Loan App for Students Without CIBIL Score

Due to the fast-paced nature of life in the present day, the importance of becoming a financially independent student is increasing day by day. Nevertheless, many students struggle financially, whether it be for learning materials, unexpected costs, or general living expenses. To obtain a standard loan from a bank or financial institution (FI), you must have a stable credit history and a good CIBIL score. Most students, however, do not have a credit history or a low CIBIL score, which makes securing these conventional loans difficult.

Understanding Why Students Often Lack a CIBIL Score

A CIBIL score is a three-digit number that ranges between 300 and 900, which lenders use to evaluate an individual’s creditworthiness. It is based on information such as credit history, payment patterns, and the amount of money you owe. This is because students have only recently begun their financial journey and generally lack a credit history, which results in a low or zero CIBIL score. To make this score more comprehensive, students in India have even fewer choices when it comes to credit, and the system of building this critical score over time.

Most traditional banks and financial institutions rely heavily on credit scores for loan approval, leaving students without a CIBIL score ineligible for many loans. The absence of options is often a substantial hindrance, particularly when there is high demand for funds, whether for pursuing academic fees, meeting day-to-day needs, or overcoming sudden financial crises.

The Limitations of Traditional Loans for Students with No Credit Score

Traditional Financial Institutions, In Most Cases, Rely On Credit Scores, Which Limits Borrowing alternatives for Students. CIBIL scores help banks and lenders measure the probability of repayment. Students without this score do face a multitude of challenges, including:

Increased likelihood of rejection: Students with no credit history have a higher probability of having their loan applications refused, as banks typically prefer borrowers with an established credit history.

Collateral or Guarantor Unemployment Loans: Certain financial institutions require that the loan be secured by collateral or accompanied by a guarantor. This represents a very significant issue, considering that most students do not have assets to use as collateral or someone else who can co-sign for them.

Increased Interest Rates: Even if students manage to take loans without a CIBIL score, their interest rate is still likely to be on the higher side as they are perceived to be riskier borrowers.

Extended Waiting Periods: A typical loan also has lengthy application and approval processes, which can be frustrating when you need quick money.

Loan Apps Without CIBIL Score: A Solution for Students

To fill this void, numerous loan apps have emerged in the Indian financial market, catering to borrowers with no or poor credit history. These apps provide students with easy access to money, eliminating the strict qualifications typically required by other lenders. They take a more flexible approach, assessing other criteria such as educational qualifications, the applicant’s academic history, or baseline identity verification, rather than relying solely on credit scores.

Loan apps like mPokket, KreditBee, StuCred, and PaySense have made things easier by bringing the application process online, offering instant approval for students. Students can access these funds quickly through a direct digital application process that requires minimal documentation and no credit bureau (CIBIL) score. This accessibility is essential for students who may not have a financial record yet and find themselves in need of borrowing money, whether to fund their academic or coursework fees, high living costs (especially for international students), or personal expenses.

What to Expect from This Guide on Student Loan Apps Without CIBIL Score

This article serves as a guide for students on loan apps that do not require a CIBIL score. In this guide, we will:

A list of student-specific loan apps will be shared, along with essential features, unique benefits, and specific requirements for each.

Understand Eligibility Criteria and How to Apply: Here, you will find the basic eligibility criteria and the required documents, along with the adoption process through these apps.

Discuss the Advantages Loan Apps Have Over Traditional Loans: We will explore the benefits that loan apps provide to students, including high flexibility, quick approval, and reduced documentation.

Offer advice for responsible borrowing: Financial literacy is crucial when using loan apps. This guide shares practical tips to help students make informed borrowing decisions.

You will learn how these loan apps work, what the different options are, and how to select the best loan app in this article. A CIBIL score is no longer a cause for nightmares with loan apps for students that help you tackle personal finance responsibilities in the simplest way possible, as needed. If you need money to further your studies, handle an emergency, or just require a short-term cash injection, try out these apps that work as a simple and easy alternative way for students who may not necessarily be able to find loans with other providers.

Can Students Get Loans Without a CIBIL Score?

The most significant hurdle facing students starting on their financial journey is accessing credit when they have neither a CIBIL score nor a track record of repayment. Most traditional lenders heavily weigh the notion of credit score when assessing an applicant; hence, students (who rarely have a CIBIL score) will not be able to obtain a loan from banks or large institutions. The growth of digital financial services has also paved the way for alternative lending options where students can avail of a loan without the need for a CIBIL score.

Explanation of CIBIL Score and Its Role in Loans

In the Indian financial world, a CIBIL score is an essential factor in determining an individual’s creditworthiness. The three-digit score, which indicates your creditworthiness and ranges from 300 to 900, is generated by one of India’s largest credit bureaus, the Credit Information Bureau (India) Limited (CIBIL). It scales the score by taking into account things such as:

Credit history: How past debts have been paid off by an individual.

Credit utilization refers to the ratio of credit you are using compared to your overall available credit limit.

Length of credit history: The Amount of time someone has had credit accounts.

Credit mix refers to the various types of credit accounts, including credit cards and loans.

Generally, a CIBIL score of 750 and above is considered ‘good’ by nearly all lenders, making it the most suitable for obtaining loans or financing with favorable conditions. Lenders find this score reassuring because it indicates that the borrower has a history of responsible credit management, thereby increasing their likelihood of repaying the loan as agreed. As a result, ensuring the CIBIL score is low or non-existent can lead to the borrower being perceived as a risk by lenders, which may result in rejection of the loan application or the offer of loans at high-interest rates with strict terms.

Why Students May Not Have a CIBIL Score

A few common reasons why students do not have a CIBIL score are as follows:

New to Credit: Students who have not opened any credit products, such as credit cards or loans, cannot demonstrate a credit history.

Untested Borrowers: Most students (most particularly those under 25) have never borrowed before. To scrutinize creditworthiness, CIBIL needs records of past borrowing and repayment, which are non-existent since they have neither borrowed nor repaid.

Lack of Awareness: Most students are unaware of the various ways to build a CIBIL score, such as through a student credit card or a small personal loan.

Relying on Family: Several students continue to borrow from family members and therefore do not benefit from independently accessing credit accounts or loans in their names.

Answering Key Questions

Is It Possible to Get a Loan Without a CIBIL Score?

With the increase in alternative lenders and loan apps that attract young adults and those who are not yet old enough to establish a credit profile, it is possible to take out a loan without a CIBIL score. Instead of credit scores, these lenders assess the potential risk involved in lending to an applicant based on factors such as education level, income source (including scholarships or part-time jobs), and personal information. For example, there are now digital platforms that rely not just on credit history alone to determine the likelihood that a person will repay a loan; these new lenders make loans available to those who have few or no opportunities to build their credit.

Which Loan App Does Not Check CIBIL?

Many loan apps in India have models that give loans without a CIBIL score check. Some of the most common ones include:

mPokket: mPokket is exclusively crafted for students; hence, it does not check the CIBIL score and has gained a lot of popularity (amongst students) because it approves loans on a fast-track basis.

StuCred: Explicitly targeted at students, this app gives instant loans with little documentation.– You do not even need a Credit Rating to avail the loan.

KreditBee: It offers small personal loans and does not rely on a CIBIL score; therefore, it is among the lenders that can provide quick loan instant approval to first-time borrowers.

Navi: Navi is a big company, but they do provide loans to people without much credit history (which makes it accessible for students).

CASHe: One of the most innovative solutions on the market, this app utilizes an exclusive AI-led credit assessment that goes beyond CIBIL and bases its loans on a diverse range of parameters.

Such apps utilize technology to screen applicants based on alternative metrics, and in turn, offer students, irrespective of their credit score, possibly also urgently needed cash.

What Happens if There Is No CIBIL Score?

For students without a CIBIL score, conventional banks may tend to reject their loan applications or impose additional conditions, such as requiring a guarantor or collateral, to offset the perceived risk. On the other hand, an absence of a CIBIL score is no longer as significant a potential roadblock today, with the emergence of alternative lenders. Unlike in the past, most modern loan apps have revised their assessment criteria to allow students to borrow without a credit score. These apps also allow students to learn about CIBIL and, over time, build one if they want to start building their credit history by taking small, easy loans.

Types of Loans Students Can Access Without a CIBIL Score

Even without a CIBIL score, students can access different types of loans. Widely catering to the needs of student borrowers, these loans are designed to meet immediate funding requirements with an easy documentation process.

Personal Loans

There are some personal loan apps for students that do not require any CIBIL score and provide a small amount of money for any purpose. These loans are typically unsecured, have quick disbursal, and can be used for multiple purposes. KreditBee, MoneyTap, and a few other apps also offer students personal loans with a hassle-free process for covering expenses such as tuition fees or emergency costs.

Instant Loans

Among students, the demand for instant loans is generally high. Students have the advantage of apps like mPokket and StuCred for faster loans with much less documentation and quicker disbursal. These are typically small, short-term loans that can be used for day-to-day expenses or to cover unexpected bills.

Education-Focused Loans

Loan apps offer loans specifically designed for students, such as tuition, study materials, or exam fees. Most education loans are traditional loans that require a CIBIL score, but students can now access academic funds directly through apps like mPokket and StuCred without needing a credit score.

To conclude, for students without a CIBIL score, loans remain accessible and obtainable, thanks to forward-thinking digital lenders that rely on alternative credit assessment techniques. Students, too, are now offered an unprecedented amount of freedom and the ability to access funding without the barrier of a CIBIL score, thanks to loan apps specifically designed for student finance.

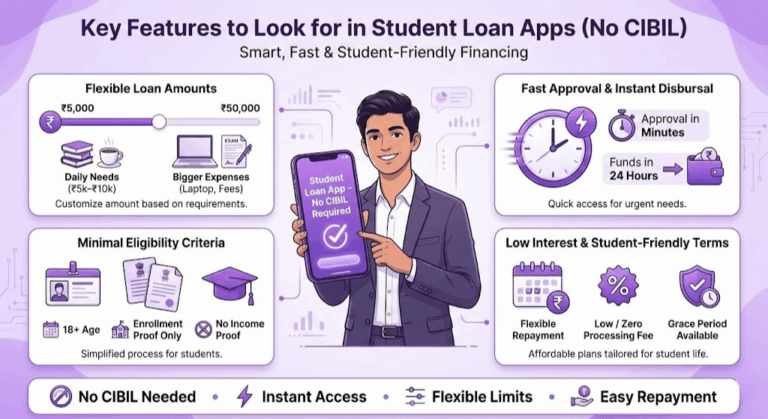

Key Features to Look for in Student Loan Apps Without CIBIL Requirements

It becomes difficult for you to get a loan when you are a student with no CIBIL Score. Borrowing again is easier because of student-friendly loan apps, which offer tailored, flexible, and convenient financing options for students. Now, let us explore some of the features that you should pay attention to when selecting a no CIBIL score student loan app:

Flexible Loan Amounts

Namely, flexibility on the loan amount when shopping for a student loan app. You may pay less, as there are various financial conditions for which you require different levels of funding. Student loan apps often offer amounts between codes, such as ₹5,000 and approximately ₹50,000. This gives students the option to determine how much they would like to borrow based on their current situation, thereby avoiding unnecessary debt.

Small Loan for Daily Needs: Other students come to us for small-ticket loans (₹5,000–₹10,000) to meet their day-to-day expenses, emergency bills, or last-minute academic needs. These are apps such as mPokket and StuCred, which lend a small amount of money that students can repay within a short duration.

Higher Loans for Important Needs: If larger academic-related expenses need to be covered, such as tuition, exam fees, or major technology purchases (like laptops), a loan of ₹20,000–₹50,000 may be necessary. These higher loan amounts are available through apps like KreditBee and CASHe, enabling students to cover significant expenses without depleting their savings.

Customizable Limits: Others allow for more flexible limits, so students can opt in for exactly what they want. This is an excellent way for responsible borrowing, meaning that students do not accumulate more debt than they need.

Students have complete control over what the amount is that they are taking to suit their needs, without creating a financial burden

Fast Approval & Instant Fund Transfer

The most distinctive characteristic of a student loan app is the processing time for both the application and the disbursement of funds. Most of these apps focus on providing quick approval and instant money transfers to help students manage sudden scientific bills or other forms of emergency cash.

Quick Processing Times: Unlike traditional loans, which can take days or even weeks to get approved, loan apps process the applications within a few hours. Some apps, such as KreditBee, mPokket, and Navi, are known for their quick turnaround time; they can even provide an approval within a few minutes.

Quick Disbursal: If you are approved, the apps usually provide your funds instantly or within 24 hours. This instant release proves to be a real boon for students, particularly in emergencies. Nothing is worse than having to wait for cash in hand when you need it the most, but that’s why apps like StuCred and MoneyTap come into play, focusing on quick disbursal.

Simplified online procedure: With all applications and authorizations completed digitally (available on many college student finance programs), you will not be required to visit in person or complete a large amount of documentation. This ease of use is essential for students who may not have the time to fill out complicated loan applications.

Quick approval and disbursement can be the most prioritized feature, as students managing unpredictable expenses need to access funds quickly.

Minimal Eligibility Criteria

Rather than traditional lenders with stringent eligibility criteria, loan apps catering to students often have relatively simple criteria, allowing even students without a CIBIL score to apply. Students can usually expect requirements such as:

Enrolment Verification: Some apps only accept proof of education (such as a student ID or admission letter) to verify that the applicant is a student. Apps like mPokket and StuCred are specifically designed for students and typically do not require proof of income.

Less Paperwork: Compared to a conventional loan, which may require extensive documentation, student loan applications typically require minimal documentation. Identification documents, such as Aadhaar and PAN cards, are usually sufficient. To ease this process for students, you now have apps like KreditBee and MoneyView, which not only reduce documentation but also make it faster.

Alternative credit assessment: Since these apps do not rely on CIBIL scores, most use alternative metrics to assess credit, such as academic history or financial dependency. This method allows first-time borrowers, who have little to no credit history, better access to funds.

Minimum age: The majority of apps for student loans require users to be at least 18 before being allowed to use the app, ensuring that they can legally enter into a loan agreement.

The eligibility criteria are minimal; it is easy for students to apply for and obtain a loan, even if their income is unstable or their credit history has not been established. As a result, these applications appear appealing to students seeking immediate and easily accessible finance.

Low-Interest Rates or Favorable Terms

Interest rates and terms will determine how much a loan is going to cost you. Many student loan apps offer attractive interest rates and flexible repayment plans, making the borrowing process more affordable for students.

Competitive interest rates: for students, some student loan apps do provide competitive rates, particularly those in which repayment is essential within the short term. For student borrowers, Navi and CASHe offer comparably low interest rates, so combining this with easing you through the repayment process should be beneficial. They provide students with opportunities to avail of affordable loans — through these apps, students can obtain a variable rate based on the amount of the loan or the student’s profile.

Flexible Repayment Options: Different reasons, such as financial stability, allow students to opt for repayment tenure options. Short-term loans (1–3 months) may be offered to students who expect to receive their funds soon after they are approved, while others may offer a more extended repayment period (6–12 months). Apps such as LazyPay and StuCred offer customized payback plans that align with students’ cash flow and budget.

Zero or Low Processing Fees: Hidden fees can increase the effective cost of a loan, so to eliminate negative surprises while repaying the loans, some loan apps have zero or low processing fees. Apps like Fibe and KreditBee offer a transparent fee structure, allowing students to borrow wisely.

Grace Period: Compared to other student loan apps, some allow a grace period before repayments commence, which is good news for students who may not have been able to work during their studies. Not all loan apps provide this feature. If a loan app offers it, it is worth exploring.

Low-interest rates or flexible repayment conditions provide students with a way to manage their finances better and reduce the impact of hardship placed by unfavourable loan app terms.

To sum up, students should look for these features when choosing a student loan app with no CIBIL, and also prioritize points like flexible loan amounts, quick approval and disbursement times, and low eligibility criteria, as well as ideal rates. These capabilities are tailored to enable students to access the necessary funds easily and quickly without having to undergo a cumbersome loan screening process. Opting for a loan app that incorporates these key features will empower students to access on-time financial assistance securely and responsibly.

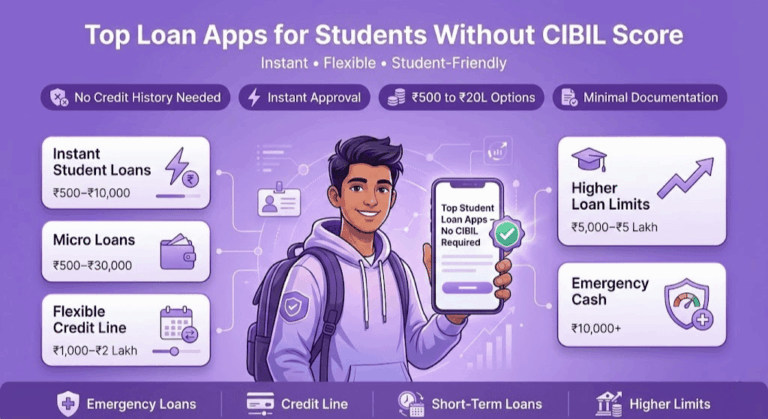

Top Loan Apps for Students Without CIBIL Score

With several loan apps catering to the unique requirements of students who need it most but lack a CIBIL score, they often fail in numerous commercial banks. Forging Multiple Paths to Lending. In supporting their borrowers, these platforms have adjusted their lending criteria to enable young people to obtain funds in a way that does not require a strong credit history or traditional financial documentation. Here are the best loan apps for you to consider, each with features designed to help students in this situation borrow more easily and with less overhead. All of these options are suitable for individuals who do not yet have a CIBIL score.

1. StuCred

It is a loan application that provides small, short-term loans with instant approval, specifically designed for students. It does not require a lot of documentation, and there is no CIBIL check involved; hence, it is very easy for students to avail themselves. StuCred differs from other companies in its offerings, as they are explicitly designed for students, with reasonable loan limits and repayment periods.

Loan Amount: ₹500–₹15,000

Highlights: No CIBIL required, only student loans, quick disbursal

Pros: Good for small purchases or an emergency fund; pays no interest if your balance is paid off before the due date

StuCred treats students like the responsible adults they are.

2. PaySense

PaySense has a simple and easy loan application process for customers, with no CIBIL Score required. Students can apply for loans using minimal documentation, such as Aadhaar and PAN details, through this app. It also provides multiple options for customized loan amounts.

Loan Amount: Maximum ₹5 lakh (higher amounts subject to further documentation)

Top Features: No requirement of CIBIL, most straightforward process for applications and approval

Pros: Flexible EMIs, customisable loan amount, and faster disbursal (good in case of a time-sensitive credit need)

PaySense is a quick and easy way for students to access small to medium loans.

3. CASHe

CASHe utilizes an AI-driven assessment system to evaluate users on multiple parameters, rather than relying solely on credit bureau scores. This app is beneficial for students who have limited or no credit history, as it is based on a person’s potential to repay in alternative ways.

Loan Amount: ₹7,000–₹4 lakh

Highlights: AI-powered credit evaluations, interest-free repayment flexibility, no CIBIL

Advantages: Grants students access to higher loan amounts according to their profile, with flexible repayment options

CASHe follows a modern assessment model that offers students palatable options, including high loan limits and bespoke lending criteria.

4. KreditBee

With no CIBIL requirement for smaller loans, Kreditbee offers quick approval and greater flexibility when it comes to loan amounts for students. This app enables you to access various loan options, including personal loan offers and payday loans. With a digital, hassle-free process offered by KreditBee, students can apply and disburse funds without any qualms.

Loan Amount: ₹1,000–₹2 lakh

Highlights: Instant Approval, Flexible Loan Products, Small loans without CIBIL check

Advantages: Available for short-term or large loan needs with a payment schedule that caters to a student

5. MoneyTap

Unlike traditional student loans, the MoneyTap credit line offers students funds as needed, charging interest only on the portion of the cash utilized. That makes it an excellent choice for students who don’t need the whole loan at once but instead just want the access of a credit line. MoneyTap does not require CIBIL scores for small borrowings, making it more accessible to Generation Y.

Loan Amount: ₹3,000–₹5 lakh

Specifications: Credit line, Easy repayment schedule, No CIBIL score required initially

Pros: Interest is paid only on the drawn amount, so it can help to minimise costs; ideal for ongoing or changing expenditure

The flexible repayment and interest-only payment capability of MoneyTap makes it cost-effective for students requiring financial flexibility.

6. mPokket

mPokket is a student favorite because it is easy to use and made for students. The required documentation is minimal; typically, only a student ID and a valid Indian identification are needed, and a CIBIL score is not necessary. It offers loans between ₹500 and ₹30,000, making it ideal for use when you need small cash for a specific purpose or in an emergency.

Loan Amount: ₹500–₹30,000

Highlights: Disbursal in a few minutes, easy eligibility & student-friendly loan terms

Pros: Repayment time of up to three months, with few documents requested and a low borrowed amount, so there is no risk of over-indebtedness.

mPokket is one of the best choices for students who want to avail instant money with no paperwork, as it offers a quick processing time.

7. Navi

Navi is a quick loan app that can grant you a much larger amount of loans without placing too much importance on your credit score, making it best suited for students. The app is a digital process that ensures expedited approval and disbursements within minutes. The loans are profile-based and do not require a CIBIL score, making them suitable for college students.

Loan Amount: ₹10,000–₹20 lakh

Highlights: A higher loan limit, no CIBIL records necessary at first, and a digital process

Pros: Better for students who require larger loans than can be covered by federal student loans; longer repayment options.

Navi offers loans across a broad spectrum, and the application process is straightforward, making this option suitable for students seeking larger funds to support their academic or personal needs.

8. Slice

Slice is an instant loan app with flexible credit solutions for the young borrower segment. Slice, which is well-known for targeting students and young professionals, has no CIBIL mandate when they apply for a smaller loan, making it easy and fast to obtain funds when handling daily expenses.

Loan Amount: ₹2,000–₹10,000

Highlights: Instant approval, CIBIL-free small loan for students

Advantages: Ideal for microloans and ongoing requirements; offers flexibility in repayment

With a simple app and smaller loan amounts, Slice caters to students seeking short-term financing that won’t strangle their budgets.

9. Pocketly

Pocketly is built to offer micro-loans, making it an ideal fit for students as well as budget-travelers who need money in small amounts with flexible payback terms.» Its user-friendly interface and rapid approval process meet the pressing financial needs of students without requiring extensive documentation or a CIBIL score.

Loan Amount: ₹500–₹10,000

Advantages: Released immediately; ideal for small amounts of money

Pocketly also offers micro-loans in India, allowing students to access funds of up to ₹10,000 instantly.

10. Dhani

Dhani is one of the most widely used loan apps, which also provides loans without a credit score. Hence, it becomes very easy for first-time borrowers and students to obtain a loan from here. The loans range from small to moderate in amount and may be rapidly administered as needed via a streamlined process. It has unique features, such as zero-interest loans for early repayment — Dhani also offers these.

Loan Amount: ₹1,000–₹15,000

Highlights: No requirement for CIBIL, interest-exempt repayment choice, smooth cycle

Pros: Ideal for small, regular purchases; helps you pay off your balance sooner.

That is why, at Dhani — with its convenient application process and flexible terms — it is tailor-made for students looking for quicker yet economical financial solutions.

These loan apps offer various features to meet the financial needs of students, and a CIBIL score is not required. The app features everything from small emergency loans to flexible credit lines, allowing students to explore their options and determine what is right for their needs in terms of borrowing and repayment ability.

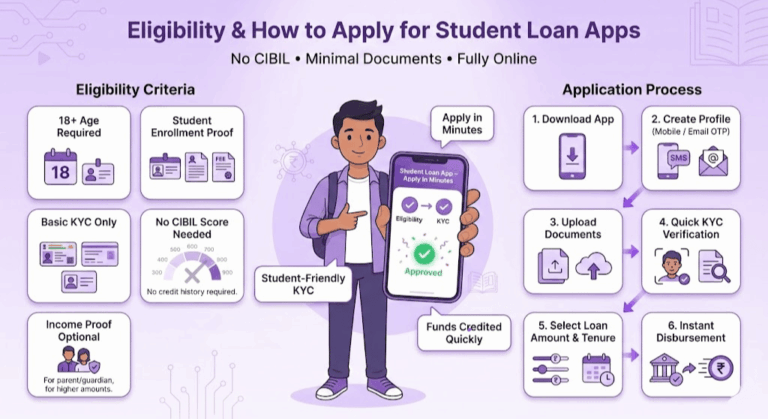

Eligibility Criteria and How to Apply for Student Loan Apps

To make it easier for young borrowers who don’t yet have a credit score or extensive documentation to obtain a loan, many of these apps also feature straightforward eligibility criteria and application processes. Here is everything students need to know about the eligibility criteria and basic steps for applying for a loan through these student-friendly apps.

Eligibility Criteria for Students

In general, student loan apps have standard criteria, making it relatively easy for students to qualify.

Criteria of Age: Most loan apps give lending to students up to the age of 18, as legal entry into financial contracts is only when a person turns 18 in India. And in some cases, the age requirement may be higher at 21 years old (this is based on the loan amount and terms).

Documents: Generally, Documents like Aadhaar and PAN cards are required for identification purposes. However, if students do not possess a PAN card, a few apps, such as StuCred and mPokket, can accept alternative documents instead.

Proof of Enrollment: As these loans are intended for students, individuals may need to provide evidence of their current enrollment status. They typically accept documents such as:

A valid student ID card

An admission letter

Recent fee receipts

Simple KYC process: Most apps will have a straightforward KYC verification process, which is often conducted online. This could be in the form of a selfie to verify identity or a digital copy of their ID.

Proof of Income or Guarantor (if needed) — As most apps do not require evidence of income, some may want to verify that the borrower is financially well-positioned or has a co-signer if they wish to request a higher loan amount. Though apps like KreditBee and Slice do not ask for income proof there is always an upper limit on the loan amount up to which you can avail of a loan without income proof, however, this limit very often gets waived off for lower loans which means students without income proof can easily avail low-value loans with these apps.

Zero CIBIL Score: These loan apps are ideal for individuals with no credit score, as they offer loans without requiring a credit score. They do not use CIBIL checks; instead, they conduct your assessment using alternatives like student profile, academic records, etc. (in some cases, social media data)

Application Process Overview

Loan applications that can be done entirely online and are relatively easy to make at a student-loan-friendly loan app. How to Apply: A Step-by-Step Guide, with Advice on Loan Applications for Students New to Borrowing

1. Download the App:

Download the loan app of your choice (mPokket, KreditBee, StuCred) from the Google Play Store or Apple App Store based on your device.

Download the app only if you are certain that the version is genuine (check for reviews and the source).

2. Create a Profile:

Sign Up With a Mobile Number or email address. You may need to verify your identity via OTP (One-Time Password) sent to Your Mobile Number.

A few apps, such as Stucred and mPokket, allow you to register without a PAN card, which helps students who do not currently have one to apply as well.

3. Submit Minimal Documents:

Uploading essential documents as asked (Like: Aadhaar, student ID)

Aadhaar and college ID would suffice, provided the apps do not require CIBIL or PAN card details.

KYC (Know Your Customer) verification — this may require you to take a selfie for some apps.

4. Complete KYC Verification:

The vast majority of loan applications have a fast online Know Your Customer (KYC) process. Typically, you will need to scan and upload your ID documents, as well as a live selfie, via a photo or video report.

KYC verification is completed in minutes to a few hours, allowing you to proceed with the loan application almost immediately.

5. Select your amount of money and payment plan:

Select the loan amount you want, as per the limits set on the app after your Know Your Customer (KYC) verification is complete.

Evaluate the repayment conditions and ensure they align with your current financial situation.

6. Receive Disbursement:

Once the loan has been approved, the money is often released to your account in minutes or hours. To speed up this process, many apps have integrated UPI or direct bank transfers.

These student loan apps help students access funds without a credit score or cumbersome paperwork, as the eligibility requirements are minimal, provided you are, of course, a student. This is how they can apply for a loan that meets their financial requirements.

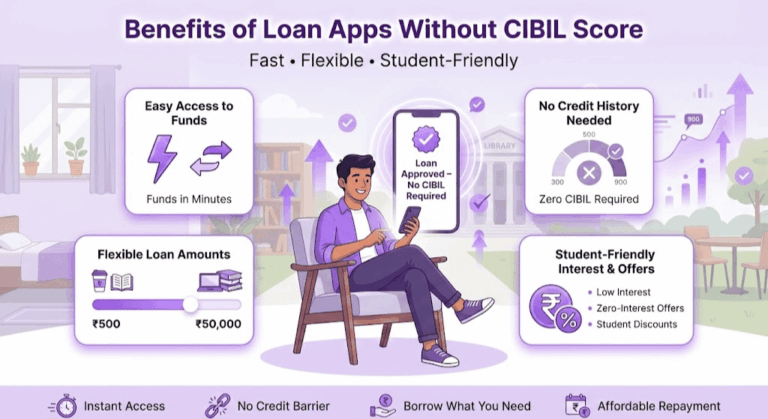

Benefits of Using a Loan App Without a CIBIL Score

Loan apps that require no CIBIL score prove to be a boon for students in financial instability. These apps fill the void of young borrowers who lack financial history, providing flexible products that are accessible, meet students where they are, and serve their needs. As a result, below are the core advantages of these loan apps.

Easy Access to Funds

Easy access to funds is a significant reason these loan apps are popular among students. Traditional loans can take a long time to get approved, but these loan apps offer the quickest and easiest way to apply online. Students are approved and funded in minutes to hours after submitting simple documentation. This immediacy is vital for students, who often face unexpected costs – whether for educational supplies, rent, or emergency expenses. The axiom funds that are on demand, a few minimal income and credits, will ensure that students will not be broke.

No Credit History Required

Most students have not yet established a credit history or a CIBIL score, which banks and traditional lenders often require. These loan apps leverage alternative parameters, such as student ID and current study status, to disburse funds without a credit score or with very basic Know Your Customer (KYC) verification. This mechanism is particularly beneficial for young borrowers, as it allows them to access funds without facing actual credit scoring barriers. Moreover, this can also be the beginning of a line of credit and prepare them for taking on other financial obligations.

Flexible Loan Amounts for Short-Term Needs

Student loan apps provide the option to avail of only the amount required, with loan amounts typically varying from as little as ₹500 (minimum) to more significant values, such as ₹50,000 (maximum), depending on the app and the student’s profile. Such flexibility will be beneficial for students who require only small loans to fulfill specific short-term goals. Instead of taking out larger, lump-sum loans as conventional lending institutions typically do, such apps allow students to borrow only what they need at the time.

While services like StuCred and mPokket allow students to borrow smaller amounts for cash inflow related to routine expenses, apps like PaySense and KreditBee can also offer larger denominations that can be put towards major educational expenses or personal expenses. This adaptability enables students to avoid unnecessary debt and helps them manage their finances more effectively.

Low-Interest Rates or Student-Focused Offers

Several loan apps offer favorable terms for students, including reduced interest rates and exclusive savings tailored to the youth market. Although interest rates may differ from platform to platform, some apps, such as StuCred and Pocketly, also offer a zero-interest repayment method, where you can pay back the loan in advance or on time. Then there are other apps, such as mPokket, which offer the first few loans at a lower rate and even student-specific discounts to ease the financial burden on students.

These offers make these loans more economical for students, reducing their overall cost and ensuring students can settle them without excessive financial strain. This is particularly beneficial for students with very tight budgets, as it provides them with an opportunity to manage debt responsibly and develop solid repayment habits, thanks to lower rates and more flexible repayment terms.

Conclusion

These student loan apps are specifically tailored for students, offering fast funds, lenient repayment terms, and no credit check. These apps provide students flexible options for affordable loans, making them accessible and allowing them to focus on their education and growth without the immediate pressure of financial burden.

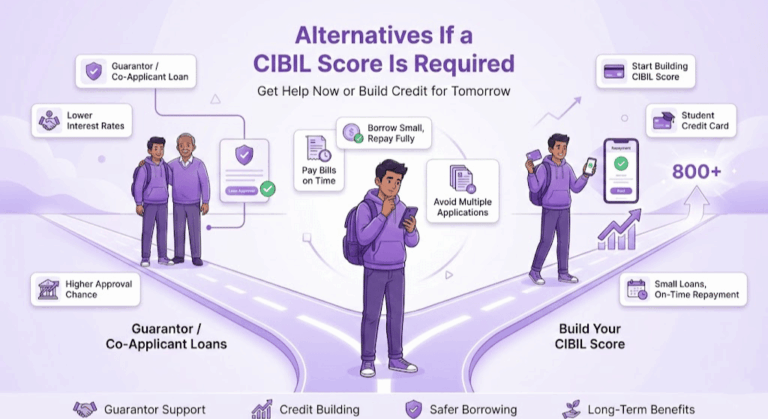

Alternatives if a CIBIL Score Is Required

In such cases, there may be instances when a loan application fills up the CIBIL score column, and students are unable to fund themselves. Here, you need not worry, as there may still be ways to start building your credit history. Where options like guarantor-backed loans or co-applicant loans can help students gain access to funding via traditional markets, a few early moves towards establishing a CIBIL score can open financial doors down the line.

1. Loans with a guarantor or co-applicant

If a student does not have a CIBIL score, they can apply for loans that offer a guarantor or co-applicant option. In these cases, a parent or other relative with a good credit history can assist the student in getting a loan as a cosigner or guarantor. That extra layer of security gives lenders the confidence to grant the loan on this basis alone, even when the primary applicant (the student) has no credit history.

How It Functions: A person who signs the loan as a guarantor or co-applicant can be considered to act as a borrower, but they will also be required to repay in case the student fails to do so. Having someone responsible on the hook can enhance the strength of the application and, in some cases, enable a student to secure a larger value or a less expensive loan than they might be able to obtain without assistance.

Benefits for Students: The presence of a guarantor or co-applicant enables students to access traditional personal loans or education loans with defined repayment schedules and lower interest rates compared to instant loan apps. It could also provide students with an opportunity to learn firsthand the fundamentals of loan repayment and budgeting in a controlled environment.

Considerations: Students should be cautious about taking out a loan with a co-applicant — if there are any missed payments, it will also impact the credit score of the guarantor. It is ideal for consistent earners, so if you have a part-time job or a regular stipend coming in, this path could be the smartest to take (so that they pay up on time).

2. Steps to Start Building a CIBIL Score

For students who want to bolster their CIBIL score over time, starting early can have a considerable impact. Ways for Students to Start Building Credit, No Matter Where.

Getting a Student Credit Card

There are several banks that offer credit cards specifically designed for students, with lower limits and less stringent eligibility requirements compared to regular credit cards. If used responsibly, a student credit card can be a valuable tool for building credit over time.

Why This Works: Making small purchases and paying them off on time every month helps establish a credit history. Regular repayments demonstrate financial responsibility, which positively impacts the CIBIL score.

Important Tips: Students must charge only essential items on the card and always pay the full balance each month to avoid interest charges. Over time, a low utilization rate (less than 30% of the credit limit) can also yield good scores.

Repaying Small, Short-Term Loans

Students can also build a CIBIL score by borrowing and repaying small, short-term loans through trusted loan apps or financial institutions. These short-term loans typically have simple eligibility criteria and can effectively prove your worth as a borrower.

How It Works: Borrow small amounts and never miss a repayment — students prove to lenders they are capable of repaying debt responsibly. Over time, this will lead to the disbursal of a loan with no negative status in the CIBIL score, and subsequently, access to larger loans becomes available for such loan holders.

Best Practice: Students should only borrow what they can realistically pay back without delay. For instance, apps like StuCred and Pocketly offer small-ticket loans, sufficient for short-term use case scenarios, and serve as a practical entry point into credit.

Other Financial Habits to Build Credit

Automated Bill Payments: Making constant, timely payments on bills or subscriptions (such as mobile phone bills) may not significantly impact your credit scores, but they can help establish a positive financial pattern and establish good credit credentials.

Avoiding Multiple Loan Applications: A haphazard approach with numerous lending requests within a brief timeframe can be disadvantageous to one’s credit ranking. The Bottom Line: Focus on paying off one loan effectively, rather than juggling multiple debts.

Students can be more proactive when applying for loans that require a CIBIL score and instead, explore options like a guarantor loan or take early steps to build their credit. These options enable students to gradually establish financial credibility, which in turn opens up a wider range of financial products for them as they lay an essential foundation for credit early on.

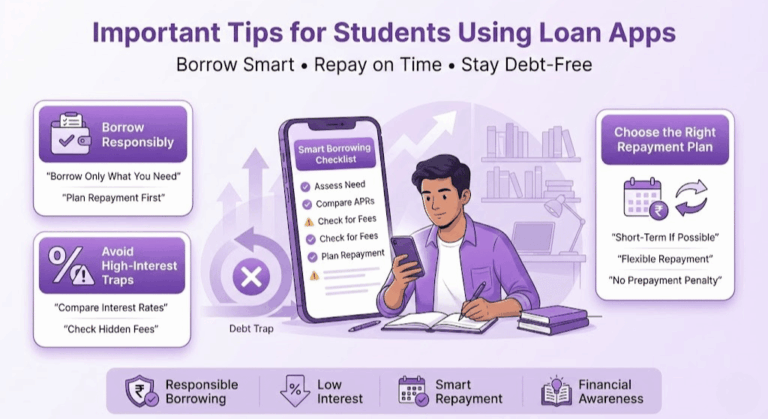

Important Tips for Students Using Loan Apps

While loan apps can be helpful for students who need to borrow money for their education or personal expenses, borrowers should only proceed if they have a clear plan. They contain crucial elements on how to borrow wisely, explore the right repayment terms, and steer clear of any quicksand of high-interest debt.

1. Responsible Borrowing

Students mustn’t over extend themselves when borrowing money, as maintaining a stable financial situation can be crucial, especially for first-time borrowers who are also learning about credit for the first time. Here are some best practices to remember:

Don’t borrow more than you need: It can be tempting to take out a larger loan when a loan app gives you higher numbers, but creating debt you don’t need will lead to struggles down the line. Think about how much you should borrow to ensure you have enough to spend on immediate necessities like study materials, fees, or whatever else is needed.

Think Ahead to Pay Back: Always have a plan for repayment before taking out this loan. In other words, calculate how much you can afford to save, whether it be because you work part-time or have an allowance, so that this money does not impact your day-to-day budget each month on the loan repayments.

Set a borrowing limit: Determine on your own how much debt you’d like to take on. It depends on your anticipated earnings, repayment capacity, or how long you intend to maintain the loan. Having a budget helps avoid falling into the debt trap.

2. Avoiding High-Interest Loan Traps

Interest rates and other related fees are crucial factors to consider when selecting a loan app. However, with high interest rates also comes the risk of a debt trap cycle, so use with care.

Compare Interest Rates Across Different Apps: Not all loan apps offer equal interest rates. Certain apps provide variations for students with lower interest rates, whereas others charge incoming college graduates high-interest cash loans for short-term use only. Always check rates on several different apps before choosing one to use.

Look for Hidden Fees: Apart from interest, also check if there are any hidden charges, such as processing fees, prepayment penalties, and late fees. There may be other charges that some loan apps don’t disclose, which can become very costly. Make sure to read the fine print so there are no surprises.

Choose Apps With Offers for Students: Many apps, such as mPokket and StuCred, focus on students, so they should offer them lower rates or more flexible repayment terms. Selecting these options can help you avoid a high-interest debt trap, as these apps are designed with student budgets in mind.

3. Choosing Repayment Options Wisely

Choosing the right repayment plan is crucial in debt management. Especially now that student loan repayment is set to restart soon, opting into a better-targeted income-driven repayment plan may provide some much-needed relief for borrowers. In this post, borrower advocate Patricia A. Payette shares tips for selecting a repayment option that matches your situation:

Choose Shorter Repayment Terms If You Can: While longer repayment terms can reduce the monthly payment, they also increase the overall interest paid. If you have a consistent income stream or expect to receive money shortly, a short-term loan can also be more economical in the long run.

Opt for Flexible Repayment: Certain loan apps, such as StuCred and KreditBee, offer flexible repayment schedules that allow you to pay back at your convenience or even close the loan early without incurring any penalties. Look for apps that enable you to do this, allowing you to make changes to your payment based on your cash.

Watch Out for Grace Periods and Penalties: Many loan apps offer a grace period before the fee is due, which is particularly beneficial for students waiting for their funds to arrive. However, always ensure that late payments and missed deadlines do not incur a penalty. Being certain you can make payments on time helps avoid late fees and keeps your credit history from being tarnished.

Conclusion

It means that students should use loan apps responsibly, take the time to analyze interest rates, and determine the most manageable field of study along with a loan repayment option, so that they do not put their financial well-being at risk. Not meant just to solve short-term problems but also promote good financial practices that will last long after students graduate.

Frequently Asked Questions

You will have several questions related to the process involved with student loans and loan applications, including who can apply for them and what you can do with them to alleviate your financial crisis. We answered some of the most common questions below to help students along the loan application path.

There are various loan apps targeting students, and those with no credit history who need to provide Know Your Customer (KYC) information can also obtain loans using other parameters, such as income and whether they are studying. Loan apps without a CIBIL score. Additionally, mPokket, PaySense, and KreditBee are also available, offering loans of ₹5,000 – ₹50,000 without a CIBIL score. However, the amount of loan that you are eligible for will differ based on your financial profile and the terms of the app.

Check the eligibility requirements (like education level, age, and student status) before you apply, as well as that your other documentation – like a student ID or other proof of enrollment – is in order.

Taking a ₹2 lakh loan without a CIBIL score is difficult but not impossible. However, stricter eligibility criteria will apply when it comes to obtaining a sizable loan, such as ₹2 lakh. However, here are a few things that these loan apps may consider while offering higher amounts without a CIBIL score:

Consistent household income (from part-time jobs, internships, or financial support)

Someone with a good credit history, e.g., a co-applicant or guarantor.

Credentials of either academic or employment nature that assure lenders that you will be able to pay back

However, if you can’t obtain a high loan amount through a loan app, consider checking with a traditional bank or institution that offers larger sums, such as those that require co-signing or a guarantee.

While most loan apps are safe to use, it is essential to choose reputable and well-established platforms. Find registered apps with positive user reviews. Apps such as PaySense, CASHe, and mPokket are safe because they fall under the ambit of laws governed by the RBI for lending businesses and cover themselves with terms and conditions.

Before you use any loan app, make sure of the following:

License and Regulations: Check if the app is licensed by the appropriate financial authorities in India, such as the RBI or other financial regulatory bodies.

Data Privacy: Ensure that the app has strong privacy and data security policies in place to protect you and your information.

Clear Terms: Read the terms of interest rates, fees, and repayments before borrowing from apps.

The repayment terms for student loans vary based on the app, but most loan apps provide flexibility according to students’ financial circumstances. Repayment terms you can expect include:

Short-Term Loans: Repaid in 15 to 30 days, these are perfect for emergencies or small expenses.

Flexible Terms: A majority of apps, like Pocketly and KreditBee, let you select your preferred repayment plan. Your payment frequency can be commonly customized to suit your needs, whether it is weekly, bi-weekly, or monthly.

Grace Periods: Some applications offer grace periods, allowing students to make their repayment a few days late without incurring additional fees.

Interest-Free Deals: If the loan is paid off early or within a specified period, many student loan apps offer interest-free repayment options, allowing you to save on interest fees.

Student loan apps typically offer fast approval, and many disburse loans within just a few hours. Once you apply and submit the required paperwork, bank loan approval and disbursement of funds can be done in 24 hours or less. While certain apps, such as PaySense and MoneyTap, aim to provide loans within a few minutes of approval, enabling instant disbursements, this can be particularly beneficial for students in need of quick cash.

However, it may take longer, as indicated by the app, loan amount, and document collection process. Before taking a loan, always check the estimated disbursement time.

So, if you are in an urgent situation where you need ₹20,000 immediately, several loan apps can help you obtain your funds quickly, even if you don’t have a CIBIL score. Various applications, including StuCred, mPokket, and Moneyview, offer personal credits and microloans to students for Rs 500–50,000. To ensure rapid approval:

Complete Your Profile: Submit your student ID, proof of enrollment, and any documents requested.

Choose Apps with Quick Disbursal: Opt for apps that provide funds within a short notice, typically within a few hours or the same day.

Look for Instant Loan Features: If you ever need an instant loan with proper documentation, some apps may offer this feature. Always look for it.

Make sure you borrow wisely and are capable of repaying the loan on time to avoid being penalized or charged high interest rates.

Most traditional banks and lenders demand a CIBIL score before providing personal loans because they consider it while calculating your capacity to repay the loan. However, many student and young borrower loan apps do not require a CIBIL score as part of the approval process. They consider various data points to assess loan applications, beyond traditional credit scores, including parameters such as income, educational status, and even Know Your Customer (KYC) details. There are apps like StuCred, KreditBee, and MoneyTap that offer personal loans with low or no CIBIL checks, which is particularly helpful for students who have no credit history at all.

For more significant loans with a bank, consider applying with a co-applicant who has a high credit score or establishing your track record first.

You may not even need to obtain a PAN card to apply for loans through certain app companies designed for students. However, some apps, such as StuCred and PaySense, may also accept alternative documents, including an Aadhaar card or enrollment proof from the institution. However, remember that due diligence standards vary between each app, and some apps may still require a PAN card number as part of their Know Your Customer (KYC) process.

Most of these apps verify eligibility based on proof of education, income (if applicable), and a valid identity card; hence, students are still in the early stages of their credit journey at 18. These apps target younger borrowers, who may not have a CIBIL score yet and are thus ideal for someone looking to be funded immediately (like StuCred and KreditBee).

Since there is no CIBIL score against which these loan apps without CIBIL checks work, generally, they evaluate your eligibility based on other criteria like —

Proof of education: You must be registered with an approved educational organization.

Income/Allowance: Many apps take the income from part-time jobs, scholarships, and money received from family into consideration for your ability to repay.

KYC Documents: For identity verification purposes, documents such as bank statements, Aadhaar card, student ID, or other similar documents may be requested.

These alternative assessments enable lenders to assess your creditworthiness without relying on a traditional credit score.

Yes, there are a few loan apps that allow you to do that. Rather than relying on your credit score or history, these apps assess your financial situation to determine if you can afford to pay back the loan. They offer loans targeted at students who have little or no credit history, using apps such as Pocketly, StuCred, and MoneyTap.

Most loan applications require a valid bank account so that the amount can be disbursed to your bank account accordingly. However, instead, it will be possible for some apps to disburse funds to a digital wallet or another form of payment. Most often, you need a bank account to apply — it helps make sure that the loan is transferred safely. A bank account is also required to manage repayments.

Failing to pay off your loan on time may result in incurring a penalty, which includes being charged late fees or a higher interest rate. Even apps KreditBee and MoneyTap also report your repayment history to credit bureaus, which would impact your credit score shortly. To prevent yourself from these kinds of penalties, always be sure to adhere to the repayment schedule or choose an app that provides flexible options for repayment.

However, even if you have a poor CIBIL score, some apps do not rely on traditional credit scores and instead approve or disapprove loans. Instead, these apps use additional factors, such as your income, education, and overall financial profile. Navi, Slice, and Moneyview are some apps that offer loans without checking a CIBIL score for individuals with bad credit.

Most student and youngster loan apps are just as free from a credit price tag. These apps assess your suitability using non-traditional measures, including educational qualifications and income from side businesses. Apps like StuCred, mPokket, and FlexSalary offer loans without requiring a credit history or CIBIL score.

The following documents may be needed when you apply for a loan without your CIBIL score:

Identity Verification: Things like an Aadhar card, passport, or voter ID.

Proof of Enrollment: A student ID card or ceremonial letter from your University.

Bank Statements: New records for income verification (if applicable).

Address Proof: Utility bills, rent agreements, or Aadhar card for address verification.

Always check the document checklist for each app before applying, as requirements may vary slightly from app to app.

Most loan applications provide some flexibility in the payback schedule. If you fail to repay the loan on time, apps such as StuCred or Navi may offer an extension in exchange for a nominal fee or a grace period before payment is due. Nevertheless, that should be done before the due date by contacting customer support to come up with a solution. Another note we have for you is to always pay on time, as this will save you from incurring extra charges that could damage your finances.

Show Consistent Income: Have a part-time job or some financial stability that indicates the capability to pay back

Complete Documentation: Ensure that all your KYC documents, proof of education, and any other requested details are provided.

Use a Co-Applicant or Guarantor: Some apps require you to apply with co-signers, which may help with approval.

Depending on the app and your eligibility, student loans will generally range between ₹5,000 and ₹50,000 from loan apps. Although mPokket and other apps might offer you a loan of ₹5000 or less, CASHe/PaySense can provide you with far better offers of amounts up to ₹50,000 if you have a steady income or a co-applicant.

Yes, but many loan apps provide an education loan without a CIBIL score. This type of loan is intended for educational purposes, such as tuition fees, study materials, and hostel fees. Student loans, such as those offered by StuCred and MoneyTap, which do not require CIBIL checks, can help you pay for your education.

Conclusion

To sum up, loan apps without a CIBIL score act as a boon if you are a student who has no credit or very little to leverage. Equipping students to respond to their short-term financial needs, few apps on the market allow students to access funds needed for education, emergencies, or personal expenses at a very competitive rate. From books to your tuition fees, some apps lend you money without the need to check a CIBIL score, be it small or big.

Loan apps such as mPokket, PaySense, StuCred, and MoneyTap offer skip CIBIL score lending, verifying data such as enrollment register number with college, proof of income (if applicable), and proof of identity. Such flexibility has made these apps a blessing in disguise for students who have unique ways of managing their finances during their studies in India. With instant loan availability, even without a credit history, students can prioritize their education without constantly worrying about money.

Reiterating the Benefits

A central selling point of these kinds of loan apps is speedy approval and disbursal, with students receiving money in as little as a few hours in some instances. These apps can be a crucial lifeline for students who lack a reliable source of income or an established credit history. Moreover, the low eligibility criteria and flexible repayment maximum periods, within which you can pay them back, are precisely what a young borrower needs, being at the beginning of their financial life.

Through these apps, students can avail of bankrolls between ₹500 and ₹50,000, depending on their requirements and the respective app. If you are looking for a short-term loan to meet an emergency or a much bigger one that could cover all your tuition fees, there is no shortage of loan app options available to meet your needs. The apps also include student-friendly features such as low-interest rates, which contribute to a manageable loan repayment process.

Encouragement for Responsible Usage

However, don’t forget that loan apps can be convenient, but you also have to use them responsibly. However, taking out more than what you require or not paying it back on time results in excess debt and penalties, as well as affecting your creditworthiness for the future. Please ensure you are aware of the terms and conditions before applying for a loan, and only apply for an amount that you can afford. Capital One offers flexible repayment options, so if you ever start experiencing difficulty making your payments, please reach out to customer service for assistance.

Students should also pay attention to interest rates and the length of loans, making sure to choose an option that works within their budget. Comparing offers from multiple loan apps, followed by reading reviews, can also help you select a reliable and affordable loan provider in Singapore.

Finally, loan apps with no CIBIL score requirement for students serve as a great solution to help them overcome their financial problems. Whether managing study expenses or coping with additional costs, these apps can assist you. But as with any other financial tool, these are not to be taken lightly – use them responsibly and you’ll never worry about golden years. Students can take advantage of these services to establish a solid financial foundation for their future, as long as they borrow responsibly.

As you think of taking loans from loan apps to fund your education or any other personal needs, do keep in mind to stay updated on it, borrow only as much as you can repay, and make use of such loans for improving your financial health rather than burdening yourself more. Approach these apps the right way, and they can be your greatest ally as a student.