₹ 3000 Loan for Students

#1 Instant Credit App for College Students in India

Empowering Your Financial Freedom

Dear Students,

Welcome to StuCred, your trusted partner in achieving financial independence. We offer instant, interest-free credit designed exclusively for college students across India.

Whether it’s for tuition, textbooks, or day-to-day expenses, StuCred is here to support you.

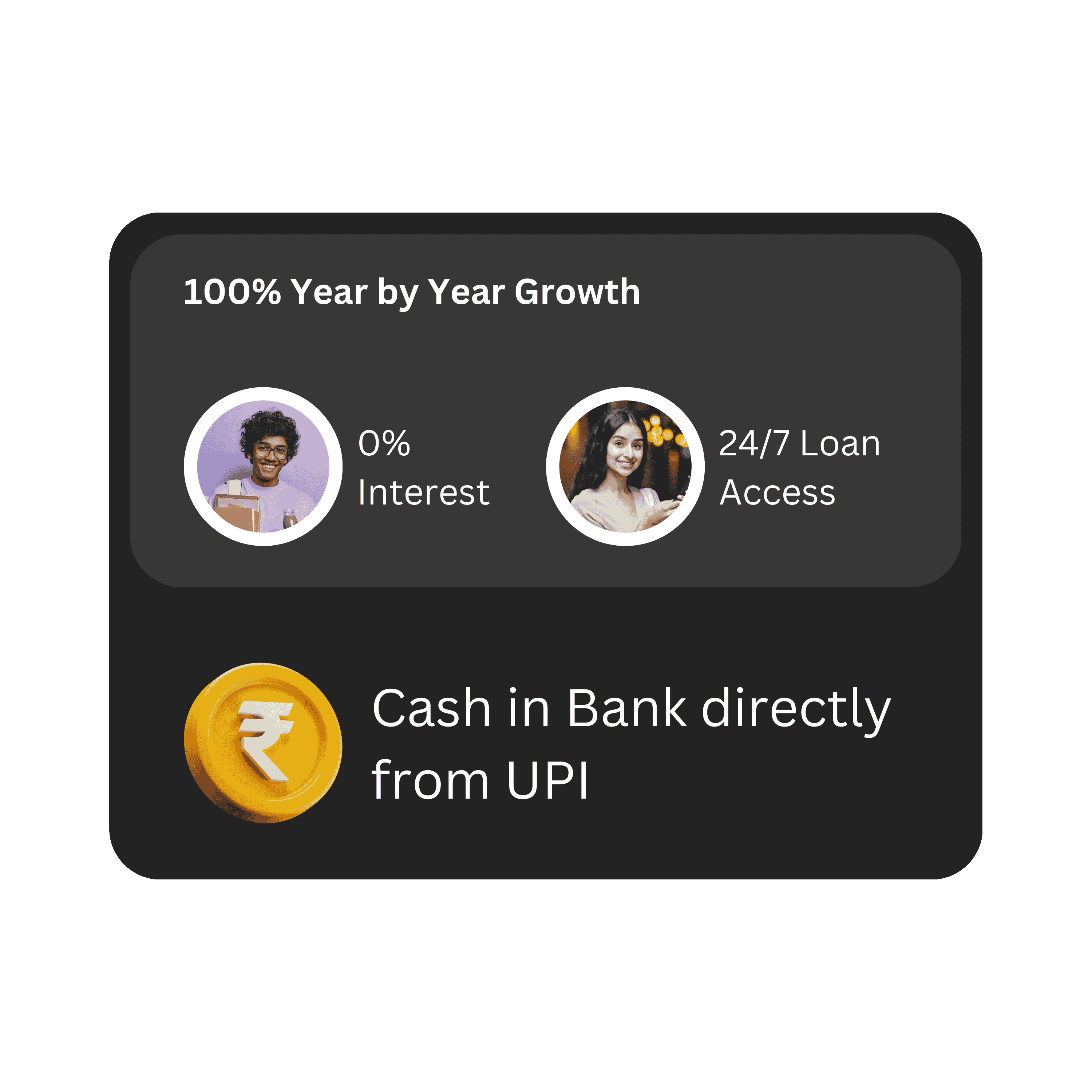

Bharath Reddy

StuCred helped me during my medical emergency. I strongly recommend this app to all the students. Its easy to use and and qiuck to get Money in your bank account

Dhanushiya

The 0% interest is a lifesaver. StuCred has made managing my finances so much easier. It’s an easy way to increase the credit limit as a student.

8Lakh+ students across India are LOVING ❤️ our services. Join the StuCred Community Now!

Why Students Love StuCred

StuCred is more than just a credit app; it’s a trusted partner in student life.

The app is secure, reliable, and designed to cover essential academic expenses, allowing students to focus on their studies without financial stress.

Instant Credit Approval:

The streamlined 5-step verification process means you can get approved for credit in 24 Hours—no lengthy paperwork or waiting periods.

0% Interest:

StuCred offers instant access to credit with absolutely 0% interest, making it easier for students to manage their finances without worrying about extra costs.

Trusted by 8L+ Students:

With a large and growing community of satisfied users across India, StuCred is a name students trust for reliable, hassle-free financial support.

24/7 Loan Access:

Whether it's day or night, StuCred is always there when you need it. Access your credit anytime, anywhere, ensuring you’re never stuck without funds.

How It Works

Fast, Easy, Reliable

Why StuCred?

StuCred offers instant, interest-free credit exclusively for college students in India. With no hidden fees and 24/7 access to funds, StuCred is trusted by over 8L+ students from top institutions.

The app ensures safe, secure transactions with bank-grade security, making it the go-to financial solution for students.

No Hidden Fees

Transparent, student-friendly terms. What you see is what you get.

Available Anytime, Anywhere

Get access to your funds 24/7, no matter where you are.

100% Safe & Secure

Your data and transactions are fully protected with bank-grade security.

Trusted by Top Colleges

StuCred is the preferred choice for students from top institutions across India.

Join our Referral Program and Earn ₹5000 Every Month

Click on the link below and get Started

Benifits for Students

With no hidden fees and 24/7 access, students can borrow confidently, knowing they’ll only repay what they borrow.

StuCred ensures funds are always available, making it a convenient and reliable financial solution.

Financial Flexibility

StuCred provides students with instant access to interest-free credit, allowing them to manage unexpected expenses, pay for textbooks, or cover daily needs without financial strain.

Stress-Free Borrowing

With no interest and no hidden fees, students can borrow with confidence, knowing they’ll only repay what they borrow, making it easier to stay on top of their finances.

Convenient & Accessible

Available 24/7, StuCred ensures students can access funds anytime, anywhere, whether they need money for academic purposes or personal expenses, ensuring they’re never caught off guard.

31K+ COLLEGES

16L+ HAPPY STUDENTS

24/7 CREDIT ACCESS

8 YEARS OF SERVICE

₹3000 Loan for Students

Students live in a fast-paced environment this day, and student life will often have surprises that may come as an emergency. The need for fast cash is frequently increasing, from emergency medical bills and unexpected school costs to day-to-day expenses that build up with time. For some students surprised by the need for immediate payments, a loan (of ₹3000) doesn’t seem very high but can change one’s life. Students often require a small loan, yet they lack the traditional financial devices and time to undertake needlessly extensive application procedures.

Reasons Why Students Require a ₹3000 Loan

Compared to adults living alone, students may not have direct access to money in case of emergencies that can happen at any moment. Cash also comes in handy for unplanned expenses, like medical costs, hostel fees, transport bills, or purchases related to academic material—they need instant money. Students can solve these immediate problems with a loan of ₹3000 without hassle.

Given the rising cost of living and the financial burden that education currently imposes, a mortgage as small as ours is absolutely vital. Quick cash on hand ensures students are not reliant on family or friends and have manageable personal finances while keeping their studies as the priority.

Why Getting An Instant Loan Online Is The Need Of The Hour

The emergence of digital technology has changed how we access loans. Students do not have to travel to a bank, fill out sheets of paper, wait for weeks, and get the loan approved. Today, digital loan platforms and mobile apps allow students to apply for a loan online, get approval instantaneously and have funds dispersed in their accounts within hours.

These platforms provide quick loans with fewer documents and more accessible processes, so students can easily access the financial assistance they need without the hassle of traditional banking systems. Students can get a loan of ₹3000 with a few clicks from the comfort of their home or dorm—perfect for students when they are in dire need of money.

Purpose of This Guide

Guide to Apply Safe & Fast ₹3000 loan For Student We will walk you through how to apply for an instant loan—be it to pay your bills or make a last-minute arrangement; this guide gives you the parameters for securing financial help without excessive waits or convoluted documentation. In this blog, we will discuss how to use various tools that help you make an informed choice about loans, including choosing the right Loan app, interest rates, repayment terms, etc.

By the end of this guide, you will have everything you need to apply for a ₹3000 loan, handle the loan terms, and steer clear from common traps you may fall into that might put your finances at risk.

What Is The Purpose Of A ₹3000 Loan For Students?

You are a student, and it is tough to handle finances at that stage as you need to invest money in every upcoming moment. Students have to deal with multiple financial obstacles during their educational journey, but sometimes, a small loan becomes necessary to keep your finances intact. Now, a loan of ₹3000 does not seem huge, but it can act as a support during difficult financial times. This article outlines the typical students’ financial challenges and how a simple, small, quick loan can ease their woes.

Emergency Medical Expenses

For students, unexpected medical expenditures rank high on the list of financial hardships. Medical bills can add up quickly, whether an unexpected illness or accident needs coverage or ongoing care costs like doctor visits or prescriptions. Students often need money to come in, so if they are away from home and their parents/guardians need help to help out, they are stuck. A ₹3000 loan can help students with the funds they need to tackle an unexpected medical emergency to focus on recovery rather than worrying about how to pay for treatment.

Study-Related Costs

Education price isn’t merely limited to the tuition fees—students must also pay for other study-associated bills, such as textbooks, online courses, reference resources, and exam fees. The associated costs can be surprising if course requirements change throughout the semester. This is what a student can study, making minimum expenses; for buds on a very tight budget but with interest to study, a ₹3000 loan will be all they will have to pay back. The rest of the students standing above can start losing based on whether they are in gain, and they don’t fall behind either (guys here). They can also have many students purchase costly books or software licenses that they need for their studies. Still, they wouldn’t or can’t be funded as usual.

Day-to-Day Living Expenses

Another area in which students are always stretched on funds is in their day-to-day living expenses. Food, travel, and other necessities can eat away at a student’s budget, depending on whether they live away from home or in the case of big cities. The costs of transportation if one commutes to college or the cost of groceries for the week can chew on a student’s budget. Often, students are forced to take a break from their academics and present a justified reason for the same. Still, with a ₹3000 loan, few excuses can be avoided to minimize the impact of such unnecessary solutions by enabling people to clear such routine expenses.

Small Personal Expenses During University Holidays

Students also encounter extra financial pressure during university breaks or festivals. Personal expenses generally increase, whether going to social events, traveling to see family, or even the cost of living during a break itself. Most students who are forced to pay for temporary expenses need quick cash. Enter the ₹3000 Loan For Students, which closes this gap and allows most students to hang out with friends during their break without any need to constantly be conscious about money.

The growing independence of finances played a significant role in beating every demand for small loans.

The rising need for small loans with increasing financial independence in students Previously, students used to depend on their parents/guardians for funding. But today, hundreds of thousands more students earn part-time or freelance income and might find themselves without a substantial credit history — or a huge pot to dip into when things go wrong. When a traditional financial institution may not give loans with no meaningful credit score or collateral, little loans similar to ₹3000 loan could assist you in paying your bills by narrowing the gap between your earnings & expenses.

Why Quick Loans in Reducing Short-Term Stress on Finances

Instant Loans and other small loans are disbursed within days — one of the most significant advantages of having such options in your arsenal. Instant loans are distinct from typical loans in that the approval process takes time, while turning to instant funding may be authorized and disbursed. Within a handful of hours, students can access needed funds in their time of need. Getting money quickly can help students solve the stress of financial emergencies and focus more on their studies and health rather than worrying about how they will pay for urgent needs.

The fact that a loan application can be made with digital platforms or mobile apps resoundingly eases students in this regard. Students can now apply for a ₹3000 loan with very little documentation and uncomplicated eligibility; no bank trips or mountains of paperwork are needed.

How to Get ₹3000 loan Instantly

In the current fast-paced world, financial emergencies can strike at any moment. Whether you are a student planning for unexpected expenses or simply needing quick cash to sustain your living, access to a ₹3000 loan instant can be instrumental in easing the stress. However, this is now easier than ever with the advent of digital lending platforms that allow students to apply for loans and get them sanctioned in no time. So, let us review how to quickly get ₹3000 RS using experiences (loan apps), Aadhar card loans, and accessible instant emergency mortgage platforms listed below.

Quick 3000 Loans for Students

For students, instant loan apps are one of the most hassle-free methods of getting a quick school loan without heavy paperwork. They are specifically designed for students with a simple loan application process and minimal documentation, and funds are disbursed quickly. Here are the best apps to get a ₹3000 instant loan from.

Stucred

Stucred, with Personal Loans for Students, is one of the most popular apps. It gives loans of ₹1,000 to ₹15,000 with instant approval. It provide loan options that are designed specifically for students, freelancers, and young professionals who can rely on them to get money quickly.

How It Serves Students: Stucred has designed its services specifically for students who need a credit score and may need a steady job. Eligibility to get a loan on the app is simple, and students can apply for loans using their Aadhar card and bank details.

Fast Loan Disbursal: Stucred disburses the Loan minutes after approval, which is highly beneficial for urgent financial requirements.

Bajaj Finserv

Core Features: Important attributes of Bajaj Finserv personal loans include flexible payback choices and low interest rates. Students can apply for Loans of a minimum of ₹3000 with very low processing charges. Bajaj Finserv also provides pre-approved loans to existing customers.

What It Offers Students: The app offers loans for students, including collateral-free student loan products. After students apply online, the loan amount approved can be credited to their bank account quickly.

Loan Disbursement: Once your Loan is approved, Bajaj Finserv disburses the funds to your account within 24 hours, making it one of the most dependable choices for students needing quick money.

ZapMoney

ZapMoney is yet another lending platform that offers instant loans hassle-free. It is popular for its honest, hassle-free user interface and the availability of loans starting from just ₹3,000.

What it does for students: The app is specifically designed for students or young professionals looking for a small sum for personal or school expenditures. The repayment terms are as flexible as you want, with no hidden fees.

Loan Approval and Disbursement: ZapMoney approves loans very quickly and disburses funds in only a few hours, so it is a suitable option for urgent monetary requirements.

Aadhar Card-Based Loans

Loans using the Aadhar card as a basis have become popular since they are easier to acquire and processed much faster. The Aadhar card is an authentic ID proof, which assists loan lenders in the timely processing of approvals.

Linking your Aadhar to get a quick loan: To apply for a ₹3000 loan, you will have to attach the Aadhar card and then apply for a loan. Lenders utilize your Aadhar card during the Know Your Customer (KYC) process, which helps them identify you easily.

Steps to Apply Using Aadhar:

Launch the lending application/platform (Stucred, Bajaj Finserv, or ZapMoney).

Choose the loan amount you want to avail of (I chose ₹3000).

Select the “Aadhar-based loan” option for quick processing.

Enter your Aadhar card number, then verify your mobile linked with Aadhar.

Finalize the application by entering your bank details to receive funds.

Due to Aadhar’s guarantee, your entire loan application and approval process is fast-tracked, allowing you quick access to funds.

Simplified KYC Process

The simplified know-your-customer (KYC) process is one of the various reasons instant loan apps are gaining popularity in India. Many traditional loan processes require you to submit documents physically, get your address checked, and wait for months. Nevertheless, most instant loan platforms currently provide an entirely digital KYC mechanism.

Importance of KYC for IMD Loans — KYC (know your customer) is a regulatory requirement that aims to establish the identity of potential borrowers and prevent fraudulent activities. Digital lending platforms, however, have made it simpler for students to submit documents such as Aadhar cards/PAN cards/bank statements through online platforms and get approved in less time.

Documents Typically Required:

Identity Verification Aadhar Card

Bank account information is used for loan disbursement purposes.

Recently clicked Photo and Email ID (sometimes used for verification).

Since the KYC process is done digitally, it becomes easier and faster for students to apply for loans without submitting physical documents or visiting a bank branch.

Instant Loan Platforms

Instant loans are available on multiple platforms with minimal documentation, and they are a good option for students if funds are urgently needed. These platforms offer instant access to ₹3000 loans and only require minimal information for processing the request.

CRED Mudra: CRED Mudra is a recently launched product in which the company gives small loans instantly without requesting any collateral or extensive documentation. It’s a platform based on limited credit history, perfect for students.

The way it works: By using an ability, students someday can practice ₹3000 loan using their CRED account. It leverages data on your CRED profile to approve loans within minutes – no extra paperwork or waiting time involved.

Loan Sanction: After you sign up, CRED Mudra usually sanctions the loan within minutes and credits the money to your bank account within hours.

Eligibility for ₹3000 Loans

While an instant loan app is typically student-oriented, essential eligibility criteria must be fulfilled.

Age: While quite a few lenders set the minimum age of the borrower at 18, other platforms allow eligibility as high as 25.

Full-time students enrolled in a college or university to get loans meant explicitly for students. Proof of enrollment > Many apps request you this

Minimum Income: Certain platforms have specific minimum income requirements (part-time work or stipend) to get a Loan, while others provide loans without proof of income if there is no active source of income.

Aadhar Card: Aadhar card is required for identity verification, which helps expedite the approval process.

How to Avail a ₹3000 loan Online (Step-by-Step Process)

The online ₹3000 loan application process is quite convenient and fast due to a growing number of digital lending avenues aimed primarily at students. Be it for medical emergencies, academic fees, or daily needs– availing of a ₹3000 loan will be in your hands after you follow some easy steps. We created this ultimate step-by-step loan application guide on applying for a loan, from creating your account until your loan is disbursed.

Pre-Requisite Steps

However, you need to accomplish a few things for basic ground instruction so that the rest of the loan request goes smoothly.

Account Creation with your preferred loan provider

Select a trusted loan provider such as Stucred, ZapMoney, Bajaj Finserv &, etc., any app/platform for instant & easy student loans.

You would then have to register a new account with the loan provider. This usually requires signing up with an email address and creating a password. At times, you will be asked to provide a phone number ( OTP — one-time password that verifies your identity)

To know your identity through an Aadhar card and other documents

Once it is done, the application process for the loan moves to the next level: identity verification. This is mainly done using your Aadhar card, as it acts like a unique identity document for you and other loan providers operating online.

Additional documents would be required, namely your student ID card, PAN card, or a bank statement (if applicable), which will also have to be uploaded. ID verification is often online, providing a speedy and smooth user experience.

Depending on the lender, they may ask for additional documents such as proof of address or income (if applicable). This allows the platform to confirm that you qualify for the loan.

Loan Application Process

When you have set up your account and verified your identity, it is time to apply for the loan. Information on what the application process usually consists of:

Filling in Basic Details

When you log in to your account, it will ask you to enter some basic personal information. These may include:

Name: Your Full Legal Name as recorded on your Aadhar card.

Attending College: The name of the college/university where you are going.

Course: The course or program that the candidate is pursuing.

Mobile Number and Email ID: To contact you.

It may also ask for information related to your academic background and year of study, which is valuable for student-specific platforms.

Uploading Documents

You will be prompted to upload the required documents. The key documents which are necessary for the application include:

Aadhar Card means identity verification and KYC (Know Your Customer).

Bank Basic information: To release a loan at your financial institution, you need to furnish the bank with your personal information, as well as the account number and IFSC code.

Supplemental Documents (if required) — Some lenders may require additional verification of enrollment at the school or a photo for identification.

Selecting the Amount and Term of the Loan

For that, you have to tell what your loan amount is. In this case, you are applying for ₹3000 loan, but many apps will let you change the loan amount in a defined range (like ₹1000–₹50000).

Once you have picked the loan amount, it will determine what repayment terms would work best for your situation. Some of the applications that provide loans may even provide a more flexible repayment process, which can also be:

Repayment in the short term (1 month to 3 months)

Extended repayment (6+ months)

Select a repayment term based on your financial situation and expected earnings. The interest rate and monthly installment will be automated when the amount and term are calculated.

Verification and Approval

After submitting your app, you will undergo the lender’s verification process. This typically involves:

How Verification Happens

Identity & Document Verification: The lender will verify your Aadhar card and all the uploaded documents, along with your bank details, to ensure everything is correct.

Checking Your Creditworthiness: Most lenders will perform a soft credit check to evaluate your financial history. Most students need a credit score; therefore, many platforms offer loans irrespective of the high credit.

Eligibility Verification: Lenders will then determine whether you qualify, including whether you are a student, 18 or older, and have some way of generating income (in the case of some platforms).

Approval Process

Your loan request will be accepted as long as you have all the papers and information organized. Generally, it gets approved in minutes, and small amounts like ₹3000 are loaned without any hassles. While some platforms can take a few hours, it will rarely take over 24 hours.

Approving your Loan: The platform will send you an SMS or email to let you know about your approval and all the loan agreement details.

Disbursement

Once your loan is approved, the funds will be deposited into your account. Here is the process of disbursement:

Timetable for Money Going Into Your Account

Today, most digital lending platforms offer instant disbursement, which is ideal for small-ticket loans like ₹3000. After approval, the funds are transferred to your bank account in as little as a few hours.

The money is disbursed that day when this loan is approved during working hours (generally between 9 AM and 6 PM). If you apply after hours, disbursement may occur the next business day.

Common Disbursement Methods

Bank Transfer: Direct Bank Deposit is the most popular form of disbursement and the one you would have received money into from within your application proceeds. Typically, this is the most stable and processed method.

Wallet Apps: Certain media-releasing platforms will pay out through digital wallets, like Paytm, Google Pay, or PhonePe. These could be used as a substitute for students who either do not have a formal bank account or wish to receive the dough in a wallet.

Requirements to Apply for a ₹3000 Loan For Students

Thus, before proceeding with accessing a ₹3000 loan as a student, you must qualify for all the necessary eligibility criteria for it. Most lenders use simple rules to ensure a borrower can make his payments. Fortunately, many digital lending platforms have student-friendly loans with low requirements. Now, let us discuss the general and student-specific eligibility criteria you should meet to apply for a ₹3000 loan.

General Eligibility Criteria

Now, before we get into student eligibility specifically, there are some general criteria that most lenders expect of borrowers.

Age Lies of (18 Years to 25 Years)

The age of a borrower is one of the most essential eligibility criteria. The age limit (minimum) for all online loan providers in India is 18 years, and the maximum age limit is usually 25 years. This is partly because such digital lending platforms primarily provide services to bright young students, either still in college or just starting their professional careers.

On the other hand, a few platforms allow extending the age limit slightly more than 85 based on income, credit score, or other standards.

Indian Residency Status

Regarding eligibility, as the loan is to be provided in India, only a person residing in India will be eligible. Non-resident Indians (NRIs) or foreigners generally do not qualify for these loans unless the platform offers explicit loan products to NRIs/foreigners.

Students who study abroad in India qualify for loans only if the lender has a policy.

Aadhar Number and Linked Aadhar Mobile Number

Aadhar card: Your Aadhar card is one of the first documents needed while applying for a loan since it is your unique identification number that will verify you. To ensure that verification is smooth and quick, you should have your Aadhar card linked to your mobile number.

Mobile Number: You will receive the OTP (One-Time Password) during the application and KYC process on the mobile number you register with your Aadhar card.

Eligibility Criteria of Student-Specifical

Apart from the general parameters, lenders also evaluate student-specific factors to check your eligibility for ₹3000.

Full-Time Student Status

Eligibility criteria for student loans require that you be a full-time student at an approved educational institution in India. This status guarantees the lenders that you will not be working full-time and will need financial help financing how you live.

Some lending platforms will likely require a confirmation of your enrollment at the school you are attending. This could be an admission letter, student ID card, or active fee receipt.

College Enrollment Proof

For example, some lenders ask you to upload or provide proof of your college enrollment while applying for a loan. This method confirms your status as a student and ensures you fully satisfy the minimum requirements for this millions down in loans.

Proof of enrollment includes the following but is not limited to:

College ID card (if issued)

A letter from your college confirming enrollment

Payment receipt or payment history from the college

Most digital lenders will not demand these documents for a loan as low as ₹3000, but you should have them in case it is mandatory.

Credit score or income, if applicable

Because most students need a credit history, credit scores are typically less of an issue. That said, some lending platforms may carry out a soft credit check to confirm the validity of no other debts/financial obligations.

Small loans of up to ₹3000 often need no income proof, making this loan category a good option for students who are not working. While some platforms offer applications without income financing, others will require evidence of a part-time position, stipend, or allowance.

You need not worry if you still have no credit score or income because many lenders, like Stucred, Bajaj Finserv, and ZapMoney, provide loans for students who need fast cash without any credit history.

Particular Case: How can students without a CIBIL score apply

CIBIL score is used as a benchmark by lending institutions to assess potential borrowers before approving any loan (or any credit score, for that matter). However, most students might still need a credit history; therefore, most lending platforms provide these loans without asking for the CIBIL score. Without a CIBIL score, students can apply for a ₹3000 loan. Here is how

Use of Alternative Data

Some lenders may even consider alternative data like your Aadhar card, bank statement, and digital footprints to determine your eligibility for a personal loan. For example, transactions regarding your spending patterns, online purchases, or even mobile recharges and utility bill payments. With this information, lenders can see if you are a reasonable risk to lend money to — it does not matter if you lack a credit score.

Lending Products Designed for Students

Many platforms have loan products for students and have designed solutions that do not require credit history. Such products can even be availed without a CIBIL score or proof of income. Instead, lenders look at your status as a student, where you go to school, and whether or not you can repay the loan based on other considerations — like how much you typically get for an allowance or if your parents have promised to give you any financial support.

Aadhar Card-Based Loans

For students who still need to get a CIBIL score, Aadhar card-based loans are available. Lenders use Aadhar as the major identity verification and disbursal tool for student business loan applications, thus allowing students to easily apply and obtain funds without going through lengthy credit verifications.

Loan option for students: Personal loan or instant loan?

However, for students, bearing the likelihood of financial problems or hardships can be a more efficient option as it serves so much purpose in resolving their troubles in one go, simply by opting and borrowing a loan. Personal Loans and Instant Loans are two types of loans you can avail yourself of. Although both are types of loans, these financing solutions vary considerably in terms of application procedure, eligibility, disbursement rate, and loan period. Here, we explore these two loan types, their pros and cons, and how you can determine which is better for students.

Personal Loan vs. Instant Loan: Know Both Types of Loans

Personal Loan:

Definition: A Personal Loan is an unsecured loan given by banks or financial institutions to individuals for personal use, covering expenses such as education, medical bills, other unforeseen expenses, etc. Non-collateral or unsecured loans are personal loans, and thus, they are one of the most sought-after financial products among students.

Loan Amounts: Personal loans are mostly higher in loan amounts seen as ₹10,000 to ₹1,00,000 or above, per the lender policy.

Applying for a personal loan is more involved. When you add a lender, they typically need you to complete lengthy forms, submit documentation such as proof of income, and check your credit.

Approval Timeline: The approval process will be more comprehensive but can take a few days to weeks, depending on the lender’s internal processes and the documentation needed.

Repayment Terms: Personal loans generally have longer repayment terms, spanning from 6 months to about five years. This allows more space for borrowers to avoid defaults when managing repayments.

Instant Loan:

What is an Instant loan? These are generally small-ticket, short-term loans offered through digital lending platforms. They are approved and disbursed in a few hours or minutes, making them perfect for emergency expenses.

Loan Amounts: Instant loans are narrow, primarily for low proportions between ₹ 1,000 and ₹30,000. This sum is usually small, helping to reduce the lender’s risk and enabling speedy disbursement.

Easy Application Process: Applying for an instant loan is quick, and there is less paperwork to complete. However, most platforms do not require KYC details beyond basic information (Aadhar card, some bank details, and, in certain cases, student proof).

Quick Approval: Instant loans provide a quick processing time. Approval and disbursement are often completed within minutes, if not hours, of application.

Repay Terms: The repayment period for instant loans is typically shorter than that of traditional loans, usually between 7 days and 3 months. Because of fast disbursal and less paperwork, these loans have a high interest rate.

Advantages of Instant Loans

Instant Approval & Quick Disbursement

The most significant benefit of a loan that can be processed immediately is fast access to money. Instant loans are meant to give ₹3000 on the same day or the next for immediate and urgent purposes like emergencies, tuition fees, etc. They often disburse in just a few minutes.

Minimal Documentation

The documentation for instant loans is much less than that for personal loans. They are much more accessible, particularly for students with no income proof or good credit history required, as the application process is all set up online with a KYC using only an Aadhar card and bank account details.

Small Loan Amounts

Instant loans are generally issued in relatively minor figures (₹1000 to ₹30,000) to meet short and immediate financial needs. With no lengthy approval process, you can use it to pay for your everyday expenses, medical bills, books, or tuition fees.

Cons of Instant Loans

High-Interest Rates

Because of the short processing time, instant loans have a higher interest rate than conventional loans. It can range from 30% to 40% per annum, depending on the amount of the loan and tenor.

Although the principal is only a small amount, this type of borrowing can add up over time if you wait to pay it back quickly.

Short Repayment Periods

Generally, instant loans have shorter repayment periods. The small loan amounts make repayment easier in the immediate term, but students need to watch out and repay it on time. If they fail to do so, you will face penalties or a higher interest rate applied to the outstanding balances.

Limited Loan Amounts

Because instant loans are designed to meet small, immediate expenses, the amount you can borrow is usually low enough for significant financial needs like tuition fees or other large academic purchases.

Which One is Best For Students?

When choosing between a personal loan and an instant loan, the answer depends on a particular student’s financial need, payback capacity, and how quickly they require cash. Consider when one may be better than the other for your use cases.

What Makes Good When to Avail an Instant Loan

Time-Sensitive, Minor Payments: If you need fast cash for minor, time-sensitive expenses such as emergency medical assistance, transport, or even purchasing textbooks to study from, instant loans are a great option. These loans require minimal documentation, so they have massive scope in short-term merchant credit for students.

Immediately Required: In cases of emergency, such as a medical condition or repairs, an instant loan provides funds quickly with the approval and disbursement process.

When it Makes More Sense to Choose a Personal Loan

Higher Loan Amount- When you want a more significant loan amount (₹10,000-₹50,000) to meet the expense of tuition or travel related to study, you should apply for a personal loan. Personal loans provide increased money and are more appropriate for large-scale borrowing.

Accommodation Repayment Terms: Personal loans are generally payable over a longer period than payday loans, and they often have lower interest rates (depending on your credit score), making these types of loans more affordable if you want to borrow a larger sum of money.

Permanent Income: A steady stream of income can be from a part-time job, stipend, or any source of constant income through which you may qualify for a personal loan at an optimal rate. This is a better option for students whose repayment schedule looks reasonable and comfortable.

Selecting a Lender Based on Terms

By the way, here are the considerations you should think about when choosing which loan to get:

Loan Amount and Terms: Select a loan provider that meets your needed loan amount and repayment term. Instant loans are good when you require only ₹3000 or ₹5000. Or, for more significant sums, think about a private loan.

Interest rates: Compare the interest rates from different lenders. Yes, instant loans are the quickest, but they can also be high on interest. Make sure the price of borrowing is appropriate for your circumstances.

Processing Time and Charges: If you are looking for an urgent loan, opt for a lender with less processing and disbursal time. Look for processing charges that might add to the total loan expense.

Flexibility in repayment: Choose a loan provider who understands your schedule, especially if you are studying while working part-time and cannot repay the loan on time.

Getting a ₹3000 Loan: A Guide to Interest Rates

Small Loan Interest Rates:

The interest percentages for small amounts of these loans, such as ₹3000, are likely to vary greatly depending upon the Lender and Loan platform and your eligibility. Often, these loans are between 15% and 30% APR.

For example:

Interest on small personal loans from MoneyTap can be priced as high as 18% – 24% p.a.

But the rates will be a little higher, ranging from 20% to 30%(per annum), because of the speed and less documentation process KreditBee.

Bajaj Finserv usually provides loans at interest rates ranging from 15% to 20%, which can be higher if one has a good credit score or guaranteed income.

The interest rate is crucial as it directly impacts the total amount and additional applicable charges in the loan repayment over each specified term. The higher the interest, the more you have to pay in total. So, if you take a loan of ₹3000 for one year @ 20% p.a interest, on the completion of the financial year, you may be required to pay₹3600 (not including any processing and/or service charges).

The Impact of Interest on Loan Repayment:

Whether it’s simple interest or compound interest on loans, the interest for most instant loans is usually calculated monthly and/or daily, which raises the total amount you will have to repay.

For instance, if a ₹3000 loan carries an interest of 20% per annum and is to be repaid in 30 days, the borrower will only owe ₹50 for that month. So, the total repayment will come to ₹3050.

Extended-Term Loans: If the loan period is long (90 days, for example), interest compounds over the month and makes it expensive. Also, consider the influence of the length of your loan on your total interest burden.

Repayment Terms

Repayment terms on a ₹3000 loan will differ from one lender to another and by type of loan. You must be aware of the repayment schedule so you do not miss any payments and plan accordingly to pay off the loan on time.

Loan Duration:

Short-Term: The most common loan term is short-term, used for small loans lasting 30 to 90 days. As a result, these short loan terms are standard, as instant loans tend to be paid back quickly. For example, a loan for ₹3000 can be payable in 30 days, 45 days, or even after 3 months.

Early Repayment:

Specific lenders let you pay off the loans sooner than the original term without penalty. Doing so can also lower the interest since you beat down on the principal faster. But be warned that many lenders will impose a prepayment fee to recover lost interest if you pay your loan early.

For example, if you have the loan to be paid at a later date (say after 15 days) and bring it to an end early, some lenders will charge a processing fee or prepayment penalty, which might be more than this range, say from 2% to 5% of the overall loan amount. When selecting a loan platform, check if it offers prepayment flexibility.

Interest Rates Comparison Across Lenders

It is advisable to compare interest rates on ₹3000 loans offered by different lenders before applying for a loan, making the most cost-effective and suitable financial choice. So, let us look at some interest rates from the top loan platforms.

MoneyTap: MoneyTap provides students with small personal loans at an interest rate of 18% to 24% per year. They also offer flexible repayment options, but the payout interest rate may differ depending on your credit rating and repayment history.

KreditBee: KreditBee offers small instant loans for students, with interest rates ranging from 20% to 30% per annum. KreditBee offers fast approval and minimum documentation, yet the quick disbursement means you are also paying a slightly higher interest rate.

Bajaj Finserv: Bajaj Finserv provides small personal loans at interest rates ranging from 15 to 20 percent annually and requires minimum documentation, making it a great option if you need funds urgently. They regularly run promotional offers with competitive rates for students with requirements such as stable income or current association with Bajaj Finserv.

How it works when comparing Interest Rates:

When comparing interest rates, do not look at the nominal interest rate; you should check the effective interest rate (EIR). Embracing all the loan fees & expenses – The EIR includes all the standard charges you must pay to use the loan.

Next, consider the costs of processing the loan. Application, as these might be incorporated into the total charge. In conjunction with the interest rate, some platforms add a fee as a percentage of the loan amount (1% to 2% of the loan, for example)

Things to Keep in Mind Before Borrowing Money

Get clarity on all the costs and terms before taking a ₹3000 loan because para. Well, here are a few points you must account for:

Hidden Charges:

Specific lenders charge hidden fees, including documentation, processing, and account maintenance costs. Sometimes, these fees are not clearly listed (hidden cost), so always check out the fine print. If necessary, call and ask for a breakdown of all fees associated with your loan through a lender.

Processing Fees:

Processing charges can be 1%-5% of the total loan amount. It also implies that while applying for a loan of ₹3000, you can be shelling out an extra ₹30 to 150 towards processing fees. Read More: Always check upfront your charges.

Prepayment Penalties:

Look for any prepayment penalties, which means they will charge you a fee if you pay off your loan early. If you are planning to do so, it might be necessary. While specific lenders will impose a penalty for debt clearance before maturity, others offer an incentive to do so. Always always always get the terms straight before taking out a loan.

Late Payment Charges:

If you miss your repayment date, you may face fees and charged with a higher interest rate. Be informed of the late payment penalties and the effect on your credit history once you are late or unable to pay for your payment.

How to get a ₹3000 loan without any collateral?

Getting an Unsecured Loan: The Best Solution for Those Who Need Credit Fast The unsecured loans you can get are perfect for students urgently seeking solutions. Today, most of the ₹3000 loans are unsecured, so you do not need to put any valuable asset (such as property, gold, or a car) as security for the loan. This mainly benefits students as they may have no collateral to use. We will discuss how unsecured loans work, the benefits of coming up with this kind of loan, and why we have to be an excellent option for students.

Unsecured Loans for Students

An unsecured loan does not require you to use any collateral. That means cash-strapped borrowers must only bring their credit, job status, or student ID. On the other hand, unsecured loans are ideal for students needing immediate funds but need more collateral to pledge halfway.

Most ₹3000 student loans are secured because the shape of the mortgage quantity is small, and lenders do not incur loads of chances. Unsecured student loans are a godsend for students who cannot provide valuable collateral in this commercial relationship because they lack good credit, the resources of their mother and father, or grandparents who happily accompany them to university.

Benefits of Not Requiring Any Security for a Loan

Fast Processing, Quick Disbursement:

Unsecured loans have one of the biggest positives: their comparatively faster processing than secured loans. The fact that no collateral evaluation is required saves a lot of time regarding approval, making it easy for students to get their required funds quickly. These loans are outstanding in emergencies because most instant loan platforms disburse funds within hours post-approval.

No Risk of Losing Assets:

With secured loans, students do not need to fear losing a car, property, or other valuables because there is no collateral. This gives young borrowers who cannot afford to use something valuable as collateral peace of mind.

Reduced Financial Stress:

This may be an unnecessary burden for students who need more collateral to offer. To ease these burdens, collateral-free loans provide quick, uncomplicated financial aid with no threat of losing any items of value.

How No-Collateral Student Loans Work

Most secured loans for students are based on a relatively simple application process. The process generally works like this for a ₹3000 loan:

Loan Application:

Students apply online via a loan platform such as ZapMoney or Stucred. The application form only requires basic details like your name, the college name and course details through which you are applying, and some contact details. In rare cases, they might ask for a line or two explaining why you need the financial aid.

Verification:

A few documents may include your Aadhar card, bank statement, etc. The lender checks these documents quickly, and you get a response from the lender instantly. This enables lenders to verify who you are and determine whether or not you qualify. Other platforms might use your mobile phone and what and how you use it to determine if you have good credit.

Approval and Disbursement:

After approval, a loan number/amount (₹3000 in this case) is instantly deposited into your bank or digital wallet. Response times are typically fast—sometimes minutes rather than hours.

Repayment:

Repayment is typically made using EMI (Equated Monthly Installment) as per the loan tenure (30 days to 3 months). Upon acceptance, the borrower is given a flexible repayment schedule for how long it takes them to repay.

Top Platforms Providing Unsecured Loans

Some lenders have loan platforms tailored to students and offer unsecured loans. Here are a few of the most common:

Stucred:

Stucred provides unsecured and quick loans to students without any collateral. They have the same procedure, with extremely little paperwork involved. Loan Amounts are usually between ₹1000 and ₹15,000, but the processing is quick, and flexible repayment options exist.

CRED Mudra:

CRED Mudra provides students with small, collateral-free loans. Here, the emphasis is on mess-free approvals; subsequently, very few documents are needed for loan processing. What it is meant for: If you have an immediate expense that needs to be covered, such as books and exams or day-to-day living expenses, it could be made up through this.

MoneyTap:

MoneyTap offers personal loan approval with very few documents. They extend quick approval to unsecured loans, particularly for those with a creditworthy file or an existing repayment history.

Additionally, these platforms typically come with user-friendly apps that allow you to process your loan request and enable students to apply from your phone.

Why are Collateral-Free Loans the Best Option for Students?

Risks of Offering Collateral:

That is why giving a pledge, even for a small amount like ₹3000, could be risky. If the borrower does not repay, the lender can take the collateral, which could cause financial or personal ruin for the borrower. This might not be ideal for students who might not have valuable assets or are already under economic duress.

No Need for Physical Assets:

Most students have no property, cars, or anything else for collateral. Collateral-free loans address this need, providing loans based on the knowledge of reasonably accurate specific personal information such as a student’s enrollment status or some basic credit profile. It guarantees that students who own little property can also borrow funds.

Concentrate on Becoming Financially Independent:

Unsecured loans encourage students to gain financial independence and build a credit history for the future. Since they are not secured loans, lenders check your other parameters via mobile phone or the internet, such as academic and past repayment history or payment habits. This allows students to establish their financial responsibility while not jeopardizing their possessions.

How to take a loan of ₹3000 with less documents

In recent days, unlimited platforms have provided loans of ₹3000 with less paperwork for students; one essential thing is that you do not need to go through a heavy paperwork process. Here, we will delve into how instant loan apps work with few documents required, the Aadhar card-based KYC loans that can be applied for, and the positives and negatives of no-documentation loans.

Stucred: Stucred is among the top instant loan platforms that require little documentation. You only need an Aadhar card and bank information to apply for a loan. It allows you to benefit from one-time KYC based on your Aadhar card without requiring further documentation (such as income evidence or college enrollment certificates). Upon verification, the loan amount is quickly disbursed, typically within minutes.

MoneyTap: MoneyTap also provides loans with the lowest documentation. Like KreditBee, you only need simple documents like your Aadhar card (to verify identity) and your bank details (for the money to be disbursed). The platform is built to provide instant approvals and speedy disbursals, even within hours, which makes it an excellent option for students who need money urgently.

These apps help with easy borrowing and provide a quick solution to students in need of ₹3000 loans without the long forms.

The Benefits of Less Documentation

The key benefit of minimal documentation loans is allowing students to access funds quickly. This is a great thing because of minimal documentation:

Speed of Approval:

The approval process is much quicker when less documentation is required. Faster than some letters on the bum of a snail, each manually verifying different papers, students can submit and learn approval instantly, in minutes, after simply entering their Aadhar card and bank details. This is great for learners needing immediate financial support for emergencies like medical expenses or school fees.

Ease of Access:

Most students need more than mainstream lenders’ standard paperwork, like an income or a report card. Low-documentation loans provide access to financial assistance without the student having to fill out lengthy forms full of details. This is particularly beneficial for folks who lack a regular income or are new to the credit system and still need a score.

Convenience:

The majority of lending apps work simply by allowing students to apply for loans from their mobile devices. This gives students the convenience of getting their loan application processed in a few clicks without stepping into any physical branch or meeting with the bank officer, making it perfect for those needing more time.

Disadvantages of No-Doc Loans

Although no-doc loans offer many benefits, there are also some disadvantages associated with them which students should examine before applying for this type of loan:

Higher Interest Rates:

Since lenders consider minimal documentation loans to be more high-risk, they have higher interest rates than traditional loans requiring more documentation. These rates can be anywhere between 20% and 30%(yearly), which makes these loans accessible, but students will eventually pay more for them in the long run.

For example, if someone takes a loan of ₹3000 for 30 days at an annual interest rate of 25%, then in this case, the repayment amount will be ₹3062.50 (₹62.50 is the interest).

Additional Fees:

Due to minimal collateral or limited verification, lenders could apply additional fees like processing and service charges. Origination may be from about 1% to around 3%, which helps increase the loan cost.

Shorter Repayment Periods:

These types of loans do not require documentation and usually need to be repaid in 30 days to 3 months, which can become problematic for students who may not have a regular income. Although the loan amount may be small, the payback terms can cause many financial problems if students need more time to repay the loan.

Risk of Over-borrowing:

The availability of a low-doc loan can sometimes lead to overborrowing. Because the process is quick and easy, students may borrow more than they can afford to pay back, accumulating debt and struggling financially.

Need ₹3000 Urgently, What to Do?

If emergencies require immediate decisions and you need ₹3000 urgently, try the following options to source the money. Things like an unforeseen medical bill, a fee payment, or emergency travel can come up when least expected, so the ability to get fast and reliable loans comes in really handy. Below, we explore options for emergency loans, getting fast small loans, and the risks of urgent loans—and how to avoid them.

Other Options for Emergency Loans

Peer-to-Peer Lending:

Peer-to-peer (P2P) lending is a new method of direct borrowing and lending between individuals, bypassing the traditional financial system. Faircent, Lendbox, etc., are peer-to-peer lending platforms where individuals lend money to others for small and significant amounts based on mutual agreements. This can include a quick ₹3000 loan for students who do not want to go through the rigorous process of traditional banking institutions. Lenders with a fast and relatively painless approval process for loans at competitive interest rates can often be found.

Reaching out to Friends or Family with a Request for an Assistance Loan

Your relatives (friends or family) might be the only ones able to provide a temporary loan so that you can get ₹3000 in this regard. One benefit is that personal contacts often charge little or no interest and have flexible terms regarding repayment schedules. Nevertheless, it is essential to communicate openly about the amount of money being lent, repayment conditions, and any expectations so that there are no misunderstandings and relationships do not become strained.

The Dangers of Emergency Loans and Their Solutions

Even though finding ₹3000 in an emergency can pay for short-term financial costs, the greater risk presented by rapid loans (from internet loan providers as an example) is worth a thought:

High Interest Rates:

Since these loans get approved fast and the paperwork is minimal, several instant types of credit take a lot of interest. Emergency loans can be offered at a much higher interest rate than is charged on conventional loans (up to as high as 25% or 30% annually). To prevent this, always read the fine print and determine how much you must pay back before accepting any loan. Other platforms may start you off at a low interest rate but then hit you with fees when your payment is late or if you pay it too soon.

Short Repayment Terms:

The repayment term of urgent loans is much shorter (in general, 30 to 60 days), which can be challenging to handle in such situations, especially if you do not have any source of income. When accepting the loan, you need to assess whether or not you can repay it on time in order to avoid defaults. If applicable, select the loan with longer tenures, or choose loans with Emi matching your monthly expenditure limit.

Hidden charges:

Some platforms may also charge processing fees, documentation fees, or prepayment penalties. These fees are added to the loan’s cost. Request a detailed list of all charges and fees from the lender before applying for any loan and be satisfied with the full repayment amount.

Loan Alternatives for Students

Taking ₹3000 loan can appear to solve an immediate financial problem quickly, at times; however, students taking a part-time in tandem with this money may not be the best option for you. Most Student loans are debts you carry with you for the rest of your life, but there are ways to earn money or cover expenses and avoid taking on this burden. Here are a few quick ways to make money, eliminate things you don’t use, and find short-term solutions to satisfy urgent financial needs.

Freelancer and Part-time job

Offering their freelancer or part-time worker skills helps students earn some cash fast and is one of the best ways to do so. Many students nowadays can earn money online through writing, graphic design, programming, tutoring, and more because of the gig economy. Freelance platforms are a great way to get in front of some clients and projects, allowing you to pocket reasonable amounts of money while working on your schedule.

Freelancing: Sites such as Upwork, Fiverr, and Freelancer allow students to create profiles to promote their skills nationally or internationally to complete work. Whether these platforms are used to create designs, write blogs, do data entry, or render digital marketing services, they simplify the execution process. They can charge their rate and take multiple projects to earn ₹3000 or more per day.

Part-time jobs: Students apply for short-term jobs or internships via the Internshala or Indeed platform and often get part-time work experience. Everything from customer service to content writing and virtual assistance is an option for students looking to earn money while getting some work experience.

Online Tutoring Students: Students who excel at a subject can start online tutoring. Chegg Tutors, Vedantu, Unacademy, etc., are some websites where students can become teachers and are paid hourly for teaching others. They tend to work from home and set personal schedules.

Students can now earn some money quickly by freelancing and working part-time, but they are also developing a much-needed experience that will benefit their careers in the future.

Selling Unused Items

Selling unused items is a popular and fast method of raising funds. Many students have textbooks, clothes, gadgets, or other items that they no longer use. Students can sell these items to get some quick cash without resorting to a loan.

OLX and Quikr: OLX and Quikr are excellent platforms where students can post their used stuff for local sale. Whether it’s an old phone, laptop, books, or furniture, all students must pick up the items and start listing them. These platforms will help them get their things in front of thousands of people instantly. The turnaround for the process is quick, with students being able to sell items within a few days at a reasonable price.

Facebook Marketplace: Another place to sell unused stuff is Facebook Marketplace, where students can post their items for free. Whether electronics, clothes, or dormitory furniture, Facebook Marketplace has one of the most significant users, so it can often be a prime outlet for second-hand products.

Earning a little bit fast by selling some items you never use again is also suitable for students who want to clear their space and eliminate clutter. This is an excellent option that can be taken instead of a loan and helps one sustain one’s immediate needs.

Things to do When You Need Money Now

However, what if a student needs money fast and wants to avoid borrowing it? Some short-term options can also help students without taking out a loan. These options allow students to save costs, get discounts, and fulfill their pressing financial demands without taking on debt.

Student Deals: Various businesses and online retailers provide student offers, helping save money on everything from food and travel to software programs and tech gadgets. Websites such as UNiDAYS or Student Beans open access to discounts for your on-demand clothing, tech, food delivery, and anything else you need to live a primarily functional life. With these discounts, students can benefit from their day-to-day purchases and fulfill their financial needs.

Free Services: Few companies provide free services to students. Students, for example, can use free editions of programs such as Spotify, Netflix, and Adobe Creative Cloud to afford entertainment or research tools. Colleges may also offer free resources to at-need students, such as gym memberships, textbooks, or tech equipment. Students can avail themselves of these facilities, minimize expenditures, and have some finances left over.

Budgeting and Reducing Expenditures: Many students must be more conscious of spending to meet other immediate bills. Students can use a budgeting plan to guide where they can tighten the belt. Eliminating excess expenses such as eating out and making careless purchases can also mean more resources at your disposal to tackle current needs.

Crowdfunding: In dire circumstances, students are turning to packages such as GoFundMe or Ketto for redressal. This is a great choice if personal needs include something urgent, such as a medical emergency, an unexpected academic or job expense, or even a family crisis. When students post their individual situations, their friends, family, or even people they have never met before will step up and make donations.

Conclusion

This guide outlined several ways for students to get a ₹3000 loan quickly, safely, and without fuss. Be it emergency medical expenses, academic fees, or any daily expense that was not planned for and could soon lead to a financial crisis, a small loan can help ease the pain.

Recap of Key Points

We put together a bit of the more outstanding student loan options students currently use out there:

Instant loan apps like Stucred, ZapMoney, and Bajaj Finserv provide instant loans with minimal documentation and quick disbursal times. These apps facilitate the application and provision of funds without collateral and are tailored to students’ needs.

Aadhar Card-based Loans (for quick loans for students with a dime)—Aadhar card-based loans are considered to be extremely convenient for students, as they ensure an easy KYC process and faster processing.

Unsecured loans work perfectly for students without any assets that can be offered as collateral. CRED Mudra offers loans of ₹3000 for students without any physical assets.

Apps like MoneyTap give students the option of Low-Documentation Loans. With basic stuff such as an Aadhar card, bank account number, and student proof, you can secure funds easily without wasting too much time or effort.

Nonetheless, loans should not be at the top of a list of potential solutions, such as working as a freelancer, selling used products that can now be disposed of, and taking advantage of discounts for students so they will leave some debt.

Final Tips for Students

Students should do the following before applying for a loan:

Make sure you know the full Terms & Conditions of the loan agreement, including interest rates, repayment schedules, and other secret variables or fees.

Only borrow what you can afford without any hassle. Make sure that you can repay the loan without straining yourself within the required period. Borrowing more than necessary is always a step towards unnecessary financial stress and long-term debts.

If you wish to take a ₹3000 loan, you may be able to choose from several different types of apps and need to compare them all with others to get the best possible loan app loan offer here. Compare interest rates, repayment tenure, processing fees, and eligibility criteria. Informed choice allows you to gain short-term benefits from the loan without jeopardizing the future.

Remember that while borrowing can relieve financial pressure, it’s best to borrow only if you’re doing so for the right reasons and under favorable terms.