Best Loan Apps for Students with Low Interest Rates in India

Empowering Your Financial Freedom

Best Loan Apps for Students with Low Interest Rates

The Need for Low-Interest Student Loans

Students in the process of schooling face financial challenges from various angles — tuition, living expenses, course books, and even unforeseen emergencies. Scholarships, part-time jobs, or even help from parents can do wonders, but many students simply resort to loans for the remainder. In such situations, securing a loan with very low interest rates becomes crucial. For students who are just beginning to establish themselves in life, high interest rates can be simply a crushing load.

Obtaining loans that are easily repayable with minimal hassle is a fundamental aspect of managing student finances effectively. Luckily for us, there is now a slew of student loan apps that aim to serve the needs of the modern young borrower, offering quick approval and low-interest rates on loans that can help students cover their expenses without incurring significant debt.

Choosing the appropriate loan app enables students to alleviate some of their financial strains, allowing them to focus on academics and personal development. Whatever the case – a small loan for textbooks, to pay tuition fees, or an emergency – finding the right app with affordable interest rates and processing times is one way to alleviate some of the burden.

Why This Guide is Essential

This guide compares the top loan apps available to students, allowing them to quickly find the most affordable option with a low interest rate. This provides an easy way to identify which app can make a significant difference in planning your student finances, as each has its unique features. We will examine the interest rates, loan amounts, and repayment flexibility so that you can make an informed decision about which app to choose.

High documentation requirements or misleading terminology make it a hassle for students to apply. We discuss even apps that have less documentation and an easy process, because a smooth and trouble-free process is the primary focus here. Additionally, we feature apps that offer instant loan approvals, so click away if you don’t want to wait long for your emergency funds.

In this blog, however, we will explore the features of every loan app but pay special attention to StuCred, a student-friendly loan app that offers you quick access to funds, lower interest rates, and an easy-to-use user interface. StuCred is a student-focused lending entity that aims to provide loans explicitly tailored to students and their increasingly unique financial needs, without the hassle of barriers often attached to more traditional loan products.

StuCred: A student-friendly platform with a difference

With numerous loan apps catering to students, the most prominent one is StuCred, which provides instant loans with a focus on low-interest rates, quick approval, and minimal documentation. Recognising the needs of a student, with an interface that lets you pay (providing financial support). StuCred allows students to borrow between ₹500 and ₹1 lakh and repay as per their course timeline.

StuCred is unique in its low-interest rates, which make it an ideal solution for students who need traditional or personal loans, as they do not have to fall into the debt cycle of inflated interest rate loans. This ensures that students can be confident about the terms and conditions of a loan before proceeding, as StuCred prioritizes transparency and simplicity. That’s right, the platform is also meant to allow students to not only develop their credit scores but also provide more flexibility in terms of finances whilst studying.

In this article, we will compare other loan apps for students with StuCred and discuss what sets it apart from the others. Here at StuCred, we can help you with immediate expenses or if you are planning to borrow money for more academic long-term expenditures. We provide tailored, cost-effective solutions as per your needs and repayment strategy.

Top Loan Apps for Students with Low Interest Rates

With many students seeking to strike a balance between their education and the cost of living, finding the right loan app can save you. Here’s an analysis of what the best student loan apps have to offer, including low-interest rates, amounts, and benefits.

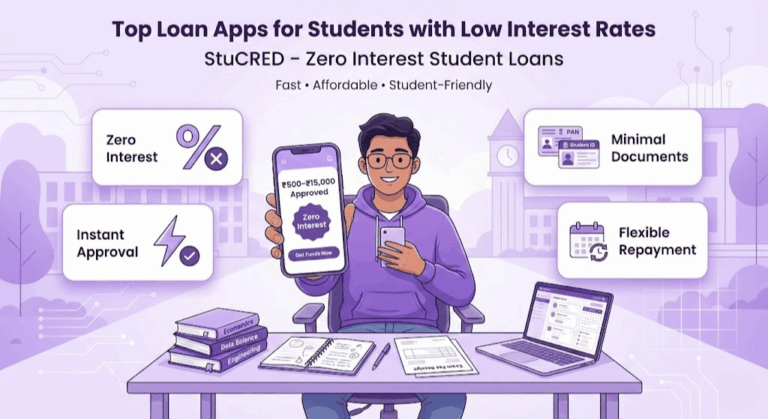

1. StuCRED – Best loan app for students with low interest (Zero interest)

Loan Amount: ₹500 to ₹15,000

Interest Rates: Zero, just a small fee to provide loan services to students

Key Features:

Quick Loan Approval: StuCRED enables fast loan approval, allowing you to receive the amount when needed.

Little Documentation Required: The loan application process is quick and hassle-free, with minimal documentation required.

Customized Payment Terms: Students can pay back with repayment schedules that suit their study years and budget.

Why Choose StuCRED?

StuCRED is ideal for meeting the immediate funding needs of students. For tuition fees, books, or other immediate expenses, the quick approval process and low interest rates have made it one of the most affordable personal student loans.

2. KreditBee

Loan Amount – ₹1k – ₹5 lakh

Interest Rates: 0% to 29.95%, based on loan type and your credit score

Key Features:

Fast Approval: KreditBee offers a fast-track approval process, with loans being disbursed within a few hours.

Since the eligibility requirement is relatively easy, it is challenging for aspirants to avoid minimal checking.

Collateral-Free: KreditBee does not require collateral from its customers, meaning students can borrow money without any risk to their assets.

Why Choose KreditBee?

KreditBee is ideal for students seeking loans that offer more flexibility in both the amount and repayment terms, as it provides a wide range of amounts that may be needed, along with an equally flexible approval process. It offers 0% interest intro rates, making it ideal for students seeking a budget-friendly option.

3. Pocketly

Loan Amount: Up to ₹50,000

Interest Rate: Low with flexible terms

Key Features:

The entire process is straightforward — all you need to do is apply with your student ID and proof of address.

Financial Assistance for Studies and Personal Expenses: Pocketly aids in both academic expenditures and daily personal needs of students, so that they are not burdened with managing their basic needs during their study tenure.

Fast Loan Approval: Loans are processed quickly, ensuring that the money needed is always within reach.

Why Choose Pocketly?

Pocketly is well-suited for quick student loan requirements, whether for tuition or daily expenses. Pocketly is thus an effortless solution with a hassle-free application process at a competitive rate.

4. StuCred (Our Business Site)

Key Features:

Quick Loan Disbursement: With StuCred, you can receive your loan quickly; the funds are transferred to your account within hours of applying, and same-day disbursals are common.

Simple Repayment Plan: The transparent and straightforward nature of repayment provides flexibility, allowing students to pay back the loan stress-free with StuCred.

Credit History: As a student-centric platform, StuCred helps students build their credit score, which can be beneficial when they need to take out loans.

Why Choose StuCred?

StuCred is a go-to option for students who can avail of instant loans quickly with attractive low interest rates and a straightforward and transparent repayment framework. By making credit easily accessible to students through a straightforward application process with student-specific offers and a credit-building-oriented approach, StuCred enables students to manage their finances efficiently while focusing on their academics.

5. Other Apps to Consider

PaySense

Loan Amount: Up to ₹ five lakhs

Interest Rates: 13% to 35%, depending on your loan type and tenure

Highlights: Rated as one of the best personal loan options for students, PaySense is a solid choice if you need to borrow larger amounts and like the idea of customizing your repayment schedule.

Cashe

Loan Amount: Varies

Interest rates: Based on eligibility, competitively

Talking about its key features, it offers fast approval loans for students who require urgent funds.

KrazyBee

Loan Amount: Generally aimed at educational costs, varies

Interest Rates: Competitive with terms around the short end

Highlights: KrazyBee is explicitly targeted towards education expenses and offers all the money in one go to cover college, books, and other related costs.

Why Choose These Apps?

Each of these is great in its way, all focused on solving student problems, whether it be small purchases or tuition costs. The one thing that they have in common is the quick and easy access to cash, low documentation, and flexible repayment options. The right app for you will depend on how much money you need, the requirements to qualify, and your urgency for receiving cash.

So, if you need urgent funds, low-interest rates, and paperless procedures, then StuCred is an excellent option for students who require quick loans without the hassle.

Detailed Comparison of the best loan app for students with low interest rates

There are several aspects to consider when choosing a loan app, including loan limits, interest rates, and eligibility, which a student should weigh before making a final decision on the best option. So, here’s a comprehensive comparison of the best loan apps for students based on parameters that you look into the most –

Loan Amount and Limits

The amount a student can borrow varies widely by app, depending on the type of loan and their financial need.

KreditBee

₹1,000 to ₹ five lakhs. KreditBee is perfect for students who need loans of a higher amount. From tuition fees, personal emergencies, or any other necessity, KreditBee comes with higher loan limits for you to meet all your financial needs!

StuCRED

₹500 to ₹ 15,000. StuCRED works better for students seeking small amounts of money on short notice, either for textbooks, living expenses, or minor emergencies. This is a good alternative for fast, smaller loans with immediate approval.

Pocketly

Up to ₹50,000 (Pocketly offers a mid-range loan amount, ideal for students who need slightly greater financial freedom than mPokket allows but don’t require the high-value loans available with KreditBee)

StuCred

Needs-Based Loans are provided by StuCred, where the financial need of a student is considered (typically between ₹500-₹1 lakh). This flexibility makes it an ideal option for students seeking to overcome hurdles related to tuition fees, living expenses, or any emergency.

Interest Rates

The higher the interest rate, the larger the total amount a student pays back over a period of time. Here’s a list of the interest rates provided by every individual app:

StuCred

Typically, they are pretty competitive (with specific, unique student offers starting as low as 0% during the first three months of your loan). StuCred rates are cost-effective and affordable, particularly for those students who need immediate financial assistance. It is a good choice for individuals who want to pay off loans slowly and at low interest rates.

KreditBee

Interest Rates: 0% to 29.95% based on type of loan, eligibility and tenure KreditBee also has promotional 0% interest for first-time borrowers or on specific loan types, however its normal rates can be as high as ~30%, and is therefore better suited to students needing larger loans willing to pay marginally higher rates instead.

mPokket

mPokket offers a comparatively low interest rate, especially for students who borrow smaller amounts. Repayment is structured to be convenient for students, making it perfect for loans that you need quickly in small quantities.

Pocketly

Adjustable and based on the borrower’s ability to repay. Pocketly provides students with low-interest loans — something that is essential to ensure that your loan will be able to be paid back without the financial burden that almost every other high-interest debt entails. This makes it an excellent choice for borrowers seeking temporary assistance, particularly students.

Eligibility Criteria – best loan app for students with low interest

While these apps have different application processes, all require minimal documents to get started! This is how the best apps measure up:

StuCred

You need basic documents, such as a student ID and proof of enrollment. A PAN card is not required. StuCred is extremely student-friendly, and the application process itself is straightforward. Additionally, it is one of the best apps with easy access for younger students (e.g., 18-19 years old) who do not yet have a PAN card.

KreditBee

Student ID, Aadhaar card, and proof of registration. It has low eligibility criteria and fast approvals, helping more students get what they need.KreditBee is providing easy accessibility with no spam.

mPokket

No PAN card is required. Only a student ID and proof of enrollment are needed. MPokket is available for young students, and undergrad students who haven’t. They have not yet built their Credit history or do not have a PAN card.

Pocketly

A student ID, an Aadhaar card, and a letter confirming registration in the college party are required. A PAN card is not needed. Pocketly has comparatively more straightforward eligibility conditions, which is why it also becomes a viable option for students with minimal documentation, similar to mPokket and KreditBee.

Loan Disbursement Time – low-interest loan app for students

For students who need a loan to cover expenses immediately, the speed at which loans are disbursed can make or break the difference.

StuCred

Immediate, usually within a few hours or 24 hours. If you are looking for instant loans, go to StuCred because priests know the processing of money is now as fast as possible. Easy Approval means that the money needed in their most important moments is instant and at their fingertips.

KreditBee

In most cases, instant; however, it may take a few hours, depending on the amount and other eligibility criteria. The loan disbursement process on KreditBee is a simpler model, especially if you have a high credit score or qualify for 0% interest offers.

mPokket

Approval typically occurs within minutes. mPokket offers loans with an instant disbursement period; within minutes of approval, the money is deposited into the student’s credit account.

Pocketly

Fast, generally within hours. Pocketly ensures that loan processing is completed quickly, allowing students to access funds without undue delay, which is particularly beneficial in emergencies.

Summary – student loan app with less interest

Loan Amount: KreditBee and PaySense offer the highest loan amount, while Stucred and Pocketly are more suitable for small, urgent loans.

Interest Rates: StuCred offers low-interest loans and flexible repayment options at competitive rates, particularly for students in need of prompt funding. Loans at KreditBee also come with low interest for select offerings, but are subject to eligibility, i.e., they commence at a lower rate and can increase up to 30%.

Who is eligible: Mostly, apps such as StuCred and mPokket are more student-friendly, as you only need a student ID proof to register (No PAN card required).

Loan Disbursal Time: All the apps boast fast processing times; however, for instant disbursals, there is no competition at all. StuCred, mPokket, and KreditBee take home medallions in this category, as we are sure that students prefer having their money as soon as possible.

If the students understand these factors, then they can compare and find which loan app best suits their financial needs and personal circumstances. Whether the need is for smaller expenses or larger financial needs, StuCred makes for an ideal choice — it helps students with reasonably quick and flexible loans.

Special Features of the Top Low-Interest Personal Loan App for Students

When searching for a loan app, don’t just check the basics, such as loan amount and interest rates. Some apps are designed to cater exclusively to students and require a distinct focus, streamlining the lending experience. Let’s examine the key features that distinguish the top loan apps from one another.

Cool Perks at StuCred for Students

Within the student loan app ecosystem, StuCred is unique in its approach to serving students (especially those with little or no credit experience and nothing to collateralise loans). In the meantime, here are some of the benefits StuCred provides:

No Credit History Needed: StuCred does not require a credit score, unlike other conventional lenders that typically require a good credit history. This is particularly beneficial for students who are just starting to establish their financial reputation and may not yet have a credit rating.

Collateral-Free Loans: StuCred provides unsecured loans, so students don’t have to submit any collateral or other assets against the loan. This is especially helpful for younger pupils who may not have valuable possessions.

It provides students with access to a record of their credit and repayment process as they borrow money via StuCred. This is extremely important for future financial decisions, such as a credit card or a larger loan, as you will not be burdened with high-interest debt.

When compared to other loan apps that require more stringent qualifications, StuCred targets students with little or no credit history and aims to build credit for these individuals through a straightforward process without complex terms.

Repayment Options – Student loan apps with low interest

Students appreciate the ability to pay it back in a common-sense manner, adjusting it if their classes, schedules, or work commitments change. Here is how some loan apps address the above need:

KreditBee: KreditBee offers flexible repayment options, allowing students to repay loans over either a short 30-day period or more extended repayment periods of up to 6 months and beyond. This flexibility enables students to align the repayment terms with their income or available muster.

Slice Pay: The repayment period can be as short as 30 days or extended to a few months, allowing students to more easily manage their finances, particularly in instances where cash flow is tight.

StuCred: StuCred offers very flexible payment plans, designed to suit the cash flow volatility of student life. StuCred goes to the lengths of modifying payback deadlines to coincide with exams or summer vacations over any given time frame, keeping in line with each student’s specific study and lifestyle. For students, there should be repayment plans of varying lengths that suit their income. The clear repayment structure enables easy budgeting for students, alleviating concerns about missing payments.

One of the standout features of StuCred is its repayment flexibility, allowing students to manage their finances with ease amid uncertain budgets and fluctuating income streams.

Support and Service to the Customer – Best Loan Apps for Students with Low Interest Rates

The thought of being in debt can be terrifying, especially for students taking out a loan for the first time. Here is how these apps compare in customer support and user experience:

StuCred: StuCred emphasizes transparency and personalized support in navigating students through the loan process. StuCred has a customer service-oriented approach throughout the life cycle of their loans, from initial application to repayment, with an emphasis on ensuring students understand precisely what they are getting and how it works. With a student-centric approach, StuCred offers multiple support channels, including chat support and email assistance, to solve queries in the quickest time possible.

Simple UI App: The loan app features a simple and intuitive user interface, allowing you to easily apply for loans, view the repayment schedule, and manage your account.

KreditBee: KreditBee provides good customer support through a chatbot and offers fast responses as well. Although it shines in efficiency, it is more of a guidance-free automated machine that may be less helpful for students who prefer well-thought-out solutions, but it is useful for most students who like quick answers.

mPokket: mPokket offers supportive customer service, allowing students to contact the support desk directly via a helpline. Support is primarily responsive, but there are reports that more extensive questions take a little longer to respond to on occasion.

Pocketly: Pocketly also provides timely customer service via its app and website. Loan details and repayment schedules are easily accessible, with support available to address any issues that students may encounter.

Why Choose Best Loan Apps for Students with Low Interest Rates with Exceptional Features

By offering features such as a no-credit-history requirement and collateral-free loans, StuCred stands out from other loan apps, as it caters exclusively to students by making borrowing worry-free and easy.

Repayment flexibility is at the core of a study-ready student, and StuCred offers flexible payment plans to assist students in repaying loans according to their financial situation, making it an ideal platform for those with long repayment terms.

Students need clear communication, along with quick and responsive customer support, and StuCred does an excellent job of providing personalized support to ensure that students feel confident throughout the loan process.

With all these features, StuCred has emerged as one of the most trustworthy loan solutions for students, offering an instant low-interest personal loan with flexible repayment periods and requiring no collateral or credit history. Designed for students, with an intuitive interface and excellent customer service, it is a platform to help you easily manage your financial journey.

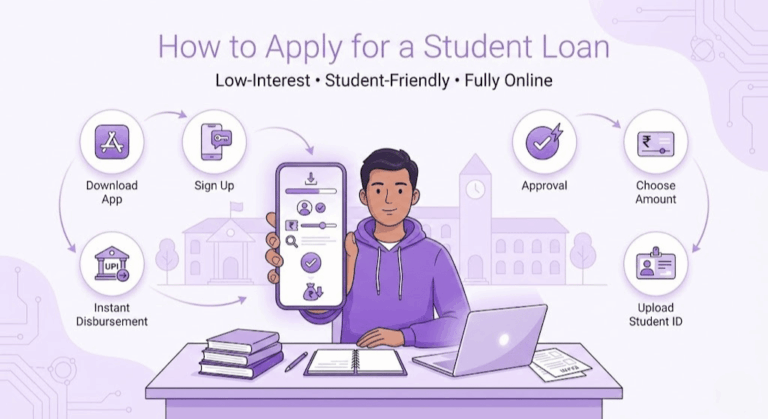

How to Apply for a Loan as a Student – best loan app for students with low interest

These days, student loan applications have been made easier by apps created specifically for students. Here is a detailed, step-by-step process on how students can apply for loans through various apps, with special emphasis on the student loan app ‘StuCred’, as it boasts one of the best user interfaces.

How To Apply For The Loan: A Step-by-Step Guide

So, this is how you can apply for a loan through some of the best loan apps for students, such as StuCred.

Step 1: Download and Install the App

Go to the Google Play Store or Apple App Store and download the StuCred app on your smartphone.

Following the same procedure as for other apps, such as KreditBee, mPokket, and Pocketly. Just download the app from your favorite app store.

Step 2: Sign Up and Set Up Your Account

StuCred: Launch the app and hit Sign Up or Register. Create an account by entering a few basic details, such as your name, phone number, and email address.

The registration process will be similar to most loan apps, where you enter your details so that the system can verify your identity.

Step 3: Choose Your Loan Type and Amount

Choose the Loan Type and Amount: After you log in, choose which type of loan you want to apply for (urgent loan, tuition loan, etc.) and enter the amount that you need (up to ₹1 lakh)

Other Apps: Select the loan amount according to your financial requirement. Apps such as KreditBee and mPokket give two parameters to select (for example, ₹500–₹45,000 at a time for mPokket or ₹1,000–₹5 lakh out of credit limit for KreditBee)

Step 4: Fill in Your Personal Details

StuCred: Enter your student ID, proof of enrollment at the institution you are studying, and Aadhaar card details.

Most of the apps just ask you for a basic document for identity verification and to ensure that you are a genuine student. StuCred is quick and efficient, with minimal documentation to trail.

Step 5: Submit Your Application

StuCred: Please fill in all the required information and submit your application for approval. StuCred offers a streamlined approval process with minimal paperwork required.

Other Apps: Just like the case with StuCred, you fill in your details on the app, and it takes a few minutes to a couple of hours for them to approve.

Step 6: Wait for Approval

StuCred: StuCred has a simplified approval system for students. If your application meets the criteria, an instant approval notification will be sent to you, and the loan will often be disbursed within 1 hour.

Other Apps: Other apps, such as KreditBee and mPokket, also have a fast approval system. However, approval time may vary slightly depending on the amount you requested and how your app conducts verification.

Step 7: Loan Disbursement

StuCred: If your loan application is approved, the amount will be credited to your bank account or e-wallet within minutes.

Other apps, like Pocketly and KreditBee, offer instant loan disbursement for urgent needs, allowing students to access funds as quickly as possible.

Required Documents for the best loan app for students with low interest

There are a few standard documents that every loan app needs for the verification of your identity and eligibility to apply for a loan. These are the things that you will generally require:

Student ID: Evidence that you are a student of record.

Aadhaar Card: Many loan apps require identity verification through the Aadhaar card.

Proof of Enrollment/College Admission: A fee receipt, college ID card, or letter from your institution of study.

Bank account information: Some apps may require your checking account information to process the disbursement of your mortgage.

Proof of address: You may be required to submit a utility bill or rental agreement (some apps may not need one for young students).

The StuCred advantage: StuCred offers even more convenience by streamlining the loan application process and minimizing documentation. It only requires a Student ID and Aadhaar card to get started, thereby reducing the hassles and making the process faster. This is a great help for students who may not have such proof available otherwise, such as a PAN card or utility bills.

Verification Process – Best Loan Apps for Students with Low Interest Rates

Each app has its own verification process, but most apps use similar methods to ensure you are eligible for this loan.

StuCred: After you upload the documents and submit your application, StuCred usually takes a few minutes to verify the documents. This may involve verifying your student ID and Aadhaar card.

Instant approval: If everything is correct, you will usually be approved within minutes. They recognize that some students may need this money urgently, so the process is designed to be seamless and efficient.

Conclusion – best loan app for students with low interest

Obtaining a loan as a student is no longer a tedious process, thanks to the app called StuCred, which allows students to apply with ease. Using the step-by-step process mentioned above, students can quickly and easily obtain a loan to cover expenses related to education or personal needs.

For students seeking hassle-free financial assistance, StuCred offers a choice with a mobile-first approach and a simple interface that requires minimal documentation, offering fast approval times. Whether a student needs a few thousand dollars for textbooks or tens of thousands for tuition, these apps provide on-demand help to students, fast, easy, and at reasonable rates.

Additional Loan Options for Students – best loan app for students with low interest

Student loan apps may be fast and flexible when you need money, but students have other financing options that can accommodate greater expenses or longer-term education plans. Here, we are discussing education loans, microloans, and government-backed schemes that could ease a student’s burden.

Education Loans v/s Personal Loans.

If you are already looking for a loan to cover your education expenses, note that there is a difference between an education loan and a personal loan, as offered by apps like StuCred and KreditBee.

Education Loans: In general, education loans have lower rates of interest (8%–12% approximately) and longer repayment tenure (up to 15 years or more). These are specifically acquired to finance your tuition fees, course materials, day-to-day living costs, and other academic costs. Apart from offering attractive interest rates and long tenures, several education loans also provide moratorium periods, allowing repayment to be deferred until the borrower begins earning after graduation or has completed their studies. Education Loan Providers – The Preferred Partners:

Then there are apps like StuCred and KreditBee that offer personal loans for shorter repayment periods (up to 2–3 years). While these loans can be used for urgent cash needs, they are generally not well-suited for long-term education financing; purpose-built education loans might be a better option.

Tip: When students are pursuing higher education or longer studies, it is better to opt for education loans, as they offer lower rates compared to other loan types, making a long repayment term more sensible. For specific needs, such apps are ideal, like Eduvanz and Avanse; whereas, for smaller and immediate needs, one can avail of these loan apps, such as StuCred.

Microloans for Urgent Needs

At times, students require a small loan that allows them to cover urgent or short-term expenses immediately, such as an emergency, a small fee, or even daily household costs. And that is where microloans come in.

Microloans are smaller loans with instant disbursal and minimal documentation, ranging from ₹500 to ₹20,000. These are an excellent fit for students looking to find some fast cash, but not wanting larger loan amounts and a long repayment term. Micro Loan Provider Recommendation:

Stucred: Provides loans to students who are in dire need of money. The approval process is as immediate, and the documentation is minimal; students can receive financial assistance within a few hours through Stucred.

Buddy Loan: Focused on providing online microloans that can be used for emergency expenses. They are best suited for students who require short-term cash loans. The remaining terms will be flexible and may even allow for unsecured capital with minimal risk.

Reasons to Consider Micro Loans: Micro loans are ideal for students who have unexpected expenses, such as new medical bills, travel costs, or minimal tuition dues. With these apps, it hardly takes time to get a vote, and funds will be transferred in no time, which is ideal for momentary fund requirements at the college student level.

Schemes for Students by the Government

Besides personal loan apps and micro loan providers, government-backed loan schemes for students make their terms more affordable. While these loans often offer lower interest rates and more extended repayment periods, they can be appealing for students looking to fund their higher education.

PM Modi’s Education Loan Scheme: The government of India provides education loans through all public sector banks, such as the State Bank of India (SBI), Bank of Baroda, and Punjab National Bank (PNB), at a subsidized interest rate. These solutions, which include tuition fees, course materials, and living expenses, are available for both domestic and international studies. It offers interest subsidies during the course, in turn making it more affordable for students.

Pradhan Mantri Kaushal Vikas Yojana (PMKVY): This government scheme emphasizes vocational education and skill development programs. Through this system, Financial Aid is provided to students enrolled in approved talent courses to meet their academic needs.

Dr. Ambedkar Central Sector Scheme: This scheme provides interest-free loans for higher education to students from marginalised communities. It is the best opportunity for a student belonging to the Scheduled Caste and Scheduled Tribe, as it offers another essential financial help without any interest.

Conclusion

Since immediate money requirements – things like a quick loan for college going students, can indeed be covered under student loan apps such as StuCred, KreditBee and mPokket, there are a host of other long-term financing options too when it comes to funding education at large with variety of loans types that go beyond simple mobile wallet loans and micro loans for students or various schemes by the government.

Education loans are ideal for significant, long-term educational expenses, offering a minimal interest rate and an extensive repayment tenure.

While microloans cater to small financial needs and require minimal documentation, such as Stucred or Buddy Loan, they also offer immediate relief.

The government also offers other schemes to assist citizens, particularly marginalized students or those advancing their careers through vocational education.

FAQs

The best rates for loans for students will depend on how much you wish to borrow and the type of loan you are looking to obtain. Below, you can break down the interest rates of a few of the top student loan apps.

StuCred: StuCred is renowned for offering interest rates tailored to students. It offers competitive interest rates, starting at about 13%. The repayment plans are also flexible, as they consider the needs of students by providing education loans at lower interest rates in India. The app even has promotions and a low interest rate for smaller loan amounts.

KreditBee: 0% – 29.95%, based on loan category and student qualifications. KreditBee may offer a 0% introductory rate for small, short-term loans to new users. However, it can go as high as KredX minimum (or higher) for bigger amounts and longer terms.

mPokket: mPokket loan interest rates begin at approximately 12%, increasing depending on the demand size and tenure. The rates are particularly competitive when it comes to short-term

You can take a ₹30,000 loan quickly as a student through the app (StuCred & KreditBee). Here’s how to do it:

StuCred: Loans upto ₹ 1 lakh instantly by providing your college ID as collateral. The process is simple and requires minimal documentation, just a student ID or an Aadhaar card. StuCred understands this and offers low-cost loans with flexible terms designed around individual payment size preferences so that repayment can take place in more manageable installments.

KreditBee: KreditBee offers loans of up to ₹5 lakhs for students requiring larger amounts. You can get a ₹30,000 loan, depending on approval from the app (in most cases, it occurs with minimal verification). As long as you meet their eligibility requirements, you’ll be approved for the loan. For example, it would be given if you’re a verified student, along with simple documents such as a Student ID and Aadhaar card etc.

You can avail of a loan without a PAN card via apps such as StuCred and mPokket. Almost none of the student loan apps demand a PAN card, because most students do not have one yet.

StuCred: No PAN card, making it perfect for students who are under the age of 18 or simply have not yet applied to get their PAN card

Student loans are now readily available in universities & colleges. Again, like StuCred, mPokket helps students to apply for loans with minimal documentation (Aadhaar card and student ID). It offers a hassle-free process for students as these loans require only basic documentation and have the money credited within 3-5 hours of applying.

Yes, Stucred is a safe platform for students to apply for loans. It is regulated by financial authorities like the RBI and follows strict guidelines to ensure secure transactions and personal data protection.

- Stucred uses encryption technologies to protect user information and ensure that your loan application process is secure.

- Stucred is also known for providing clear loan terms and transparent fees, so there are no hidden charges or surprises.

- The app is backed by established financial institutions, giving users confidence in its legitimacy and safety.

If you need a loan immediately for urgent expenses, apps like StuCred and mPokket offer instant loans with quick approval and fast disbursement. Here’s how:

- StuCred: Once your loan application is submitted, StuCred can disburse loans within minutes. With a quick verification process, students can get the financial support they need almost instantly.

- mPokket: Similar to StuCred, mPokket offers instant loans, especially for smaller amounts (up to ₹45,000). Their fast processing and minimal documentation make them ideal for emergencies.

- Other Apps: KreditBee also offers fast disbursements, but approval time can vary based on the loan amount and eligibility.

Both StuCred and mPokket are particularly well-suited for urgent needs as they specialize in small loans with quick approval. If you’re in a situation where time is of the essence, these apps are great choices.

Conclusion

Low Interest Student Loans: Best Apps For Students

The availability of an appropriate loan application can help alleviate some of the financial burdens faced by students in the current fast-paced educational environment. Considering the factors of interest rates, loan amount, and flexibility, these are the best apps for students:

StuCred: Offers a student-friendly approach with competitive interest rates, a quick approval process, and flexible repayment options. Perfect for students who need financial support without the burden of high-interest rates.

KreditBee: A good choice for larger loans (for students) within the range of ₹5 lakhs, KreditBee offers loans with interest rates ranging from 0% to 29.95% (within this range, based on eligibility). It also promises quick loan approval with minimal documentation required.

mPokket: mPokket allows students quick access to very low-interest loans. Loan amount: ₹500 to ₹45,000. Loan application process: Straightforward

Pocketly and Cashe: For students seeking instant, but relatively small, loans, these apps may be worth considering. They offer a simple repayment schedule and competitive interest rates.

Therefore, it is crucial to find the right loan app. Best Loan Apps for Students with Low Interest Rates

Thus, it becomes essential to choose a perfect loan app that can help you with the necessary terms and comfort of repaying at lower interest rates, as the wrong one could become a serious threat to your financial stability. With the right choice, you can finance your education, living expenses, or any emergency without facing daunting debt.

One of the best student features that it has to offer is that no PAN card is required, and the amount will be disbursed to your account in real-time. Instead of wasting your time on paperwork, you can choose StuCred as a flexible option because it provides you with user-friendly services for students. Additionally, it helps students build their credit history, which is beneficial in the long run.

The best platform for you, if you are a student looking to get your finances sorted out efficiently while studying, is StuCred. StuCred ensures that you get an instant loan with the best rates and repayment plans with very little work on your part.

Join StuCred today and experience a world of easy, simple, hassle-free loans that will help you focus only on your studies without having to worry about any financial issues.