Complete Guide to No-Interest Student Loans in India — Options, Eligibility, Application Steps and Repayment Alternatives

Affordable student loans have been a primary concern for Indian students and families. This guide explains no-interest student loans, interest-subsidised loans, how to apply, and whether you are eligible.

This also covers repaying the loan, your options to repay the loan quickly, and alternatives – including practical templates, risk checks, and a policy perspective. Use the sections below to compare the schemes (government, bank, NBFC, university, and NGO), understand who is eligible, complete an application form with confidence, and protect yourself from scams.

Categories under which the data is classified include no-interest student loans in India, interest-free education loans in India, government-subsidy education loans, zero-interest education loans, and similar categories.

What “No-Interest Student Loans” Mean in India

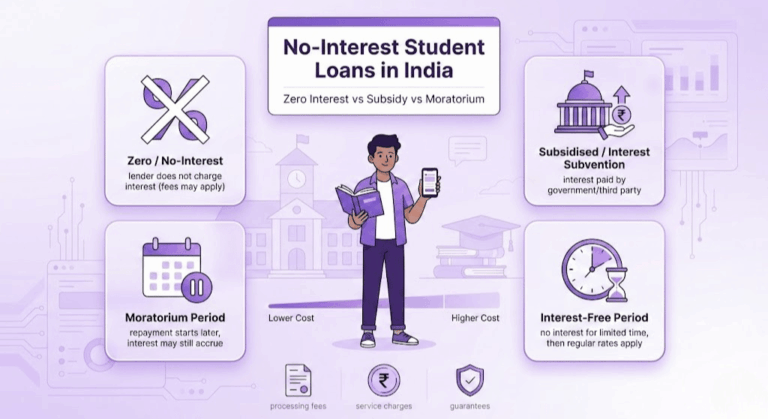

Definition and how “no-interest” differs from subsidised/zero-interest schemes

“No-interest” student loans: Historically, borrowers are not charged interest for a set number of years or for the life of the loan. In India, genuinely perpetual zero-interest commercial loans are rare. Far more common are frequent interest subventions (where the government or a third party pays interest), short-term interest-free periods followed by heavy, bag-laden payoff dates, or conditional forgiveness.

Subsidised vs zero-interest: Subsidised loans charge interest, but the government, a university, or a donor pays it on your behalf. Zero-interest offers do not charge interest to the borrower, but they may still include fees.

Common structures: interest waiver, moratorium, government subsidy, interest-free period

Interest waiver: The lender waives interest either at the outset or upon an employee meeting the conditions (working and repaying on time).

Moratorium: Under the moratorium, you don’t pay EMIs for principal/interest during the study or the immediate post-study period; interest may still accrue if not subsidized.

Government subsidy/interest subvention: The Government pays some/all of the interest directly to the lender for a specified period.

Interest-free period: A temporary window during which no interest is charged, typically 6–12 months, after which the standard interest rate applies.

Why students look for no-interest options — cost comparisons vs regular education loans

Case in point: A ₹10 lakh loan at 10% vs 0% over 10 years results in a difference of lakhs in total repayment; most students prefer options that provide relief from the monthly burden during the early career years.

No-interest options reduce upfront cash-flow pressure and can make high-cost courses viable for low-income families.

How lenders are still getting paid back (processing fees, collateralised service charges)

Processing fees: One-time, up-front fee (typically 0.25–1% or a fixed amount) to cover administrative costs.

Service charges and documentary fees: Periodic or one-time fees that are charged separately.

Collateral and Guaranty: To mitigate default risk, lenders obtain security in the form of property collateral, a third-party guarantee, or a lien.

Hidden costs: There may be prepayment penalties, late payment fees, and insurance premiums—read your sanction letter and policy schedule carefully.

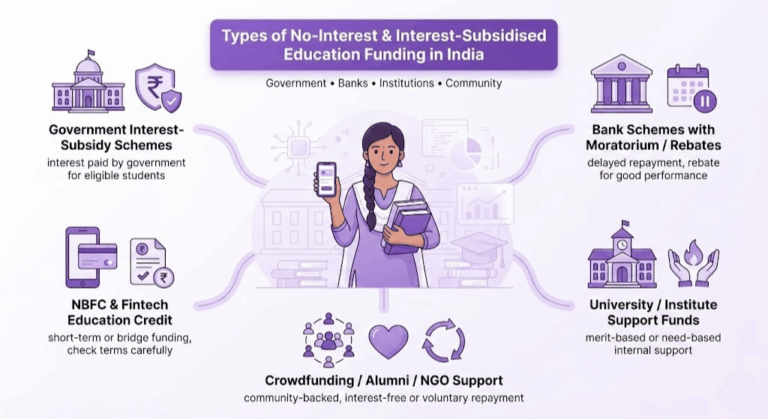

Types of No-Interest or Interest-Subsidised Education Funding Available in India

Government schemes with interest subsidy

Several Ministries occasionally offer interest subvention schemes to specific beneficiary groups (e.g., technical/medical education or graduates from Economically Weaker Sections). The borrower is generally required to apply for such schemes by approaching the nominated bank branches and producing admission and income records.

National Scholarship-linked loans: Certain scholarship schemes are linked with banks to provide interest-free/low-interest education loans.

Sample: Interest subvention for minorities or special scheme runs (state-wise variations are described in section 5).

Bank Schemes Providing Moratoriums or Rebates.

Public sector banks (PSBs) offer concessional terms for priority sectors, and government-specified subvention benefits are available to them. PSBs typically run centrally or state-sponsored schemes and offer a moratorium on courses such as research or medical studies.

Private banks may offer zero- or low-interest promotions, with terms of one to three years, in partnership with universities or corporates. These tend to be marketing-driven and anecdotal.

Rebate features: A few banks offer interest rebates for prompt repayments or academic excellence certificates.

Non-bank lenders & NBFC initiatives

NBFCs and fintech lenders also advertise “low or zero interest” on short-term bridges, top-ups, or micro-education credit. Such offers generally come with offsetting factors: high processing fees, short tenures, or revenue-sharing elements.

Key caution: Confirm NBFC registration with the Reserve Bank of India (RBI) and the terms for default, rollover, and collection practices.

University/institute-supported interest-free loans and institutional bursaries.

Several public and private organisations have their own loan funds or bursaries for needy students; these can be interest-free or carry a low-interest burden.

Standard qualification: Need-based, academic merit-based, typically for in-house students; distribution commonly follows semester fee schedules.

Crowdfunding, peer-to-peer, interest-free support, and alumni-funded loans programs

Crowdfunding platforms: Students raise tuition funds with no interest; campaigns rely on social reach and compelling storytelling. Platforms may charge platform fees.

Alumni-backed loans: Some institutions establish alumni-funded revolving funds that offer interest-free or otherwise reduced-rate loans to students who later pay back into the fund.

Peer-to-peer: Community or campus groups may lend interest-free; formality and protections can be sparse.

NGO and charity grants that function like no-interest loans

NGOs can issue grant-loan products with voluntary or income-contingent repayments; some charity-only organisations offer interest-free loans for vocational or professional study related to social uplift.

Application: Proof of need, community context, and project-level justification are generally required.

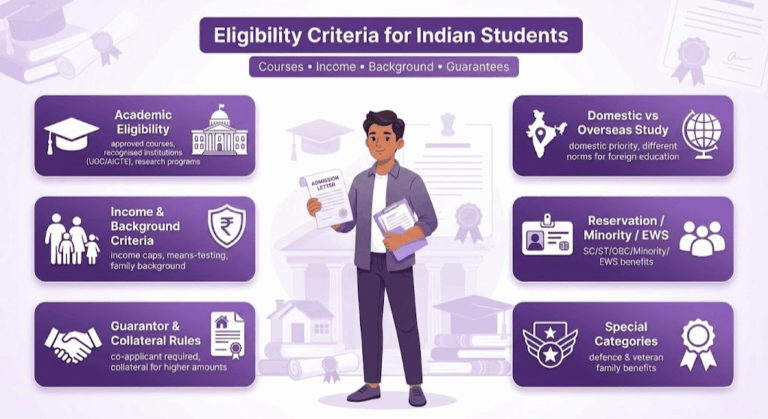

Eligibility Criteria Specific to Indian Students

Academic prerequisites, types of programs, and schools (domestic vs abroad)

Eligible courses: Most schemes support professional courses (engineering, medicine, law, MBA) and higher-education graduation degrees/diplomas approved by UGC/AICTE. Special moratoriums are often imposed on research programmes (PhD).

Domestic vs Overseas study: Public-sponsored interest discounts are usually granted for domestic education rather than overseas, while some banks have different collateral norms, like special education loan products for studies abroad. Loans made with university funds are typically available only to enrolled students.

Minimum academic criteria: Some programmes require proof of admission (offer letter) and minimum scores or ranks to be granted a merit-based interest waiver.

Income and family-background caps, caste/reservation, and minority-specific programs

Income limits: Subsidised/no-interest schemes usually have an upper limit on household income (e.g., ≤₹4-8 lakh p.a., depending on scheme).

Reservation and minority schemes: Some programs offer special benefits to SC/ST/OBC/Minority communities or to different religious/linguistic minorities.

Means-testing: Evidence through income certificate, PAN, Form 16 or ITR.

Guarantor and collateral norms for interest-free/interest-subvented options

Small loans: If you’re borrowing within a particular limit (say ₹4-7.5 lakh in some bank policies), security need not be furnished as long as a credible co-applicant exists – parent or guardian.

Higher amount/foreign education: Depending on the loan amount and whether studying in Australia without a third-party guarantee is available.

Guarantor’s requirement: Having a financially stable co-applicant with good credit history can help secure loan approval.

Additional eligibility for EWS, SC/ST/OBC, family members of defence or ex-servicemen

There are relaxed income caps, collateral norms, and priority processing for EWSs (Economically Weaker Sections) and other reserved categories.

Defence/veterans family schemes: Some banks, as well as states, offer special interest concessions or priority loans for the wards/family members of defence personnel and veterans.

Documents: You may need to produce caste certificates, EWS certificates, defence identity cards, or service records.

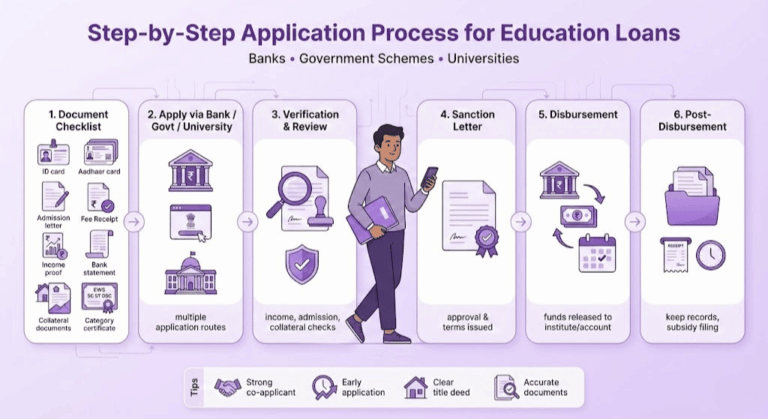

Step-by-Step Application Process (Bank/Govt/University)

Checklist of documents to carry

Core documents:

- Student ID/Applicant photo, Aadhaar or passport.

- Admission letter or provisional seat allotment.

- Fee details from the institution.

- ID and Address Proof of Co-applicant.

- Income proof: Salary slip, Form 16, ITR for the last 2–3 years; income certificate for self-employed.

- Collateral documents: Property papers, NOC if applicable, and valuation wherever required.

- Caste/minority/EWS certificates in case of claiming category benefits.

- School transcripts and test results (if applicable).

- Bank statements (last 6 – 12 months), passport photos, and signed application forms for the loan.

How to apply for central/state interest-subvention programmes — forms & portals

Visit the central and state education department portals to learn about the subvention schemes currently available and your eligibility.

Portals and forms: Several schemes allow online applications via bank portals linked to the scheme or government websites created for this purpose. Download the application, submit scanned documents, and obtain a bank branch reference or scheme acknowledgement.

Bank coordination: The scheme typically requires the bank to file a claim for interest subvention after disbursing the loan. The bank should include the scheme name in the loan documentation and obtain signed scheme-wise declaration forms.

Bank application process for education loans claiming subsidy — sample timeline

Week 0–1: document gathering and application to the bank (in branch or online).

Week 1–2: Bank verification — identity, income, admissions verification, and valuation of collateral.

Week 2–3: Issuance of sanction letter (Terms, interest moratorium, processing fee). If part of the subsidy program, parameters for bank note subsidy claims.

Week 3–4: Disbursement to the institute’s accounts on receipt of fee demand and admission details.

Post-disbursal: After a loan has been disbursed to the bank account, and for interest subvention claims (if applicable), the bank files. Keep all receipts and copies of sanction letters safe.

How to approach the loan bureaus from the university/college and alumni funds

Get in touch with student services or the bursar’s office: Inquire about internal loan programs, alum funds, or hardship grants.

Application: Complete the institution application and submit a financial need statement, proof of admission, and references.

Terms: Review the length of time, repayment plans, and any community service or postgraduate conditions associated with the loan.

Tips to increase approval chances

- The co-applicant should be strong: namely, parents with a stable source of income, a good credit history, a regular borrowing pattern, and documentary evidence.

- Build credit history: Pay off any remaining small credit card balances and avoid defaulting on loans.

- By providing acceptable collateral, such as property papers in place, a clear title, and a valuation.

- Application date: The earlier you apply after being admitted, the sooner money can be in your bank account and claims for (partial) subsidy.

- Accurate Documentation: Incomplete or fraudulent documents are among the main reasons applications are refused.

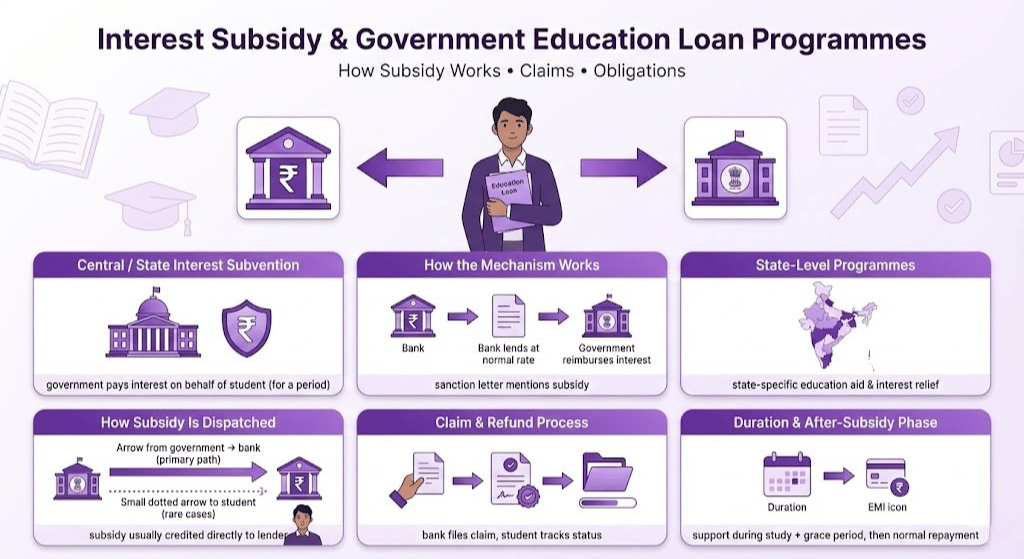

Interest Subsidy & Government Programmes — Details and How They Work

Central interest subvention schemes: The central/state government pays the borrower’s interest to the lending bank (usually for a specified period, during school, and for a limited time after school). The borrower experiences reduced outflows, and the lender receives interest from the government.

Mechanics: The bank lends at a standard interest rate but receives a periodic subsidy or the claim upfront, depending on the Government’s scheme design. The sanction letter must state the relevant subvention.

Who refunds: Banks are reimbursed the interest amount by the concerned government department or nodal agency. Some programs are operated in conjunction with banks; banks may receive a small fraction as servicing fees.

The state-level schemes

Maharashtra: State scholarships and education loan reimbursement schemes offer interest waivers to reserved-category and EWS students at state universities.

Tamil Nadu has had targeted loan subsidy and scholarship programmes for backward classes and minorities, which have also included interest relief in the past.

Uttar Pradesh & Kerala: Many details are available on state scholarship portals and on welfare department pages regarding education aid or short-term interest-relief packages for meritorious and economically disadvantaged students.

Note: Program titles and eligibility guidelines change; please check the most recent state education department websites or local bank branches.

Mode of Dispatch of Interest Subsidy and Process for claiming refund/waiver

Disbursement methods:

Direct to lender: Government credit subsidy component deposited into bank accounts via validated claims (more prevalent).

Repayment to borrower: Uncommon, generally only in extraordinary corrective circumstances.

Claims process:

The bank submits the claim to the nodal agency upon receipt of the requisite borrower documents and proof of disbursement.

The borrower should confirm that the bank has filed the claim and retain copies of the submitted forms and the bank’s confirmation.

Refunds and adjustments: If a subsidy is applied or terminated in error, the bank and borrower must reconcile the accounts through formal communication and maintain all sanction letters and subsidy approval memos.

Average length of support and post-support obligations

Duration: Most scholarships cover the study period plus a short grace period (6–12 months) or a fixed tenure, depending on the scholarship scheme.

After the subsidy period, the borrower must pay the prevailing interest under the loan terms. Make sure to reserve the EMI budget for the post-subsidy period.

Obligations: Make prompt repayments, furnish employment/residential changes as and when required under the scheme and inform the lender/nodal agency of any significant change.

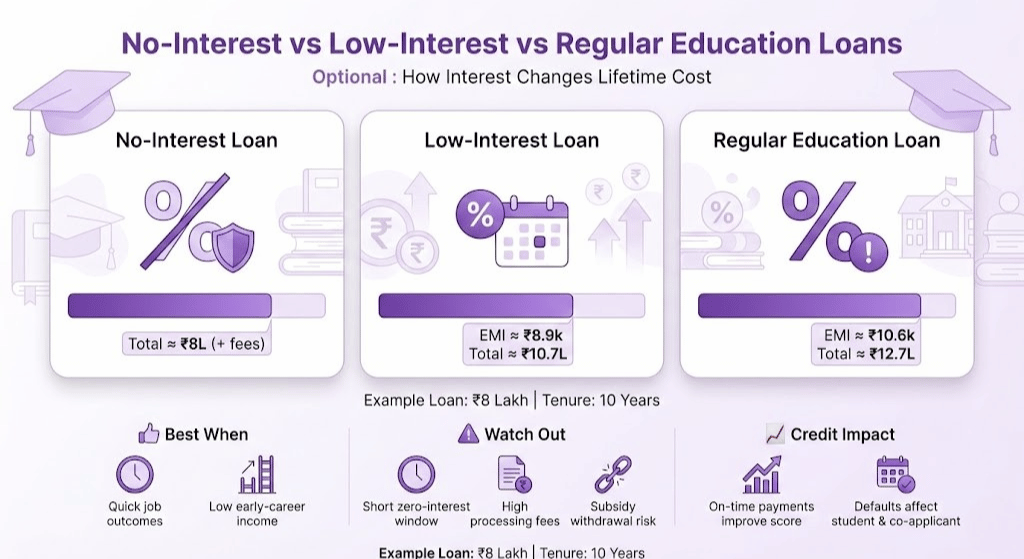

Compare: No-Interest vs Low-Interest vs Regular Education Loans

Cost breakdown examples for typical undergraduate/postgraduate courses in India

Illustration: Loan of ₹8 lakh for 10 years

No-interest: Total repayment is about ₹8 lakh (plus fees).

Low-interest like 6%: EMI ₹ 8,887; total is close to ₹10.67 lakh — but interest = ~ ₹2.67 lakh.

Normal 10% EMI: EMI ₹10,589; total paid ₹12.71 lac — interest ~₹4.71 lac

Variations demonstrate the role of the interest rate in lifetime cost; therefore, a preference for 0% or subsidised options, if available.

Cases where interest-free loans are good/bad

Better when:

- Immediate funding for certifications or vocational programs with short time-to-employment opportunities.

- Students with uncertain early-career income should bear little upfront burden.

Worse when:

- The interest-free period is short, but the processing fees or up-front charges are high; the total effective cost may be comparable to a low-interest loan.

- If the subsidy is withdrawn, borrowers may face a surprise increase in EMIs they cannot afford.

Hidden charges: processing fee, advance payment, and late charges

- Insurance costs (credit life or loan protection) increase costs, but may be required by some lenders.

- Late-payment penalties and compound interest that accrue on overdue balances can be steep.

Effect on credit rating and ability to qualify for loans in the future

- On-time payments increase credit scores and improve access to future loans.

- Default or nonpayment — even under a heavily subsidised system — affects credit history and increases borrowing costs.

- Defaults from the co-applicant will also reflect in the creditworthiness of both; Educate the co-applicant on liability.

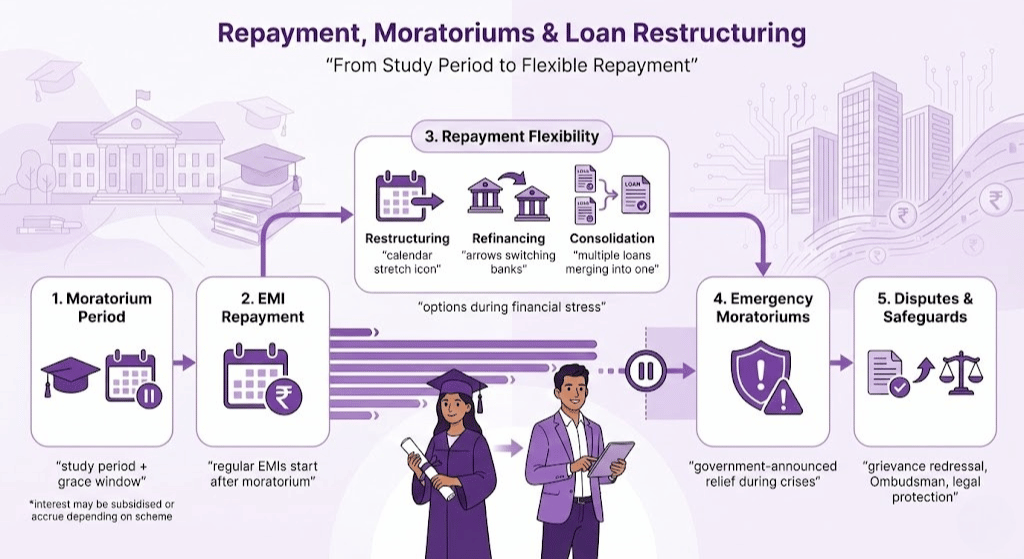

Repayment Options, Moratoriums, and Loan Restructuring

Regular repayment schedules and EMI after moratorium

Normal Tenure: Generally, the repayment tenure for educational loans in India ranges from 5 to 15 years, depending on the loan amount and lender.

Moratorium: Study plus grace period (6–12 months) is commonly provided; some schemes subsidise interest during moratorium.

EMI start: Generally, post the moratorium period; the bank includes a repayment schedule in the sanction letter indicating EMI and tenure.

Loan restructuring, refinancing, and consolidation options are available in India

Restructuring: Banks may reschedule EMIs, extend tenure, or change repayment frequency if there is genuine financial stress; a formal request and documentation are required.

Refinancing: Borrowers have the option to switch to another lender offering lower rates or better terms; do check prepayment penalties and NOC from the existing lender.

Consolidation: Combining several education loans into one loan makes repayment easier; costs and rates vary—compare carefully.

Government-imposed moratoriums during times of emergency, and how to claim

Previous example: Pandemic-relief measures in which moratorium options were announced; some schemes also offered partial subsidies or deferment.

Claim procedure: Contact the bank, submit evidence of eligibility, obtain written approval for moratorium; verify the terms of payment and accrued interest.

Dealing with banks and legal position if the lender declines the agreed subsidy

Maintain documentation: Preserve written proofs of scheme claims, application acknowledgements and sanction letters.

Bank refusal: First, escalate to the higher bank authorities (branch manager, grievance cell); then file a complaint against the bank with the nodal officer and the Ombudsman if the problem is still not resolved.

Legal recourse: If banks are deducting interest incorrectly or refusing a subsidy due, borrowers can approach the Banking Ombudsman and, if necessary, the consumer courts.

Verification, Fraud Risks, and How to Protect Yourself

Common scams around “zero-interest” loans in India

Advance-fee scams: Scammers offer to provide guaranteed zero-interest loans for a fee before the loan is disbursed.

Fake lenders: Individuals claiming to be a bank/NBFC without registration.

Phishing: Calls requesting confidential information or OTP to obtain identity and withdraw funds.

How to verify lender legitimacy (bank license, NBFC registration, UPI/payment checks)

Verify bank presence: Longstanding banks post branch information and regulatory status on official websites.

NBFC verification: Ensure registration on the RBI’s list of registered NBFCs.

Payment requests: Real lenders will never ask for online payment transfers to random accounts. Instead, use demand drafts or bank-procured charges.

Sanction letters: Authentic lenders issue a sanctioned letter with the registration number and branch stamp.

Red flags in contracts and clauses to watch (prepayment penalties, compound fees).

Avoid pre-sanction demands for upfront payment.

General penalty provisions: Detail in clear terms, for example, prepayment penalties and the computation of late charges.

Compound interest on arrears: Find out how and when interest is charged on already overdue amounts.

Vague mention of subsidy: Where a subsidy is to be disbursed, it shall be clearly mentioned in the sanction letter by name and scheme.

Steps to take if duped — bank ombudsman, RBI complaint, police FIR

- Block financial transactions to the bank and report without delay.

- Complain with the Grievance Cell of the lending institution and retain the reference number.

- If the bank/NBFC does not resolve the issue, approach the Banking Ombudsman or file a complaint on the RBI’s Consumer Portal.

- In case of fraud related to theft or forged documents, file a police FIR and retain copies for legal proceedings.

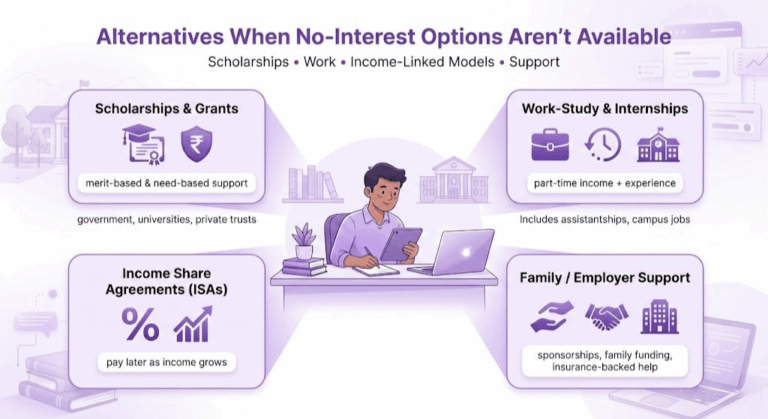

Alternatives When No-Interest Options Aren’t Available

Scholarships and merit/need-based awards (where to look in India)

Multiple opportunities are also displayed on various central and state scholarship portals (e.g., the National Scholarship Portal).

University scholarships, private trusts (such as the Tata Trusts or Reliance Foundation), and corporate CSR programs.

Search portals: university financial aid offices, scholarship aggregators, and government education portals.

Work-study, assistantships, internships, and part-time on-campus jobs

Postgraduate students are often funded through a teaching or research assistantship that covers tuition or provides a stipend.

On-campus jobs: Library, lab, or administrative work that helps defray living costs.

Internships: Getting paid internships during breaks can decrease the need for loans and add to experience.

Income Share Agreements (ISAs) and how they stack up for Indian Students

ISA-based: Student is funded in exchange for a cash-like stream of payments over time, as a percentage of future earnings.

Pros: No interest rate, payments tied to income, and a risk-sharing model.

Cons: More expensive than traditional student loans for high earners; borrowers could end up paying back more than they borrow; ISAs are relatively new and less regulated in India.

Family funding, employer sponsorships, and education loan insurance products

Family/friends: the cheapest source, but could ruin friendships; make the terms formal with a written agreement.

Employer sponsorships: Some businesses offer higher-education sponsorships in exchange for a service commitment.

Loan insurance: Should cover repayment upon death or disability; see whether the premium on the loan makes it affordable.

Checklist: Before You Sign Any No-Interest Loan Agreement

12-point checklist (legal, financial, fallback, documentation)

- Confirm the scheme name and the exact subsidy/interest-free clause in the sanction letter.

- Verify lender legitimacy (bank branch address, RBI/NBFC registration).

- Read processing fee, service charges, and exact rupee amounts.

- Check collateral requirements and valuation method.

- Note the moratorium duration and whether interest accrues during it.

- Confirm disbursal mode (direct to institute vs borrower).

- Review prepayment terms and penalties.

- Check documentation retention: get copies of the sanction letter and agreement.

- Understand the EMI start date and frequency.

- Verify grievance redressal channels and nodal officer contact.

- Confirm tax treatment (if any) of subsidy/grant components.

- Ensure the co-applicant signs and understands the liability clauses.

Questions to ask the lender/university before accepting the offer

- Who pays the subsidy and for how long?

- Will the subsidy be shown on my sanction letter and bank statements?

- What happens if I secure a job before the moratorium ends?

- Are there any hidden fees or mandatory insurances?

- What documentation will the lender submit to claim the subsidy?

Resources For Indian Students: Portals, Helplines, and Legal Help

Central and state loan portals and helplines

National Scholarship Portal: Unified portal for various scholarships and schemes.

State scholarship portals: Each state has a website for education welfare and schemes—search for “[State] scholarship portal.”

Bank helplines: Most large banks offer separate education loan branches and toll-free numbers; note the complaint and nodal officer contacts in the sanction letter.

Useful government departments and schemes to follow

MHRD (now the Ministry of Education): Policy updates and central scholarship announcements.

State higher education departments: Local schemes, interest-subvention offerings.

Nodal agencies: For some schemes (minorities, SC/ST welfare boards, etc.).

Option of consumer complaints (RBI, Ombudsman, National Commission)

- Banking Ombudsman: Speedy resolution of disputes with banks.

- RBI Consumer Education website: File complaints against banks and NBFCs; verify lists of regulated entities.

- NCDRC and State consumer forums for higher escalations.

- Police and cyber cells to register complaints related to fraud.

Final note

No-interest or interest-subsidised student financing can significantly reduce the cost of education, but the terms vary widely and are conditional. Always verify the authenticity of a scheme, obtain written confirmation in the sanction letter, plan your post-subsidy EMIs, and maintain complete documentation. If you are uncertain, seek advice from bank nodal officers, university financial aid offices, or a reputable financial adviser before signing.