Best Private Student Loan Companies in India | Complete Guide for 2026

What are Private Student Loans in India?

What are they, and how are they different from scholarships, grants & public education loans

Private student loans in India are offered by private banks, NBFCs, fintech lenders, P2P platforms, and a few international lenders, catering to the needs of education financiers. Unlike government-funded student loans, which may be issued at below-market interest rates (for example, by public-sector banks under special schemes such as the Concessional Rate of Interest or Interest Subvention), private student loans apply risk-based pricing at both origination and in the post-disbursement period. Grants are nonrepayable funds awarded based on need, merit, or other criteria, while private loans must be repaid in full, plus interest.

Common uses — fees, living expenses, studying overseas, exams/courses

Other education costs covered with private student loans include, but are not limited to:

- Undergraduate, postgraduate, professional and vocational tuition and semester fees.

- Living expenses: housing, meals, local transportation, and study resources.

- Study-abroad costs: tuition deposits, visa fees, airfare, international insurance, and initial living expenses.

- Course-related charges: lab fees, exam and certification fees, equipment such as a laptop or cellphone (and repairs), internships with unpaid stipends.

Since private lenders typically approve larger loan amounts and disburse funds more quickly, students use them to fill gaps not covered by scholarships or public loans.

Words to know

Interest rate: Easier to understand than other financing; the annual rate charged may be fixed or variable. Private lenders charge higher interest rates for unsecured loans and international programs.

Tenor: loan term or maturity, typically 3 – 15 years for private student loans.

Moratorium: a period of grace where no repayment falls due (usually until the end of the course plus a month or so). Interest capitalisation during the moratorium is optional for lenders.

Processing fee: a one-time fee for processing the loan application (fixed or percentage-based).

Co-signer/guarantor: a third party (usually a parent) who has agreed to assume responsibility for loan repayment if the borrower does not do so; more frequently requested in unsecured or high-value loans.

Private loans vs. Bank/NBFC education loan

Undergraduates choose to borrow privately when public-sector or priority education loans are inadequate, too slow, or have stringent collateral requirements. Private lenders can offer:

- Quicker decisions and faster payments could help meet tight admission/deposit deadlines.

- Soft eligibility (factoring in future earning potential, campus tie-ups).

- ECU lending ratios have become too high for international programs.

- Tailor-made repayments (Interest-only EMIs, Deferred EMIs, Bullet Repayments).

- But private loans may come with higher rates and fees, so comparing costs and convenience is essential.

Who offers private student loans in India? | Types of lenders

Private banks

Private banks (such as HDFC Bank, ICICI Bank, and Axis Bank) offer loans specifically designed for study-related expenses in India and overseas. Typical features:

- Competitive rates for those with excellent credit/co-signer.

- In-branch network personnel for processing and documentation.

- Bundled products: overdrafts, student OD and pre-approved loans for specific campuses.

- Formal Collateral Policies: unsecured for smaller loans; a lien on FD/property for larger ticket sizes.

- Private banks may be more stringent in their documentation and credit history requirements than fintechs.

NBFCs & Fintech lenders (features, flexibility of eligibility)

In the current space, NBFCs (like Credenc, Auxilo, InCred, Avanse, many have both NBFC and fintech wings) provide specialised education lending with much greater agility:

- Willing to consider your potential income, school, and a cosigner.

- Faster online onboarding and more flexible eligibility criteria for overseas students.

- Value-added services: pre-sanction letter templates for admission deposits, career counselling tie-ups.

Their interest rates vary widely but are typically between those offered by private banks and those in the marketplace. They may have greater discretion to take collateral beyond real estate and to provide creative moratoriums.

Peer-to-peer and marketplace platforms

P2P platforms and loan marketplaces connect individuals and/or entities with investors. Features:

- Possibly lower interest rates for creditworthy borrowers through marketplace competition.

- Clear fee structures and digital-only processes.

- Limited track record for larger student loans; parts of the market still focus on smaller-ticket and credit.

- Possible lender level terms variations; Responsibility to review the credibility of the platform and legal protection.

International private lenders for study abroad (what sets them apart)

International private lenders and buyers offered this new type of guarantee only to NGOs, for study-abroad use. Private international loans are generally on the basis that they provide top-up funding to students who incur extra costs while studying overseas, mainly:

- Underwriting potential future earnings and university rankings, not domestic credit history.

- Providing non-cosigner and limited-cosigner products in most cases, particularly to high-ranking schools.

- Prices in USD/GBP/EUR, with structured repayments aligned with global careers (students anticipating foreign salaries may find this appealing).

- More often, they require admission and program cost documents and do not transfer funds directly into Indian accounts.

Top private student loan companies and product comparison

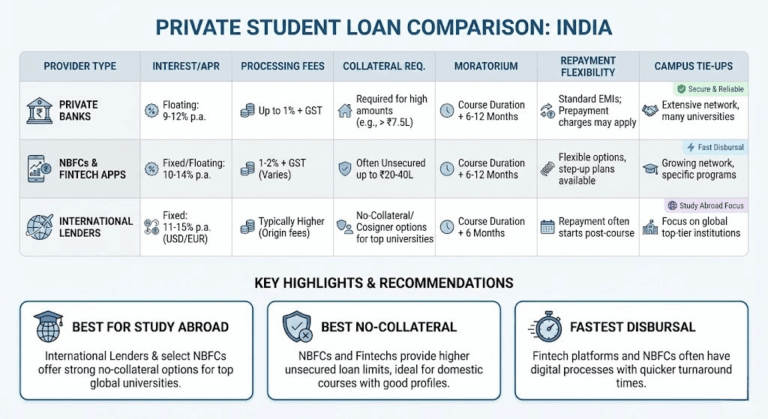

Parameter used: APR/interest, processing fees, collateral required, moratorium period on repayment, flexibility in repayment and customer service with campus tie-ups

In comparing private student loan companies, consider:

- APR/Interest: headline rate (plus fees); lower APR = lower total cost.

- Processing fees and other front-end charges.

- Collateral specification: secured, unsecured, and the types of assets it accepts.

- Moratorium terms: duration and whether interest is capitalised.

- Flexibility in repayments: interest-only EMIs, EMI deferment, pre-payment/foreclosure charges.

- Customer service: response turnaround, grievance redressals, and digital access.

- Campus tie-ups: Lenders that have a tie-up with the universities can provide smoother documentation and pre-approved loans.

Lender Profiles

1) HDFC Credila

Product details: Specialised education loan for students pursuing professional courses in India, available only if the course is relatively expensive.

Eligibility: A cosigner with at least high-quality or good academic/admission records.

Usual interest rates: 9.5%–13% p.a.

Term: Up to 15 years.

Collateral: For big-ticket items, mortgages, or third-party guarantees, may be requested.

Standout feature: University partnerships and customised underwriting for international STEM, MBA, and professional degrees; strong pre- and post-loan career support.

2) ICICI Bank Education Loan

Product summary: Full-service private bank loan for studies abroad, available at a branch or online.

Eligibility: For students residing in India with a co-applicant/guarantor.

Interest range: 8.5%-13% p.a.

Tenor: Up to 15 years.

Collateral: Secured, but for the high-dollar loans; unsecured if it’s not much more.

Best feature: Competitive fixed-rate products that enable quick disbursement through an extensive branch network.

3) Axis Bank Education Loan

Product details: Offers a broad selection of classes with flexible moratoriums and repayment options.

Interest rate: 9%–13% p.a.

Tenure: Up to 12–15 years.

Collateral: If a large amount, property or FD lien.

Notable features: Campus tie-ins and EMI moratorium options for study-abroad packages.

4) Avanse Financial Services (NBFC)

Product Summary: An NBFC-led education loan specialist for domestic & overseas students, with a reputation for flexible underwriting. For students with a valid offer letter and co-lender details.

Interest range: 9.5%-14% p.a.

Tenor: Up to 15 years.

Security: Mostly limited to small amounts; unsecured for smaller loans; larger loans require security.

Best feature: Fast digital processing on anything-goes moratorium with choices to capitalise interest.

5) InCred (NBFC)

Product summary: Fintech-enabled NBFC that provides tailor-made loan products and quick disbursement.

Requirements: Focus on the institution’s future ability to pay and its ranking.

Interest range: 10-16% p.a.

Tenor: up to 15 years.

Collateral: Usually unsecured below thresholds.

Unique selling point: Online approvals and innovations such as deferred EMIs.

6) Auxilo (Education finance NBFC)

Product summary: Focus on substandard rates for overseas study loans.

Interest rate: 10%-14% p.a.

Tenor: Up to 12-15 years

Collateral: Larger loans may require collateral—key differentiators include industry-based underwriting and robust campus partnerships.

7) Prodigy Finance (international-focused)

Product summary: Worldwide lender for international students (mainly PG) that underwrites based on future earnings.

Eligibility: Students enrolled at partner schools with strong academic performance.

Interest range: It depends on the market you’re in; it is usually higher than that of local NBFCs, but there is no requirement for a co-signer.

Tenor: Typically 5–10 years.

Collateral: No collateral; cross-border disbursal.

Best features: No-cosigner option and international repayment freedom.

8) MPOWER Financing (international-focused)

Product summary: US lender for Indian students attending specific foreign institutions; specialises in no-cosigner products.

Eligibility: Students accepted by partner schools with impressive profiles.

Interest rate range: market dependent, usually fixed for a term. Tenor: 5–10 years.

Collateral: No collateral required.

Notable feature: No cosigner requirement and a focus on employability metrics.

Comparison matrix summary

Best for study abroad (no cosigner): Prodigy Finance and MPOWER (as long as you are eligible and your university is a partner).

Best no-collateral options: NBFCs – Avanse, InCred for smaller loans; international lenders for particular programs.

Fastest disbursal: Fintech NBFCs and marketplace lenders that have online processes.

Best campus tie-ups: HDFC Credila, Axis, and a few NBFCs with pre-approved/simplified documentation for partner campuses.

Eligibility documentation and co-signer requirements

General eligibility for Indian residents and NRIs

Residents of India: Minimum age typically 18; an admission letter from a recognised institution; a co-applicant/parent is often required unless the borrower has excellent credit history or income. Your chances of being approved may increase if you have academic merit and your school ranks highly.

NRIs: If an Indian co-applicant is available, NRIs or PIOs can take a loan from an Indian lender; some lenders offer products exclusively for these categories, with different documentation and taxation norms.

International-focused lenders may enable Indian citizens without a domestic credit history to obtain credit based on admission quality and future earning prospects.

Common documents required (student, parent/guardian, course admission proof)

Student: Admission letter, fee structure/invoice, passport (for study abroad), education documents, identity card (Aadhaar, PAN).

Parent/guardian (co-applicant): Pan, identity proof and address proof, latest salary slips/IT Return, bank statements (last 6–12 months), employment/job proof and property documents if any property is to be pledged.

Course proof: Home fees, letter of admission/enrolment, cost to attend, visa/acceptance documents for foreign study.

When Collateral is required

Collateral is generally required for higher-value loans (specific amounts will vary by lender). Acceptable collateral includes:

- Property Mortgage of a residential house or commercial property.

- Lien on term deposits or NSC/PPF (in some instances).

- Third-party guarantee with a property as collateral.

- Smaller loans (below certain lender limits) are generally uncollateralized but may still require a co-signer.

Duties and obligations of the Co-Signer or Guarantor

A co-signer is legally liable to repay if the borrower defaults; the lender can collect from both the borrower and the co-signer.

The co-signer’s income, credit score, and liabilities affect loan eligibility and interest rates.

The co-signer remains on the loan until released, per lender policy (after a specified number of on-time payments, either in whole or in part, or through refinancing). Make sure they understand the legal risk.

Interest rates, charges and working out the actual cost

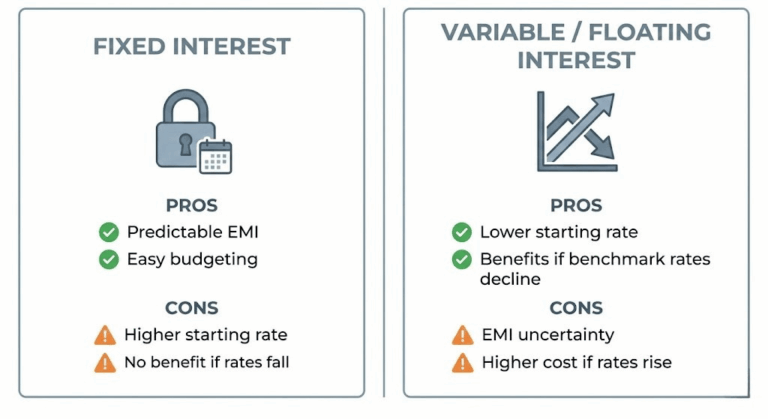

Fixed vs variable interest — the pros and cons

Fixed interest:

Pros: EMI is predictable; budgeting is more straightforward and not affected by market-rate spikes.

Cons: Potentially higher initial rate; limited benefit if market rates decline.

Variable (floating) interest:

Pros: Rates typically start lower; you stand to benefit if the benchmark (such as the repo-linked or base rate) declines.

Cons: EMIs may increase with market-rate hikes; total cost unclear.

Moratorium, repayment options and loan servicing

Every day, the moratorium practices in India and variations among lenders

Standard moratorium: Most lenders maintain a moratorium (about 6 months to 1 year after course completion) to facilitate job search and placement.

Variables: some lenders do not charge interest during a moratorium (rare in private lending); more often, interest accrues and may be capitalised (added to principal) at the end of the moratorium period, increasing your total borrowing cost.

Terms of Passage Embeds: NBFCs and fintech firms sometimes allow partial payments during the moratorium to prevent interest compounding.

EMI, deferred interest, interest-only, repayment options

Complete EMI: EMIs commence after the moratorium; both principal and interest are paid simultaneously.

Deferred interest: Borrower repays only interest during the moratorium, with principal repayment starting later—minimising the capitalised interest burden.

Interest-only EMIs: Only interest is paid during a stipulated period; principal is repaid later.

Bullet repayment: A lump-sum payment of principal at maturity; usually associated with short-term or special arrangements—greater risk and cost.

Decide with a view to cash flow forecasts: interest-only reduces the immediate burden but increases the overall cost.

Loan transfer, top-up loans and refinancing in India

Loan transfer/refinance: Borrowers can refinance their education loans with lenders offering lower interest rates or more favourable terms. Observe transfer fees and exit penalties.

Top-up loans: Borrowers who have already borrowed can request additional funds (for higher fees or longer study) and may be unsecured/top-up, depending on the lender.

When to refinance: Wait until after the job, when your credit is better; compare prepayment penalties with your current lender before moving.

Implications of default and impact on credit history (CIBIL)

Credit: Missing EMIs are reported to CIBIL, Experian, and Equifax. Defaults reduce credit scores, limiting future access to loans and employment, contingent on a credit check.

Recovery and rehabilitation: Lenders might have restructuring or settlement options; proactive communication can prevent long-term harm.

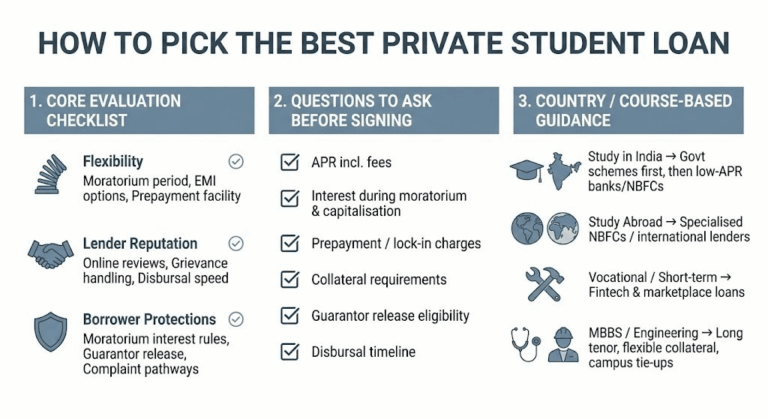

How to pick the best private student loan — decision checklist

Evaluate the following

- Flexibility: moratorium period, EMI choices, prepayment/foreclosure charges.

- Lender reputation: user reviews, complaint resolution process, and time to disburse.

- Borrower protections: qualifications for moratorium interest, guarantor forgiveness policy, and grievance pathways.

Queries to ask lenders before signing

- Take note of the APR with fees. Request a written cost sheet.

- Any interest charges during the moratorium? If yes, is it capitalised?

- Are there prepayment or penalty fees? Any lock-in period?

- What collateral is demanded, and what if the property is already mortgaged?

- Am I eligible for a guarantor release after X years of making timely payments?

- Post-approval, how soon is the disbursement, and when do instalments to the institution become due?

Country-wise guidance (studying in India, studying Overseas, vocational courses and short-term certification)

Study in India (public/private universities): Apply for government-subsidised loans where eligible; if not, apply to private banks and NBFCs with the lowest APR & clear moratorium clauses.

Study abroad (expensive ticket): Check whether you’ve options such as specialised NBFCs or international lenders (Prodigy/MPOWER) that underwrite future earnings and provide no-cosigner products, where available.

Vocational courses/short-term certification: For a relatively small amount, fintech and marketplace lenders offer quick, no-collateral loans; consider the cost-benefit, given the shorter repayment period.

MBBS/Engineering (high fees): Prioritise lenders with flexible collateral and longer tenors; also check for campus tie-ups and the track record of disbursals.

Application process and tips for documentation

Admission letter, Fee schedule, Co-signer documents, Pre-application checklist

- Co-signer (as per system-generated eligibility), KYC (PAN, Aadhaar) of co-signer, income proof(Salary slips/ ITR form), and bank statements to be obtained.

- Property/FD papers are ready if you are pledging them as collateral.

- Review lender-specific eligibility and pre-qualify online to compare offers.

Completing an application — things to watch for and how to avoid delays

Pitfalls: Incomplete KYC, names that don’t match on the documents, signature missing, no clear breakup of fee, failure to submit co-signer proof in time.

Avoidance: scan clean colour copies, ensure PAN/Aadhaar names are the same as the name issued for PAN/Aadhaar verification, put your admission letter with the course start date of your College, as well as upload continuous bank statements (6-12 months) and accurately answer income/ debt questions.

Haggling over loan interest rates and waiver of fees with lenders

- Haggle with evidence of a strong co-signer’s credit, high academic merit or campus tie-up, and competing offers from other lenders.

- Request that the lender waive or reduce processing fees and cap foreclosure/prepayment charges.

- Leverage campus finance offices or placement officers (they often have tie-up schemes pre-negotiated).

What happens post-approval — disbursal, bank mandates, lien on collateral

Funds are not disbursed to the borrower’s account; they are sent directly to the university based on invoices. Some lenders also disburse a portion to the borrower for living expenses.

Execution of the loan agreement: Lenders will ensure the loan agreement is executed, and, post-disbursement, will place a lien on the collateral, if applicable, by registering the mortgage.

Establish EMI mandates along with the bank account; monitor the first EMI date and the moratorium end date.

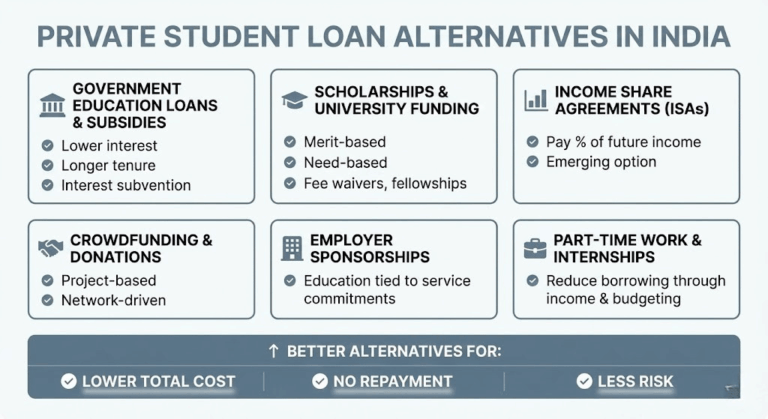

Private student loan alternatives in India

Government education loans and subsidies — when they outperform private alternatives

Interest Subvention: Public and priority sector lending offers lower interest rates, longer tenors, and interest subvention for specific categories. When available, they typically offer a lower total cost for regular classes. If disbursal timelines align with admission needs and the pledged assets are acceptable, government loans score higher than private ones.

Scholarships, fellowships and university funding (for Indian schemes)

Central and state scholarships (e.g., merit scholarships, SC/ST/OBC scholarships), university fellowships, and need-based grants can reduce the need to take out a loan.

Institutions frequently offer partial fee waivers or assistantships—apply early and stop by the university financial aid offices.

Income Share Agreements (ISAs): Just sprouting up in India; pay a portion of future income over a set period, rather than fixed-interest loans.

Crowdfunding: Better suited for a niche project; random and might require significant networking.

Employer sponsorships: Professional or vocational courses can be sponsored by employers in exchange for service agreements.

Casual work, internships and budgeting while studying

Part-time jobs, internships, on-campus work-study positions, and scholarships reduce the need to borrow. Consider cheaper housing, roommates, and a part-time course load to spread your cash flow and reduce the loan amount.

Keeping yourself safe, your legal rights, how to complain and tips for staying safe

Key loan agreement clauses to look for (prepayments, security and guarantor release)

- Look out for prepayment/foreclosure charges and lock-in periods.

- Make sure you know exactly what each layer of security is and how to lift the lien after payoff.

- Guarantor release provision: time or performance of the conditions.

- Read the clauses on rate reset (for floating rates) and penalty provisions, among others.

Where to file complaints: RBI, NHB, banking ombudsman and consumer courts in India

For scheduled banks, first go to the bank’s grievance redressal; escalate to the Banking Ombudsman if not resolved.

For NBFCs and non-bank lenders: Employ company grievance channels and escalate to the Reserve Bank of India’s grievance portal or consumer courts if necessary.

Maintain all communications, complaint IDs, and the timeline; file a consumer complaint in district forums for unresolved grievances.

Requirements and advice for maintaining your records and staying KYC compliant

- Keep copies of the signed loan agreement, sanction letter, disbursement schedules, EMI schedule, and receipts.

- Maintain up-to-date KYC details and inform your lender of any changes to contact information.

- Keep for at least the loan tenure plus a couple of years: bank statements and repayment confirmations.

When You Should Talk to a Financial Adviser or Lawyer

Check with your financial advisor for large loans to model repayment, APR, and moratorium effects.

Consult a lawyer where guarantor liabilities, property collateral or ambiguous contract clauses put you at personal risk, or when engaging with dispute/ default mechanisms.

Final checklist and next steps for applicants

Quick checklist before you sign

- Get a written cost sheet for the loan that shows the APR and all fees.

- Verify moratorium treatment of interest (with or without capitalisation).

- Check prepayment and foreclosure charges, as well as the lock-in period.

- Establish the definitions of collateral and guarantor, along with their respective responsibilities and release terms.

- Retain original signed papers and set up a reimbursement timetable.

Application to disbursal timeline format

Weeks -8 to -4: Prequalify with the lender; submit the admission letter and fee schedule.

Week -4 to -2: Finalise the lender, KYC documents, proof of income and documents relating to collateral.

Week -2 to 0: Sanction Loan & execute agreement and submit any post-sanction docs.

Day 0 to +7: Disbursement to the institution against the invoice; acknowledge receipt and release schedule.

Post-disbursal: Establish an EMI mandate; note the moratorium expiry date and the first EMI due date.

Final note

Private loans may help fill funding gaps and open doors, especially for high-cost or international programs. Opt for total cost, clear terms, and manageable repayment schedules. Compare lender quotes, negotiate fees, and stay organised with your paperwork to secure the best possible deal on your education financing.