Student Personal Loan

#1 Instant Credit App for College Students in India

Empowering Your Financial Freedom with Personal Loans for Students in India

Dear Students,

Welcome to StuCred, your trusted partner in achieving financial independence. We offer instant, interest-free credit designed exclusively for college students across India.

Whether it’s for tuition, textbooks, or day-to-day expenses, StuCred is here to support you.

Bharath Reddy

StuCred helped me during my medical emergency. I strongly recommend this app to all the students. Its easy to use and and qiuck to get Money in your bank account

Dhanushiya

The 0% interest is a lifesaver. StuCred has made managing my finances so much easier. It’s an easy way to increase the credit limit as a student.

8Lakh+ students across India are LOVING ❤️ our services. Join the StuCred Community Now!

Why Students Love StuCred

StuCred is more than just a credit app; it’s a trusted partner in student life.

The app is secure, reliable, and designed to cover essential academic expenses, allowing students to focus on their studies without financial stress.

Instant Credit Approval:

The streamlined 5-step verification process means you can get approved for credit in 24 Hours—no lengthy paperwork or waiting periods.

0% Interest:

StuCred offers instant access to credit with absolutely 0% interest, making it easier for students to manage their finances without worrying about extra costs.

Trusted by 8L+ Students:

With a large and growing community of satisfied users across India, StuCred is a name students trust for reliable, hassle-free financial support.

24/7 Loan Access:

Whether it's day or night, StuCred is always there when you need it. Access your credit anytime, anywhere, ensuring you’re never stuck without funds.

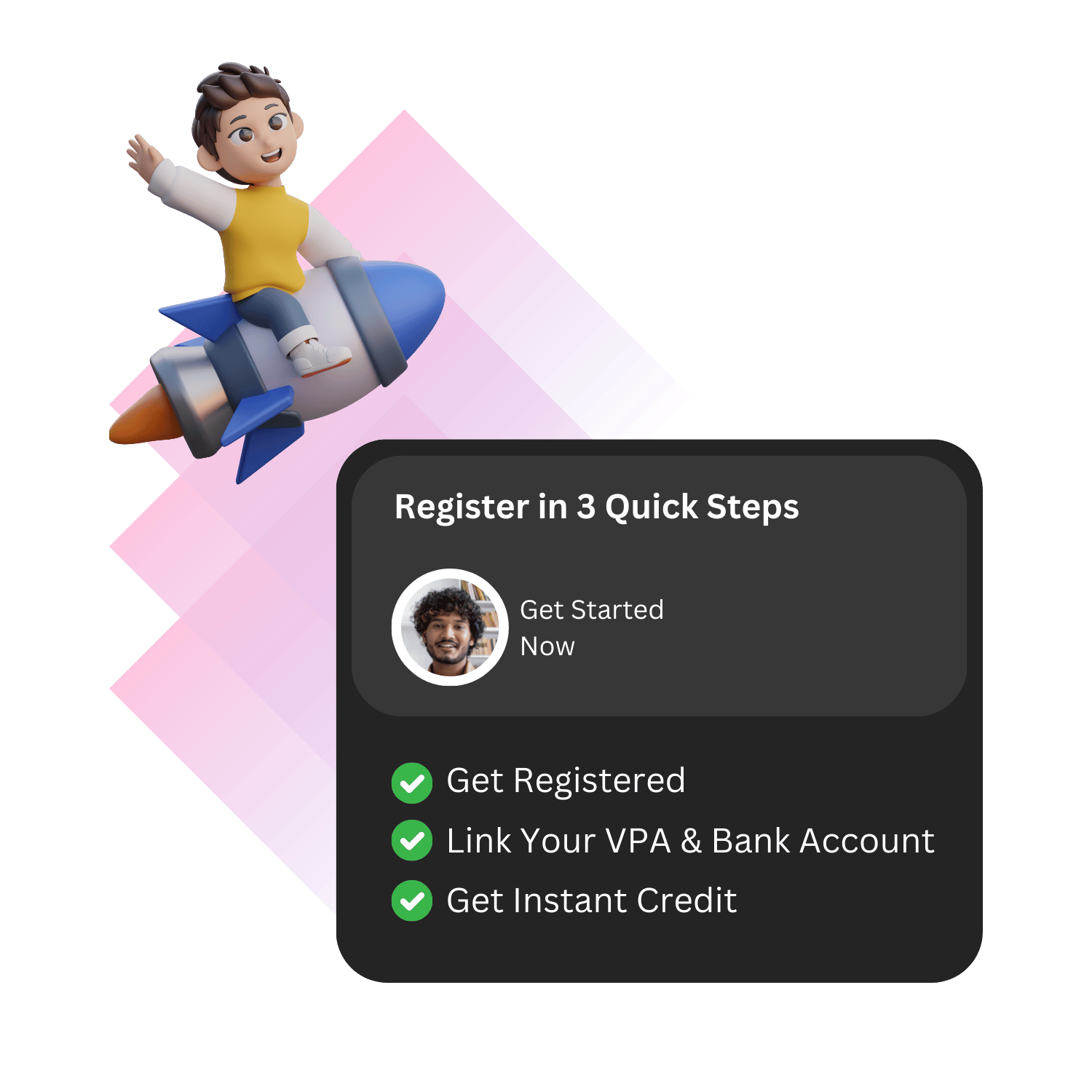

How It Works

Fast, Easy, Reliable

Start by downloading the StuCred app and completing a quick 5-step verification process. It’s designed to be fast and straightforward, ensuring you can get started without any hassle. The verification involves providing basic details, verifying your student status, and confirming your identity—all within minutes.

Once verified, securely link your Virtual Payment Address (VPA) and bank account to the StuCred app. This step is crucial for enabling smooth and instant transactions. StuCred uses bank-grade encryption to ensure your financial information is fully protected.

With your account set up, you’re ready to access your credit anytime, anywhere. StuCred provides 24/7 access to interest-free credit, giving you the financial flexibility to manage expenses as they arise. Whether it’s for textbooks, tuition, or emergency funds, StuCred is always there when you need it.

Why StuCred?

StuCred offers instant, interest-free credit exclusively for college students in India. With no hidden fees and 24/7 access to funds, StuCred is trusted by over 8L+ students from top institutions.

The app ensures safe, secure transactions with bank-grade security, making it the go-to financial solution for students.

No Hidden Fees

Transparent, student-friendly terms. What you see is what you get.

Available Anytime, Anywhere

Get access to your funds 24/7, no matter where you are.

100% Safe & Secure

Your data and transactions are fully protected with bank-grade security.

Trusted by Top Colleges

StuCred is the preferred choice for students from top institutions across India.

Join our Referral Program and Earn ₹5000 Every Month

Click on the link below and get Started

Benifits for Students

With no hidden fees and 24/7 access, students can borrow confidently, knowing they’ll only repay what they borrow.

StuCred ensures funds are always available, making it a convenient and reliable financial solution.

Financial Flexibility

StuCred provides students with instant access to interest-free credit, allowing them to manage unexpected expenses, pay for textbooks, or cover daily needs without financial strain.

Stress-Free Borrowing

With no interest and no hidden fees, students can borrow with confidence, knowing they’ll only repay what they borrow, making it easier to stay on top of their finances.

Convenient & Accessible

Available 24/7, StuCred ensures students can access funds anytime, anywhere, whether they need money for academic purposes or personal expenses, ensuring they’re never caught off guard.

20K+ COLLEGES

8L+ HAPPY STUDENTS

24/7 CREDIT ACCESS

8 YEARS OF SERVICE

Student Personal Loan: A Complete Guide for Indian Students

Introduction

In a similar study, it was envisaged that finance would benefit students. In addition to tuition costs, students frequently bear the burden of other expenses, including accommodation, transportation, books, technology, and everyday living services. Most students, especially those who do not earn a regular income, find it hard to meet these financial requirements.

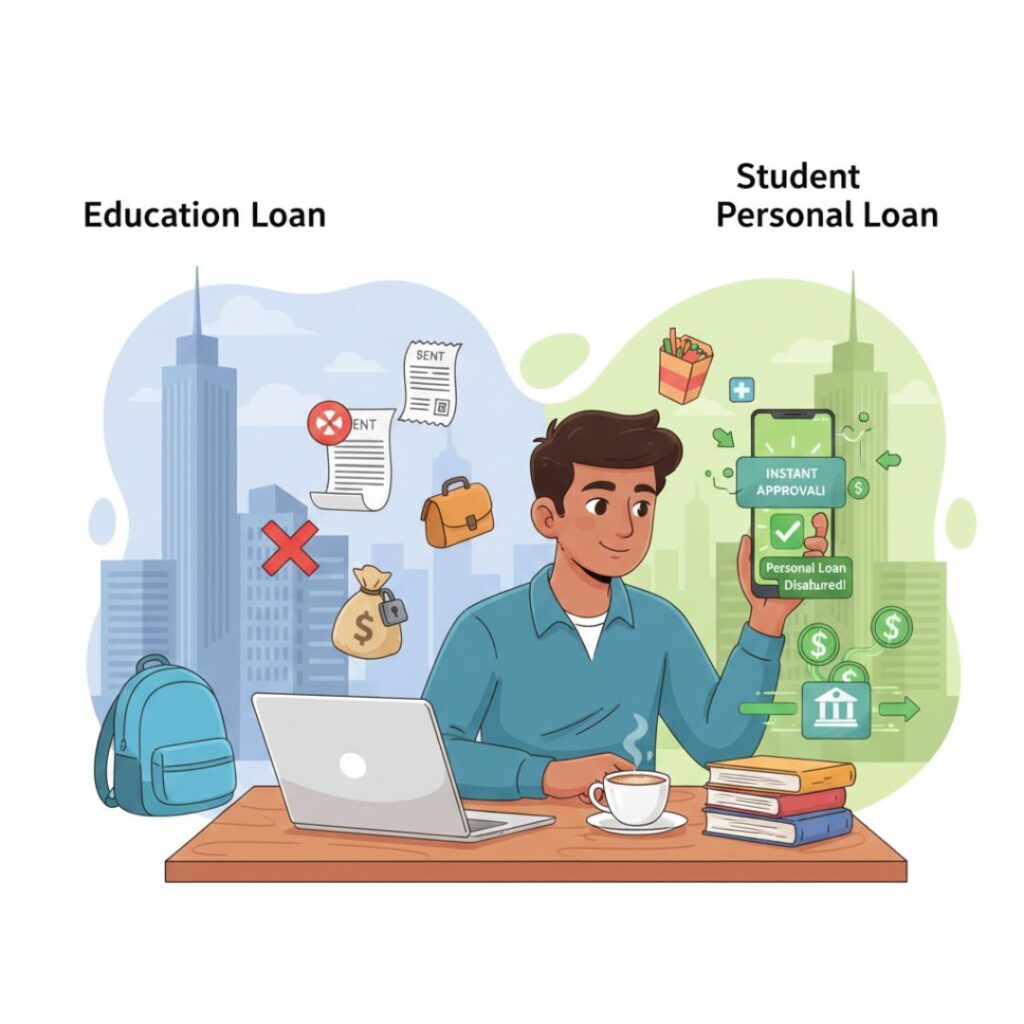

Although education loans are meant for students to pay tuition fees and other academic expenses, they do have limitations. These loans usually come with extensive paperwork, collateral, and limitations on use (such as tuition payments). Also, the education loan disbursement process can take weeks, which may not help students who need money crunches.

That’s where instant student personal loans come in. Personal loans have more flexibility compared to education loans. Students can apply the loan amount towards any need—be it rent, a new laptop, or an emergency cost. Personal loans usually come with quick approval processes; some lenders give instant loans that are disbursed in about 24 hours. This is why they are an ideal solution for students who need short-term financial assistance. Best instant personal loan for students

In conclusion, personal loans offer a fast and flexible option for helping students cope with financial obligations without waiting periods or restrictions on use.

What Is a Student Personal Loan?

A student personal loan is an unsecured loan that is supposed to help students with their finances during academics. Whereas education loans are usually limited to tuition and other approved educational expenses, student personal loans allow you to spend the money however you need. This allows students to spend money on rent, food, books, travel, or unexpected medical bills.

Personal Loan vs Education Loan: Important Differences

Usage Restrictions:

Education loans can only be used for academic commitments such as tuition, hostel fees, or course-related expenses. On the other hand, education loans also don’t limit spending but only offer students the chance to cover more significant financial needs. Instant personal loan for students

Approval Process:

Bundling up admission letters, fee receipts, and, in some cases, providing collateral, among other things, makes education loans a most documented segment of this financial category. Approval can take a long time. Conversely, instant personal loans have a pretty uncomplicated application process and get approved within hours, mostly instantly through loan apps.

Loan Disbursement:

The disbursement of an education loan is also done in a phased manner and is remitted directly to the educational institution. In contrast, personal loans are sent directly to the student’s bank account, meaning the student has complete control over how the money is used.

Pros of Student Personal Loans

No Restrictions on Spending:

The loan can be used for anything students need to pay, whether academic or non-academic.

Easier Application Process:

The paperwork is minimal — typically ID proof, address proof and essential information on income.

Approval and Disbursement in Quick Time:

The built-in advantage of digital lending is that instant lenders are now readily available to lend personal loans to students in emergencies.

This combination of flexibility, ease, and speed makes personal loans a practical option for students who need cash quickly.

Benefits of Personal Loans for Students

When it comes to academics, personal loans have benefits that assist students in valuing their financial responsibilities. They are intended to offer rapid and flexible financing to meet many costs, making them one of the most outstanding student loans. Here’s a rundown on how personal loans can work to a student’s advantage. Instant personal loan for students on StuCred

Cover Tuition Fees

Education loans are the most common option for tuition, but many students may not be able to qualify as they follow stringent eligibility criteria. This is where a student personal loan can come in handy, as it allows the immediate settlement of tuition or exam fees without the student having to wait long for the course or exam to begin.

Pay for Accommodation

Studying away can come with expenses like rent and other housing-related costs, but many students rely on financial help to pay these bills. Student loans can help students find quality housing so they can concentrate on their education and not have to worry about losing money.

Invest in Study Materials and Technology

Often, it’s about having the right tools and resources available to students to ensure success. Students might require laptops, software, textbooks or lab equipment, which can be costly. A personal loan is sanctioned to buy necessary study materials without blowing up their budget.

Meet Daily Expenses

Daily living expenses, such as food, transportation, and utilities, add up fast. A personal loan allows students to cover these recurring expenses without settling for a lower standard of living.

Access Quick Funding Solutions

Students typically have an immediate financial need, like paying a hanging fee or dealing with an emergency. Easier options: Several lenders offer instant loans to support students, available in amounts of ₹10,000–₹20,000, to help students when time is of the essence.

High Approval Rates of Unemployed Students

Even students not working full-time might qualify for a personal loan if they have a parent or guardian who has a steady income as a co-signer on the loan. This has a higher chance of getting approved, and students can get loans even if they have low incomes.

As such, both academic and personal expenses make the best use of these student personal loan benefits.

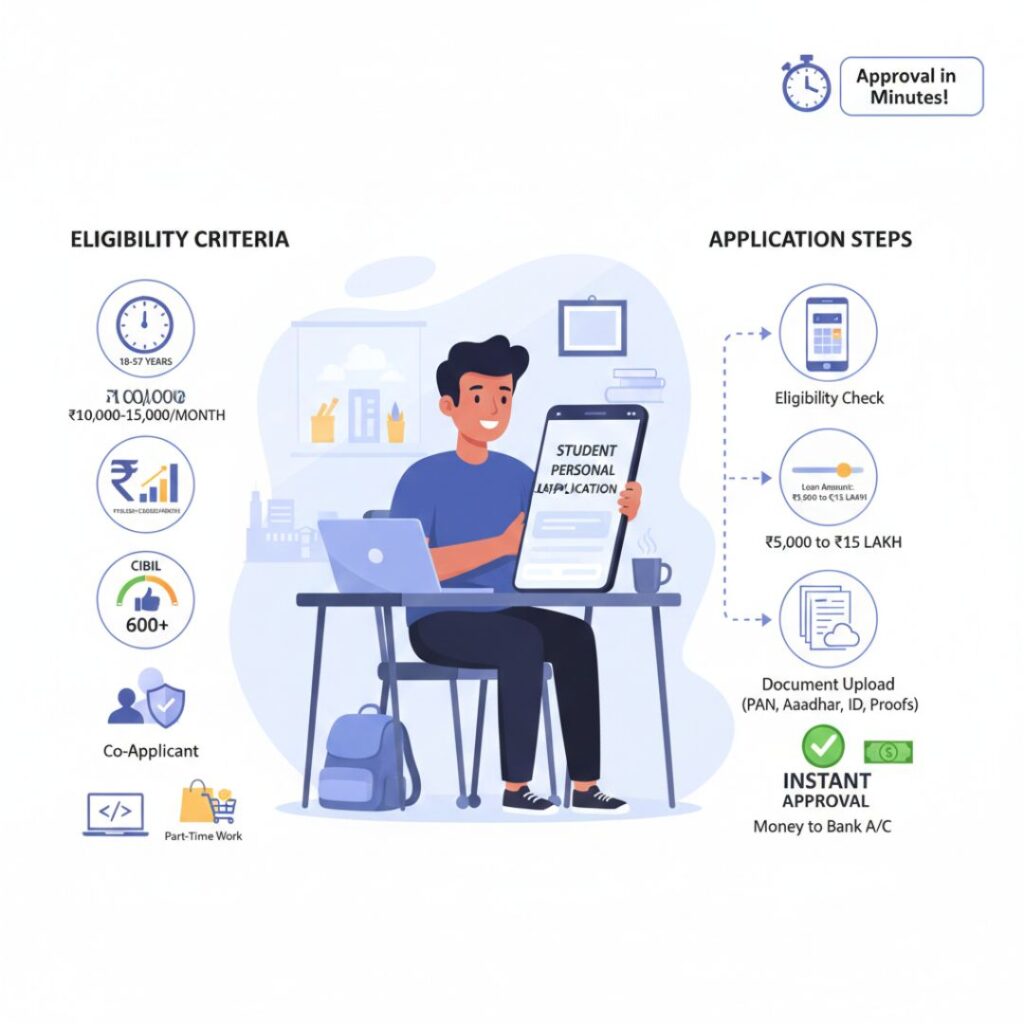

Student Personal Loan Eligibility Criteria

To get a student personal loan, prospective borrowers must meet specific eligibility criteria, which typically vary slightly by lender. These criteria ensure that the students can really repay the loan, whether through their own income or with the help of a guarantor. Students need to know these requirements to improve their chances of getting a loan approved.

General Eligibility Criteria

Here are the general criteria most lenders use to approve a student personal loan:

Age Requirements:

Students usually must be between the ages of 21 and 57 to qualify. Depending on the type of loan and terms, some lenders may lower the minimum age to 18.

Minimum Monthly Income:

Most lenders want applicants to have a steady monthly income of ₹10,000 to ₹15,000. This depends on the loan amount and the lender’s policies. But if students have no formal job, they must rely on a co-applicant (parent/guardian).

Credit Score:

Credit scores are very important when applying for a loan. A CIBIL score of 600 or higher is generally acceptable for a personal loan. Higher scores bolster eligibility for lower interest rates and larger loans.

For students with little credit history, a co-signer can help offset a low or non-existent credit score.

Eligibility of Student Without a Job

To be eligible for a personal loan without regular income, students need to meet these additional conditions:

Must-Have a Co-Applicant or Guarantor:

A co-applicant (or co-signer), typically a steady-income person such as a parent, guardian or spouse, is often required of a student for a personal loan. The co-applicant will be responsible if the student cannot repay the loan.

Alternative Income Sources:

Student Work: If employed part-time while studying, you can prove income through your job to help with eligibility.

Self-employment: Lenders will also consider income from freelance work or other self-employment jobs if they can verify it.

For students without a regular source of income, applying for a personal loan can significantly enhance their approval chances. Some lenders provide special loan schemes to support students in their academic journey.

Hence, with knowledge of these student loan eligibility guidelines, students could make a more conscious effort to frame their own applications and boost their chances of being approved (for both regular and personal loans for students without jobs).

Steps to Apply for a Student Personal Loan

Applying for a student personal loan has become significantly simplified due to modern conveniences in online banking and digitized loan services. Most lenders provide a fully online application so students can easily apply for loans from home. Here’s a step-by-step guide to help you through the student personal loan process.

Steps to Apply

Check Loan Eligibility:

First, on the lender’s website or mobile app, you’ll be asked if you meet the loan eligibility requirements. Most platforms have an online eligibility calculator, where you input information like your age, income, and credit score to determine if you qualify.

Choose Loan Amount and Repayment Period:

Know how much you need and the amount you want to take as a loan. If you’re borrowing money, lenders usually give you an amount between ₹5,000 to ₹50,000 for short-term needs, while you’re eligible to borrow up to ₹15 lakh for bigger expenses. Choose an appropriate repayment tenure between a few months to many years.

Submit Required Documents:

Once you become eligible, you will be required to upload the necessary documents:

Proof of identity (PAN card, Aadhaar card, student ID, etc.)

Proof of address (like utility bills and rental agreements)

Proof of income (e.g., payslips or other income)

If you don’t have an income, you may be required to offer documentation of your co-signer’s income.

Approval and Disbursement of Loan

After you complete and submit your application, the lender will review your documents and verify your information. The approval time for student instant personal loans can vary from a few minutes to hours. Upon approval, the loan amount is credited directly to your bank account.

Required Documentation

Here are the documents that you need to keep handy to ensure a hassle-free application process:

Identity Proof:

The documents accepted include a PAN card, Aadhaar card, passport or valid student ID card.

Address Proof:

Recent utility bills, rental agreements or bank statements can all be used to prove where you live.

Documents of Co-Signer (if applicable):

If there are co-applicants, you will have to submit proof of their income, including salary slips, bank statements, or tax returns.

Following these steps and having the documentation you need in place will help you ensure that you can complete the student personal loan application process quickly and have access to funds for other financial needs quickly.

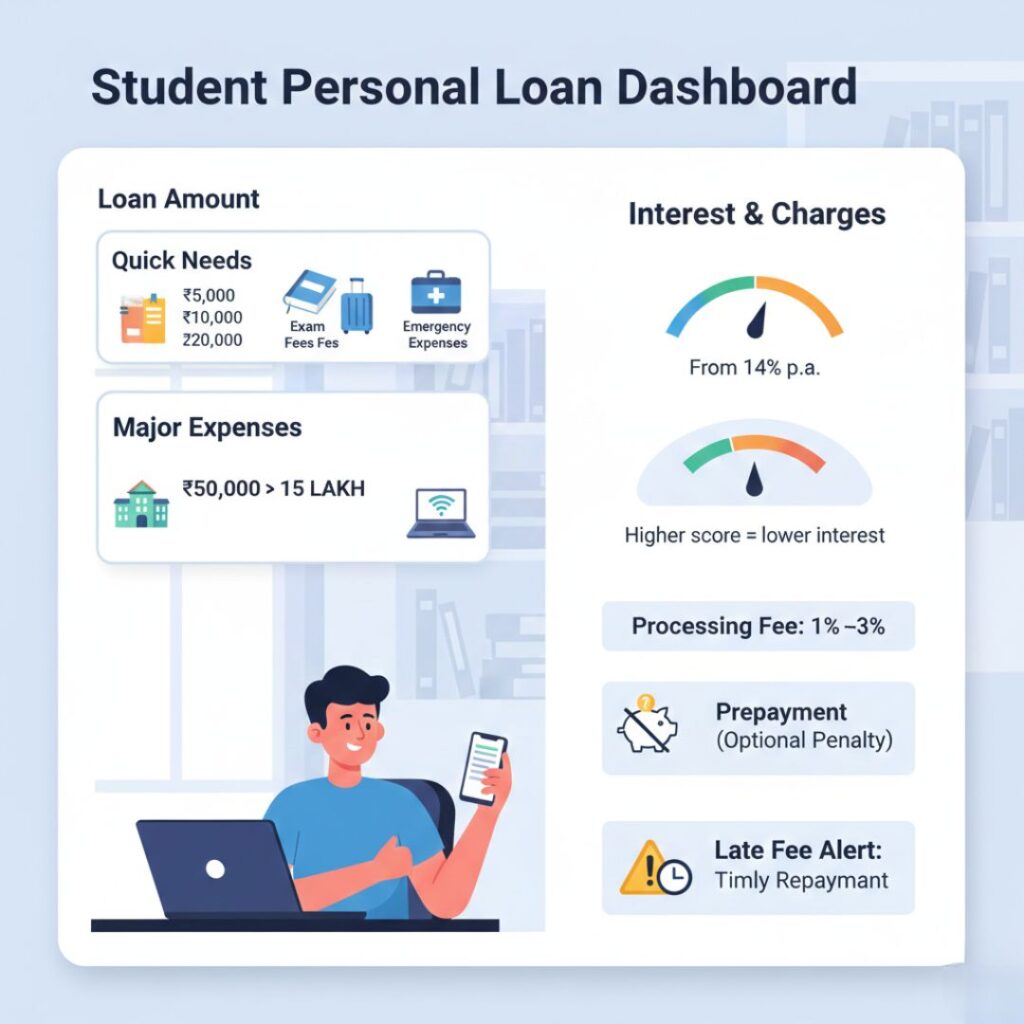

Loan Amount and Interest Rates

Student personal loan applicants also need a clear idea of the loan amounts that could be borrowed and the interest rates and charges being levied. Lenders offer various loan options that could fulfil students’ short-term and long-term needs.

Loan Amounts Available

Students can request loans ranging from low to high based on their needs. Common types of loans include:

Small Loan Amounts:

Variable income-based loans: Compared to other institution-specific loans, lenders provide low-cost loans of ₹5000, ₹ 10,000, or ₹ 20,000 in case of brief financial requirements for students. These loans are perfect for one-off expenses like exam fees, transportation, study material, and minor emergencies.

For instance, a ₹5,000 loan for students is a quick relief if a student urgently needs to pay for a textbook or travel costs.

Larger Loan Amounts:

Students can even get loans between ₹50,000 to ₹15 lakh for significant expenses such as tuition fees, room rent, or buying technology. However, more substantial amounts are usually reserved for students with a steady income or a co-signer with adequate income and good credit.

For instance, a student wanting to buy a laptop or pay a semester’s fee in advance may book a ₹50,000 or more student personal loan.

Interest rates and charges

A student’s personal loan’s overall value significantly depends on interest rates and any associated charges. Here are the particulars to keep in mind:

Interest Rates:

Most lenders offer interest rates starting from 14% per annum and vary based on the applicant’s credit profile and loan amount.

Students with high credit scores or a co-signer may qualify for better rates, whereas students without credit history can expect higher rates.

Processing Fees:

Most lenders charge a processing fee, which normally varies from 1% to 3% of the loan amount. This charge is taken before funds are disbursed.

Prepayment and Late Fees:

Others will allow you to prepay (repay the sum early) but might carry a prepayment penalty.

Not paying can result in late fees and hurt your credit score, so paying back on time is essential.

Knowing these details allows students to select a loan that serves them best while keeping costs down. Students should compare offers from different lenders to find cheap interest rates and terms that suit their budget.

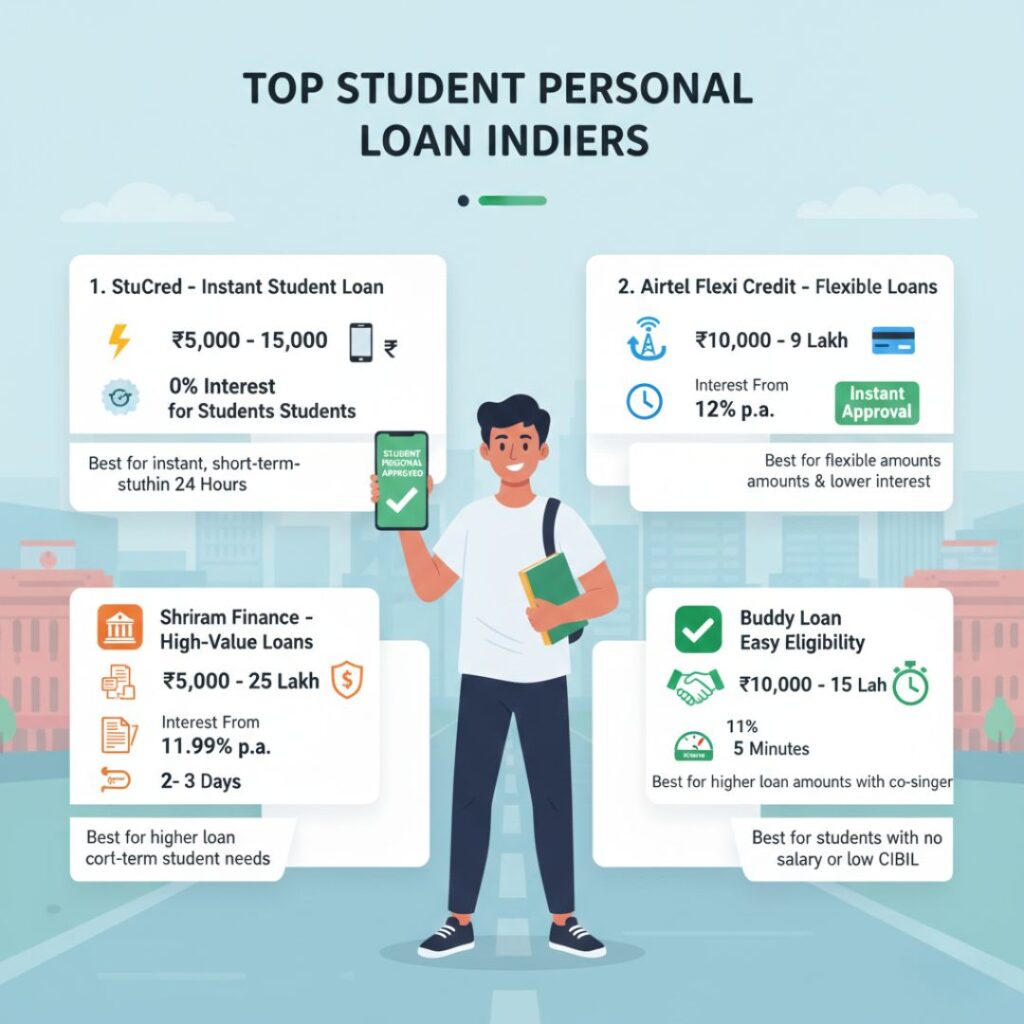

Top Financial Institutions Offering Student Personal Loans

Many different student personal loan options offer flexible terms, fast approvals, and competitive interest rates. Here are some of the best student loan providers in India that address the financial requirements of students.

1 StuCred – Instant Personal Loan for students

StuCred, a popular digital lending platform known for providing instant personal loans for students for only some essential documentation and fast disbursement.

Loan Features:

Amount of the loan: ₹5,00 to ₹ 15000

Interest Rate – 0% Per Month for Students (with a small service fee)

Tenure for repayment: 1 to 3 months

Time Until Approval: 24 hours or less

Eligibility Criteria:

The age Limit For Students is 18 and above

Benefits for Students:

100% digitized loan application process

No collateral required

Overview – Best for immediately processing loans and students in immediate need of funds

StuCred is one of the most trustworthy and quickest instant personal loans for students if you have to look for one.

2. Airtel Flexi Credit – Ideal for Flexible Loan Amounts

With Airtel Flexi Credit, a subsidiary of this major telecom provider that has moved into the digital lending arena, Airtel helps students snare small loans with ease.

Loan Features:

Loan Amount: ₹10,000 – ₹9 lakh

Interest rate: From 12% per annum

Tenure of repayment: 12 to 60 months

Instant approval and disbursement in minutes

Eligibility Criteria:

Indian citizen of at least 21 years of age

Monthly income requirement of ₹15,000 minimum

A decent credit score (650+ preferred)

Benefits for Students:

Instant approval and disbursal for emergency expenses

Lower interest rates than most personal loan providers

Paperless process for pre-approved Airtel customers

Airtel Flexi Credit: This is the ideal loan option with flexible loans without a lot of documentation or strict eligibility requirements, putting students in a better position to seek in-person funding.

3. Shriram Finance

Shriram Finance: It is one of the best NBFCs in India and also offers personal loans to students at reasonable rates.

Loan Features:

Loan amount: ₹50,000 – ₹25 lakh

Interest rate: From 11.99% onwards per year

Repayment period: 12 — 60 months

Time of processing: 2 to 3 business days

Eligibility Criteria:

The age limit for applicants is between 21 and 60

Minimum monthly income required: ₹12000+

A co-signer (parent/guardian) is mandatory if the applicant does not have income.

Benefits for Students:

Reasonable interest rates versus those from online fintech lenders

Payment plans that allow some backlog of payments

Higher loan amount, so good for students needing ₹50,000 and above

Shriram Finance is ideal for students who need higher loan amounts and are willing to apply with a co-signer.

4. Buddy Loan – Instant Personal Loan for Students With No Salary

About Buddy Loan: Buddy Loan is a fintech lending site that offers multiple loan options for students and facilitates quick approval for urgent money needs.

Loan Features:

Maximum Loan amount: ₹10,000 to ₹15 lakh

Interest rate: minimum amount is 11% per annum

Loan tenure: 6 to 60 months

Get Instant Loan Approval In 5 Minutes

Eligibility Criteria:

Age Requirement: Must be at least 21 Years Old

No Income Requirement (With Co-Signer)

Applicants can be eligible with a low CIBIL score

Benefits for Students:

Approval rates, including for students who have a poor credit history.

Loan amounts ranging from ₹10,000 to ₹20,000₹50,000 or above based on eligibility

Hassle-free option collateral required

Buddy Loan is an excellent choice for students who need quick loans with loose eligibility requirements.

Final Thoughts

These top providers listed below offer 24/7 student personal loans with instant approvals, flexible repayment terms, and competitive interest rates.

In case of emergency small loans: Buddy Loan and Airtel Flexi Credit

For immediate and flexible individual loans, MoneyView

For high-value loans at low interest: Shriram Finance

Seeking funds from a suitable lender based on your financial condition will help you get funds without going through a complex process.

Addressing Common Queries

Many students have questions regarding personal loans, eligibility, and how to access funds quickly. Below are answers to some of the most frequently asked questions about student personal loans, their eligibility, and how they compare with education loans.

Can Students Get a Personal Loan?

Indeed, students may obtain a personal loan, but eligibility relies upon income constancy, credit score, and co-signer availability. Because most students lack full-time employment, lenders require a co-signer or guarantor—usually a parent or guardian—with a steady income and a high credit score.

Personal Loan Eligibility for Students Applying for Personal Loans:

Must be at least 18 or 21 (depending on the lender)

Income Source: No income for students and also no income for co-signers

Credit Score: A minimum of 600+ CIBIL score will increase the chances of approval

Documents Required:

Identity Proof (Aadhaar/PAN card/student ID)

Proof of Address (utility bills, rental agreement)

(approved income proof — salary slips, bank statements)

Lenders could consider it as your income source for part-time jobs and freelance work or if you have a scholarship. Some app-based loan providers, such as MoneyView, Buddy Loan, and Airtel Flexi Credit, can offer personal loans to jobless students with a student guarantor.

How to Get ₹10,000 Immediately for Students?

If students need information on how to get an instant personal loan of ₹10000, they can avail it via digital lending platforms that provide instant approval and disbursement.

How to Avail an Immediate Loan for Student Upto ₹10,000-Process:

Select the Digital Lender: The process is faster using Digital Loan Providers like StuCred, Buddy Loan, MoneyView, or Airtel Flexi Credit.

Online Loan Eligibility Checker: Most lenders offer an instant eligibility check on their website or app;

Enter ID Proof and other details: Basic details such as ID proof, address proof, co-signer, etc.

Approval and Disbursement: When eligible, the loan gets credited within hours or the next business day.

How to Get ₹15,000 Urgently Without Salary?

Students without a salary can avail of instant personal loans of up to ₹15,000 through several alternative lenders.

Student Non-Salary Income-Based Loans

Co-Signer Loan: If a parent or guardian co-signs the loan application, many NBFCs and banks provide such loans.

App-Based Personal Loan: Fintech platforms like Buddy Loan and MoneyView provide personal loans without salary slips in minutes.

Peer-to-Peer (P2P) Lending: Platforms like Faircent and Lendbox match students with individual lenders ready to provide small, unsecured loans.

Short-Term Loan Apps: Digital lending platforms like Airtel Flexi Credit offer ₹20,000 loans to salaried customers with good credit scores.

If the students don’t have a regular income, getting a loan without a salary is easiest through a co-signer or alternative income proof (e.g., earnings or scholarship funds).

Conclusion

A student personal loan is thus essential to many students’ funding for their higher education needs. Personal loans are more accessible than education loans in that they are easier to obtain and qualify for and only require a simple documentation process. Thus, they are suitable for students who need immediate help.

Due to multiple lenders and immediate loan apps, students have a variety of loans to choose from, whether they require a small amount like ₹5,000 for sudden emergencies or ₹15 lakh for significant expenses. Some options will fit your financial situation, whether you are a part-time student, a borrower who needs a co-signer personal loan, or something else.

When students make the most of a student personal loan, they must borrow responsibly, plan repayments well, and build a good credit score. Students can choose a loan based on a comparison between interest rates, eligibility requirements, and repayment terms, ensuring that they have a loan that best suits their financial requirements and repayment capacity.

🚀 Ready to apply? The online application takes just 10 minutes and is free of obligation. Instant personal loan for students