Student Loan Without Collateral in India — Complete Guide

A no-collateral loan for students enables aspiring students to finance their tuition, living expenses, and other education-related expenses without having to provide a guarantee by pledging property. These loans are premised on borrower credibility — the student’s admission and academic track record, and typically a co-applicant’s income to be able to repay and credit history — rather than mortgageable collateral. Unsecured education loans can be ideal for deserving students, fresh graduates, or families with no property to take a loan through traditional channels, who are seeking instant financing for domestic courses and overseas study programs.

This post will help you understand such loans, who can apply for them, how lenders make this decision based on risk factors involved, what the standard offerings are at banks/NBFCs/fintech lenders, application process (including interest rates and repayments), maximum amount one can borrow practically, tricks to increase chances of approval, implications of defaulting a payment and the like looking back with hindsight etc. It’s designed for Indian students and parents comparing student loans without collateral options—such as unsecured education loans in India and study loans without a guarantor—so you can apply with confidence and reduce the risk of surprises.

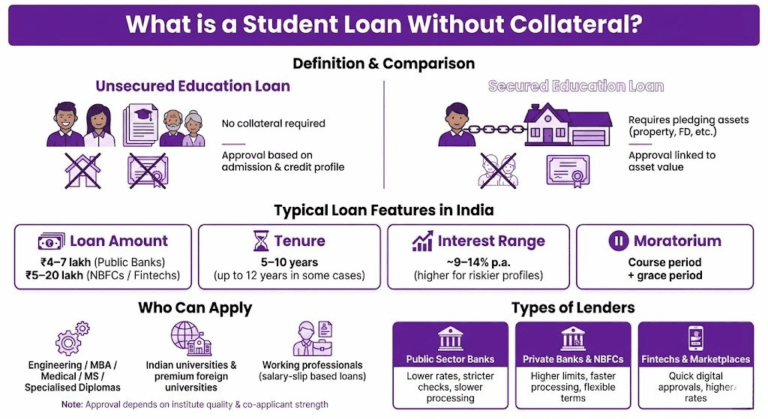

What is a Student Loan Without Collateral?

Definition and how it differs from secured loans

An unsecured education loan, is a form of credit granted without the pledge of collateral such as a house, land, or a fixed deposit. Unsecured loans do not require collateral; the lender can take other measures to recover the defaulted funds. Unsecured credit depends on the borrower’s and co-applicant’s ability to repay, income documentation, and academic/institutional criteria that highlight future repayment potential. Unsecured versions of these loans generally require more robust underwriting and may have lower maximum loan amounts or slightly higher rates.

Standard loan amounts, tenures, and interest rate ranges in India

Loan amounts differ from lender to lender; public sector banks may provide collateral-free loans of INR 4-7 lakh (even higher for top programs), whereas NBFCs and fintech lenders extend loans in the range of INR 5 – 20 lakhs, depending on the applicant’s course, institute and co-applicant’s profile. Unsecured education loans typically have a tenure of 5 to 10 years, with a moratorium period; some lenders can extend the tenure up to 12 years for higher loan amounts. Interest rates are based on lender type and borrower profile: ~9-14% p.a. for well-profiled borrowers with strong co-applicants, and higher for riskier profiles or faster fintech disbursals.

Who is an unsecured education loan borrower?

Run-of-the-mill borrowers are students enrolled in courses (Engineering/MBA/Medicine/MS/Specialised Diplomas, etc.) at Indian institutions and at other high-quality foreign universities. New students with a thin credit history Small chance to be approved if applicant has low income/low credit score. Some lenders also offer working-student graduate loans that verify salary slips and employer details. Unsecured study abroad loans are available for premium universities and students with excellent co-applicants.

Types of lenders that provide collateral-free student loans (banks, NBFCs, fintechs)

Public sector banks (prudent underwriting, lower rates, slower processing) for education loan eligibility in India.

Private banks & NBFCs: higher unsecured loan limits, faster processing + flexible terms for top institutes.

Fintech lenders & marketplaces: fast approvals, digital onboarding, sometimes higher rates but slick UX.

Each type of lender balances interest rate against speed and the maximum unsecured loan cap.

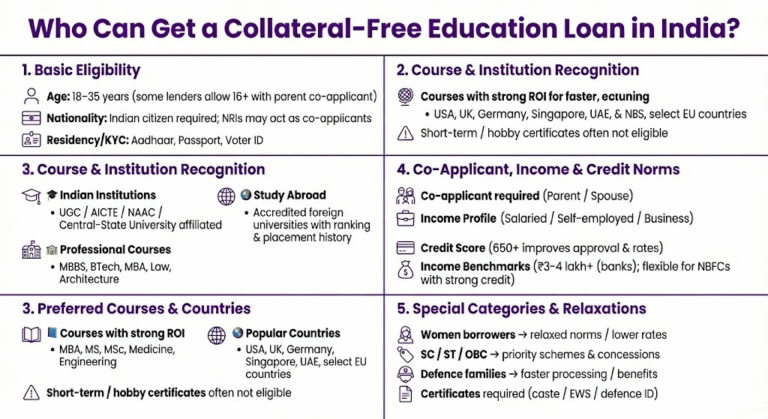

Eligibility Criteria — Who Can Get a Collateral-Free Education Loan in India?

Age, nationality and residency requirements

While most lending institutions require Indian citizenship, some fintech players go a step further by including NRIs (Non-Resident Indians) as co-applicants. Common age restrictions vary: 18–35 years for undergraduate/postgraduate courses; some lenders may offer financing starting at 16+ with parental co-signature. Primary borrowing by NRIs is rare for unsecured loans; typically, at least one co-applicant must be an Indian national. The KYC requires proof of residency (Aadhaar, voter ID , or passport).

Eligibility and course/institute/University Recognition

The lender would prefer that you be admitted to a well-documented, accredited institution. For Indian courses, approvals may be sought under AICTE/UGC/NAAC accreditation or affiliation to central/state universities. For professional courses (MBBS, BTech, MBA), admission proof and seat confirmation are crucial. For study abroad loans, acceptance chances are enhanced by offers from accredited international universities with established placement and ranking.

Favourable study abroad courses and countries

Acceptable courses include degrees, diplomas, professional certifications, and programs with clear career ROI—MBA, MS, MSc, medicine, engineering, law, and architecture, among others—as well as specific vocational programs. Short-term, non-degree or recreation certificates may not be applicable. Popular countries: the U.S., the U.K., Germany, Singapore, and the UAE. Some EU countries. For the highest-tier programs or institutions with strong placement expectations, higher unsecured limits may be available.

Income/to co-applicant/credit score norms

There is an expectation of a co-applicant (usually a parent/spouse) with stable income and good credit.

Acceptable co-applicants: Employees/salaried professionals, Self-employed professionals and Businessmen.

Minimum income requirement: Minimum income requirements differ a lot; while some banks seek at least INR 3/4 lakh annual household (for unsecured loans), NBFCs/fintech underwrite slightly lower incomes if the credit scores are robust.

A CIBIL score of 650+ enhances approval chances; below 650 may raise rates or require better co-applicant’s credit history.

Provisions for women, SC/ST, OBC, and defence families, etc.

Concessions or more relaxed norms are therefore often offered to priority groups: lower interest rates, more relaxed underwriting for women borrowers; schemes from government banks that offer reduced rates or quick processing to SC/ST and OBC applicants and defence families. Proof of identity (community certificates, defence IDs, etc.) must be submitted. Scholarships (funded by the central/state government), along with loans, can help you reduce collateral requirements.

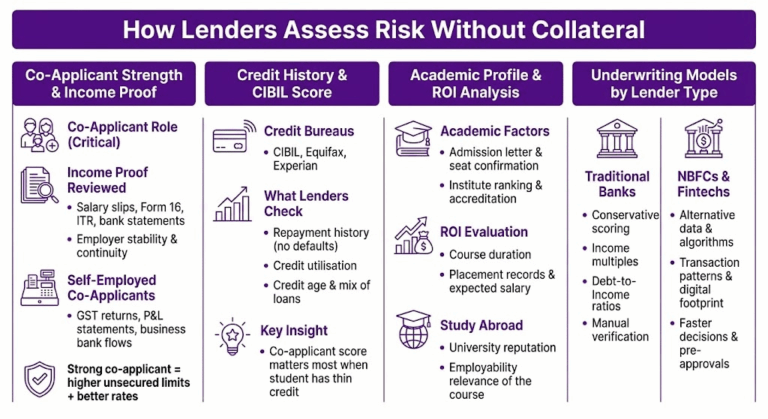

How Lenders Assess Risk Without Collateral

Co-applicant role and Income proof

The co-applicant is crucial when no collateral exists. Lenders review salary slips, bank statements, Form 16, tax returns (ITR), and employer stability to assess a borrower’s repayment capacity. Self-Employed Co-Applicants – Business financials, GST returns, profit & loss statements and bank statement stability will be reviewed when you apply for a home loan. An excellent co-applicant can increase unsecured loan limits and secure better interest rates.

Individual Credit History and CIBIL/India-based credit scores

Information from the credit bureaus (CIBIL, Equifax, Experian) includes repayment history, outstanding dues, and utilisation of a specific amount. A clean history (no defaults, low utilisation, timely EMI records all point to lower risk. Lenders look at credit age as well as the types of credit used. Meanwhile, the co-applicant score matters more when students have a low history.

Academic background, admission letters, and ROI analysis.

Lenders consider admission letters, institute ranking, course duration & probable post-study salary (ROI). As it is, top institutes and professional courses boast strong placement stats, making repayment prospects bright – and it’s the prospect of loan repayments that makes lenders approve higher unsecured amounts. Academia is essential, and the relevance of studying abroad, the course’s relevance to your employability/university reputation are crucial when studying abroad.

Underwriting model and Fintech-only evaluation for each lender

Traditional banks use conservative scoring: income multiples, debt-to-income ratios, and manual checks. NBFCs and fintechs can harness alternative data (digital footprints, transaction patterns, and education history) and proprietary algorithms to assess risk, making decisions more quickly and, in some cases, broadening acceptance of non-traditional co-applicant profiles. Fintechs can also provide real-time pre-approvals through algorithmic credit evaluation.

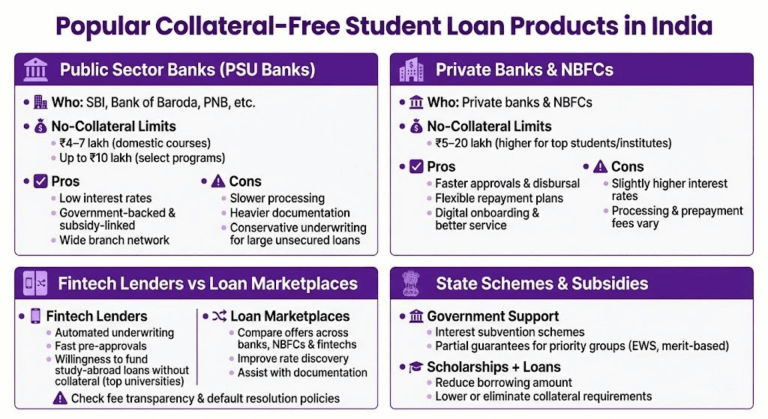

Popular Collateral-Free Student Loan Products in India

Public sector banks- characteristics, usual limits and advantages/disadvantages

PSU banks (SBI, BoB, PNB, etc.) provide education loans at subsidised interest rates to meritorious students and to priority sectors. The no-collateral thresholds are usually quite tight: Rs 4-7 lakh for domestic courses, and up to Rs 10 lakh for specific programmes.

Pros: low interest rates, government-backed schemes, and a branch network.

Cons: longer turnaround times, more documentation and conservative underwriting for unsecured large amounts.

Private banks and NBFCs offer speed, flexibility, and competitive fees.

In the private space (banks and NBFCs such as HDFC, ICICI, and Bajaj Finserv), you get faster processing, more flexible collateral-free limits (INR 5-20 lakh or more for top students), and digital onboarding.

Pros: fast disbursement, personalised repayment plans, and customer service.

Cons: Slightly higher interest rates, processing fees, and prepayment terms vary by lender.

How fintech lenders differ from education loan marketplaces

Fintechs (lenders and aggregators) targeting students use automated underwriting to provide fast pre-approvals, low-documentation processes, and competitive pricing for firm profiles. The marketplaces compare offers across banks, NBFCs, and fintech companies and help improve rate discovery. Fintechs might be more willing to underwrite international study loans without collateral for prestigious universities at higher interest rates. Look for transparency on fees and default resolution.

State schemes and subsidies discourage collateral pledging.

Government-supported schemes (central or state bank schemes, education loan subsidy schemes) may either reduce interest rates for students from underprivileged sections or offer partial guarantees. For instance, interest subvention schemes for merit-based or EWS (Economically Weaker Sections) are examples.

Scholarship Programs: Both the Central Government and some State governments are involved in this; combining scholarships with loans reduces the financed amount and collateral requirements.

Step-by-Step Application Process

List of documents required for the student and the co-applicant

- Student ID/KYC: Aadhaar, passport, PAN or Photo IDs

- Admission proof: Copy of the offer letter, the fee structure and the course duration

- Academic papers such as mark sheets, degree certificates, and entrance score cards

- KYC of co-applicant: Aadhaar, PAN, passport photograph

- Income proof: salary slips(3–6 months), Form 16, last 2–3 years ITR, bank statement (6–12 months)

- Business: GST, balance sheet, profit & loss statement, business registration, etc.

- Proof of residence, statement of purpose (in case of some lenders), fee receipts and cost estimates

How to prepare bank statements, income proofs and academic documents

- Bank statements showing consistent inflows and no excessive overdrafts for 6–12 months.

- Take out salary slips, employer details, and Form 16. For those in business, bring audited statements or accountant-signed financials.

- Keep your admission offer, fee breakdowns, and institute accreditation documents handy. Scan original documents and maintain digital copies to expedite online applications.

Applying online vs in-branch process and timelines

Online fintech/marketplace route: assume rapid form-filling, fully digital KYC, soft credit checks, and instant pre-approval; complete verification is usually available within 3 to 10 working days.

Branch/Bank channel: Fill application, physical doc submission, manual underwriting; two to 10 working days average for loans without collateral.

Disbursement timeline varies based on verification, lien/POA requirements (if any), and institution billing; typically 1-6 weeks after approval.

How to increase the odds of approval before you apply

- Enhance the co-applicant’s creditworthiness; repay any outstanding personal liabilities.

- Guarantees admission in an accredited institute and strong placement/ or ROI data.

- Boost your credit score (pay down cards, limit new inquiries).

- Avoid delays by submitting clear, legible documentation and accurate financial information.

Interest Rates, Fees, Repayment Options and Tax Benefits

Interest rate range of an unsecured loan and the factors that influence it

Collateral-free education loan interest rates are set by the lender, based on the loan amount and the borrower’s profile.

Average Range: 10%–16% p.a. Public-sector banks can offer lower rates for priority groups; private banks/NBFCs and fintechs lend based on risk & speed.

Factors affecting rate:

- Co-applicant credit score and the stability of their income

- Course/college reputation and ROI after study

- Size and term of loan (different spreads may apply for larger amounts or longer terms)

- Total debts and income of the borrower and co-applicant

- Market-linked reference rates and the lender’s own internal benchmark (MCLR/Repo-linked pricing)

Processing fee, prepayment charge and hidden charges to keep an eye out for

Processing fees: Usually 0.25-2% of loan amount; fintechs/NBFCs may levy higher convenience fees.

Prepayment charges: Many banks don’t charge a penalty for prepayment of floating-rate education loans; NBFCs/fintechs may impose a prepayment or foreclosure fee—check with the company.

Hidden costs: Documentation charges, appraisal fees (uncommon for unsecured loans), legal charges, and GST on fees. Always demand a cost breakup and confirm whether the loan amount is charged interest during the moratorium.

Moratorium EMI options, only periods, and Flexible repayment plans

The EMI Repayment Holiday/Moratorium period is the course duration plus 6 to 12 months after course completion, depending on the lender. Lenders may charge interest (which may be capitalised) or offer options to waive interest during the moratorium for subsidised schemes. Repayment options:

- Regular EMI: principal + interest, post moratorium.

- Interest-only while in course and moratorium; pay off principal later.

- Interest Payment in Account: Moratorium (paying interest during study ensures capitalised interest will be lower).

- Seasonal, income-based flexible EMIs for some customers. See whether the lender permits part-prepayments, an EMI holiday, or restructuring.

Section 80E and Section 10(34A) tax deductible – eligibility and examples for Indian taxpayers

Deduction on interest of student loan (Section 80E) Section 80E of the Income Tax Act permits a deduction for the interest paid on an education loan taken by you for higher studies for up to eight years or till the actual interest is paid, whichever is earlier. The loan repayment is not deductible under 80E (may be deductible in other sections under specific conditions).

Illustration: If a parent of a student pays INR 1,20,000 in interest on a loan taken to pay tuition fees, which have already been claimed under Section 80C—INR 1,20,000 can be deducted from taxable income under Section 80E, thereby reducing tax. To obtain and retain interest certificates from the lender, and attach the loan and college information to the tax return.

How Much Can You Borrow Without Collateral? Practical Limits & Funding Gap Strategies

Typical amount range for unsecured loans as per lender type (Banks vs NBFCs vs Fintech)

Public sector banks: ₹4–10 lakh unsecured; higher for high-ranked courses or a strong co-applicant.

Private banks/NBFCs: Unsecured-INR 5–20 lakh depending on profile and institute.

Fintech lenders: INR 2–25 lakh (some platforms even match lenders for larger packages), but they are more expensive. Lenders use caps to manage unsecured exposure; however, high foreign study costs could exceed collateral-free limits.

Utilising partial collateral, the co-borrower’s strength and personal loans

If unsecured caps do not pass muster, try options:

- Second loan option from Pledge fixed deposit (FD/LIC policy) to get a higher loan, even with low eligibility.

- Opt for a stronger co-borrower (two applicants) to enhance eligibility.

- Top-up with a personal loan or an education top-up (shorter tenure, higher cost) for minor deficiencies.

- Arrange the staged payments (based on the fee) to reduce the peak funding requirement.

Other sources of funding: scholarships, crowdfunding, education finance platforms

Scholarships and grants cut loans down – chase after institutional, government and private scholarships.

Institutes and fintech firms offering income share agreements (ISAs) and deferred tuition plans help shift student payments to post-graduation.

Crowdfunding, or peer-to-peer lending, can help raise funds, but again, confirm legitimacy and fees. To minimise borrowing through unsecured, higher-rate loans, you can combine multiple sources.

Improving Approval Odds — Practical Tips for Indian Students and Parents

Strengthening the co-applicant profile and income proof

- Co-Borrower may include a Salaried Parent (steady employment only); the spouse’s income can be used to improve debt-to-income ratios.

- Submission of regular bank credits and Form 16/ITR to reflect income consistency.

- Clear existing liabilities before applying (seek bank dues, close unwanted loans) to ensure repayment capacity is strong.

Raising credit score fast and over the long term

Quick wins:

- Clear all credit card dues to avoid EMI delays.

- 30% credit utilisation and below.

- Do not have so many hard inquiries before applying for a loan.

- Long-term: establish a costless credit history through smaller secured loans, EMIs and regular bill paying.

ROI case presentation: course, college ranking and placement proof

Create a one-page ROI brief: Average salary you expect, placement figures, campus placements and course relevancy.

Append institute accreditation, placement reports and program-specific salary data to demonstrate realistic repayment possibilities.

Negotiation techniques with banks and pre-sanction offers

Bargain for lower interest rates or processing fees by providing pre-sanction letters or comparison quotes from fintech platforms.

Request concessions: eliminate processing fees, provide an interest-only moratorium, or eliminate prepayment penalties.

Take advantage of institutional tie-ups (colleges have relationships with lenders) for better terms.

What Happens If You Default — Risks and Recovery Process

Legal, credit and co-applicant repercussions in India

Defaulting on unsecured student loans also lowers the borrower’s and co-applicant’s credit scores, which can result in higher interest rates or no credit in the future. Many defaulters are reported to credit bureaus; repeated defaults can result in legal notices, recovery suits, and frozen credit limits. The co-applicant is equally legally responsible; lenders can pursue salary/garnishee or asset-recovery measures against the co-applicant.

Lender recovery methods and timeline

First actions: Reminder calls and restructured offers. Failure to make payment will result in a demand notice and subsequent legal recourse, including by way of legal process or settlement negotiations. Timelines obviously differ, but a certain number of late payments (usually 90 to 180) triggers the lender’s official recovery process outlined in its policy.

Restructuring, settlement and rehabilitation options

Lenders may also offer restructuring options such as EMI reduction, tenure extension, moratorium extension, or interest-only repayment to prevent the account from slipping into a non-performing asset.

Settlements (one-time lump-sum settlements) are time-negotiated on partial payoffs of older NPAs. There are also government-sponsored rehabilitation programmes or debt relief schemes available to some distressed borrowers. For those in distress, engaging with your lender early increases the likelihood of a successful restructuring.

Prevention methods and professional counsel from the lender

Preemptive communication with the lender regarding anticipated difficulty. Create a practical repayment model. Request a temporary EMI moratorium. Convert the loan to an interest-only loan.

Checklist Before Signing the Loan Agreement

Key covenants to check (interest rate, prepayment, definition of default)

- Interest reset: Specify whether the interest rate is part-fixed or fixed and the reference rate (MCLR/Repo). Ask how and when rates adjust.

- Prepayment: Check whether prepayment/foreclosure charges apply, and, if so, under what conditions.

- Default explanation: Break down triggers (missed EMI days), penalties, and the timeline for reporting defaults to credit bureaus.

- Moratorium: Check whether interest accrues and capitalises.

- Disbursement terms: Verify how and when the lender will disburse to the institute -Direct allocation or cheque to borrower.

Which documents to keep, and digital record-keeping techniques

- Preserve originals and scanned copies of the loan agreement, sanction letter, repayment schedule, and interest certificate.

- Keep digital assets secure (encrypted cloud storage) & keep a loan amortisation spreadsheet to manage the EMI principal/interest breakdown.

When to seek financial and legal advice

If the contract details are complex, collateral is requested suddenly, or prohibitive/amorphous clauses appear, seek counsel. An advisor can help you compare offers or consult a lawyer before you sign deals involving significant, long-term commitments.

Resources, Tools, and Next Steps

Loan features comparison, download checklist, and documents

Checklist: interest rate and type, processing fees, prepayment conditions, moratorium interest rule, max unsecured limit, who can be a co-applicant, disbursement process (how long! what docs?), customer service support, grievances handling.

List of documents: KYC (Aadhaar, PAN), admission letter, fee breakup confirmation from the institution or university, previous academic records, Co-applicant salary slips/Form 16/ITR(IT Returns), bank statement and residence proof.

EMI and Full Cost Calculators

Calculate via an EMI calculator with the inclusion of these steps:

- Loan amount (INR)

- Interest rate (%) p.a.

- Tenure (years)

- Moratorium (interest capitalised or payment of interest

Find the EMI payments, the interest to be paid, and the total repayment. Include foreign exchange conversion and foreign fee schedules for study abroad loans.

How to prep for the lender meetings and timeline on documentation

Get a one-page profile ready: student details, course/institute, admission offer, fee schedule, co-applicant income synopsis and loan amount applied for.

Collect bank statements (6-12 months) and ITR of the last 2-3 years for the co-applicant.

Apply well in advance (3–6 months before fee deadlines), obtain pre-approvals to confirm the seat, and maintain timely follow-up with the institute’s finance office for hassle-free disbursement.

Next Steps: Shortlist lenders using this checklist, apply for pre-sanction offers from them, compare total cost (EMI + fees), and proceed with the lender offering the best mix of rate/speed / borrower-friendly terms. If you are well prepared and can provide all the required documents, you increase the likelihood of obtaining a student loan without collateral in India.