Best Student Credit Cards

In today’s fast-paced financial landscape, gaining financial independence and managing personal finances are important skills, even for students.

Student credit cards cater to college and university students with benefits that apply specifically to younger cardholders who may have no or limited credit history. Student credit cards can help create responsibility by establishing a credit score, allowing students to purchase essential things, and adding flexibility to their financial lives.

What is a Student Credit Card?

As the name implies, a student credit card is designed for college-aged consumers (generally 18+ and employed) still in school. While traditional credit cards usually require a lengthy credit history or a stable income, student cards are intended for people who have just begun their journey to acquire constructive credit. They generally have lower credit limits, straightforward eligibility requirements, and even some benefits such as annual fee waivers, cashback, and student-oriented discounts.

Student cards are a low-risk and easy way for students to begin learning about personal finance without the danger of accumulating substantial debt. Student credit cards are often flexible and allow students to repay smaller sums over time without hefty interest costs—as long as they make the minimum monthly payment.

Importance of Having a Credit Card for Students

For students, it can be more than just a way to spend money – having a credit card can be an essential financial tool. Below are some of the key advantages of student credit cards:

One of the most significant benefits of having a student credit card is that you can build a positive credit history early in life. One reason is that a good credit history plays a vital role in all future financial decisions, such as borrowing money, finding an apartment to rent, or even getting some jobs, answering specific position definitions. Quick payments and staying on top of the line will contribute to students acquiring a nice credit score over the years.

Financial Management Learning: Student credit cards are great for learning the fundamentals of financial management. As the student takes out loans with a specific monthly payment, it is helpful to track expenses and stay within a budget, which gives them the experience of having credit. It helps boost healthy financial habits, which are essential during adult life.

Quick access to money for emergencies: Life as a student can be unexpected, and having a credit card lined up means they can turn to their credit card in an emergency. A student credit card provides an emergency answer when cash is low, whether for a one-off medical expense, urgent travel, or books and other school supplies.

Making Day-to-Day & Small Purchases: Whether it is textbooks or a bite between classes, student credit cards allow students to manage everyday expenses without carrying large amounts of cash. Some student credit cards also provide cashback or rewards on specific categories, such as dining, entertainment, and online shopping, which is helpful for students who typically purchase in these areas.

Student Credit Cards in India: Eligibility

Banks in India generally provide student credit cards to students above 18 who are currently studying at an approved educational institution. Banks usually request some confirmation of enrollment, a pupil identification card, or the presence of a co-signer (usually a parent or guardian if the student does not have an income). A few banks provide credit cards to students if they already have a savings account, making applying for a new credit card very easy.

Getting a credit card can be especially beneficial for Indian students because it meets the eligibility criteria and helps them build credit at an early stage. Some states, such as West Bengal, also offer special credit card schemes that help students with financial planning.

What is the Best Credit Card for Students?

A suitable credit card is essential for millennial consumers just starting with their finances. What is the best credit card for students? Individual needs and financial habits will ideally determine a student’s credit card. Whether they want to build or maintain their credit, pay as little interest as possible, or earn rewards on purchases. This guide will review several student-friendly credit card options, their perks, and when to use them.

Secured Credit Cards

Secured credit cards, which are great for students who don’t have any history of credit. In contrast to a credit card account, where the bank will do due diligence before awarding a line to an individual, a secured credit card is backed by your cash (deposit) — giving the lender 100% collateral. The deposit amount usually functions as a credit limit, so students will not exceed the relationship limit too large to be managed while providing a risk cushion for banks when they do not pay.

Mechanism: Once the student pays the security deposit (₹5,000–₹10,000), they can use the card like any other credit card. The deposit sits with the bank, but they might return it after a certain period of solid, responsible usage and potentially upgrade the user to an unsecured card at some point.

Skilled at benefits: Secured credit cards are great for students with no credit history. They’re a low-risk, simple way to create a credit history and prove financial responsibility. They’re also easier to get since the bank has less risk after you pay a deposit as collateral.

Ideal For: Students without a credit history or students who may not have access to traditional forms of credit. A secured credit card is also a simple way to help you establish good credit.

Low-Interest Credit Cards

Low-interest credit cards are ideal for students who need to manage their debts. With lower interest rates, these cards can be best for students who sometimes hold a balance from month to month. Student credit cards charge low interest, another way to prevent students from accruing high finance charges that regular cards may raise.

How They Operate: Low-interest cards function like any standard credit card but with a lower Annual Percentage Rate (APR). They cost less if you don’t pay the full invoice instantly. Certain banks market an introductory low-interest student credit card that rises over the years.

Benefits: A low-interest card allows students to cover surprise expenses without accruing high interest. This card type is helpful for students who need financial flexibility but are on a tight budget and do not want to incur high costs.

Who’s it Best For: Budgets students save dollars managing without dealing with high interest rates. New credit users who do not want their debt to spiral out of control will find low-interest cards helpful.

Rewards Credit Cards

Reward credit cards are popular for students looking to maximise their everyday spending. These cards offer cashback/points or rewards on select purchases, such as eating out, groceries, and online shopping that coincide with a student’s typical spending patterns. Banks also offer student-specific rewards, such as deals on food delivery, cinema tickets, and study materials.

How They Work: Students earn points or cashback for every transaction in specific categories. These rewards can later be redeemed for statement credits, discounts, or vouchers. Many rewards cards also partner with brands to provide exclusive student discounts on purchases.

Rewards: Students can earn points or cashback when they spend money. This mainly benefits students who plan their budgets well and want to increase their buying efficiency.

Ideal for: Students who spend regularly in categories like dining or entertainment want to earn rewards. Rewards credit cards incentivise responsible and profitable spending when the spending can add value to a day-to-day purchase.

So, What Type is Best for an 18-Year-Old?

A secured credit card is the best option for an 18-year-old just starting to build their credit. Because most 18-year-olds have no or minimal credit history, a secured card is an easy way to establish good credit. For young students, secured credit cards teach budgeting habits but without the risk of high credit limits. Similarly, low-interest cards are also a good fit, especially if the student thinks they may want some credit flexibility (not very much debt) from time to time.

Top Student Credit Cards in India – Comparison of Options

Selecting the right student credit card is a big step for young adults in India looking to establish financial independence and build a credit history. With various banks offering student credit cards with unique benefits, choosing the right one can feel overwhelming.

1. SBI Student Credit Card

Tag: Best for those with zero credit history

Description: The SBI Student Credit Card is the best option for students willing to manage their education expenses and want to develop a credit history. It is targeted at students in the 18-25 age group and has a credit limit between ₹ zero and ₹25,000.

Pros:

Low-interest rates

First-year, no annual fee

Accessible to students in India

Cons:

Low credit limit

Limited rewards program

Rating: 4.2/5

Ideal for: Students who need to establish their credit history and don’t want to pay annual fees.

Benefits:

Reduced prices on learning devices

Access to online banking

Pricing: ₹500 per year (after one free trial year)

2. HDFC Bank Student Credit Card

Category: Best Low Interest Rates

Description: HDFC student credit card allows students to obtain credit inexpensively. It comes with a zero annual fee, and the credit limit is up to ₹10,000.

Pros:

Low-interest rate

Rewards on purchases

First-year, annual fee waiver

Cons:

Low credit limit

Must be accompanied by a parent or guardian

Rating: 4.5/5

Ideal for: Credit-building students who also want to earn rewards.

Benefits:

Points on purchases made at grocery and fuel

International usage

Pricing: Annual fee (after first year): ₹500

3. Student Credit Card from ICICI Bank

Category: Best for education costs

Details: Full-time students above 18 can avail of the ICICI student credit card with a higher limit between ₹10,000 to ₹50,000. Great for students who want a card they can use for everything education-related.

Pros:

Low-interest rate

Offers on eLearning websites and for online courses

Cons:

Credit limit varies

General Purchases No Cashback

Rating: 4.3/5

Ideal for: College students looking for an education-focused credit card.

Benefits:

Reduced prices for books, study materials, and tuition fees

Pricing: Annual fee: ₹500

4. Axis Bank Student Credit Card

Category: Best for reward on dining and shopping

Axis Bank Student Credit Card: This credit card helps you earn reward points on dining, shopping, and entertainment as a student to build your credit. It also makes a great student credit card for anyone who spends a lot in these categories.

Pros:

Dining and entertainment bonus categories

First-year free of annual fee

Cons:

Interest rates can be sky-high if the balance is not paid in full

Rating: 4.0/5

Ideal for: Students looking to stockpile rewards on their everyday spending.

Benefits:

Dining and Shopping Cashback

Access to exclusive student events (for free, of course)

Pricing: Annual fee (after the first year) — ₹500

5. Student Credit Card — IDFC FIRST Bank

Category: No-Annual-Fee, Low-Interest Credit Card

The IDFC FIRST Bank Student Credit Card offers a high credit limit and a low interest rate. It allows students to handle small educational expenses while maintaining their finances.

Pros:

No annual fee

Low interest rates

Easy application process

Cons:

There is no meaningful loyalty program

Rating: 4.5/5

Ideal for: Students looking for a no-fuss card with low rates

Benefits:

No annual fee

Educational discounts without charge

Pricing: No annual fee

6. BOB (Bank of Baroda)

Category: Most suitable for local students

BOB is committed to providing financial support to students in India with its student credit card. The floating and low-interest rates with a finite credit limit,

Pros:

Low-interest rates

Flexible repayment options

Cons:

Limited to Indian students

Rating: 3.9/5

Ideal for: A no-frills, budget credit card for Indian students.

Benefits:

Straightforward and not complicated application procedure

Pricing: Annual fee: ₹400

7. HSBC Student Credit Card

Type: Top pick for international student

Student Credit Card By HSBC Details: This is a suitable credit card for an international student studying in India. It has a desirable rewards program that includes dining, shopping, and travel benefits.

Pros:

International usage

High rewards program

Cons:

Every year after the first gives you a whopping annual fee

Rating: 4.0/5

Ideal for: International students who want a multi-purpose gal.

Benefits:

HSBC offers access to its international network

Exclusive promotion related to international money transfers

When it comes to pricing, the Annual charge is ₹1000 (after 1st year)

8. Citibank Student Credit Card

Category: Best for online spenders and shoppers

Student card (cashback rewards for online shopping and e-commerce purchases) Description Citibank: This card is perfect for tech-savvy students.

Pros:

Cashback on online purchases

Low-interest rates

Cons:

Petty credit limit accessible to students

Stiff fees for not paying the balance in full

Rating: 4.2/5

Ideal for: Students who regularly shop online.

Benefits:

Up to 5% cashback on online shopping

Pricing: Annual fee: ₹600

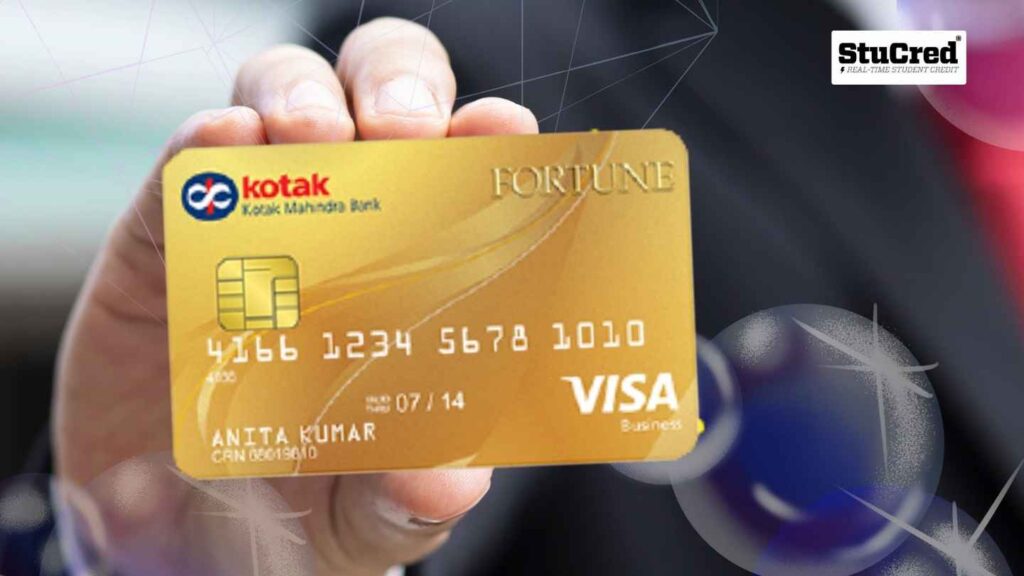

9. Kotak Mahindra Student Credit Card

Category: Ideal for low-income students

Details: If you have a low or no credit score and want to start building one, Kotak Mahindra’s student credit card can be a great option. All this will have a nominal credit limit and a simple credential application process.

Pros:

No income requirement

Easy application process

Cons:

Low credit limit

Basic rewards program

Rating: 3.8/5

Who is it best for: Those starting with a low income or no credit history

Benefits:

Simple rewards system

Low fees

Pricing: Annual fee: ₹500

10. Standard Chartered Student Credit Card

Top Lifestyle-Specific Card

Overview: This student card is perfect for anyone looking to start building their credit history at a low-cost option with sensible credit limits. This is mainly targeted at college students and young adults.

Pros:

No income proof is required

Easy approval process

Cons:

The absence of a solid rewards scheme

Rating: 4.0/5

Ideal for: Credit-building students.

Benefits:

Low annual fees

Pricing: Annual fee: ₹500

11. Fizz Card by ICICI Bank

About: Ideal for the Digital-First Lifestyle-minded student

Name: Fizz Card by ICICI BankDetails: This digital-first credit card targets students comfortable managing their online finances. It is a wallet with pre-paid features that enables students to pay using Digital wallets.

Pros:

No annual fee

Strong emphasis on online payment and digital transaction

Cons:

Less physical use (digital-first)

Rating: 4.3/5

Ideal for: A student who wants to do everything and put the bills on a finance card

Benefits:

Cashless transactions

Digital Wallet Integration

Pricing: No annual fee

12. RBL Bank Student Credit Card

Best for getting cashback from your spending

Details: RBL Bank Student Credit Card comes with a cashback program that gives students cashback on regular purchases, including shopping, dining, and groceries. Perfect for spending students.

Pros:

Cashback on all purchases

Annual fee waived for the first year

Students can quickly get it approved

Cons:

Limited credit limit

Will charge higher interest rates if carry forward the bill

Rating: 4.2/5

Ideal for: Students looking to earn cashback on everyday purchases.

Benefits:

Cashback on dining, shopping, and groceries

Sip on minimum entry levels for new to-credit

Price: ₹500 Fee per Year (after the first year)

13. Yes Bank Student Credit Card

Category: Ideal for city students

Details: This Student Credit Card by Yes Bank is intended for urban students who require a dependable card to cover their basic expenses. Its redemption options include cashback, travel discounts, and provider Quizzes!

Pros:

Earn cashback on travel and entertainment

Special discounts on educational platforms

Cons:

Relatively high interest rate

Limited credit limit

Rating: 4.1/5

Ideal For: Urban students seeking education and travel discounts

Benefits:

Promotional material and services

Rewards for travel and leisure

Price: ₹550 (annual fee, waived for the first year)

14. Bajaj Finserv

My best pick for flexible repayment

The Bajaj Finserv Student Credit Card offers flexible repayment terms and low interest rates, ensuring students can manage their finances without high monthly repayments.

Pros:

Low-interest rates

Flexible repayment options

Cons:

It comes with a hefty yearly charge after the first yr

Low cashback or reward program

Rating: 4.0/5

Ideal for: Individuals who need flexibility in paying their statements.

Benefits:

EMI options on Purchases flexibly

Zero EMI for education-related expenses

Cost: ₹1,000 (after the first year)per year

15. Kotak Mahindra 811 Credit Card Student

Category: Best Student Card for Low Credit Score

Name: 811StudentCredit Card by Kotak Mahindra

Description: The 811 CreditCard is designed for students. Students aged between 18 and 30 with no or less credit history are more likely to get this credit card than adults and custodial accounts. The monthly fee waiver can be up to Rs1 lakh on your purchases. Full cashback is obtained depending on spending requirements for groceries, online shopping, etc. Points can also be achieved. See Also – Top 10 Types Of Credit Cards Best Suited For You. Although this card has a low limit, it is an excellent choice for beginners seeking credit history.

Pros:

1st time users have access to very low interest rate

Easy approval process

Cons:

Limited credit limit

Few rewards and offers

Rating: 3.9/5

Ideal For: Students with Limited Credit

Benefits:

Easily manageable on the Kotak mobile banking app

Online management at no cost

Pricing: Annual fee: ₹500

16. HSBC Student Credit Card

Category: The Best Choice for Overseas Students

Details: This HSBC Student Credit Card is best for international students and regular travellers. It offers Excellent International Transaction Rewards and Global Acceptance.

Pros:

Ideal for transacting overseas

Rewards on foreign purchases

Cons:

Sky-high annual fee after the first year

Demands guidance for foreign students

Rating: 4.3/5

Benefits:

International Travel & Dining Rewards

Accessibility to world deals and discounts

Cost: ₹1,000 for each FY year after the first

16. Young Achiever’s Card from IDFC FIRST Bank

Suitable for: Students who want benefits and rewards

Young Achiever’s Card by IDFC FIRST Bank Description: The bank’s Young Achiever’s Card is aimed at students and offers features such as cashback, rewards on books and materials purchased, and discounts on several online educational platforms.

Pros:

Cashback and reward points

First-year annual fee waived

Cons:

Limited credit limit

Not available in all regions

Rating: 4.4/5

Ideal for: Student-aid shoppers earning some cashback on their educational purchases

Benefits:

Cashback on studying book tips

Points for regular purchases ( vous en ricavarete quelque points pour les achats réguliers )

Price: The first year is free; ₹500 thereafter

17. Axis Bank Youth Credit Card

Best for students with moderate spending Have More.

Card Type: This card is specifically for students and young adults who wish to get rewards for dining, entertainment, and online shopping. You get a solid medium here of price vs reward.

Pros:

Attractive rewards program

Low-interest rates

Cons:

Student credit card with a smaller credit limit

Requires parental co-signer to be approved

Rating: 4.1/5

Ideal for: Students who are big on entertainment and shopping.

Benefits:

Points earned for purchasing goods, eating at restaurants, and engaging in recreation

Special discount on partner platforms

Fee: ₹550 p.a – Rs. 0 First Year (zero for the first year)

18. Citibank Cashback College Student Credit Card

Best for cash back on your daily spending**

Description: The Citibank Cashback Student Credit Card provides cashback on daily expenses such as groceries, dining, and entertainment. It is ideal for students who want to maximise rewards for their everyday spending.

Pros:

Cashback on everyday expenses

Annual fee waived for the first 12 months

Cons:

Limited reward categories

Interest will be high when you have a balance

Rating: 4.3/5

Ideal for: Students looking for an easy cashback card.

Benefits:

5 per cent cashback on categories selected

First-year, $0 annual fee

Cost: ₹600 per year (from the second year)

19. Bank of India Student Credit Card

Category: Most useful for foundational credit building

The Bank of India Student Credit Card is ideal for first-time users and individuals who want to create a basic credit history. It includes a low credit limit and reasonable fees, making it an excellent option for those just beginning to use credit.

Pros:

Also, low credit and quick approvals are possible

First-year annual fee waiver

Cons:

Limited rewards and benefits

Interest is applied to any overdue balances at a higher rate

Rating: 3.8/5

Ideal for: Those with no previous credit history needing bare bones credit builder.

Benefits:

Annually fee-free for the first year

Easy online application

Pricing: One-time Registration fee ₹500 (only after first year)

20. Student Credit Card IndusInd Bank

Best for reward-driven pupils (pupils).

IndusInd Bank Student Credit Card Description—With this card, you can earn points based on your spending, which can be exchanged for exciting goodies like merchandise and vouchers. This is a solid pick for students who spend regularly in these categories.

Pros:

The benefits that you get in the form of points for every purchase

First-year free of Annual fee.

Cons:

More Interest Rates On Bills That Aren’t Pay

Not much power for smaller purchases

Rating: 4.2/5

Best for earning rewards on dining, shopping, and travel while in school

Benefits:

Earn reward points for all purchase(s)

Free rewards redemption

Fees: ₹500 per annum (after the first year)

Factors to Consider When Choosing a Student Credit Card

There are a few essential factors that you need to consider when choosing the best student credit card:

Restricted Credit Limit: Most student credit cards have limited credit limits to prevent students from overspending and falling into debt traps. Ensure the credit limit is on par with what you think you should spend.

Annual Fees: Many student credit cards have low or no annual fees, but some may charge a yearly fee per usage. Find fee waiver cards or cards that charge student-friendly fees to reduce the cost.

Interest Rate: An interest rate determines how much your balance costs to carry month-over-month. For a student on a budget, a lower interest rate card is always the best way to go. If you suspect you might not be able to pay the entire balance each month, it is best to shop around for a card with a lower APR.

Rewards and Cashback: Certain student credit cards may provide rewards in specific categories such as dining, groceries, or entertainment. Rewards can also be accumulated if you generally plan on using your card, which will balance costs or provide great discounts. E. HDFC Millennia Card is great for students who shop frequently and love to earn cashback on their purchases. It will help them utilise this benefit instead of helplessly seeing their money wasted on shopping without earning anything in return.

Student Benefits: Some banks offer discounts on educational platforms, online courses, and bookstores that may benefit students. Student credit cards, such as SBI’s, offer educational platform deals and cater to students’ standard requirements.

Groceries and Dining Cashback: Since students generally spend on basic needs like groceries or dining out, you should pick cards that will give you a percentage of your purchase back in any of these categories. For example, the ICICI Coral Credit Card provides rewards in these two sectors.

Smooth Application and Paperwork Process: Getting a student credit card should never be too complicated. If you attempt to get credit for the first time, look for banks that allow more straightforward applications. Minimal eligibility and easy process — IDFC First Bank offers cards that students can easily avail of due to the minimal eligibility requirement involved in getting such credit cards, along with a simple way of applying for these.

Eligibility Criteria for Student Credit Cards in India

Obtaining a student credit card depends on whether you fulfil the eligibility criteria needed for banks in India. While every bank has its specifications, there are a few factors that all banks look for, like age, enrollment details, and proof of Identity. Knowing these requirements can help students prepare their applications and maximise their chances of successful approval.

What you need to know about a student credit card

Most banks have a specific criterion based on which they issue credit cards for college students. However, the basic requirements are standard across all banks.

Minimum Age: Student credit cards are generally designed for 18-year-olds and older. Banks have different policies on which students can be eligible, but this age is typically 22 or younger; some banks may extend it to 21.

Eligible Candidate: Banks require candidates to be presently enrolled with an approved college or university in India. Proof of enrollment might be a valid student ID or an enrollment letter showing the person in question is taking an academic course.

Parental Consent or Co-signer: Students without a stable income or credit history will require a parent or guardian to act as a co-signer. A co-borrower acts as a guarantor and is liable if the student cannot pay back. It is a standard norm to ask in place of youngsters, and it can vary from bank to bank.

Address and Identity Proof: Banks usually ask for a few documents that can verify the applicant’s address and identity. Common documents consist of Aadhaar and PAN cards, passports or voter IDs for verification, and student ID cards as identification evidence.

Income proof or fixed deposit: HDFC is one of the banks that ask for proof of income if the student works part-time. You can also have a fixed deposit account with the same bank, which may also be accepted as collateral, and your chances of card approval can be increased without income evidence.

Bank-specific: What You Need to Know

Here is a list of eligibility requirements for student credit cards at some top Indian banks, such as SBI, HDFC, and ICICI.

SBI Student Credit Card

SBI Student Credit Card is another student-friendly credit card that is quite popular in India. It has very easy eligibility criteria and offers benefits suited to students.

Eligibility: At least 18 years old.

The applicant must be a student of a recognised college in India

Co-signer: This may be required if the applicant is under 21 or has no credit history.

Documents: ID student, proof of residence, Aadhaar or PAN card.

Other conditions: In some cases, SBI may require that the student or co-signer already have an account with the bank.

HDFC Student Credit Cards

HDFC does not have a dedicated student credit card, but the bank allows applicants to apply for cards like the MoneyBack Credit Card and Millennia Credit Card with easy requirements.

Eligibility Age: 18+ years old

Enrollment: As the leading and most important factor but not written, you have to be in college.

Income: Earners may need a steady income, but students can apply with a co-signer or set up a fixed deposit account, depending on eligibility.

Documents: PAN Card, Statement of Objectives, Proof Of Address, and Family Members (if applicable)

For instance, if the student does not have any income or credit history, banks can ask for a fixed deposit, which would help get the loan approved.

Student Credit Card by ICICI Bank

The ICICI Coral Credit Card is one of the most commonly recommended credit cards for students, given its benefits and easy eligibility criteria.

Age restriction: must be at least 18 years old.

Enrollment: You should be in a college or university recognised by the Indian government.

Income or Co-signer requirement: For ICICI, income proof can be avoided through a co-signor or a minimum fixed deposit if there’s no credit history.

Documents Required: PAN card; student ID and proof of residence; co-signer details, if applicable

Other: ICICI permits upgrading a card after demonstrating good usage, allowing students to build their credit gradually.

Can Non-Indian Nationals Studying in India Get Student Credit Cards?

Yes, few Indian banks offer student credit cards to non-Indian nationals studying in India; selection criteria are likely more rigorous in such cases. Generally, the applicant has to submit:

Student Visa—Non-Indian nationals must show a valid student visa that proves their lawful stay in India for study.

Proof of Enrollment: Applicants must provide proof of enrollment from an accredited Indian Institute.

Non-Indian students might also be required to submit proof of residence in India, including the address on their rental agreement or hostel and their local address.

Bank Account (In India)—This varies from bank to bank, but most banks in India require a savings/fixed deposit account to be opened, at least by a student who is not an Indian citizen/resident, before applying for a credit card.

Some banks may request a co-signer or a guarantor, which could be the case for international students who do not hold an income or credit history within the local context.

Other Considerations that Affect Eligibility

Apart from the general requirements, a few factors affect whether a student qualifies for a credit card or not:

Student Record: Some banks treat students with scholarships or excellent academic scores with privileged treatment, especially when issuing unsecured credit.

College Tie-Ups: A few banks in India also have tie-ups with certain institutes, wherein such banks provide credit cards exclusively to institute students with much-relaxed eligibility criteria. Some banks provide special offers to students with tie-ups with colleges and degrees; your eligibility might be more straightforward.

Financial Literacy Programs—Some banks, like HDFC and SBI, provide financial literacy programs for students. These programs guide applicants through credit management and responsible financial decisions before card issuance.

How to Apply for a Student Credit Card: Step-by-Step Guide

Student credit cards are an easy way for students to establish credit and learn how to be responsible with money. A step-by-step walkthrough of the application process and a document checklist are needed for students to get started confidently.

Student Credit Card Application Document List

Prepare Required Documents For Inmates Before You Apply There are also some requirements that banks need to have, such as identity documents, residency documents, and documents specifying your status as a student. Here is a list of some of the documents that you may be commonly required:

Proof of Student Status: To verify enrollment, you need a current student ID from an accredited college or university.

Age certificate: just like an Aadhaar, PAN, or passport to prove that the applicant is older than 18 years (can be older too)

Address proof: Most of the banks would require an Aadhaar card, passport, or utility bill, which serves as residence proof

Guardian Consent or Co-signer—if applicable, some banks require a guardian to co-sign the student loan if the student does not have a meaningful credit history or stable income.

So, having a savings account from the issuing bank will help, and some banks also require you to have an account with them to be eligible.

Proof of Income or Fixed Deposit (Optional)—Most student credit cards do not require proof of income, but few banks may ask to secure either.

Online vs. In-Branch Applications

Students apply for credit cards online or in a branch. Either method works equally well with online applications, usually in a faster and more convenient way.

Application On The Internet: This option is perfect for students with busy schedules, as the entire process can be done from home. Student credit card applications are through an online portal, which is easy to access at most banks or third-party websites like PaisaBazaar.

In-Branch: If you need help with general eligibility questions and document requirements, visiting a bank branch can be helpful. The bank representative can help you complete the application and submit all necessary documents.

How to Apply for a Student Credit Card — The Complete Walkthrough

Here are the steps for applying either online or in-branch:

Select a Suitable Credit Card: Look for various student credit cards available in the market and pick one that resonates with your requirements, like lesser payment of annual fee, cashback, or some offer on a particular spending category. Student-friendly options are available from banks such as SBI, HDFC, and ICICI, and a comparison can help you make an informed decision.

Get Your Documents Ready: Collect all required documents from the checklist above. If applying with a co-signer, have their ID and income documents ready.

Visit the Bank or Go Online:

For in-branch applications, simply proceed to the nearest branch of the bank of your choice, fill out the application form with a bank officer, and submit the necessary documents.

You can apply for online forms at the bank’s official site or through a reliable third-party website such as PaisaBazaar. Find the Student Credit Card Apply Link and fill it out.

Fill Out the Application Form: Please fill out the application form carefully at any branch or online. You must enter your details, college, and proof of enrollment. Please ensure none of the fields are missed, as this will likely lead to processing delays.

Submit Documents for Verification: After the form is filled out and the documents uploaded, submit the documents. Most banks will let you upload scanned copies directly on the web for online applications. If applying in-branch, submit physical copies for the bank to authenticate.

This is where you will need to wait for verification and approval from the bank. It can take a couple of days to verify. The bank will contact you if you require more details or paperwork. While the exact timing varies, expect your approval in 3 to 7 business days.

Get Your Credit Card: The student credit card will be delivered to your address after your application is approved. After you receive it, activate it (usually via online banking or customer service hotline as instructed by the bank)

Apply Online Through Bank Specific Portals and Third Party Sites

SBI, HDFC, etc., have their student credit card application websites. A brief overview of how to apply through these portals is as follows:

SBI: Go to SBI’s official website, click on the credit card link, and apply for a Student Credit Card. Complete the form, upload the required documents, and submit.

HDFC: HDFC also has online applications. Head to the Credit Card section, choose an appropriate card (e.g., a MoneyBack/Millennia card), and apply.

Third-Party Portals—Some websites, such as PaisaBazaar, collect details of several credit cards and provide a comparison. One platform for all cards: It brings many cards on a single platform for browsing, checking credentials, and applying.

Student Credit Card Interest Rates and Fees

While student credit cards can be an excellent way for young adults to take their first steps toward financial independence, it is essential to know what the interest rate and fees on a student credit card will look like. Many banks will offer competitive interest rates and low fees for student credit cards so they can help students with their finances without becoming too much of a burden. Let us take a closer look at the fees involved, how interest is calculated, and some great tips on keeping the costs down.

How Student Credit Card Interest Rates Work

Like a regular credit card, interest on student credit cards is the percentage that the issuing bank will charge for any unpaid balances rolled from one billing cycle into another. The first student card will often have lower interest rates compared to most regular credit cards available in the market as most students are new to credits, and this is a deliberate attempt by banks to attract younger customers; the monthly rate would typically be at least 2% lower up to about 3.5% contraction with an annualised rate of 24% to 42%, it should be noted that these figures may still vary depending on each bank and the specific type of student credit cards.

How Interest is Calculated:

Students are only charged interest if they do not pay the outstanding balances by their due date. However, if part of that total is unpaid, interest is charged daily on the balance owed until paid off.

Some banks also offer a grace period (usually 20 to 50 days) for new purchases if the previous balance is paid in full. The grace period allows students to avoid interest charges if they pay off their balance in full each month.

Cards with Lower Rates:

There are also banks that issue credit cards designed specifically for students and offer them lower-interest-rate credit cards to minimise their risk exposure. For example, HDFC and ICICI offer student credit cards but charge a lower interest rate for the first year or for up to a specific monthly spending limit. Nonetheless, students should verify the current rates before applying since these are subject to change.

Typical Student Credit Card Fees

For student credit cards, more than just interest rates could apply. Although sometimes nominal, these fees can build up when unchecked. Typical charges include the following:

Annual Fees:

You should expect low annual student credit card fees or no fees in the first year. For example, the SBI student credit card charges a nominal yearly fee of ₹500 per annum or lower, which may be waived on spending above a particular minimum threshold.

There are banks, such as HDFC Bank, that provide no-fee cards, which makes it easier to keep the card without any charges. Note: Check with the bank to see whether it charges any fees after the first year.

Late Payment Fees:

If a payment due date is missed, a late fee will be charged. The credit card also levies late fee charges depending on the unpaid amount, usually between ₹100 and ₹500 for student credit cards. Timely payments are critical because late fees drive up costs, and those late payments can damage credit scores over time.

Cash Advance Fees:

Certain student credit cards also permit cash withdrawal (cash advances) from ATMs, but this service has a fee–typically 2.5% to 3.5% of the withdrawn sum with the lowest charge ranging from ₹300. Cash advances, in general, also carry a higher interest rate than regular purchases, and there is no grace period, so interest begins to accumulate from the moment of withdrawal.

Over-limit Fees:

An over-limit fee is charged when spending exceeds the credit limit. This charge ranges from ₹500 to ₹600, depending on the card issuer. Students can track their spending and use budgeting tools available in most mobile banking apps today to help them avoid this.

Foreign Transaction Fees:

Foreign transaction fees are charged for students studying outside the U.S. or making purchases from international online merchants—usually 2% to 3.5% of the transaction amount. If you are going to use your card abroad, it is a good idea to check these fees.

Understanding Fees and Interest: Controlling the Expense

To ensure that credit card costs remain low, consumers need to be proactive and hope to avoid the appearance of delinquency. Below are a few tips for students to help them avoid paying fees and limit their interest charges:

Clear The Balance Each Month:

Paying your entire balance before the due date will result in $0 in interest on those purchases. This approach ensures students don’t have a balance and avoids interest charges, which add up over time.

Set Up Payment Reminders:

Most banks can send students an SMS or email reminder when a payment is due so they are never caught out. Plus, by configuring automatic payments for at least the very minimum payment due, you can avoid paying a late fee if you inadvertently forget to make a payment.

Use Grace Periods Wisely:

Capitalise on the grace period that comes with new purchases. Students benefit from a grace period during which interest is not charged if the previous balance is paid off. Students can capitalise on this period to clear the payments of any immediate expenses without the need to pay any other costs.

Limit Cash Advances:

Unlike conventional credit, cash advances have much higher interest rates and fees and should only be used in emergencies. Save up or find other solutions to fund emergency expenses, as cash advances on credit cards are often expensive.

Keep Tabs on Spending and Stay Within Limits

Avoiding going over the credit limit restricts many over-the-limit fees and assists students in budget control. Your mobile banking app can easily monitor your spending and help you stay within a reasonable budget.

Choose the Right Card:

Balance: When choosing a student credit card, consider the interest rates, annual fees, and other charges to find the most suitable card for you. A credit card with no annual fees, low interest rates, and student-friendly features can help you manage your credit more easily and affordably.

Student Credit Card Interest Rates and Fees

By choosing a card with low fees, paying the balance in full every month, and keeping an eye on expenditures, students can keep costs down and get value from their credit cards. A student credit card, when appropriately used, offers a solid foundation for gaining financial literacy and independence in the long run.

Credit Limits and Undergrad-Card Spending Limits

The knowledge of credit limits is one of the most influential tools in choosing your student credit card because it affects how you manage your expenses and develop good behaviours for building credit. Credit limits, which vary by card type, bank policies, and sometimes a student’s financial history, show the maximum amount that can be charged on the card. The average student’s credit card limit, how they work, and how this can affect a student’s financial future.

Credit Limits on Student Cards

Most likely because the card is meant for students, credit limits on student credit cards are much lower than regular cards — this would help encourage responsible usage while reducing financial risk for banks. Limit on Student Credit Cards in India: The limit on student credit cards generally lies between ₹5,000 to ₹25,000. This sets boundaries on how much they can spend, so balances are more manageable, and leverage can be paid off before it snowballs into a large debt.

Why Students Lesser Amounts?

Risk control—banks have a lower limit, which reduces the risk of lending to people without a stable salary. Many students’ credit history consists of little more than the loans they took to put them through school, so they are high-risk borrowers.

Starts Building Credit: Students have a lower spending limit, which means they can use their cards responsibly and pay off the balance, helping them start building credit for the future.

Tip: Lower limits encourage disciplined spending and repayment skills as students adjust to future financial obligations.

A minimum and maximum credit limit are two-sided arrows that balance between them both.

Yes, nearly all banks have minimum and maximum ranges for student credit cards, and a student will fall somewhere within the range depending on their eligibility. However, the ceiling differs between banks and individual cards.

Minimum Limit: The minimum credit limit is ₹5,000 for most entry-level student credit cards. A lower threshold means students can begin with higher spending limits suitable for daily expenses.

Amt of Max: A regular student credit card usually has a max limit of ₹25,000 to ₹50,000; however, they can be higher depending on certain conditions:

Secured Credit Cards—If the student has a secured card against an FD, there may be a credit limit of up to 80%–90% of the fixed deposit amount, which provides more freedom than debit cards while reducing the underlying risk for the bank.

Earnings Aspect: If you have a part-time job or income coming in, if the student card has the option to set one, other banks start at this point and give rather higher limits, but this is not very common with cards aimed at students.

Bank-Specific Examples:

SBI STUDENT CREDIT CARD — Credit Limit: Starting from ₹5,000 to up to ₹20,000 depending on eligibility & as per the bank policy

HDFC and ICICI Student Cards: They range from ₹10,000 to about ₹25,000 but can be increased according to usage/behaviour and bank policy.

What is the Highest Student Credit Card Credit Limit?

Though credit limits differ, many student credit cards in India are capped at ₹50,000. You might only get a higher limit with a secured card or exceptional circumstances, like having a co-signer or security deposit. Some banks will gradually raise the limit if all credit card terms are met, payments are made on time, and credit history is in good standing, but this takes time. A student who needs a higher limit may also need to increase quickly.

Secured Student Credit Cards: Certain banks, such as HDFC, provide secured student credit cards tied to fixed deposits. These cards usually have a credit limit equal to a percentage—up to 90% in some cases—of the deposit amount, giving students more room to manoeuvre without exposing the bank to loss risks.

More than one way to spend your credits — Managing management responsibly. Credit limits, lessons for students

Bridging the gap between credit limit awareness and management is vital for students to establish sound financial behaviour. To get the most out of a credit limit offer, students can follow these tips:

Use at most 30% of Credit Utilization: It is recommended to use a maximum of 30% of credit utilisation. If you have a credit limit of ₹10,000, this would amount to maintaining spending below ₹3,000. This habit helps keep the balance in check and benefits credit scores.

Don’t Max Out The Limit: Repeatedly reaching the credit limit could result in fees, a rise in interest, and damaged credit scores. Try not to spend anything so that you have wiggle room for emergencies or surprise payments.

Pay Full Monthly—This is where the student pays off the total each month and avoids interest charges while building a robust repayment record. Paying in full also reflects responsible personal finance management, which may increase your credit limit.

Check Your Spending: Track spending with a mobile banking app or SMS alerts to prevent an unintentional over-limit fee. Some banks provide features so that students can check and control their expenses.

Advantages and Disadvantages of Student Credit Cards

This first taste of financial independence may come with some perks but also pitfalls — which is why credit cards for students are specifically designed for new adults just starting on their own. This way, students can weigh the pros and cons of using credit cards to determine if a credit card is truly right for their financial needs. With that in mind, here’s a detailed look at both sides so you can decide whether or not it makes sense to get a student credit card.

Benefits of Student Credit Cards

Building Credit History

Creating a credit history is the most significant benefit of student credit cards. When students purchase a textbook or utility bill and pay on time, they build credit history. A decent credit score is essential for future financial activities, including applying for loans, mortgages, or renting an apartment.

A student card allows them to build good credit, which will help them when they enter the job market or need to make larger purchases later on.

Always remember that you have access to funds.

Student credit cards offer convenience for students, including purchasing ice cream and concert tickets. This means that when it comes to online shopping, going out for dinner, or emergency expenses, students don’t always have to carry cash with them in anticipation of running out of money.

In times of emergency, a student credit card may serve as a financial cushion, providing access to funds when you need them most. This can be useful, especially for medical emergencies or unplanned travel costs.

Rewards and Discounts

Student credit cards often include benefits that cater to students, including cashback rewards and discounts. Cashback can be applied to specific categories such as dining, groceries, or online shopping.

Other credit cards also provide discounts on educational platforms, books, and Movie tickets, which is useful for students who want to save money on daily expenses.

Improved Financial Literacy

By having a student credit card, these young adults understand what is involved in budgeting, tracking expenses, and managing debt. In the long run, these skills can be beneficial, as students will familiarise themselves with their finances, which will later allow them to make wiser decisions regarding how they choose to spend money or save it.

Disadvantages of Student Credit Cards

Potential for Debt

The biggest risk with student credit cards is debt. With students now new to credit, some may not realise how quickly they can rack up debt. The remaining credit balance will accrue interest if it is not paid off in full each month.

The straightforward availability of credit then tempts students to spend more money than they can afford, creating a balance that rapidly becomes hard to repay. This is a perilous game to play when students are living paycheck-to-paycheck or have very few sources of income.

Higher Interest Rates

Student credit cards usually have even higher interest rates than standard cards, and this is especially true for those with little or no credit history. The annual interest rates on student credit cards in India typically fall between 24% and 42%, subject to the bank and card.

If balances are not paid in full, students will pay large amounts in interest and greatly increase the total amount they spend on purchases over time.

Hidden Fees

There are many student credit card fees, though some may not be immediately apparent. Here are some of the most common fees:

Annual fees (although the first year is usually free of charge)

Charges incurred for overdue payments

Fees for going over limit if the student has exceeded their limit on credit

Fees for Cash Advance [taking out cash with a credit card]

These fees can rack up soon enough if students take the opposite approach and fall behind on payments or exceed their credit limits.

Limited Credit Limits

This is great for those trying to give credit their first shot, but not so much if a student needs to make larger purchases. Credit limits on most student credit cards fall between ₹5,000 and ₹25,000, which is not likely enough for students living away from home or needing to juggle more considerable expenses such as tuition payments or electronics.

But this can also backfire, as students will try to rack up higher amounts on the card and incur over-limit fees and interest penalties.

In what situations is a Student Credit Card NOT the right choice?

While student credit cards can have some benefits, there will always be students for whom a credit card is not the best financial tool. These are some situations in which a student credit card might not be the right choice:

If You Have a Hard Time Controlling Your Spending

For students who struggle with impulse spending or managing their finances, a credit card could mean unnecessary debt. If the holders are not mindful of their usage, credit cards can become a pitfall (particularly with steep interest).

If You Are NOT Making Money Regularly

If you aren’t earning a consistent income, it’s best to reconsider your credit application. Without an income, paying the bills on time is difficult, resulting in debt passing and credit scores.

Your Other Financial Aid

In cases where parents or guardians provide ample financial support, and a student does not need a credit card to practice the responsibility of earning their own money, obtaining a card may be unnecessary. A savings account with a debit card is a safer option.

For big-ticket items on the card

Student cards are not ideal if you require a credit card to make big-ticket purchases. The downside with these cards is that they have low credit limits — insufficient to cover major expenses like tuition or a new laptop. Otherwise, students may need to find alternatives when they have larger limits or pursue personal loans for significant costs.

How to Use a Student Credit Card Responsibly

You must learn how to be responsible when using a credit card because you’ll want to establish some credit history without getting into debt and having financial difficulty. Credit cards have their advantages, allowing you to buy things and build credit in the process, but if not done right, also one of the disadvantages is having high interest rates or being a slave to your debt. Let us look at some of the tips necessary for students to utilise their cards productively.

How to Budget and Stay Out of Debt

Creating and adhering to a budget is one of the most critical principles of responsible student credit card usage. Planning your expenditure helps you avoid overspending, which might lead to debt. Here are some budgeting tips:

Monitor Your Spending: Make sure your credit card purchases match your monthly budget. Most banks now provide a mobile app, while most are relatively small apps that allow you to track your spending instantly. Budgeting tools or apps can also do the trick — they will enable you to categorise your expenses and ensure that you remain within your limits.

Implement Spending Limits: How much will you give yourself the budget permission to spend in a month? For instance, even if your credit limit is ₹5,000, it is advisable to remain at ₹2,500–₹3,000. This will keep you within your budget and allow you to pay off your balance in full each month.

Cut Down on Unnecessary Spending: While you may feel the itch to whip out your credit card every chance, remember that a student credit card exists mainly for small things they need. Use your card only for vital purchases like books, food, or other necessary learning materials, but never for non-essential shopping.

Setting Up Payment Reminders

A straightforward method to stay on top of your credit card payments is to set reminders for various payment periods. The financial institute can charge you late fees inc, increase interest rates, and eventually affect your credit score. So, here are things you should do to get paid on time:

Automate your payments. Many banks offer automated payments of the minimum due or your entire balance. Set up autopay—perhaps the best way to ensure you don’t miss a payment. Once you add the payment, it can be set to withdraw each month automatically from your linked bank account.

Create Reminders: If you opt for manual payments, set reminders on the phone or schedule the calendar a few days before your due date. This way, you won’t forget, and if your card is not charged until the due date, then at least you will have sufficient time to arrange payment.

Pay More Than The Minimum: Paying only the minimum keeps you from incurring late fees, but it also means that taking advantage of your monthly payment plan will take longer and be less effective. Pay more than the minimum to get your debt cleared faster and save money on interest rates. You should pay your entire balance off each month to avoid rolling over debt.

As a Student, How to keep track of your Credit Score

Your credit score is key for your financial future. A student credit card is a great way to help you build a healthy credit history if you use it responsibly. Successful Strategies To Keep Your Credit in Check

Keep Your Credit Utilization Low: A low credit utilisation ratio (the amount of credit you use compared to your total credit limit) affects the score unemotionally. You should keep this below 30% for a healthy score. E.g., If your credit limit is ₹10,000, try to maintain a balance of not more than ₹3,000.

Do Not Apply For Several Credit Cards in a short time period. If you do apply for multiple credit cards in a short time period, it leads to many hard inquiries on your report, which may decrease your score. Problem 1: You only have one card as a student, which is ideal for building credit progress.

FAQs on Student Credit Cards

1. Can I Get a Credit Card at 18?

So, while you can get a credit card at 18, there are a few caveats. Almost every bank and financial institution offers student credit cards, provided the applicant is over 18. Although any 18-year-old is legally capable of entering into a contract, some banks that offer student accounts do ask you to prove your place at an approved school or other address details and sometimes need a co-signer or parent approval.

Key Points:

There might need to be a place income (part-time job) or guaranteed approval.

The student credit card is typically the most straightforward route for first-time cardholders aged 18.

2. Is Fizz Card Trustworthy?

Fizz Card is a new product aimed at students and young adults. Whether applying for a financial product or something else, it is always good to check the credibility. Currently, Fizz Card is still working with major financial institutions to gain trust. However, read the fine print and check for reviews and ratings on trusted sites like financial forums, blogs, and consumer sites.

Considerations:

Note if the card is run out of a licensed monetary establishment.

Be transparent about fees, interest rates, and rewards.

3. Which Credit Card Has a 10 Lakh Limit?

A credit card with a limit of ₹10 lakh is usually not made available to student cardholders. Student credit limits are considerably lower, averaging ₹5,000 to ₹50,000. Though higher credit limits are only available for a certain class of individuals, regular credit cards (not limited to students) tend to have limits much greater than ₹10 lakh. They are usual cards for people with high incomes and good credit profiles.

Alternative:

Students who want a higher credit limit may have to look into getting a secured credit card or wait until after graduation to establish their credit first.

4. Does SBI Offer Credit Cards to Students?4. Does SBI Offer Credit Cards to Students?

Yes, SBI credit cards for students are exclusively targeted towards individuals aged 18 to 25. The SBI Student Plus Advantage Card is another favourite card among students in India and offers benefits like:

First-year — No annual fees

Cashback is available in different categories, such as dining, groceries, etc.

Student loans with low interest rates for borrowers who pay on time

Eligibility:

MUST BE BETWEEN 18 AND 25 YEARS OF AGE, A STUDENT.

Student verification (enrolled in an accredited program)

5. Are Student Credit Cards Free?

Student credit cards are not entirely free, but most banks give first-year annual fee waivers. Banks may assess yearly or membership fees in later years; however, those costs are generally less than standard credit cards. Some banks can waive these fees if you stay above a minimum spend threshold or pay your bills on time.

Key Points:

With plenty of student credit cards, the first year is usually free.

The second year may require an annual fee, but it is usually waived.

6. Should I Have Multiple Credit Cards as a Student?

Although having more credit cards may seem to be a good way to receive more benefits and raise your limit, it is best not to do so as a student. Managing more than a card involves fiscal discipline, and if you’re juggling multiple payments, you can easily end up missing payments and paying high interest rates on these debts.

Best Practice:

Get started with a single card and establish your first good credit history before you open more—one card allows you to learn to manage money without complications.

However, even if posting and maintaining multiple cards seems appealing, only do it when you are financially stable.

7. What Is the Best Type of Credit Card for a Student?

Student credit cards, low-fee cards, essential rewards, and cashback cards are common types of credit cards that are best for students because they generally have low fees and limits while offering features like rewards. Popular options include:

SBI Student Plus Advantage Card.

HDFC Student Credit Card.

ICICI Student Credit Card.

Such cards usually have lower interest rates and more straightforward eligibility requirements, so they are tailored toward students.

8. Can an 18-Year-Old Get a Credit Card Without a Co-Signer?

An 18-year-old can get a credit card without a co-signer if they fulfil specific qualifications. With a student credit card, the requirements are usually less strict. Banks might look at your situation to see if you have a job. If you are not working full-time, you will likely need a parent or other relative to be the credit card guarantor.

9. What Is the Minimum Credit Limit for Student Credit Cards?

The minimum credit limit on student credit cards is usually around ₹5,000. The sum will depend upon your bank, the type of card, and your eligibility criteria. Limits on student cards are limited, as they are intended for first-time credit users, so lenders want to ensure you do not overspend or fall into debt.

Examples:

The SBI Student Plus Advantage Card is available with a starting limit of ₹5,000.

Limits: The HDFC Student Credit Card generally offers limits from ₹5,000 to ₹25,000.

10. What Happens If I Miss a Payment on My Student Credit Card?

The bank will impose a late payment charge and interest on the unpaid amount if you cannot make a timely payment. In addition, missing payments are also insufficient for your credit score and make it difficult to obtain loans or other financial products in the future.

To Avoid Late Fees:

Organise direct debit payment of bills

Remember to pay your minimum balance monthly.

11. Are There Any Age Restrictions for Student Credit Cards?

Yes, most student credit cards are accessible to students 18 and older. However, certain banks can extend it to as long as 25 years, so long as you are enrolled at an accredited college or university.

12. How Do I Increase My Credit Limit on a Student Credit Card?

To get your credit limit increased, you need to use the card responsibly. Key steps include:

Paying your bills on time.

Keep your credit utilisation low (spending less than 30% of what you could pay on plastic).

Asking your bank for a raise after 12 months of positive usage.

Depending on how you use your credit card and if the bank has information about your creditworthiness, they can even raise this limit.

13. Can a Student Credit Card Be Used for Online Shopping?

As long as the merchant accepts a credit card, student credit cards can be used for online shopping. But be careful to keep your balances below your credit limit and pay them off in full if you don’t want to pay interest.

14. Can Non-Indian Students Apply for a Student Credit Card in India?

However, the same holds for non-Indian students studying in India. They can apply for student credit cards but must submit additional documents, like a valid student visa and proof of residence. Some banks may also request a parental guarantee or local co-signer.

15. How Can I Avoid Interest Charges on My Student Credit Card?

To avoid interest charges:

Pay your bill(s) in full and on time.

Make sure to pay over the minimum payment to reduce your balance quickly.

16. Can I Use My Student Credit Card Abroad?

It also begs the question of whether you can use a student credit card abroad which you can. However, make sure to let your bank know that you are travelling. Also, be aware of any foreign transaction fees your bank may charge for overseas purchases.

17. What Should I Do If I Lose My Student Credit Card?

If your student credit cards have been lost or stolen, report them to the bank and block them as soon as possible to avoid unwanted purchases. If it has been lost or stolen, request a new one and monitor your account for suspicious activity.

Conclusion

Student credit cards might be the right choice for your college-aged youth and can help them build financial literacy, plan their budget for school, and learn how to finance a responsible life on credit early in life. When students are responsible for these cards, they benefit not only from accessible funds but also receive the opportunity to learn how to handle credit and budget while learning about timely payments.

However, students need to be careful with credit cards. This means setting a budget, paying your bills on time, and avoiding unnecessary debt. Factoring in these different choices and searching for credit cards provided through a variety of good banks could assist students in gathering and discovering their finest cards, which might match their own needs, like minimal or standard interest charge cards, reward charge cards, or bank cards affording ideal credit history limits.

Students should weigh their options, review the requirements for student credit cards, and learn about any applicable fees and interest rates before applying. State-sponsored programs in certain states, such as West Bengal, could offer supplementary benefits, which can help relieve educational costs.

In the end, if utilised correctly, a student credit card can assist college-goers in handling their finances at the moment and allow them to prepare for financial success down the road. Students can avoid pitfalls with the right card and responsible usage behaviours while establishing a positive credit history.