What documents are required for a student loan in India?

Obtaining an education loan in India can be a key step for students seeking higher education in India and/or abroad. Yet one of the most important and overlooked elements in this path that someone will have to walk is that of their student loan paperwork. It is crucial that the correct documents, in the proper format, are submitted, as banks and financial institutions require them to verify your identity, academic history, economic stability, and loan worthiness.

Incomplete, mismatched, or delayed documentation is a key reason why applications for education loans are rejected or delayed, especially during peak admission seasons. Whether you are applying to a public-sector bank, such as SBI or Union Bank of India, or to a private lender like HDFC Credila or ICICI Bank, being aware of the necessary paperwork can save you from unwanted delays and increase your chances of easy sanction.

This comprehensive guide will help you dissect the full roster of documents required for a student loan — including identity, academic, financial, collateral (if applicable), and more. We’ve also added bank-level prerequisites, study abroad loan documents, and FAQs to ensure that your application process is as seamless as possible.

What is a Student Loan in India?

A Student Loan in India, also known as an education loan, is a type of financial support that banks and NBFCs provide to help students afford higher studies. The loans are to be used for paying tuition fees, buying computers and books, or for other personal necessities.

The principle of an education loan is to enable students to focus on their studies, while repaying the loan after they complete their course, without financial constraints standing in the way of their academic ambitions.

In India, there are two kinds of education loans .

- Collateral-based loans: Depend on collateral, such as property or a fixed deposit.

- Non-collateral loans: Provided without security and usually depend on the co-applicant’s income and the student’s academic background.

Students can also apply for:

- Domestic education loans: Indian Studies Loan.

- Study abroad loans: For programs abroad, you may be required to submit further documents, such as your passport, visa, and admission confirmation from the school or university you will be studying at.

Additionally, most education loans come with a moratorium period, which allows you to start repaying the loan once the course is over or once you find a job, thereby increasing their accessibility for struggling students.

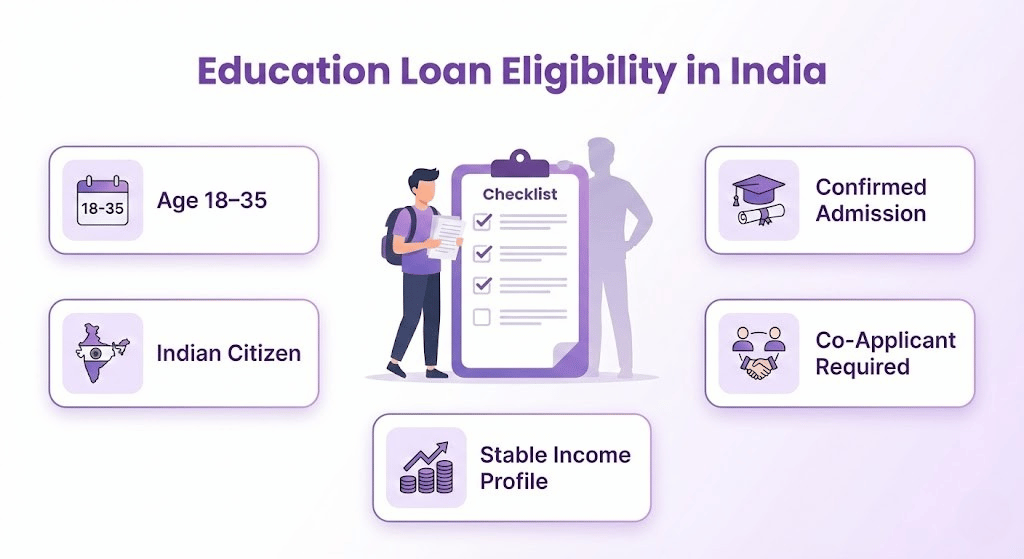

Basic Eligibility Criteria to Apply for an Education Loan in India

Before you apply, you need to be aware of the student loan eligibility criteria of most Indian banks and NBFCs. These benchmarks help determine your eligibility for an instant loan (and that of your co-applicant) and assess your ability to repay it once the moratorium period is over.

Here’s a closer look at standard eligibility requirements:

- Age Limits

Student Loan in India Eligibility: Applicants for a student loan in India are required to be between 18 and 35 years of age at the time of application. Certain banks may raise this age bar to 40 years for post-graduate or foreign education.

- Indian Nationality

The candidate should be a citizen of India. In general, many NRIs are not eligible for this loan unless it is taken under an NRI special scheme.

- Confirmed Admission in a Recognized Institution

You should gain admission to a reputable College or University in India or abroad through a relevant entrance examination or merit-based selection. Proof of admission is one of the initial documents required.

- Co-applicant Requirement

A co-applicant, such as a parent, legal guardian, or spouse, is usually required by most lenders. The profile and income of the co-applicant also matter a lot in the sanction and disbursal of a home loan.

- Minimum Salary and Financial Capacity

Although there’s no standard minimum income requirement for a student loan, most banks generally look for a co-applicant who has a regular source of income, which could be ₹20,000 or more per month. Self-employed co-applicants need to submit ITRs and documents as proof of the stability and existence of the business. The CIBIL score and credit history play an important role, and a good score will significantly increase the chances of getting your loan approved, especially for larger loan amounts.

Master Checklist: Documents Required for Student Loan in India

When you apply for an education loan in India, you should file your documents precisely. Lenders assess your Eligibility, credibility, and repayment capabilities primarily based on your Identity, academic Performance, co-applicant’s financial standing, and the provision of collateral and guarantor documents. Here’s the complete list of documents to be submitted separately by category for your easy reference.

1. Personal Identity and Address Proof Documents

Banks are also known to follow strict KYC (Know Your Customer) specifications and require hard evidence of identity and address for both the student and the co-applicant. These include:

- Aadhaar Card – Identity and address proof is effectively mandatory.

- PAN Card- Compulsory for Applicant and Co-applicant/Guarantor

- Passport – Mandatory for students traveling abroad.

- Driving License or Voter ID – Can be used as supporting ID/ address proof.

- Passport-size Photographs – Typically, 2–6 copies of recent photographs of both the applicant and co-applicant.

- Proof of Address – in case the address is different from Aadhaar, Banks may request:

- Bills (such as electricity/water/telephone)

- Rent agreement

- Bank passbook statement having the address (Only for Bank)

- Ration card

Tip: Prepare both the original and photocopies of these documents, as they are required for verification.

2. Academic Documents

Academic records can help lenders determine a student’s educational background, track record, and aptitude for their chosen course.

- 10th & 12th Standard Marksheets – Compulsory for all Loans

- Degree/Provisional Certificate – Qualifying degree for UG and PG programmes

- Admission/Offer Letter from University/College with its Seal and Stamp – This is one of the most essential documents that certifies your acceptance to study at an institute.

- Admission test scores – if available, for the course:

- NEET, JEE, GATE (Indian education)

- GRE, GMAT, TOEFL, IELTS (abroad education applications)

- Fee Structure – Official letter issued by the college/university, including semester/yearly detailed fee structure

- Study Plan/Course Curriculum – May be required for international studies, particularly those involving private lenders.

The admission letter should clearly state the Full name, course title, duration, and course tuition fee for transparency.

3. Financial Documents of Co-Applicant (Parent/Guardian/Spouse)

Undertaking a higher degree or education in a foreign country is costly, and not every student or their family is capable of shouldering this load.

The income of the co-applicant plays a crucial role in the approval of the loan, particularly in cases where the loan is not secured by collateral. Here’s what’s needed:

For Salaried Co-Applicants:

- Salary Slips – 3 to 6 months ( Last as per available)

- Form 16 – Previous 2 years with employer

- ITR (Income Tax Returns) 2-3 recent years of the financial year.

- Bank Statements – For the last 6 months with salary credits

For Self-Employed Co-Applicants:

- Business Registration Certificate /GST Certificate.

- ITRs – AT LEAST IN THE PAST 2–3 YEARS

- Profit and Loss BV, CA certified, and Balance CA certified

- Bank Account Statements – Personal and Business accounts (6–12 months)

Additional Supporting Proofs:

- Pension Certificate (if co-applicant is retired)

- Employment Verification Letter – Optional, but valuable for the income of salaried co-applicants

- Net Worth Certificate – Some private banks may request this (e.g., Axis Bank, ICICI).

Note: Ensure all financial documents are signed, stamped, and up to date. Outdated or unsigned forms may hold up approval.

4. Loan Application & Related Documents

Formal loan application process. You will be required to fill out, sign, and submit a number of forms and contracts.

- Application for Loan Form – Duly Filled and Signed by the Student and Co-applicant

- Declaration or Affidavit – As per the bank’s format

- Loan Sanction Letter – Given by the lender when the loan is sanctioned (Keep a copy)

- Letter of Request for Disbursement – Although the loan may be disbursed in stages on a semester/year basis, the student must submit a letter of request for disbursement to the Financial Aid Office.

- Academic Progress Reports – These are mandatory on an annual basis from banks like SBI to track performance.

Ensure all pages are signed where they should be—an unsigned page usually causes a delay in loan processing.

5. Collateral Documents (If Applicable)

If your education loan exceeds ₹7.5 lakh (terms vary by bank), collateral security may be required. This includes:

- Own Proof of Land/Title Deed – Should be in the name of the applicant or co-applicant

- Sale Deed registration – Legal documents of ownership

- Property Tax Receipts

- Encumbrance Certificate – For ensuring that no legal liabilities on the property

- Property Report – Done by the bank or professional valuer

- FD Receipts – In case you give FD as collateral.

- LIC Policies / Govt Bonds – Many banks can accept in place of property

The property will be required to have a good legal title, and the value must meet the loan’s requirements. Otherwise, more security will be required.

6. Guarantor Documents (If Required)

Not all banks demand the presence of a guarantor, but in most cases (mainly for large amounts or high-risk accounts), you have to bring these documents with you:

- Identity and Address Proof – PAN, Aadhaar, Voter ID, etc.

- Proof of income – same as that for the co-applicant (salary slips, ITRs, pension slips)

- Relationship Declaration – States the relationship between the guarantor and the applicant.

- Letter of Consent – Written undertaking to act as a guarantor, duly signed

With a guarantor loan, the guarantor (the person who makes sure the loan is paid) is expected to have a good credit history and steady income (some lenders require the guarantor to have a higher income level than the borrower), and possibly even the financial means to repay the loan if the borrower defaults.

Conclusion: A complete, properly filled-out education loan document submission streamlines the process and reduces uncertainty and delays in approvals. Every bank will have its minor differences, but this list addresses all the major requirements for most loan applications in India.

Bank-Wise Education Loan Document Checklist

Documentation for education loans varies from one bank to another in India. The host country requires more or less the same documents, but the formats may differ; additional declarations may be requested, or digital uploads may be required in some cases. Here’s a look at what major banks are asking for, and how you should prepare.

1. SBI Student Loan Scheme: Documents Required

Most professionals who have taken student loans from public sector banks prefer SBI due to its low interest rates and simple procedure. Required documents include:

- Standard KYC: Aadhaar, PAN, photographs, which are KYC documents as of today.

- Offer letter and Cost of study

- Academic marksheets along with the Entrance test score card

- Co-applicant’s income proof (Form 16, ITRs, bank statements)

- Documents for security on loans over ₹7.5lakh (RF-3, valuation report, etc.)

- Proof of property insurance is required if collateral is used

- Disbursement is continued based on annual progress reports.

SBI: Focus on physical submission and hand-signed declarations. Applicants must visit a branch once while their application is being processed.

2. HDFC Credila: Online Application & Document Upload Process

HDFC Credila is renowned for its fully digitized process and specialized loan options for both Indian and overseas students. Key document points:

- Submission of Scan copies of documents through the HDFC Credila online portal

- Normal KYC and evidence of an educational institution

- Evidence of admission and the fee structure of the course

- Co-applicant finances: payslips, ITRs, bank statements, and Form 16.

Additional documents for study abroad:

- Valid passport and visa copy

- Scores for any standardized test (GRE, IELTS, TOEFL, GMAT)

- Bank’s Foreign Remittance Form

May ask for the Net worth certificate or the collateral documents for loans of high value

Tip: HDFC permits pre-sanction before admission confirmation on the student profile & target countries.

3. ICICI Education Loan: Digital Process, Income Proof, Fees

ICICI Bank offers loans with less documentation and quicker turnaround on its digital platforms. Here’s what’s needed:

- PAN, Aadhaar, passport-size photos

- Transcripts and admission evidence

- Schedule of fees and syllabus (where available)

- ITRs, salary slips, and the employer’s letter of the Co-applicant.

- Copies of the passport and visa for international students

- CA-certified financials and audited statements, where applicable, for self-employed co-applicants

- Processing fee receipt

ICICI loans may have a processing fee (approximately 1–2%) that needs to be paid up front. The proposed loan contract can also be signed digitally.

4. Axis Bank Loan: Eligibility + Document Verification

If the loan sanctioned is more than ₹ 4 lakh, the following additional documents are required.

At Axis Bank, students can now take out student loans for studies in India or overseas, with flexible repayment options. Below are the most interesting aspects of the documentation:

- Basic identity, address, and academic documents

- Offer a letter of admission and a detailed cost breakdown from the university

- Co-applicant (Preferably Salaried) Latest Salary Slip or Salary Certificate With Latest Form 16/IT Return.

- May seek net worth declaration in case of amount above 30 lakh

- For education outside your home country: a passport, a visa, travel insurance, and result cards.

- And even if applied online, physical document verification is commonly necessary

At times, Axis Bank requires a check of the property and legal verification, as well as a loan against property.

5. Union Bank of India: Specific Document Format Requirements

Union Bank has a systematic procedure and time and again provides relaxations in documentation for the weaker section of society.

- Regular KYC, admission letter, academic documents, etc.

- Co-Applicant’s income papers- salary slips, bank statements, Form 16

- An ITR and a PAN card are mandatory.

For low-income applicants, documentation such as:

- Ration card

- For Other Backward Classes (Non-Creamy Layer)/Economically Weaker Sections (EWS), if the applicable certificate has already been uploaded.

- Documents should be in the specified format, which can be downloaded from their website.

Manual verification is a necessity; originals should be kept ready for submission.

6. Bank of Baroda: Vidya Lakshmi Portal + Physical Submission

Most of the education loans at Bank of Baroda are being processed/ disbursed/ recovered through the Vidya Lakshmi Portal. Document steps include:

- Digitally submit all standard KYC, academic, and financial documents

- Portal printout of the application summary

- Hard copies of documentation to be delivered to the branch

- In case of applying for the Baroda Scholar (study abroad):

- Passport

- Visa

- test results ( IELTS, GMAT, etc.)

- Travel and real estate insurance as collateral

- Insurance on property securing loans

BoB adheres to RBI education loan guidelines and may request additional documents as per state regulations.

Final Tip: One Checklist Doesn’t Fit All

While these are standard requirements, always visit the official website or nearest branch of your chosen bank to get the most updated and bank-specific checklist. Small variations in document type, format, or validity can cause delays or rejections.

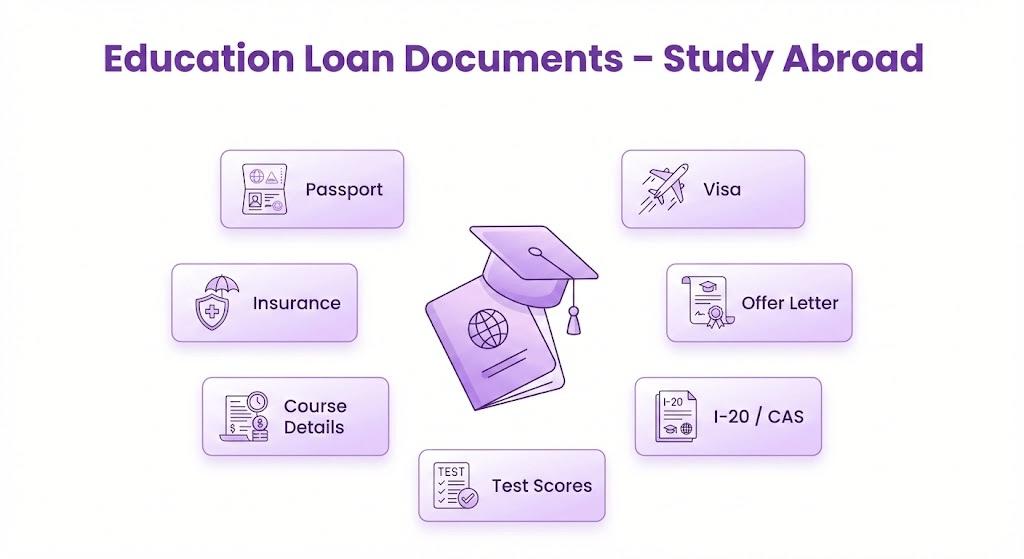

Documents Required for Education Loan for Abroad Studies

Studying abroad is an aspiration for most Indian students — and yet, an expensive one. Banks and NBFCs offer customized education loans for overseas universities, and the required documents for such loans typically exceed the standard checklist. These assist lenders in validating eligibility, estimating foreign exchange needs, and assessing the credibility of the course and institution.

Below is a complete list of essential documents needed while applying for an educational loan to study abroad:

1. Passport and Student Visa

- A valid passport is an obligatory identification document for foreign study.

- One in the form of a student visa (i.e., F-1 for the U.S. or Tier 4 for the UK), once completed.

- If the visa is still pending, you may be given conditional approval.

2. . I-20 / CAS / Admission Letter

- You have your I-20 form (U.S.), CAS (UK), and a university offer/admission letter that proves your admission.

- The course name, Duration, and Total Course Fee should be mentioned in the document.

- Most banks require this before the final loan disbursal.

3. Travel And Health Insurance Documents

- Selective Banks, such as the Bank of Baroda and SBI, require travel/medical insurance for study abroad loans.

- If insurance is purchased from the university, a policy copy must be produced.

- Insurance documentation is essential for both safety and liability reasons while the student is abroad.

4. Course Structure and Duration

- A course curriculum or study plan allows banks to determine the value and applicability of the program.

- It is helpful to decide on the overall costs and the insurance period.

5. Foreign Exchange Requirement Letter otherwise (where applicable)

- Some institutions send letters declaring the anticipated needs of foreign exchange students.

- Assists banks in establishing conversion limits and payment schedules.

6. Proof of Standardized Test Scores

- Supply GRE, GMAT, TOEFL, and IELTS scorecards according to country and course requirements.

- Organized on behalf of the lenders to assess entry merit and visa probability.

7. SOP or Resume

- Some private lenders and NBFCs (such as HDFC Credila or Avanse) may request an SOP or resume.

- SOP reflects your academic history, aspirations, and reasons for applying for a loan.

- The resume focuses on internships, projects, and extra-curricular activities.

Final Thought

Loans against property for studying abroad are of a higher amount and carry greater risk for banks, requiring good documentation. If you have all the correct documents, such as a passport, visa, I-20, and test scores, it may help to get approval faster.

Frequently Asked Questions (FAQs)

To make the student loan process easier for you, here are some answers to the most frequently asked questions that students and their parents ask in India. These FAQs cover everything from eligibility to documentation and local needs.

To avail an education loan in India, you will generally need:

For ID and Address Proof: Aadhaar, PAN, Passport, Voter ID

10th/12th Mark sheets, Admission Letter originals with two sets of attested copies.

Documents for finances: Income proof of co-applicant (salary slips, bank statements, ITRs)

Loan Documents: A duly filled application form, fee structure, and declaration forms. There may be a few differences in documents from lender to lender, although this list is inclusive of the standard documents required for most banks and NBFCs.

Yes, however, there are education loans that are non-collateral based (unsecured), up to ₹7.5 lakh for courses within India and up to ₹40-50 lakh for premier institutions or education abroad. These are offered by private players, including HDFC’s Credila or Avanse. However, approval depends on:

Co-applicant’s income

University ranking

Course money back value and employability. Loans above ₹7.5 lakh from public banks are typically a secured loan – unless you get into a top-rung institute (IIT/IIM/NIT, etc.).

A salary requirement is not specified, although most banks would prefer a co-applicant who earns ₹25,000–₹30,000 per month. Sampling of an applicant’s disposable monthly income and debt-to-income ratios may be conducted by private lenders. The more income and job security your co-applicant provides, the better your chances of getting approved more quickly and on terms you prefer (i.e., lower interest rates, fewer assets required for collateral).

It is challenging to obtain an education loan without proof of income, particularly from public sector banks. However, there can be a few NBFCs and fintech platforms where you can avail loans based on:

Strong academic profile

Admission to a foreign renowned university

Security (such as a property or FD). However, prepare for a much closer look, higher interest rates, or a need for a guarantor.

Yes, a PAN card is required for both the student and the co-applicant at the time of the loan application.

No, most banks and NBFCs require a confirmed admission letter from a recognized institute for loan sanction. However, you can start your application, ensure you have all the necessary documents, and request a pre-sanction or conditional approval, especially for study abroad programs, as the visa process can take time.

Yes, there are slight variations in document requirements:

Public Sector Banks (SBI, Union Bank, BoB)

Stricter rules

Physical document submission

Approved formats of ITR and fee structures

₹7.5 lakh is a new threshold for collateral.

Private Banks & NBFCs (HDFC Credila, ICICI, Axis, Avanse) Customized: Shall be provided as per Aptitude & Financial Need.

Online document uploads

Require SOP/resume sometimes

Relaxation in income/collateral norms

Yes, the bank scrutinizes the CIBIL score of the co-applicant or guarantor, not the student. A score of at least 700 is generally preferred to secure easy approvals. Some consequences of bad credit are:

Loan rejection

Higher interest rates

Request more guarantors or collateral

Absolutely! If you have obtained confirmed admission to a graduation course (e.g., BA, BSc, B.Tech, MBBS), then you are eligible for the student loan. Documents required:

10th and 12th marksheets

Admission letter from the college

Co-applicant’s income proof

Fee structure, both in India and abroad.

The fundamental documents are not so different from state to state, but some regional differences may exist:

Karnataka: Rental agreement, BBMP tax receipt, are some papers used for address proof

Tamil Nadu: The Need for a Community certificate for government scholarship-linked loans may go

Maharashtra: State-run banks may seek domicile certificate for local quota

Make sure to consult the local branch of your bank, as they may require state-specific forms or proof of identity.

Tips to Avoid Documentation Delays & Loan Rejections

One of the most prevalent reasons for an education loan to be rejected or experience a delay in India is document-related delays or mistakes in your application. To increase the likelihood of a successful and swift loan approval, you can follow these expert tips:

1. Cross-Verify Names and Spellings on All ID Proofs

Your name/spelling appearing differently across documents, such as Aadhaar, PAN card, passport, and admission letter, can spell big verification trouble for you. Ensure that your name, date of birth, and other crucial details align as they should on all submitted materials. If you see mistakes, make your corrections before applying them.

2. Ensure Address Consistency Across Proofs

The bank requires address proof, which matches the address you provided on the loan application. Include an ID proof that has the new address printed on it. If the present address is not the same as the one on the ID proof, submit one of the address proofs, such as utility bills, rent agreement, or bank passbook. If the address is consistent and the information is correct, verification time is minimized.

3. Keep Scanned Copies Ready in Advance

Compile and scan clear copies of all necessary documents before you begin your application. Many banks and NBFCs have introduced online applications with document uploads recently. Excellent, easily readable scans of your documentation facilitate quick processing of your submission and prevent unnecessary follow-ups from the lender asking for the missing documents.

4. Always Submit Self-Attested Photocopies

When submitting the physical copies, do not forget to submit self-attested photocopies along with the originals. Self-attestation is a fancy way of saying that you need to sign or stamp your copies to prove that they’re true copies. Most lenders require this, and it demonstrates that you have read and approved the documents.

5. Consult With Your Loan Officer Before Final Submission

Speak to the loan officer of the bank, NBFC, or relationship manager for the exact documents required. At the same time, each lender may have different underwriting guidelines. Clearing up questions beforehand, before filing, prevents omissions, incomplete forms, or formatting mistakes.

Pro Tip: Keep track of each document on a list and check them off as you collect them to help keep you organized. The more polished your documents, the faster you will receive the funds to facilitate your education.

Conclusion: Be Document-Ready and Confident

Being well-prepared with the right documents is the cornerstone of a hassle-free student loan application in India. Proper documentation not only speeds up the approval process but also significantly reduces the chances of rejection or delays. While most banks and financial institutions require similar documents, there are slight variations depending on the lender and the type of loan you apply for.

Always verify the latest and specific document checklist from your chosen bank before submitting your application. Early preparation and organizing your personal, academic, financial, and collateral documents will give you confidence throughout the process.

Start gathering your documents as soon as you receive your admission letter and avoid last-minute stress. Being document-ready can make your journey towards financing your education smooth and successful.