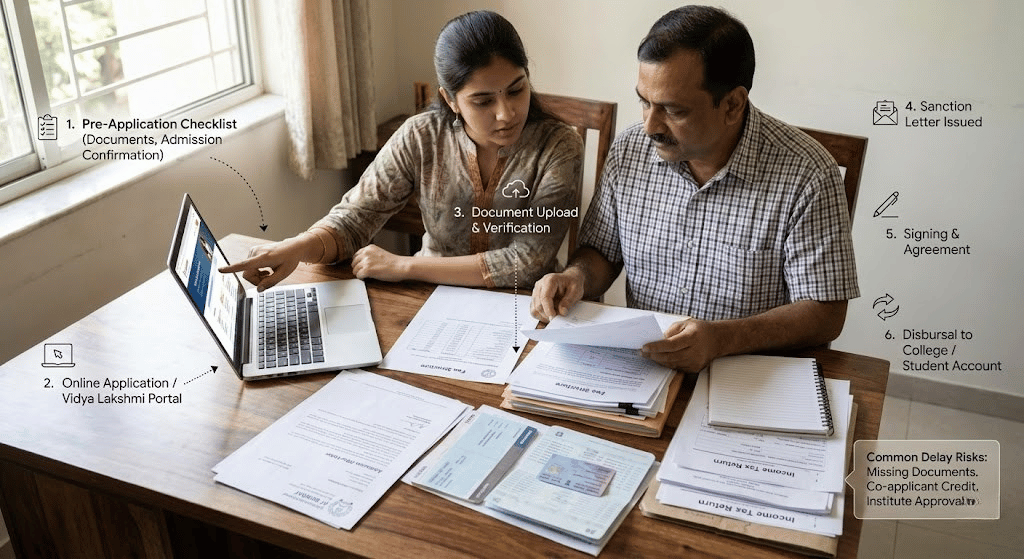

Application Process From Pre-Approval to Disbursal

Pre-application checklist and preparing your offer of admission

Confirm the course, fee structure, and admission letter; obtain and review the living expenses quotations.

Keep ready identity proof, address proof, academic records, co-applicant income proof, and bank statements.

Determine whether the institute is approved/recognised by the lender and whether it qualifies for unsecured limits.

Step-by-step application flow for banks, NBFCs, and online lenders

Online pre-application: Enter details on the bank/NBFC website or on Vidya Lakshmi to compare offers.

Submission of Documents: You must upload KYC documents, proof of admission, fee bills, and income documents.

Validation: The lender performs a credit evaluation, verifies income, and assesses collateral through field visits.

Sanction: Obtain the sanction letter specifying the amount, interest rate, tenure, and terms.

Signing Process: At the branch/DPN/Digital/Mobile banking, the co-applicant must sign.

Disbursal: Funds are either paid directly to the institution by the bank or deposited into the student’s account in accordance with the disbursal schedule.

Common reasons for delay or rejection and how to avoid them

- Inadequate documents: Verify the document checklist

- Low co-applicant credit and/or high existing obligations: Rebuild your credit or secure a stronger co-applicant.

- Institution not on the lender’s approved list: Check before applying to confirm eligibility.

- Income proof mismatch: consistency among Form 16, ITR, and bank statements.

Loan sanction letter, disbursal schedule, and signing the agreement

Sanction letter: It includes the sanctioned amount, interest rate, tenure, fees, and terms. Read the moratorium, part-payment, and collateral terms carefully.

Disbursal Schedule: Partial /Staggered disbursement (if applicable, Age of the Programme Course duration). Any partial or staggered fees that need to be paid out should specify whether documentary proof is required for each tranche, such as semester- or year-wise fee receipts/invoices.

How disbursal is paid to colleges (direct disbursal, a release disbursement)

Direct-to-college payment: The lender pays the college directly when invoiced—typical for tuition payments.

Organised disbursal: In the case of multi-year courses, lenders disburse funds on a semester or annual basis, depending on the fee schedules issued by the institutions.

Student expense allowances: Some lenders provide students with a portion of their funds for living expenses; check whether the payment is made in instalments or upfront.

Managing Loan Repayment: Practical Strategies for Students & Parents

Budgeting during the moratorium and planning for EMI commencement

Make a post-graduation budget and adhere to it, taking into account your EMIs, living expenses, and taxes.

Begin a separate EMI corpus at the time of taking a moratorium, pooling small amounts monthly to ease the initial burden.

Allocate sufficient short-term investment funds (liquid funds, recurring deposits) to the EMI corpus and avoid high-risk investments.

Options if you are unable to pay EMI: restructuring, moratorium extension, and settlement

Restructure: Demand EMI reduction/term extension; document is case-dependent and can affect interest costs.

Extension of the moratorium: Some lenders are providing limited relief, but interest may still accrue.

Settlement: Finally, as a last resort, you could attempt to settle the debt. This can affect your credit score and future borrowing capacity.

Using part-time jobs, internships, and freelancing to meet EMIs

Discover freelancing and internships aligned with your skills to generate income and build your CV.

Seek out dependable, legal work and don’t let it get in the way of your academics.

Allocate funds from work and service to EMIs; add to emergency funds and pay off the loan principal.

Tax advantage on paid interest — Section 80E details for Indian tax-filer

Section 80E: Interest payments on an education loan for higher studies by Indian taxpayers are tax-deductible. The deduction is allowed for paid interest throughout the repayment term, with no limit, and may be used for up to 8 years or until there is no longer any interest, whichever is earlier.

Principal repayment: You don’t receive any tax benefit on principal repayment under 80E. Retain the interest certificate from the lender for tax filing.

Maintaining a credit score post-graduation and why it matters

On-time EMI payments help build a good credit history, which enables easier approval for future loans (e.g., car, home) and credit cards.

Avoid defaults and be proactive in negotiating with lenders if you encounter difficulties repaying to limit long-term harm.

Check CIBIL/credit reports annually to identify errors and take corrective measures.

Risks, Pitfalls & How to Avoid Debt Traps

Predatory lenders and red flags in loan offers

Red flags: Upfront “guaranteed” approvals for a fee, ambiguous fee structure, high prepayment penalties, or verbal promises not reflected in the sanction letter.

Avoid lenders who pressure you to pay processing fees immediately in cash or who refuse to provide written terms.

Verify lender credentials and check reviews; prefer regulated banks/NBFCs registered with RBI.

Over-borrowing — why taking an excess loan is dangerous

- Higher interest and longer repayment terms increase lifetime cost and financial stress.

- Excess funds can be misused for non-educational expenses; only borrow what’s necessary with a clear budget.

- Remember that interest accrues even during the study period; a smaller principal reduces the compounding effect.

Misunderstanding moratoriums and accumulating interest

Myth: A moratorium is a free period.

Reality: Interest will usually accumulate and, if unpaid, is added to the principal (capitalised), so you end up paying more EMI.

Mitigation: Pay interest during the moratorium, or save into an EMI corpus to reduce the impact of capitalisation.

Borrowers’ legal rights and how to escalate them

Borrowers’ Rights: Effective notice, more secure loans with disclosures, and other allied matters for the proper nurture of the rights.

Escalation: First, the lender’s complaint cell. If not settled within the time frame or to your satisfaction, escalate it to the Banking Ombudsman or the RBI consumer education cell for banks; NBFC complaints to their grievance redressal mechanism, and, if necessary, to the RBI or a consumer court.

Keep a log of all correspondence, sanction letters, and receipts.

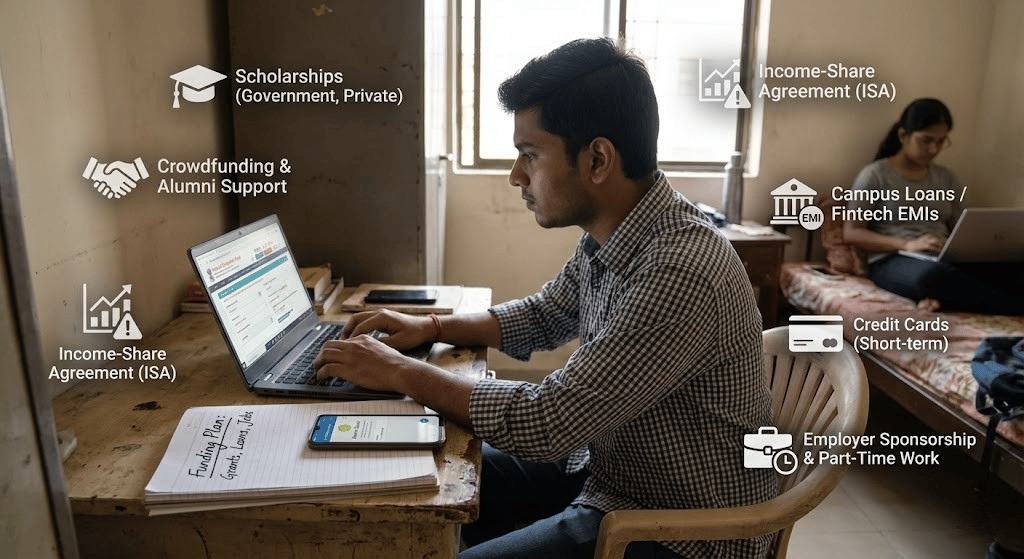

Alternatives & Complementary Funding Options for Indian Students

Scholarships (merit, needs-based, and government & private) — best places to look

Government scholarships: Central and state government schemes for reserved categories, merit, and students from the economically weaker section.

College scholarships: merit- and need-based aid from colleges; review the institution’s portal.

Private foundations and corporate scholarships: Search for websites such as Vidya Lakshmi, NGO platforms (e.g., Teach For India and Agastya), or the CSR (corporate social responsibility) sections of corporations.

Action: Apply early and have strong SOPs and letters of recommendation prepared for these competitive awards.

Education crowdfunding, loan scholarships, and income-share agreements

Crowdfunding: Platforms enable friends, alums, and the public to give; effective for niche programming or urgent shortfalls.

Loan scholarships: Some lenders provide partial interest waivers or scholarships based on academic achievement.

Income-share agreements (ISAs): A new model in which repayment is based on a percentage of future income over a set number of years; be sure to read terms closely, as the cost can be steep for those who earn higher incomes.

Campus loans, interest-free EMI options from Fintech companies, and Credit Cards

Campus loans/EMIs: Occasionally, institutions collaborate with lenders or edtech platforms to offer fee-payment EMIs or interest-free short-term repayment options.

Fintech EMIs and credit cards are Good for quick fee payment

Do the math on total cost before choosing credit cards to cover tuition.

Scholarships from employers and part-time employment opportunities

Employer sponsorship: Some corporations offer financial support to employees or their dependents for higher education; check with HR or alumni networks.

Part-time placements and internships: That university placement, research assistantship, and campus job help defray living costs while providing experience.

Establishing Credibility — Docs & Proofs That Enhance Your Loan Approval Chances

Transcripts and offer of admission letters to support applications

High academic scores, entrance ranks, and confirmed offers from reputable institutions reduce perceived risk for lenders, enabling them to extend the loan amount to higher caps.

For self-employed or informal earners: bank statements, GST filings (if applicable), business invoices, client references, and notarised income declarations can be used alongside ITRs to substantiate repayment arrangements.

Using fixed deposits, NSC, or property as collateral — valuation tips

Fixed deposit and NSC: Ready collateral; check whether they are in the name appropriate for the bank and how liens are secured.

Property: Clear title, valuation of the property within 2 years, and municipal receipts. Lenders prefer clear, unencumbered property. Expect valuation and legal charges.

Sponsor letters, campus recommendations, and professional references

Letters of support from employers, teachers, or training institutions can also improve our perception of employability and repayment outlooks (Evidence not scored) – this may be particularly relevant to vocational course applicants.

What To Do Next – Using Safely and Getting the Best Value

Prioritise the action list before applying.

- Admission and fee schedules to be verified independently; a reasonable budget for living costs may be required as costs may increase.

- Compare different lenders based on Annual Percentage Rate (APR) and total repayment amount.

- Apply for government schemes (CSIS) and register on the Vidya Lakshmi portal.

- Collecting documents, improving the creditworthiness of the co-applicant (if within limits), and applying for pre-sanction letters, if needed, for visa/seat booking.

How to negotiate the terms of your loan — and whom to talk to

- Bargain for processing charges, waive off prepayment penalties, and provide a favourable moratorium period if needed.

- Refer to the Branch Manager, Relationship Manager/Loan Desk; escalate to the regional office if required. Use comparators to display competing offers and request equality.

When to opt for financial counselling or legal advice in India

- If you are uncertain about how much to borrow overall, your ability to repay, or how to design a repayment plan, consider financial counselling.

- Verify with legal counsel before exercising the pen on complex collateral agreements or joint guarantees, or when you notice a vague clause in sanction letters.

This guide helps you assess education loan options in India, learn how student loans work, and apply with confidence. Some are legitimate financial services; others may be scams. Do what you can to win scholarships. Confirm your lender’s terms in writing. Plan to repay your student debt – this will save your credit and ensure that the degree you borrow to get is a tool, not a burden.